The Infertility Testing Market size is expected to reach US$ 871.3 million by 2031 from US$ 494.7 million in 2024. The market is anticipated to register a CAGR of 8.6% during 2025–2031.

Infertility Testing Market AnalysisThe infertility testing market is growing due to rising infertility rates, advanced diagnostic technologies, increasing awareness, and demand for personalized reproductive solutions, with North America and Europe leading global adoption.

Infertility Testing Market OverviewThe infertility testing market is expanding with innovations in genetic, hormonal, and imaging diagnostics, driven by delayed parenthood, lifestyle factors, rising healthcare access, and growing demand for accurate, early fertility assessments worldwide.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Infertility Testing Market: Strategic Insights

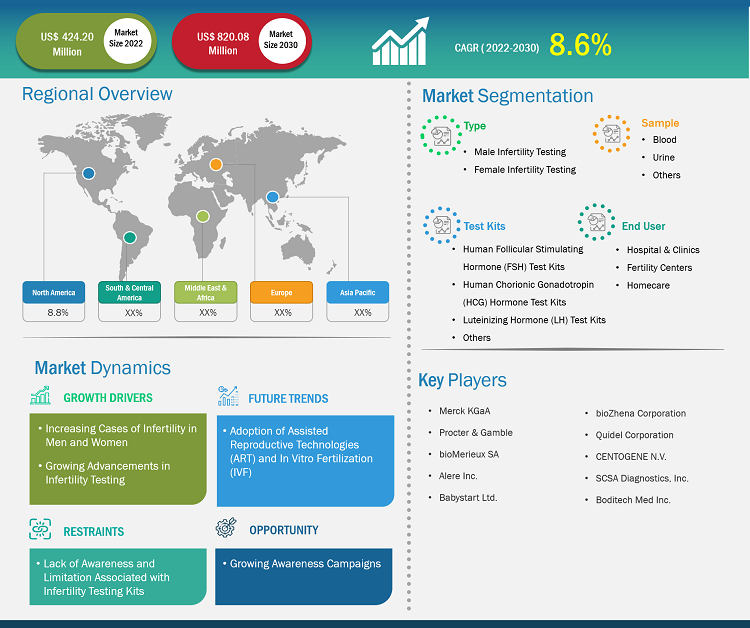

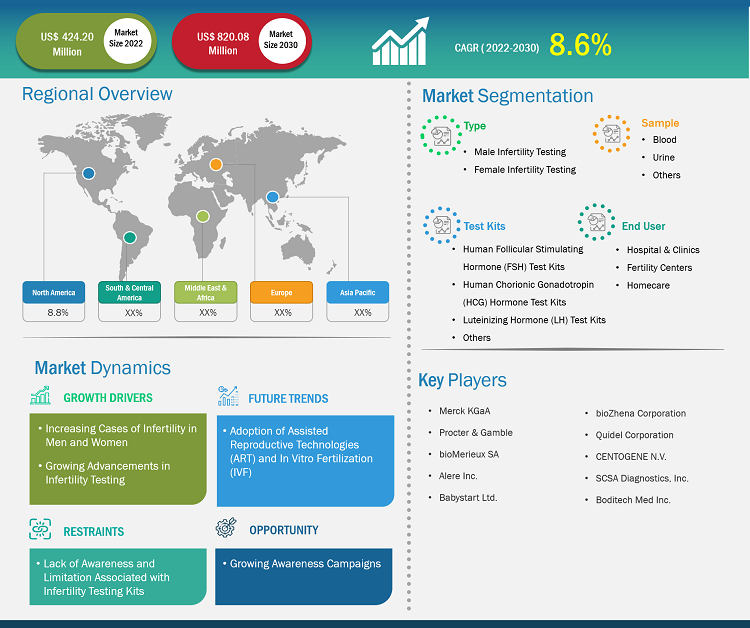

Market Size Value in US$ 424.20 million in 2022 Market Size Value by US$ 820.08 million by 2030 Growth rate CAGR of 8.6% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Infertility Testing Market Drivers and OpportunitiesCustomize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Infertility Testing Market: Strategic Insights

| Market Size Value in | US$ 424.20 million in 2022 |

| Market Size Value by | US$ 820.08 million by 2030 |

| Growth rate | CAGR of 8.6% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Market Drivers:

- Rising Infertility Rates: Soaring cases of infertility worldwide increase demand for diagnostic testing.

- Advanced Diagnostic Technologies: Innovations such as genetic and hormonal tests improve accuracy and patient outcomes.

- Delayed Parenthood Trends: More couples postponing pregnancy drives the need for fertility assessment.

- Increasing Awareness: Continuous breakthroughs in qubits, photonics, and algorithms drive market growth.

- Government & Private Healthcare Support: Policies and insurance coverage promote access to infertility diagnostics.

Market Opportunities:

- Emerging Markets Expansion: Untapped regions in Asia Pacific and Latin America offer growth potential.

- Integration of AI & Digital Tools: Q AI-driven analysis can enhance test accuracy and efficiency.

- Partnerships with Fertility Clinics: Collaborations can expand market reach and patient engagement.

- Development of Home-Based Testing Kits: At-home fertility tests can attract tech-savvy users.

- Personalized Fertility Solutions: Customized testing and treatment plans create value for patients.

The infertility testing market is categorized into distinct segments to understand its structure, growth prospects, and emerging trends. Below is the standard segmentation approach used in industry reports:

By Type:

- Female Infertility Testing: The female infertility testing segment encompasses a variety of diagnostic procedures aimed at identifying underlying causes of infertility in women.

- Male Infertility Testing: The male infertility testing segment focuses on evaluating factors that affect male reproductive health, contributing to nearly 40–50% of infertility cases globally. Core diagnostic procedures include semen analysis, hormonal testing, genetic testing, and imaging studies.

By Test Kits:

- Human Follicular Stimulating Hormone (FSH) Test Kits: Human Follicular Stimulating Hormone (FSH) test kits are used to assess ovarian function and fertility potential in women. FSH regulates the growth and maturation of ovarian follicles, making it critical for ovulation and conception.

- Luteinizing Hormone (LH) Test Kits: Luteinizing Hormone (LH) test kits are used to monitor ovulation, a key factor in female fertility. LH surges trigger ovulation, making its measurement essential for timing conception or assisted reproductive interventions.

- Human Chorionic Gonadotropin (HCG) Hormone Test Kits: Human Chorionic Gonadotropin (HCG) test kits are essential for early pregnancy detection and monitoring after fertility treatments.

- Others: The “Others” segment includes additional hormonal and biochemical test kits used in infertility diagnostics, such as Anti-Müllerian Hormone (AMH), prolactin, thyroid-stimulating hormone (TSH), and estradiol tests.

By Sample:

- Blood

- Urine

- Others

By End User:

- Homecare

- Hospital and Clinics

- Fertility Centers

By Geography:

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa

Market Report Scope

Infertility Testing Market Share Analysis by GeographyThe Infertility Testing Market in the Asia Pacific is experiencing rapid growth driven by rising infertility rates, delayed parenthood, improving healthcare infrastructure, increasing awareness, and expanding access to advanced diagnostic technologies. Emerging markets in South & Central America, the Middle East, and Africa present untapped opportunities for expanding infertility testing services due to improving healthcare access and growing awareness. Rising investments, urbanization, and demand for affordable diagnostic solutions support market growth in these regions.

The infertility testing market growth differs in each region due to variations in healthcare infrastructure, awareness levels, economic conditions, regulatory policies, and access to advanced diagnostic technologies. Below is a summary of market share and trends by region:

1. North America

- Market Share: Holds a significant portion of the global market

- Key Drivers:

- High infertility prevalence & delayed parenthood

- Rising age at first pregnancy increases demand for testing.

- Advanced healthcare infrastructure

- Digital & at-home fertility solutions

- Trends: Growing consumer preference for at-home digital fertility tests.

2. Europe

- Market Share: Substantial share owing to stringent EU regulations

- Key Drivers:

- Robust public healthcare systems

- National support increases access to infertility diagnostics.

- Delayed childbirth trends

- Demand for personalized reproductive solutions.

- Trends: Increasing integration of clinical fertility diagnostics with ART services.

3. Asia Pacific

- Market Share: Fastest-growing region with dominant market share

- Key Drivers:

- Rising infertility awareness and healthcare investment

- Urban lifestyle impacts

- Increasing disposable incomes

- Trends: Expanding government and private investment.

4. Middle East and Africa

- Market Share: Although small, it is growing quickly

- Key Drivers:

- Rising healthcare investments

- Modernization of medical facilities improves access.

- Growing fertility awareness

- Adoption of advanced reproductive tech

- Trends: Emergence of digital fertility platforms and app-based tools.

5. South & Central America

- Market Share: Growing Market with steady progress

- Key Drivers:

- Growing awareness & middle-class spending

- More individuals seek reproductive diagnostics.

- Expansion of fertility clinics.

- Societal trends of delayed family planning

- Trends: Growth in fertility services and medical tourism.

High Market Density and Competition

Competition is intense due to the presence of major global players such as Quest Diagnostics Inc; Church & Dwight Co Inc; Swiss Precision Diagnostics GmbH; bioMérieux SA; QuidelOrtho Corp; Abbott Laboratories; Thermo Fisher Scientific Inc; Prestige Consumer Healthcare Inc.; LetsGetChecked; and Mira companies.

This high level of competition urges companies to stand out by offering:

- Innovative and highly accurate diagnostic technologies

- User-friendly and at-home testing solutions

- Faster test results with improved turnaround times

- Cost-effective and affordable testing options

- Strong brand credibility and regulatory compliance.

Opportunities and Strategic Moves

- Expansion into at-home and digital fertility testing– Companies can tap into rising consumer demand for convenient, private, and app-integrated testing solutions.

- Strategic partnerships and geographic expansion– Collaborations with fertility clinics and entry into emerging markets help broaden reach and accelerate revenue growth.

Disclaimer: The companies listed above are not ranked in any particular order.

Other companies analyzed during the course of research:

- F. Hoffmann-La Roche Ltd (Roche Diagnostics)

- Merck KGaA

- Bio-Rad Laboratories, Inc.

- Siemens Healthineers AG

- CooperSurgical, Inc.

- Genea Limited

- Babystart Ltd

- AdvaCare Pharma

- Fertility Focus Limited

- Sensiia

- bioMérieux entered into an agreement to acquire SpinChip Diagnostics ASA in January 2025 - bioMérieux, a world leader in the field of in vitro diagnostics, announced that it has agreed to acquire SpinChip Diagnostics ASA (“SpinChip”). This privately held Norwegian diagnostics company has developed a game-changing immunoassay diagnostics platform. The small benchtop analyzer is well adapted to near-patient testing as it can deliver a result from a whole blood sample within 10 minutes with the same high-sensitivity performance as the laboratory instruments. bioMérieux has held a minority stake in SpinChip since March 2024.

- Mira introduced Ultra4, the first at-home hormone monitor August 2025 - Mira, a hormonal health company, introduced Ultra4, the first at-home hormone monitor that provides lab-quality insights into four key hormones — FSH, LH, E3G, and PdG — using a single wand in just 16 minutes. This innovation allows users to track their complete cycle, from ovulation strength to hormonal balance, with the same accuracy previously available only in clinical settings.

The "Infertility Testing Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Infertility Testing Market size and forecast at global, regional, and country levels for all the segments covered under the scope

- Infertility Testing Market trends, as well as dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Real-time Location Systems Market For Healthcare analysis covering key trends, global and regional framework, major players, regulations, and recent developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the infertility testing market

- Detailed company profiles

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Test Kits, Sample, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

While Asia Pacific and North America currently dominate, Europe, the Middle East & Africa, and South & Central America are expanding rapidly due to rising healthcare awareness, improving medical infrastructure, and increasing adoption of fertility testing.

1. Delayed Parenthood Trends: More couples postponing pregnancy drives the need for fertility assessment.2. Increasing Awareness: Continuous breakthroughs in qubits, photonics, and algorithms drive market growth.

The Female Infertility Testing segment is experiencing significant growth in the infertility testing market due to increasing awareness and demand for early detection of reproductive health issues.

Top trends include:1. At-home and self-administered testing2. Integration with digital health platforms3. Personalized fertility solutions4. Rapid and point-of-care diagnostics5. Expansion in emerging market

Major players include Quest Diagnostics Inc., Church & Dwight Co. Inc., Swiss Precision Diagnostics GmbH, bioMérieux SA, QuidelOrtho Corp, and Abbott Laboratories.

As of 2024, the global infertility testing market is valued at approximately US$ 494.7 million. It is projected to reach US$ 871.3 million by 2031, growing at a compound annual growth rate (CAGR) of 8.6% from 2025 to 2031.

AI and ML are revolutionizing infertility testing by:1.Enhancing diagnostic accuracy: Machine learning algorithms analyze hormone levels, ovulation patterns, and semen quality for precise results.2. Predicting fertility outcomes: AI models forecast chances of conception or IVF success based on patient data.

Challenges include:1. High cost of advanced diagnostic tests: Limits accessibility, especially in developing regions.2. Lack of awareness in certain regions: Many people remain unaware of infertility issues and available testing.

1. Executive Summary

1.1 Analyst Market Outlook

1.2 Market Attractiveness

2. Infertility Testing Market Landscape

2.1 Overview

2.2 Value Chain Analysis

2.3 Supply Chain Analysis

2.3.1 List of Manufacturers/Suppliers

2.4 Porter`s Five Force Analysis

2.5 PEST Analysis

2.6 Impact of Artificial Intelligence (AI)

2.7 Product or Technology Roadmap

2.8 Sustainability and ESG Trends

2.9 Regulatory Framework

3. Competitive Landscape

3.1 Company Benchmarking by Key Players

3.2 Market Concentration

4. Infertility Testing Market – Key Industry Dynamics

4.1 Market Drivers

4.1.1 Rising Global Incidence of Infertility

4.1.2 Surging Awareness & Demand for Fertility Health

4.1.3 Rising Adoption of Assisted Reproductive Technologies

4.2 Market Restraints

4.2.1 High Cost & Limited Insurance Coverage

4.2.2 Lesser Precision of Ovulation Prediction Kits

4.2.3 Challenges in Ovulation Detection Using Urine Tests in PCOS/PCOD Cases

4.3 Market Opportunities

4.3.1 Rising Demand for Preventive Fertility Screening

4.3.2 Public–Private Healthcare Collaborations

4.3.3 Rise of Home?Based and At?Home Testing Solutions

4.4 Future Trends

4.4.1 Expansion of Digital & Telehealth?Enabled Fertility Services

4.4.2 Advanced Genetic and Molecular Diagnostics

4.4.3 AI?Driven Predictive and Personalized Testing

4.5 Impact of Drivers and Restraints

5. Infertility Testing Market – Global Market Analysis

5.1 Infertility Testing Market Revenue (US$ Million), 2021–2031

5.2 Infertility Testing Market Forecast and Analysis

6. Infertility Testing Market Revenue Analysis –Type

6.1 Infertility Testing Market Forecasts and Analysis by Type

6.1.1 Female Infertility Testing

6.1.1.1 Overview

6.1.1.2 Female Infertility Testing: Infertility Testing Market –Revenue, 2021–2031 (US$ Million)

6.1.2 Male Infertility Testing

6.1.2.1 Overview

6.1.2.2 Male Infertility Testing: Infertility Testing Market –Revenue, 2021–2031 (US$ Million)

7. Infertility Testing Market Revenue Analysis –Test Kits

7.1 Infertility Testing Market Forecasts and Analysis by Test Kits

7.1.1 Human Follicular Stimulating Hormone (FSH) Test Kits

7.1.1.1 Overview

7.1.1.2 Human Follicular Stimulating Hormone (FSH) Test Kits: Infertility Testing Market –Revenue, 2021–2031 (US$ Million)

7.1.2 Luteinizing Hormone (LH) Test Kits

7.1.2.1 Overview

7.1.2.2 Luteinizing Hormone (LH) Test Kits: Infertility Testing Market –Revenue, 2021–2031 (US$ Million)

7.1.3 Human Chorionic Gonadotropin (HCG) Hormone Test Kits

7.1.3.1 Overview

7.1.3.2 Human Chorionic Gonadotropin (HCG) Hormone Test Kits: Infertility Testing Market –Revenue, 2021–2031 (US$ Million)

7.1.4 Others

7.1.4.1 Overview

7.1.4.2 Others: Infertility Testing Market –Revenue, 2021–2031 (US$ Million)

8. Infertility Testing Market Revenue Analysis –Sample

8.1 Infertility Testing Market Forecasts and Analysis by Sample

8.1.1 Blood

8.1.1.1 Overview

8.1.1.2 Blood: Infertility Testing Market –Revenue, 2021–2031 (US$ Million)

8.1.2 Urine

8.1.2.1 Overview

8.1.2.2 Urine: Infertility Testing Market –Revenue, 2021–2031 (US$ Million)

8.1.3 Others

8.1.3.1 Overview

8.1.3.2 Others: Infertility Testing Market –Revenue, 2021–2031 (US$ Million)

9. Infertility Testing Market Revenue Analysis –End User

9.1 Infertility Testing Market Forecasts and Analysis by End User

9.1.1 Homcare

9.1.1.1 Overview

9.1.1.2 Homcare: Infertility Testing Market –Revenue, 2021–2031 (US$ Million)

9.1.2 Hospital and Clinics

9.1.2.1 Overview

9.1.2.2 Hospital and Clinics: Infertility Testing Market –Revenue, 2021–2031 (US$ Million)

9.1.3 Fertility Centers

9.1.3.1 Overview

9.1.3.2 Fertility Centers: Infertility Testing Market –Revenue, 2021–2031 (US$ Million)

10. Infertility Testing Market – Geographical Analysis

10.1 North America

10.1.1 North America Infertility Testing Market Overview

10.1.2 North America: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

10.1.3 North America: Infertility Testing Market– By Segmentation

10.1.3.1 Type

10.1.3.2 Test Kits

10.1.3.3 Sample

10.1.3.4 End User

10.1.4 North America: Infertility Testing Market Breakdown by Countries

10.1.4.1 United States Market

10.1.4.1.1 United States: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

10.1.4.1.2 United States: Infertility Testing Market– By Segmentation

10.1.4.1.2.1 Type

10.1.4.1.2.2 Test Kits

10.1.4.1.2.3 Sample

10.1.4.1.2.4 End User

10.1.4.2 Canada Market

10.1.4.2.1 Canada: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

10.1.4.2.2 Canada: Infertility Testing Market– By Segmentation

10.1.4.2.2.1 Type

10.1.4.2.2.2 Test Kits

10.1.4.2.2.3 Sample

10.1.4.2.2.4 End User

10.1.4.3 Mexico Market

10.1.4.3.1 Mexico: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

10.1.4.3.2 Mexico: Infertility Testing Market– By Segmentation

10.1.4.3.2.1 Type

10.1.4.3.2.2 Test Kits

10.1.4.3.2.3 Sample

10.1.4.3.2.4 End User

10.2 Europe

10.2.1 Europe Infertility Testing Market Overview

10.2.2 Europe: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

10.2.3 Europe: Infertility Testing Market– By Segmentation

10.2.3.1 Type

10.2.3.2 Test Kits

10.2.3.3 Sample

10.2.3.4 End User

10.2.4 Europe: Infertility Testing Market Breakdown by Countries

10.2.4.1 United Kingdom Market

10.2.4.1.1 United Kingdom: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

10.2.4.1.2 United Kingdom: Infertility Testing Market– By Segmentation

10.2.4.1.2.1 Type

10.2.4.1.2.2 Test Kits

10.2.4.1.2.3 Sample

10.2.4.1.2.4 End User

10.2.4.2 Germany Market

10.2.4.2.1 Germany: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

10.2.4.2.2 Germany: Infertility Testing Market– By Segmentation

10.2.4.2.2.1 Type

10.2.4.2.2.2 Test Kits

10.2.4.2.2.3 Sample

10.2.4.2.2.4 End User

10.2.4.3 Italy Market

10.2.4.3.1 Italy: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

10.2.4.3.2 Italy: Infertility Testing Market– By Segmentation

10.2.4.3.2.1 Type

10.2.4.3.2.2 Test Kits

10.2.4.3.2.3 Sample

10.2.4.3.2.4 End User

10.2.4.4 France Market

10.2.4.4.1 France: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

10.2.4.4.2 France: Infertility Testing Market– By Segmentation

10.2.4.4.2.1 Type

10.2.4.4.2.2 Test Kits

10.2.4.4.2.3 Sample

10.2.4.4.2.4 End User

10.2.4.5 Spain Market

10.2.4.5.1 Spain: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

10.2.4.5.2 Spain: Infertility Testing Market– By Segmentation

10.2.4.5.2.1 Type

10.2.4.5.2.2 Test Kits

10.2.4.5.2.3 Sample

10.2.4.5.2.4 End User

10.2.4.6 Rest of Europe Market

10.2.4.6.1 Rest of Europe: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

10.2.4.6.2 Rest of Europe: Infertility Testing Market– By Segmentation

10.2.4.6.2.1 Type

10.2.4.6.2.2 Test Kits

10.2.4.6.2.3 Sample

10.2.4.6.2.4 End User

10.3 Asia Pacific

10.3.1 Asia Pacific Infertility Testing Market Overview

10.3.2 Asia Pacific: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

10.3.3 Asia Pacific: Infertility Testing Market– By Segmentation

10.3.3.1 Type

10.3.3.2 Test Kits

10.3.3.3 Sample

10.3.3.4 End User

10.3.4 Asia Pacific: Infertility Testing Market Breakdown by Countries

10.3.4.1 China Market

10.3.4.1.1 China: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

10.3.4.1.2 China: Infertility Testing Market– By Segmentation

10.3.4.1.2.1 Type

10.3.4.1.2.2 Test Kits

10.3.4.1.2.3 Sample

10.3.4.1.2.4 End User

10.3.4.2 India Market

10.3.4.2.1 India: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

10.3.4.2.2 India: Infertility Testing Market– By Segmentation

10.3.4.2.2.1 Type

10.3.4.2.2.2 Test Kits

10.3.4.2.2.3 Sample

10.3.4.2.2.4 End User

10.3.4.3 Japan Market

10.3.4.3.1 Japan: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

10.3.4.3.2 Japan: Infertility Testing Market– By Segmentation

10.3.4.3.2.1 Type

10.3.4.3.2.2 Test Kits

10.3.4.3.2.3 Sample

10.3.4.3.2.4 End User

10.3.4.4 Australia Market

10.3.4.4.1 Australia: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

10.3.4.4.2 Australia: Infertility Testing Market– By Segmentation

10.3.4.4.2.1 Type

10.3.4.4.2.2 Test Kits

10.3.4.4.2.3 Sample

10.3.4.4.2.4 End User

10.3.4.5 South Korea Market

10.3.4.5.1 South Korea: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

10.3.4.5.2 South Korea: Infertility Testing Market– By Segmentation

10.3.4.5.2.1 Type

10.3.4.5.2.2 Test Kits

10.3.4.5.2.3 Sample

10.3.4.5.2.4 End User

10.3.4.6 Rest of APAC Market

10.3.4.6.1 Rest of APAC: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

10.3.4.6.2 Rest of APAC: Infertility Testing Market– By Segmentation

10.3.4.6.2.1 Type

10.3.4.6.2.2 Test Kits

10.3.4.6.2.3 Sample

10.3.4.6.2.4 End User

10.4 Middle East and Africa

10.4.1 Middle East and Africa Infertility Testing Market Overview

10.4.2 Middle East and Africa: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

10.4.3 Middle East and Africa: Infertility Testing Market– By Segmentation

10.4.3.1 Type

10.4.3.2 Test Kits

10.4.3.3 Sample

10.4.3.4 End User

10.4.4 Middle East and Africa: Infertility Testing Market Breakdown by Countries

10.4.4.1 South Africa Market

10.4.4.1.1 South Africa: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

10.4.4.1.2 South Africa: Infertility Testing Market– By Segmentation

10.4.4.1.2.1 Type

10.4.4.1.2.2 Test Kits

10.4.4.1.2.3 Sample

10.4.4.1.2.4 End User

10.4.4.2 Saudi Arabia Market

10.4.4.2.1 Saudi Arabia: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

10.4.4.2.2 Saudi Arabia: Infertility Testing Market– By Segmentation

10.4.4.2.2.1 Type

10.4.4.2.2.2 Test Kits

10.4.4.2.2.3 Sample

10.4.4.2.2.4 End User

10.4.4.3 United Arab Emirates Market

10.4.4.3.1 United Arab Emirates: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

10.4.4.3.2 United Arab Emirates: Infertility Testing Market– By Segmentation

10.4.4.3.2.1 Type

10.4.4.3.2.2 Test Kits

10.4.4.3.2.3 Sample

10.4.4.3.2.4 End User

10.4.4.4 Rest of Middle East and Africa Market

10.4.4.4.1 Rest of Middle East and Africa: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

10.4.4.4.2 Rest of Middle East and Africa: Infertility Testing Market– By Segmentation

10.4.4.4.2.1 Type

10.4.4.4.2.2 Test Kits

10.4.4.4.2.3 Sample

10.4.4.4.2.4 End User

10.5 South and Central America

10.5.1 South and Central America Infertility Testing Market Overview

10.5.2 South and Central America: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

10.5.3 South and Central America: Infertility Testing Market– By Segmentation

10.5.3.1 Type

10.5.3.2 Test Kits

10.5.3.3 Sample

10.5.3.4 End User

10.5.4 South and Central America: Infertility Testing Market Breakdown by Countries

10.5.4.1 Brazil Market

10.5.4.1.1 Brazil: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

10.5.4.1.2 Brazil: Infertility Testing Market– By Segmentation

10.5.4.1.2.1 Type

10.5.4.1.2.2 Test Kits

10.5.4.1.2.3 Sample

10.5.4.1.2.4 End User

10.5.4.2 Argentina Market

10.5.4.2.1 Argentina: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

10.5.4.2.2 Argentina: Infertility Testing Market– By Segmentation

10.5.4.2.2.1 Type

10.5.4.2.2.2 Test Kits

10.5.4.2.2.3 Sample

10.5.4.2.2.4 End User

10.5.4.3 Rest of South and Central America Market

10.5.4.3.1 Rest of South and Central America: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

10.5.4.3.2 Rest of South and Central America: Infertility Testing Market– By Segmentation

10.5.4.3.2.1 Type

10.5.4.3.2.2 Test Kits

10.5.4.3.2.3 Sample

10.5.4.3.2.4 End User

11. Infertility Testing Market Industry Landscape

12. Infertility Testing Market – Key Company Profiles

12.1 Quest Diagnostics Inc

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.1.6 Key Developments

12.2 Church & Dwight Co Inc

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Products and Services

12.2.4 Financial Overview

12.2.5 SWOT Analysis

12.2.6 Key Developments

12.3 Swiss Precision Diagnostics GmbH

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Products and Services

12.3.4 Financial Overview

12.3.5 SWOT Analysis

12.3.6 Key Developments

12.4 QuidelOrtho Corp

12.4.1 Key Facts

12.4.2 Business Description

12.4.3 Products and Services

12.4.4 Financial Overview

12.4.5 SWOT Analysis

12.4.6 Key Developments

12.5 Abbott Laboratories

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Products and Services

12.5.4 Financial Overview

12.5.5 SWOT Analysis

12.5.6 Key Developments

12.6 bioMerieux SA

12.6.1 Key Facts

12.6.2 Business Description

12.6.3 Products and Services

12.6.4 Financial Overview

12.6.5 SWOT Analysis

12.6.6 Key Developments

12.7 Thermo Fisher Scientific Inc

12.7.1 Key Facts

12.7.2 Business Description

12.7.3 Products and Services

12.7.4 Financial Overview

12.7.5 SWOT Analysis

12.7.6 Key Developments

12.8 Prestige Consumer Healthcare Inc.

12.8.1 Key Facts

12.8.2 Business Description

12.8.3 Products and Services

12.8.4 Financial Overview

12.8.5 SWOT Analysis

12.8.6 Key Developments

12.9 LetsGetChecked

12.9.1 Key Facts

12.9.2 Business Description

12.9.3 Products and Services

12.9.4 Financial Overview

12.9.5 SWOT Analysis

12.9.6 Key Developments

12.10 Mira

12.10.1 Key Facts

12.10.2 Business Description

12.10.3 Products and Services

12.10.4 Financial Overview

12.10.5 SWOT Analysis

12.10.6 Key Developments

13. Appendix

13.1 Glossary

13.2 Research Methodology and Approach

13.2.1 Secondary Research

13.2.2 Primary Research

13.2.3 Market Estimation Approach

13.2.3.1 Supply Side Analysis

13.2.3.2 Demand Side Analysis

13.2.4 Research Assumptions and Limitations

13.2.5 Currency Conversion

13.3 About The Insight Partners

13.4 Market Intelligence Cloud

List of Tables

Table 1. Infertility Testing Market Segmentation

Table 2. List of Regulatory Bodies and Organizations

Table 3. Ease of Doing Business: Key Country Rankings

Table 4. Infertility Testing Market – Revenue, 2021–2024(US$ Million)

Table 5. Infertility Testing Market – Revenue Forecast, 2025–2031(US$ Million)

Table 6. Infertility Testing Market – Revenue, 2021–2024(US$ Million) – by Type

Table 7. Infertility Testing Market – Revenue Forecast, 2025–2031(US$ Million) – by Type

Table 8. Infertility Testing Market – Revenue, 2021–2024(US$ Million) – by Test Kits

Table 9. Infertility Testing Market – Revenue Forecast, 2025–2031(US$ Million) – by Test Kits

Table 10. Infertility Testing Market – Revenue, 2021–2024(US$ Million) – by Sample

Table 11. Infertility Testing Market – Revenue Forecast, 2025–2031(US$ Million) – by Sample

Table 12. Infertility Testing Market – Revenue, 2021–2024(US$ Million) – by End User

Table 13. Infertility Testing Market – Revenue Forecast, 2025–2031(US$ Million) – by End User

Table 14. North America: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Type

Table 15. North America: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Type

Table 16. North America: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Test Kits

Table 17. North America: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Test Kits

Table 18. North America: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Sample

Table 19. North America: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Sample

Table 20. North America: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by End User

Table 21. North America: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by End User

Table 22. North America: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Country

Table 23. North America: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Country

Table 24. United States: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Type

Table 25. United States: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Type

Table 26. United States: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Test Kits

Table 27. United States: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Test Kits

Table 28. United States: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Sample

Table 29. United States: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Sample

Table 30. United States: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by End User

Table 31. United States: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by End User

Table 32. Canada: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Type

Table 33. Canada: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Type

Table 34. Canada: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Test Kits

Table 35. Canada: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Test Kits

Table 36. Canada: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Sample

Table 37. Canada: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Sample

Table 38. Canada: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by End User

Table 39. Canada: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by End User

Table 40. Mexico: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Type

Table 41. Mexico: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Type

Table 42. Mexico: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Test Kits

Table 43. Mexico: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Test Kits

Table 44. Mexico: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Sample

Table 45. Mexico: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Sample

Table 46. Mexico: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by End User

Table 47. Mexico: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by End User

Table 48. Europe: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Type

Table 49. Europe: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Type

Table 50. Europe: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Test Kits

Table 51. Europe: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Test Kits

Table 52. Europe: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Sample

Table 53. Europe: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Sample

Table 54. Europe: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by End User

Table 55. Europe: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by End User

Table 56. Europe: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Country

Table 57. Europe: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Country

Table 58. United Kingdom: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Type

Table 59. United Kingdom: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Type

Table 60. United Kingdom: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Test Kits

Table 61. United Kingdom: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Test Kits

Table 62. United Kingdom: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Sample

Table 63. United Kingdom: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Sample

Table 64. United Kingdom: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by End User

Table 65. United Kingdom: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by End User

Table 66. Germany: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Type

Table 67. Germany: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Type

Table 68. Germany: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Test Kits

Table 69. Germany: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Test Kits

Table 70. Germany: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Sample

Table 71. Germany: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Sample

Table 72. Germany: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by End User

Table 73. Germany: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by End User

Table 74. Italy: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Type

Table 75. Italy: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Type

Table 76. Italy: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Test Kits

Table 77. Italy: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Test Kits

Table 78. Italy: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Sample

Table 79. Italy: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Sample

Table 80. Italy: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by End User

Table 81. Italy: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by End User

Table 82. France: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Type

Table 83. France: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Type

Table 84. France: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Test Kits

Table 85. France: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Test Kits

Table 86. France: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Sample

Table 87. France: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Sample

Table 88. France: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by End User

Table 89. France: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by End User

Table 90. Spain: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Type

Table 91. Spain: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Type

Table 92. Spain: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Test Kits

Table 93. Spain: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Test Kits

Table 94. Spain: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Sample

Table 95. Spain: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Sample

Table 96. Spain: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by End User

Table 97. Spain: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by End User

Table 98. Rest of Europe: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Type

Table 99. Rest of Europe: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Type

Table 100. Rest of Europe: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Test Kits

Table 101. Rest of Europe: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Test Kits

Table 102. Rest of Europe: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Sample

Table 103. Rest of Europe: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Sample

Table 104. Rest of Europe: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by End User

Table 105. Rest of Europe: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by End User

Table 106. Asia Pacific: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Type

Table 107. Asia Pacific: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Type

Table 108. Asia Pacific: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Test Kits

Table 109. Asia Pacific: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Test Kits

Table 110. Asia Pacific: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Sample

Table 111. Asia Pacific: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Sample

Table 112. Asia Pacific: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by End User

Table 113. Asia Pacific: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by End User

Table 114. Asia Pacific: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Country

Table 115. Asia Pacific: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Country

Table 116. China: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Type

Table 117. China: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Type

Table 118. China: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Test Kits

Table 119. China: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Test Kits

Table 120. China: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Sample

Table 121. China: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Sample

Table 122. China: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by End User

Table 123. China: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by End User

Table 124. India: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Type

Table 125. India: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Type

Table 126. India: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Test Kits

Table 127. India: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Test Kits

Table 128. India: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Sample

Table 129. India: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Sample

Table 130. India: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by End User

Table 131. India: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by End User

Table 132. Japan: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Type

Table 133. Japan: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Type

Table 134. Japan: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Test Kits

Table 135. Japan: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Test Kits

Table 136. Japan: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Sample

Table 137. Japan: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Sample

Table 138. Japan: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by End User

Table 139. Japan: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by End User

Table 140. Australia: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Type

Table 141. Australia: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Type

Table 142. Australia: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Test Kits

Table 143. Australia: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Test Kits

Table 144. Australia: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Sample

Table 145. Australia: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Sample

Table 146. Australia: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by End User

Table 147. Australia: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by End User

Table 148. South Korea: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Type

Table 149. South Korea: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Type

Table 150. South Korea: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Test Kits

Table 151. South Korea: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Test Kits

Table 152. South Korea: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Sample

Table 153. South Korea: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Sample

Table 154. South Korea: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by End User

Table 155. South Korea: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by End User

Table 156. Rest of APAC: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Type

Table 157. Rest of APAC: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Type

Table 158. Rest of APAC: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Test Kits

Table 159. Rest of APAC: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Test Kits

Table 160. Rest of APAC: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Sample

Table 161. Rest of APAC: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Sample

Table 162. Rest of APAC: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by End User

Table 163. Rest of APAC: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by End User

Table 164. Middle East and Africa: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Type

Table 165. Middle East and Africa: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Type

Table 166. Middle East and Africa: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Test Kits

Table 167. Middle East and Africa: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Test Kits

Table 168. Middle East and Africa: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Sample

Table 169. Middle East and Africa: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Sample

Table 170. Middle East and Africa: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by End User

Table 171. Middle East and Africa: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by End User

Table 172. Middle East and Africa: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Country

Table 173. Middle East and Africa: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Country

Table 174. South Africa: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Type

Table 175. South Africa: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Type

Table 176. South Africa: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Test Kits

Table 177. South Africa: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Test Kits

Table 178. South Africa: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Sample

Table 179. South Africa: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Sample

Table 180. South Africa: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by End User

Table 181. South Africa: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by End User

Table 182. Saudi Arabia: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Type

Table 183. Saudi Arabia: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Type

Table 184. Saudi Arabia: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Test Kits

Table 185. Saudi Arabia: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Test Kits

Table 186. Saudi Arabia: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Sample

Table 187. Saudi Arabia: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Sample

Table 188. Saudi Arabia: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by End User

Table 189. Saudi Arabia: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by End User

Table 190. United Arab Emirates: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Type

Table 191. United Arab Emirates: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Type

Table 192. United Arab Emirates: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Test Kits

Table 193. United Arab Emirates: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Test Kits

Table 194. United Arab Emirates: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Sample

Table 195. United Arab Emirates: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Sample

Table 196. United Arab Emirates: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by End User

Table 197. United Arab Emirates: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by End User

Table 198. Rest of Middle East and Africa: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Type

Table 199. Rest of Middle East and Africa: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Type

Table 200. Rest of Middle East and Africa: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Test Kits

Table 201. Rest of Middle East and Africa: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Test Kits

Table 202. Rest of Middle East and Africa: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Sample

Table 203. Rest of Middle East and Africa: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Sample

Table 204. Rest of Middle East and Africa: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by End User

Table 205. Rest of Middle East and Africa: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by End User

Table 206. South and Central America: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Type

Table 207. South and Central America: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Type

Table 208. South and Central America: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Test Kits

Table 209. South and Central America: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Test Kits

Table 210. South and Central America: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Sample

Table 211. South and Central America: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Sample

Table 212. South and Central America: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by End User

Table 213. South and Central America: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by End User

Table 214. South and Central America: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Country

Table 215. South and Central America: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Country

Table 216. Brazil: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Type

Table 217. Brazil: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Type

Table 218. Brazil: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Test Kits

Table 219. Brazil: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Test Kits

Table 220. Brazil: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Sample

Table 221. Brazil: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Sample

Table 222. Brazil: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by End User

Table 223. Brazil: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by End User

Table 224. Argentina: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Type

Table 225. Argentina: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Type

Table 226. Argentina: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Test Kits

Table 227. Argentina: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Test Kits

Table 228. Argentina: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Sample

Table 229. Argentina: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Sample

Table 230. Argentina: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by End User

Table 231. Argentina: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by End User

Table 232. Rest of South and Central America: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Type

Table 233. Rest of South and Central America: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Type

Table 234. Rest of South and Central America: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Test Kits

Table 235. Rest of South and Central America: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Test Kits

Table 236. Rest of South and Central America: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by Sample

Table 237. Rest of South and Central America: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by Sample

Table 238. Rest of South and Central America: Infertility Testing Market – Revenue, 2021–2024 (US$ Million) – by End User

Table 239. Rest of South and Central America: Infertility Testing Market – Revenue Forecast, 2025–2031 (US$ Million) – by End User

Table 240. Glossary – Infertility Testing Market

List of Figures

Figure 1. Infertility Testing Market – Value Chain Analysis

Figure 2. Porter’s Five Forces Analysis

Figure 3. Pest Analysis

Figure 4. Infertility Testing Market – Key Industry Dynamics

Figure 5. Impact Analysis of Drivers and Restraints

Figure 6. Infertility Testing Market Revenue (US$ Million), 2021–2031

Figure 7. Infertility Testing Market Share (%) – by Type (2024 and 2031)

Figure 8. Female Infertility Testing: Infertility Testing Market –Revenue and Forecasts, 2021–2031 (US$ Million)

Figure 9. Male Infertility Testing: Infertility Testing Market –Revenue and Forecasts, 2021–2031 (US$ Million)

Figure 10. Infertility Testing Market Share (%) – by Test Kits (2024 and 2031)

Figure 11. Human Follicular Stimulating Hormone (FSH) Test Kits: Infertility Testing Market –Revenue and Forecasts, 2021–2031 (US$ Million)

Figure 12. Luteinizing Hormone (LH) Test Kits: Infertility Testing Market –Revenue and Forecasts, 2021–2031 (US$ Million)

Figure 13. Human Chorionic Gonadotropin (HCG) Hormone Test Kits: Infertility Testing Market –Revenue and Forecasts, 2021–2031 (US$ Million)

Figure 14. Others: Infertility Testing Market –Revenue and Forecasts, 2021–2031 (US$ Million)

Figure 15. Infertility Testing Market Share (%) – by Sample (2024 and 2031)

Figure 16. Blood: Infertility Testing Market –Revenue and Forecasts, 2021–2031 (US$ Million)

Figure 17. Urine: Infertility Testing Market –Revenue and Forecasts, 2021–2031 (US$ Million)

Figure 18. Others: Infertility Testing Market –Revenue and Forecasts, 2021–2031 (US$ Million)

Figure 19. Infertility Testing Market Share (%) – by End User (2024 and 2031)

Figure 20. Homcare: Infertility Testing Market –Revenue and Forecasts, 2021–2031 (US$ Million)

Figure 21. Hospital and Clinics: Infertility Testing Market –Revenue and Forecasts, 2021–2031 (US$ Million)

Figure 22. Fertility Centers: Infertility Testing Market –Revenue and Forecasts, 2021–2031 (US$ Million)

Figure 23. Infertility Testing Market Breakdown by Geography, 2024 and 2031

Figure 24. North America: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

Figure 25. North America: Infertility Testing Market Breakdown by Key Countries, 2024 and 2031 (%)

Figure 26. United States: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

Figure 27. Canada: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

Figure 28. Mexico: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

Figure 29. Europe: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

Figure 30. Europe: Infertility Testing Market Breakdown by Key Countries, 2024 and 2031 (%)

Figure 31. United Kingdom: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

Figure 32. Germany: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

Figure 33. Italy: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

Figure 34. France: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

Figure 35. Spain: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

Figure 36. Rest of Europe: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

Figure 37. Asia Pacific: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

Figure 38. Asia Pacific: Infertility Testing Market Breakdown by Key Countries, 2024 and 2031 (%)

Figure 39. China: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

Figure 40. India: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

Figure 41. Japan: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

Figure 42. Australia: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

Figure 43. South Korea: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

Figure 44. Rest of APAC: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

Figure 45. Middle East and Africa: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

Figure 46. Middle East and Africa: Infertility Testing Market Breakdown by Key Countries, 2024 and 2031 (%)

Figure 47. South Africa: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

Figure 48. Saudi Arabia: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

Figure 49. United Arab Emirates: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

Figure 50. Rest of Middle East and Africa: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

Figure 51. South and Central America: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

Figure 52. South and Central America: Infertility Testing Market Breakdown by Key Countries, 2024 and 2031 (%)

Figure 53. Brazil: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

Figure 54. Argentina: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

Figure 55. Rest of South and Central America: Infertility Testing Market Revenue and Forecasts, 2021–2031 (US$ Million)

Figure 56. Bottom–Up Approach and Top–Down Approach

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely - analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You'll receive access to the report within 4-6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we'll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we're happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you're considering, and we'll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report's scope, methodology, customization options, or which license suits you best, we're here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we'll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we'll ensure the issue is resolved quickly so you can access your report without interruption.

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For