Infertility Testing Market Size, Share & Industry Growth by 2031

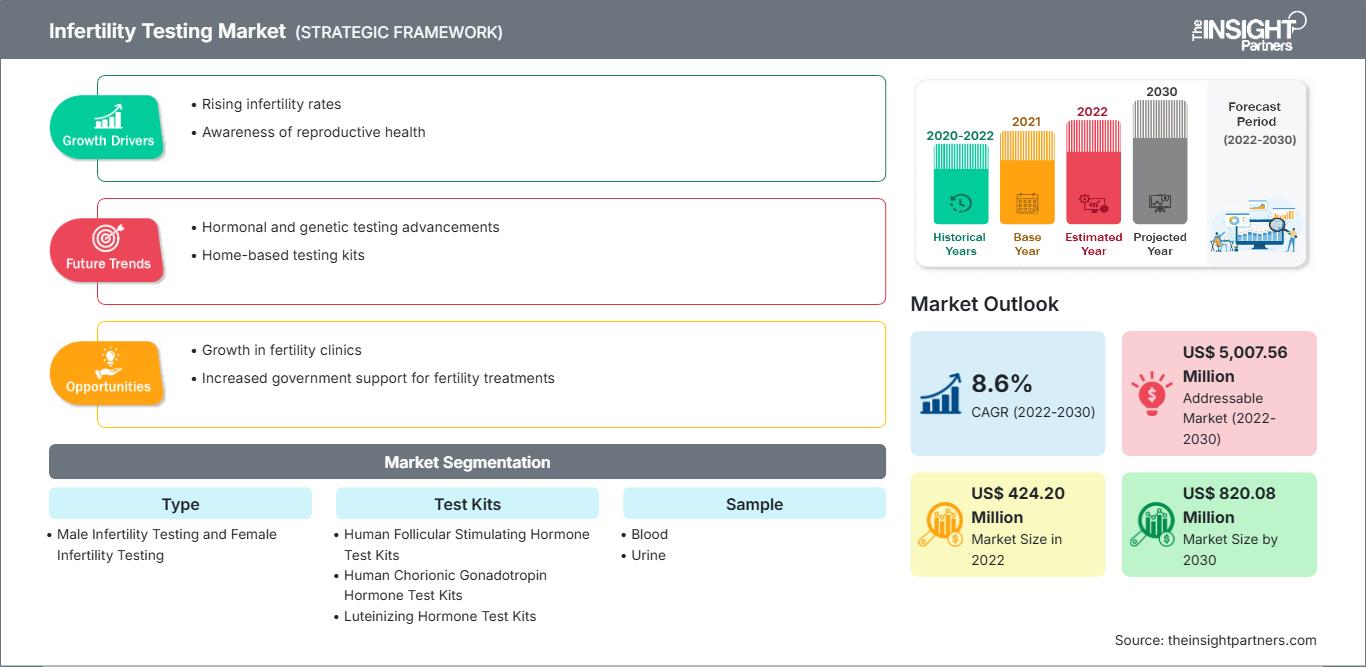

Infertility Testing Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Female Infertility Testing and Male Infertility Testing), Test Kits (Human Follicular Stimulating Hormone (FSH) Test Kits, Luteinizing Hormone (LH) Test Kits, Human Chorionic Gonadotropin (HCG) Hormone Test Kits, and Others), Sample (Blood, Urine, and Others), End Use (Homecare, Hospital and Clinics, and Fertility Centers), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Jan 2026

- Report Code : TIPHE100001421

- Category : Technology, Media and Telecommunications

- Status : Published

- Available Report Formats :

- No. of Pages : 283

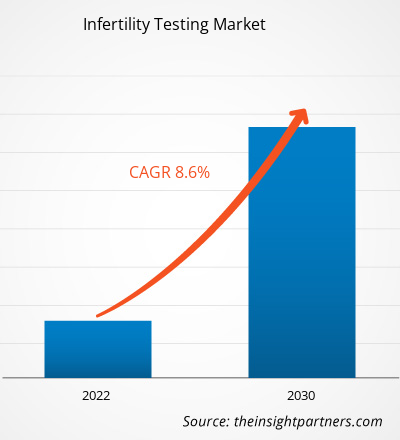

The Infertility Testing Market size is expected to reach US$ 871.3 million by 2031 from US$ 494.7 million in 2024. The market is anticipated to register a CAGR of 8.6% during 2025–2031.

Infertility Testing Market Analysis

The infertility testing market is growing due to rising infertility rates, advanced diagnostic technologies, increasing awareness, and demand for personalized reproductive solutions, with North America and Europe leading global adoption.

Infertility Testing Market Overview

The infertility testing market is expanding with innovations in genetic, hormonal, and imaging diagnostics, driven by delayed parenthood, lifestyle factors, rising healthcare access, and growing demand for accurate, early fertility assessments worldwide.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONInfertility Testing Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Infertility Testing Market Drivers and Opportunities

Market Drivers:

- Rising Infertility Rates: Soaring cases of infertility worldwide increase demand for diagnostic testing.

- Advanced Diagnostic Technologies: Innovations such as genetic and hormonal tests improve accuracy and patient outcomes.

- Delayed Parenthood Trends: More couples postponing pregnancy drives the need for fertility assessment.

- Increasing Awareness: Continuous breakthroughs in qubits, photonics, and algorithms drive market growth.

- Government & Private Healthcare Support: Policies and insurance coverage promote access to infertility diagnostics.

Market Opportunities:

- Emerging Markets Expansion: Untapped regions in Asia Pacific and Latin America offer growth potential.

- Integration of AI & Digital Tools: Q AI-driven analysis can enhance test accuracy and efficiency.

- Partnerships with Fertility Clinics: Collaborations can expand market reach and patient engagement.

- Development of Home-Based Testing Kits: At-home fertility tests can attract tech-savvy users.

- Personalized Fertility Solutions: Customized testing and treatment plans create value for patients.

Infertility Testing Market Report Segmentation Analysis

The infertility testing market is categorized into distinct segments to understand its structure, growth prospects, and emerging trends. Below is the standard segmentation approach used in industry reports:

By Type:

- Female Infertility Testing: The female infertility testing segment encompasses a variety of diagnostic procedures aimed at identifying underlying causes of infertility in women.

- Male Infertility Testing: The male infertility testing segment focuses on evaluating factors that affect male reproductive health, contributing to nearly 40–50% of infertility cases globally. Core diagnostic procedures include semen analysis, hormonal testing, genetic testing, and imaging studies.

By Test Kits:

- Human Follicular Stimulating Hormone (FSH) Test Kits: Human Follicular Stimulating Hormone (FSH) test kits are used to assess ovarian function and fertility potential in women. FSH regulates the growth and maturation of ovarian follicles, making it critical for ovulation and conception.

- Luteinizing Hormone (LH) Test Kits: Luteinizing Hormone (LH) test kits are used to monitor ovulation, a key factor in female fertility. LH surges trigger ovulation, making its measurement essential for timing conception or assisted reproductive interventions.

- Human Chorionic Gonadotropin (HCG) Hormone Test Kits: Human Chorionic Gonadotropin (HCG) test kits are essential for early pregnancy detection and monitoring after fertility treatments.

- Others: The “Others” segment includes additional hormonal and biochemical test kits used in infertility diagnostics, such as Anti-Müllerian Hormone (AMH), prolactin, thyroid-stimulating hormone (TSH), and estradiol tests.

By Sample:

- Blood

- Urine

- Others

By End User:

- Homecare

- Hospital and Clinics

- Fertility Centers

By Geography:

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa

Infertility Testing Market Regional Insights

The regional trends and factors influencing the Infertility Testing Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Infertility Testing Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Infertility Testing Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 494.7 Billion |

| Market Size by 2031 | US$ 871.3 Billion |

| Global CAGR (2025 - 2031) | 8.6% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Infertility Testing Market Players Density: Understanding Its Impact on Business Dynamics

The Infertility Testing Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Infertility Testing Market top key players overview

Infertility Testing Market Share Analysis by Geography

The Infertility Testing Market in the Asia Pacific is experiencing rapid growth driven by rising infertility rates, delayed parenthood, improving healthcare infrastructure, increasing awareness, and expanding access to advanced diagnostic technologies. Emerging markets in South & Central America, the Middle East, and Africa present untapped opportunities for expanding infertility testing services due to improving healthcare access and growing awareness. Rising investments, urbanization, and demand for affordable diagnostic solutions support market growth in these regions.

The infertility testing market growth differs in each region due to variations in healthcare infrastructure, awareness levels, economic conditions, regulatory policies, and access to advanced diagnostic technologies. Below is a summary of market share and trends by region:

1. North America

- Market Share: Holds a significant portion of the global market

- Key Drivers:

- High infertility prevalence & delayed parenthood

- Rising age at first pregnancy increases demand for testing.

- Advanced healthcare infrastructure

- Digital & at-home fertility solutions

- Trends: Growing consumer preference for at-home digital fertility tests.

2. Europe

- Market Share: Substantial share owing to stringent EU regulations

- Key Drivers:

- Robust public healthcare systems

- National support increases access to infertility diagnostics.

- Delayed childbirth trends

- Demand for personalized reproductive solutions.

- Trends: Increasing integration of clinical fertility diagnostics with ART services.

3. Asia Pacific

- Market Share: Fastest-growing region with dominant market share

- Key Drivers:

- Rising infertility awareness and healthcare investment

- Urban lifestyle impacts

- Increasing disposable incomes

- Trends: Expanding government and private investment.

4. Middle East and Africa

- Market Share: Although small, it is growing quickly

- Key Drivers:

- Rising healthcare investments

- Modernization of medical facilities improves access.

- Growing fertility awareness

- Adoption of advanced reproductive tech

- Trends: Emergence of digital fertility platforms and app-based tools.

5. South & Central America

- Market Share: Growing Market with steady progress

- Key Drivers:

- Growing awareness & middle-class spending

- More individuals seek reproductive diagnostics.

- Expansion of fertility clinics.

- Societal trends of delayed family planning

- Trends: Growth in fertility services and medical tourism.

Infertility Testing Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

Competition is intense due to the presence of major global players such as Quest Diagnostics Inc; Church & Dwight Co Inc; Swiss Precision Diagnostics GmbH; bioMérieux SA; QuidelOrtho Corp; Abbott Laboratories; Thermo Fisher Scientific Inc; Prestige Consumer Healthcare Inc.; LetsGetChecked; and Mira companies.

This high level of competition urges companies to stand out by offering:

- Innovative and highly accurate diagnostic technologies

- User-friendly and at-home testing solutions

- Faster test results with improved turnaround times

- Cost-effective and affordable testing options

- Strong brand credibility and regulatory compliance.

Opportunities and Strategic Moves

- Expansion into at-home and digital fertility testing– Companies can tap into rising consumer demand for convenient, private, and app-integrated testing solutions.

- Strategic partnerships and geographic expansion– Collaborations with fertility clinics and entry into emerging markets help broaden reach and accelerate revenue growth.

Disclaimer: The companies listed above are not ranked in any particular order.

Other companies analyzed during the course of research:

- F. Hoffmann-La Roche Ltd (Roche Diagnostics)

- Merck KGaA

- Bio-Rad Laboratories, Inc.

- Siemens Healthineers AG

- CooperSurgical, Inc.

- Genea Limited

- Babystart Ltd

- AdvaCare Pharma

- Fertility Focus Limited

- Sensiia

Infertility Testing Market News and Recent Developments

- bioMérieux entered into an agreement to acquire SpinChip Diagnostics ASA in January 2025 - bioMérieux, a world leader in the field of in vitro diagnostics, announced that it has agreed to acquire SpinChip Diagnostics ASA (“SpinChip”). This privately held Norwegian diagnostics company has developed a game-changing immunoassay diagnostics platform. The small benchtop analyzer is well adapted to near-patient testing as it can deliver a result from a whole blood sample within 10 minutes with the same high-sensitivity performance as the laboratory instruments. bioMérieux has held a minority stake in SpinChip since March 2024.

- Mira introduced Ultra4, the first at-home hormone monitor August 2025 - Mira, a hormonal health company, introduced Ultra4, the first at-home hormone monitor that provides lab-quality insights into four key hormones — FSH, LH, E3G, and PdG — using a single wand in just 16 minutes. This innovation allows users to track their complete cycle, from ovulation strength to hormonal balance, with the same accuracy previously available only in clinical settings.

Infertility Testing Market Report Coverage and Deliverables

The "Infertility Testing Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Infertility Testing Market size and forecast at global, regional, and country levels for all the segments covered under the scope

- Infertility Testing Market trends, as well as dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Real-time Location Systems Market For Healthcare analysis covering key trends, global and regional framework, major players, regulations, and recent developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the infertility testing market

- Detailed company profiles

Frequently Asked Questions

Ankita is a dynamic market research and consulting professional with over 8 years of experience across the technology, media, ICT, and electronics & semiconductor sectors. She has successfully led and delivered 100+ consulting and research assignments for global clients such as Microsoft, Oracle, NEC Corporation, SAP, KPMG, and Expeditors International. Her core competencies include market assessment, data analysis, forecasting, strategy formulation, competitive intelligence, and report writing.

Ankita is adept at handling complete project cycles—from pre-sales proposal design and client discussions to post-sales delivery of actionable insights. She is skilled in managing cross-functional teams, structuring complex research modules, and aligning solutions with client-specific business goals. Her excellent communication, leadership, and presentation abilities have enabled her to consistently deliver value-driven outcomes in fast-paced and evolving market environments.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For