Battery Metals Market Size, Demand & Growth by 2034

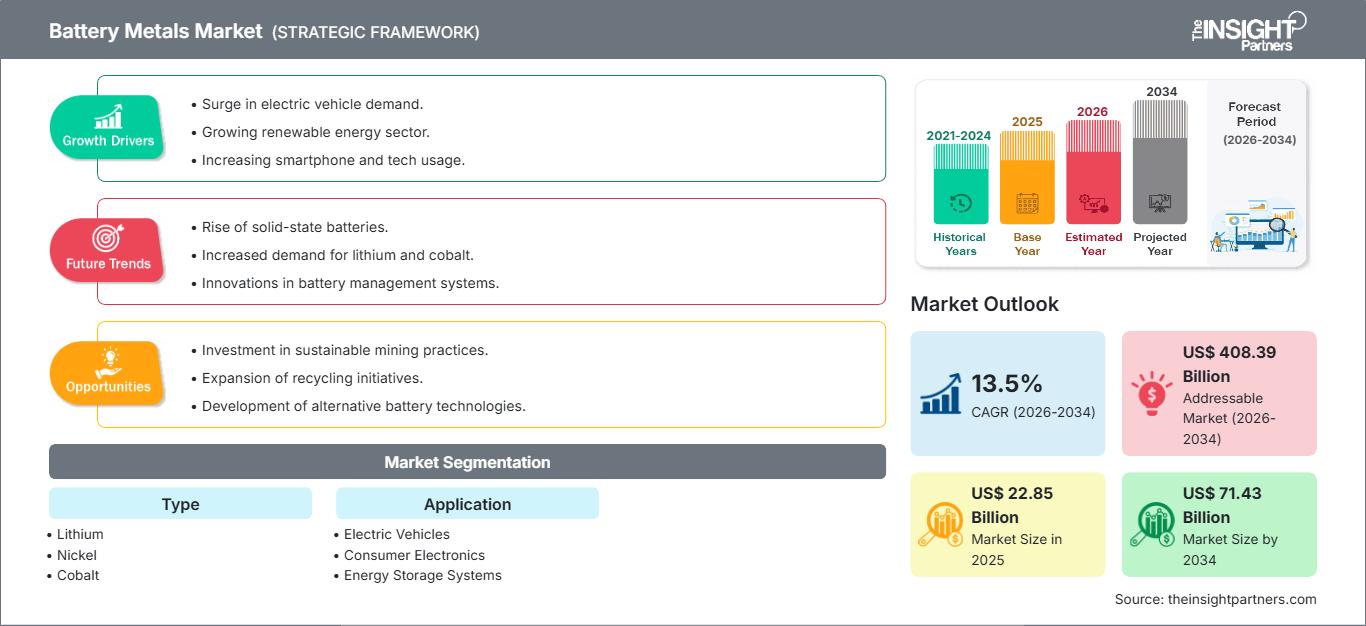

Battery Metals Market Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Lithium, Nickel, Cobalt, and Others) and Application (Electric Vehicles, Consumer Electronics, Energy Storage Systems, and Others)

Historic Data: 2021-2024 | Base Year: 2025 | Forecast Period: 2026-2034- Report Date : Mar 2026

- Report Code : TIPRE00024358

- Category : Chemicals and Materials

- Status : Upcoming

- Available Report Formats :

- No. of Pages : 150

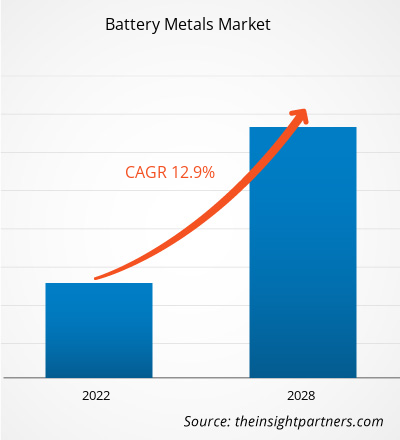

The global Battery Metals market size is projected to reach US$ 71.43 billion by 2034 from US$ 22.85 billion in 2025. The market is anticipated to register a CAGR of 13.5% during the forecast period 2026–2034. Key market dynamics include the rapid global transition toward decarbonization, the aggressive expansion of the electric vehicle (EV) ecosystem, and significant government policy support, such as subsidies and tax credits for green energy. Additionally, the market is expected to benefit from advancements in battery chemistry—including the shift toward high-nickel and solid-state batteries—and the increasing integration of large-scale energy storage systems (ESS) into national power grids to manage renewable energy intermittency.

Battery Metals Market Analysis

The battery metals market analysis underscores a critical strategic shift toward supply chain resilience and vertical integration. As geopolitical tensions and resource nationalism heighten, procurement trends indicate that major automotive and technology firms are moving away from open-market purchasing toward direct investment in mining operations and long-term offtake agreements. Strategic opportunities are emerging in the development of circular supply chains, where battery recycling and urban mining offer a secondary source of lithium, cobalt, and nickel to mitigate primary supply deficits. The analysis also indicates that market players must focus on diversifying their geographic footprints to reduce reliance on specific regions, while investing in sustainable extraction technologies like Direct Lithium Extraction (DLE) to meet stringent Environmental, Social, and Governance (ESG) mandates.

Battery Metals Market Overview

Battery metals have transformed from a niche industrial sector into the foundational pillar of the global energy transition. Centered around key elements like lithium, nickel, and cobalt, the industry serves as the primary engine for the electrification of transport and the stabilization of renewable energy grids. While the market was historically driven by small-scale consumer electronics, the current landscape is dominated by the massive requirements of the EV industry. This shift has led to unprecedented volatility in commodity pricing and a rush for global exploration. The market is characterized by a mix of traditional diversified mining giants and pure-play energy metal companies, all navigating a complex landscape of fluctuating battery chemistries and evolving regulatory frameworks. For instance, the market in the US is undergoing a significant revitalization driven by federal initiatives to establish a domestic mine-to-battery supply chain. Increasing investments in localized refining and processing facilities aim to reduce import dependencies. There is a strong emphasis on sustainable mining practices and the development of next-generation battery technologies to support domestic automotive manufacturing.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONBattery Metals Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Battery Metals Market Drivers and Opportunities

Market Drivers:

- Surge in Electric Vehicle (EV) Adoption: The global push by automotive manufacturers to phase out internal combustion engines is the primary driver for battery metal demand. Stringent emission regulations and consumer interest in sustainable transport are forcing a massive scale-up in the production of high-capacity lithium-ion batteries.

- Global Push for Renewable Energy Integration: As nations transition to solar and wind power, the need for stationary energy storage systems has skyrocketed. These systems require vast quantities of battery metals to store excess energy, ensuring grid stability and reliable power delivery during non-productive periods.

- Advancements in Battery Chemistries: Continuous R&D into increasing energy density and reducing charging times is driving the demand for specific high-purity metals. The evolution toward NCM (Nickel-Cobalt-Manganese) and LFP (Lithium Iron Phosphate) chemistries creates a dynamic demand environment for various metal types.

Market Opportunities:

- Investment in Battery Recycling and Recovery: With the first generation of EVs reaching the end of their life cycle, there is a burgeoning opportunity for companies to specialize in the recovery of high-value metals from spent cells, reducing the environmental impact and cost of raw material sourcing.

- Exploration of Alternative Extraction Technologies: Technological breakthroughs in Direct Lithium Extraction (DLE) and high-pressure acid leaching for nickel offer opportunities to unlock previously uneconomical or lower-grade mineral deposits, expanding the global supply base.

- Strategic Partnerships Across the Value Chain: Forming alliances between mining companies, chemical processors, and battery manufacturers can streamline the supply chain, ensuring a consistent flow of materials and reducing the risks associated with price volatility.

Battery Metals Market Report Segmentation Analysis

The Battery Metals Market share is analyzed across various segments to provide a clearer understanding of its structure, growth potential, and emerging trends. Below is the standard segmentation approach used in most industry reports:

By Type:

- Lithium: Recognized as the core component of modern battery technology, this segment is driven by its irreplaceable role in high-energy-density applications.

- Nickel: Increasingly vital for long-range electric vehicles, with high-nickel chemistries becoming the industry standard for performance.

- Cobalt: A key stabilizer in batteries, though the market is seeing a shift toward lower-cobalt formulations due to ethical sourcing concerns and cost.

- Others: Includes metals like manganese, graphite, and aluminum, which are essential for anodes, cathodes, and structural battery components.

By Application:

- Electric Vehicles: The primary consumer segment, encompassing passenger cars, commercial fleets, and two-wheelers, dictates the overall market trajectory.

- Consumer Electronics: A mature segment that continues to demand high-purity metals for smartphones, laptops, and wearable technology.

- Energy Storage Systems: A high-growth area focused on utility-scale and residential batteries used to store renewable energy.

- Others: Includes industrial applications, aerospace, and specialized medical devices requiring portable power solutions.

By Geography:

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa

Battery Metals Market Regional Insights

The regional trends and factors influencing the Battery Metals Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Battery Metals Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Battery Metals Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 22.85 Billion |

| Market Size by 2034 | US$ 71.43 Billion |

| Global CAGR (2026 - 2034) | 13.5% |

| Historical Data | 2021-2024 |

| Forecast period | 2026-2034 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Battery Metals Market Players Density: Understanding Its Impact on Business Dynamics

The Battery Metals Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Battery Metals Market top key players overview

Battery Metals Market Share Analysis by Geography

Asia-Pacific is expected to grow fastest in the coming years. Emerging markets in South & Central America, the Middle East, and Africa also have many untapped opportunities for manufacturers to expand.

The battery metals market is undergoing a significant transformation, moving from a traditional industrial commodity to a global high-value strategic asset. Growth is driven by the rising global demand for electric vehicles (EVs), a surge in renewable energy integration through storage systems, and the expansion of the high-performance consumer electronics sector. Below is a summary of market share and trends by region:

North America

- Market Share: A rapidly expanding segment driven by aggressive federal policy support and the localization of the battery supply chain.

- Key Drivers:

- Substantial government incentives, such as the Inflation Reduction Act (IRA), favor domestic mineral processing and EV manufacturing.

- Rapid expansion of Gigafactories and domestic refining facilities to reduce reliance on foreign supply chains

- Growing consumer preference for high-nickel battery chemistries to support long-range vehicle capabilities

- Trends: Scaling of lithium extraction from geothermal brines and the development of a circular economy through advanced battery recycling and localized urban mining initiatives.

Europe

- Market Share: Holds a significant global share, anchored by stringent decarbonization targets and a robust automotive manufacturing ecosystem.

- Key Drivers:

-

Aggressive mandates for the phase-out of internal combustion engines (ICE) across the European Union

- Strict regulatory frameworks, including the Battery Passport, are pushing for high ESG standards in metal sourcing.

- Strong institutional support for regional gigafactory pipelines to ensure energy security and industrial resilience

- Trends: A strategic shift toward prioritizing sustainable and low-carbon mineral extraction, with an increasing focus on localized precursor refining and high-purity nickel production.

Asia-Pacific

- Market Share: The dominant global region, serving as the world's primary engine for battery metal processing and battery cell manufacturing.

- Key Drivers:

- Massive manufacturing output in China, Japan, and South Korea, which control a vast majority of the global battery-grade chemical market

- Favorable government policies and the massive scale of NEV (New Energy Vehicle) adoption in China

- Access to diverse regional mineral resources and a highly integrated, cost-efficient supply chain

- Trends: Heavy investment in next-generation chemistries like Sodium-ion and LFP (Lithium Iron Phosphate) to cater to high-volume market segments, alongside significant R&D in solid-state battery materials.

South and Central America

- Market Share: A critical supply-side market, particularly within the Lithium Triangle of Chile, Argentina, and Bolivia.

- Key Drivers:

- Possession of the world's largest and most cost-competitive brine-based lithium reserves

- Modernization of extraction technologies, such as Direct Lithium Extraction (DLE), to improve yields and sustainability

- Strategic focus on moving up the value chain by developing localized refining and precursor manufacturing

- Trends: Transition from a purely raw-material export model toward a value-add hub, supported by strategic partnerships with global automotive OEMs looking to secure direct mineral access.

Middle East and Africa

- Market Share: Developing market with deep mineral roots, transitioning toward formalized commercial production and regional manufacturing.

- Key Drivers:

- Critical role in the global supply of cobalt (DRC) and nickel/manganese (South Africa)

- Strategic investments in the GCC to build localized battery manufacturing hubs and support economic diversification

- High demand for grid-scale energy storage to manage large-scale solar power projects in arid climates

- Trends: Implementation of modern ESG and transparency standards to formalize the mining sector, coupled with investments in Smart Mining technologies to optimize mineral recovery.

High Market Density and Competition

Competition is intensifying due to the presence of established leaders such as Albemarle Corporation, Bolt Metals, Ganfeng Lithium Co., Ltd., Umicore, LG Chem, Honjo Metal Co., Ltd., Vale, Lithium Australia NL, and BASF SE, which also contribute to a diverse and rapidly expanding market landscape.

This competitive environment pushes vendors to differentiate through:

- Vertical Supply Chain Integration: Positioning as reliable long-term partners by controlling the entire value chain, from upstream mining assets to midstream chemical refining-to to ensure transparency and meet the clean-label ethical standards demanded by global automotive OEMs.

- Advanced Extraction and Refining Technologies: Companies are increasingly competing through the deployment of Direct Lithium Extraction (DLE) and high-pressure acid leaching (HPAL) for nickel. These technologies allow for the processing of lower-grade ores with a smaller environmental footprint, providing a significant competitive edge in an ESG-conscious market.

- Strategic Offtake and Joint Venture Models: Leading producers are moving beyond simple spot-market sales to form deep strategic partnerships with battery manufacturers (e.g., CATL, LG Chem) and automotive giants (e.g., Tesla, GM). These multi-year agreements stabilize revenue and de-risk the massive capital expenditures required for new mining projects.

- Sustainability and Circular Branding: Differentiating through low-carbon production profiles and integrated recycling capabilities. By offering closed-loop metals recovered from end-of-life batteries, vendors can appeal to European and North American customers facing strict secondary-material mandates.

Opportunities and Strategic Moves

- Develop Domestic Refining and Processing Hubs: Partner with governments in North America and Europe to tap into significant subsidies and tax credits (such as the US Inflation Reduction Act) aimed at localizing the mine-to-battery supply chain and reducing import dependencies.

- Invest in Next-Generation Metal Chemistries: Focus R&D on high-purity materials compatible with emerging battery technologies, such as Lithium-Sulfur, Sodium-ion, and Solid-State batteries, which are projected to enter initial commercial production phases by 2030.

- Expand into Emerging Recycling and Recovery Verticals: Establish dedicated urban mining facilities to recover cobalt, nickel, and lithium from the first generation of decommissioned EV batteries, creating a secondary, sustainable revenue stream that mitigates primary supply volatility.

Major Companies operating in the Battery Metals Market are:

- Albemarle Corporation

- Bolt Metals

- Ganfeng Lithium Co., Ltd.

- Umicore

- LG Chem

- Honjo Metal Co., Ltd.

- Vale

- Lithium Australia NL

- BASF SE

Disclaimer: The companies listed above are not ranked in any particular order.

Battery Metals Market News and Recent Developments

- In August 2025, Glencore Plc. acquired Li-Cycle. This strategic move integrated Li-Cycle into Glencore's operations, ensuring that the Battery Metals specialist would continue to deliver value and enhanced service to their joint global customers.

- In October 2024, Rio Tinto and Arcadium Lithium plc announced a definitive agreement under which Rio Tinto acquired Arcadium in an all-cash transaction for US$ 5.85 per share. This acquisition, which valued Arcadium's diluted share capital at approximately US$ 6.7 billion, significantly strengthened Rio Tinto's position in the global Battery Metals market.

Battery Metals Market Report Coverage and Deliverables

The Battery Metals Market Size and Forecast (2021–2034) report provides a detailed analysis of the market covering below areas:

- Battery Metals Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Battery Metals Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Battery Metals Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the Battery Metals Market.

- Detailed company profiles

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For