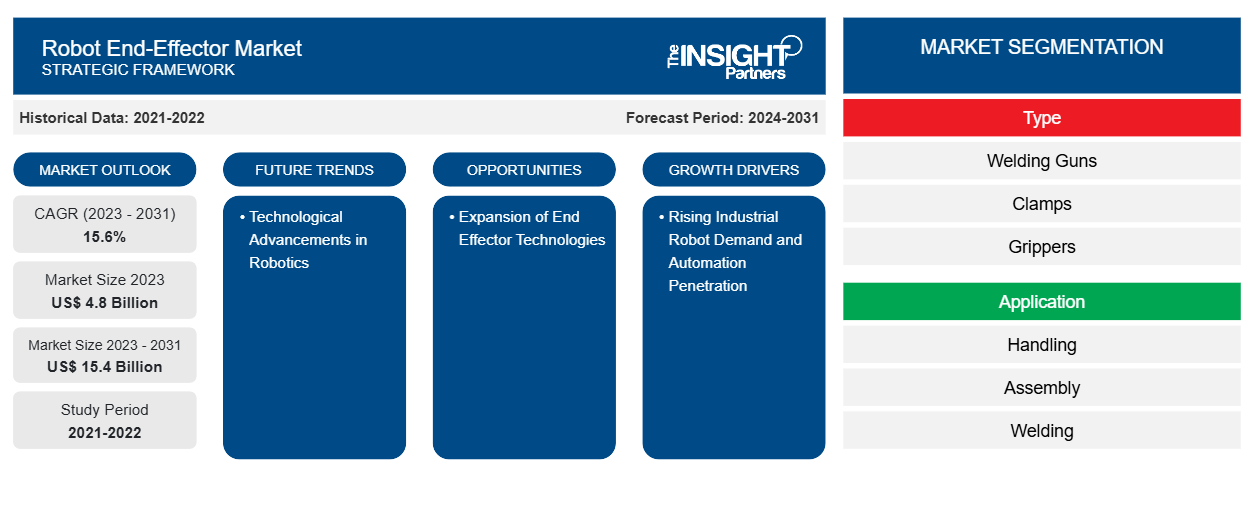

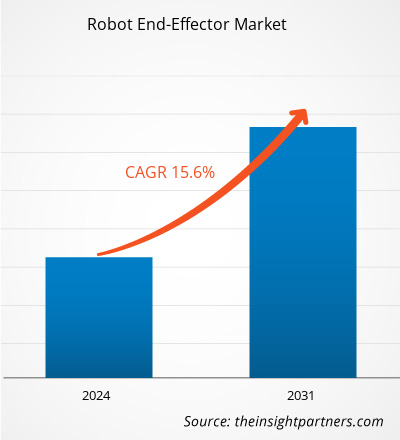

The robot end-effector market size is projected to reach US$ 15.4 billion by 2031 from US$ 4.8 billion in 2023. The market is expected to register a CAGR of 15.6% during 2023–2031. Technological advancements in robotics are likely to remain a key trend in the market.

Robot End-Effector Market Analysis

The market for robot end-effector is growing at a significant CAGR. With the help of these robot arms and end-effectors, automation of different business processes can be achieved within a fraction of the time as compared to traditional industrial robots. This flexibility or versatility makes end-effectors suit almost every type of complex task, thus maximizing the ROI. Positive growth of the market is also influenced by the rising applications of automated packaging and palletizing in the manufacturing industry, together with rapid modernization and industrialization across all regions. Moreover, an increasing trend of adoption of collaborative robots, also known as Cobots, and the attraction of foreign direct investments by developing countries further support the growth of the market. All these factors together support the growth of the robot end-effector market.

Robot End-Effector Market Overview

The robot end-effector market is that part of the industry comprising all devices attached to an arm of any robot, enabling it to interact with work components or parts to achieve a certain predefined task. These end-effectors are otherwise referred to as end-of-arm tooling and may include grippers, processing tools, suction cups, and other peripheral devices. The market is driven by the increasing adoption of robots in various tasks—a task handled by specially designed end-effectors that are capable of handling complex operations with a high accuracy and precision level.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Robot End-Effector Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Robot End-Effector Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Robot End-Effector Market Drivers and Opportunities

Rising Industrial Robot Demand and Automation Penetration

The considerable growth in demand for industrial robots, particularly within warehouses and semiconductor plants, provides a huge impetus to the market for robot end-effectors. This is, in turn, driven by huge investments being made in industrial robots, whereby sales volumes of industrial robots have increased substantially, giving a corresponding boost to the demand for robotic end-effectors. Furthermore, the increasing integration of automation solutions within SMEs shall be instrumental in holding a favorable environment for the high adoption rate of end-effectors, further catalyzing market growth and adoption across a wide spectrum of industrial sectors.

Expansion of End Effector Technologies

The burgeoning growth of robotic end-effectors, particularly the grippers, is making way for immense opportunities in market growth. One of the important drivers for market growth is the use of pneumatic grippers, particularly in industries such as cosmetics, pharmaceuticals, and electronics. Besides, the growing adoption of modular end-effectors and increasing adoption of cobots are further adding to the growth of the market, thus offering lucrative opportunities and a future with innovation in the industry.

Robot End-Effector Market Report Segmentation Analysis

Key segments that contributed to the derivation of the robot end-effector market analysis are type, application, and industry.

- Based on type, the market is segmented into welding guns, clamps, grippers, suction cups, tool changers, and others. The welding guns segment held a significant market share in 2023.

- In terms of application, the market is segmented into handling, assembly, welding, processing, dispensing, and others. The handling segment held a significant market share in 2023.

- Based on industry, the market is segmented into automotive, metals and machinery, electrical and electronics, food and beverages, and others. The automotive segment held a significant market share in 2023.

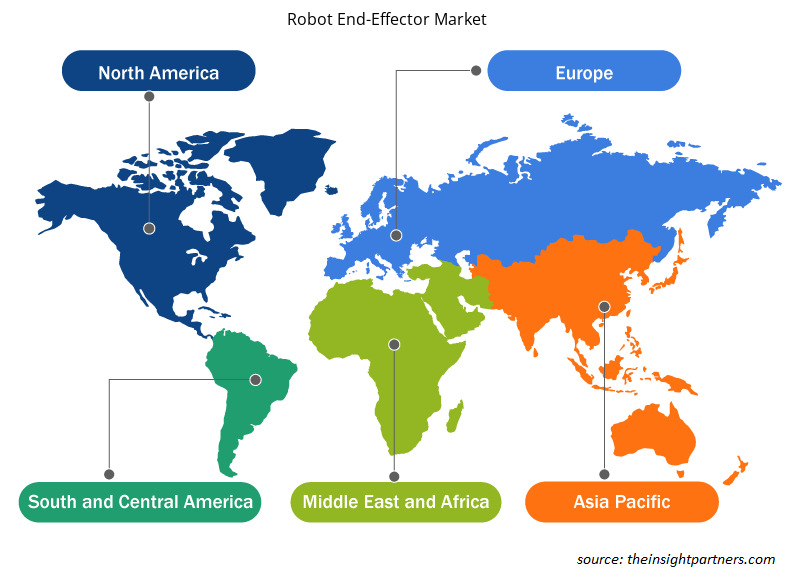

Robot End-Effector Market Share Analysis by Geography

The geographic scope of the robot end-effector market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

The Asia-Pacific region, particularly countries such as South Korea, China, and Japan, is experiencing rapid growth in the implementation of end-effectors, driven by the deployment of a large number of robots and strong developments in the electronics and electrical industry. Japan, a leading supplier in the industrial robotics market, contributes to a substantial portion of industrial robot deliveries and is a major adopter of robots, with a high robot density compared to the global average. Additionally, Europe, amidst its transition into Industry 4.0, is witnessing a surge in the adoption of robotic end-effectors and cobots, supported by government encouragement and initiatives.

Robot End-Effector Market Regional Insights

The regional trends and factors influencing the Robot End-Effector Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Robot End-Effector Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Robot End-Effector Market

Robot End-Effector Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 4.8 Billion |

| Market Size by 2031 | US$ 15.4 Billion |

| Global CAGR (2023 - 2031) | 15.6% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Robot End-Effector Market Players Density: Understanding Its Impact on Business Dynamics

The Robot End-Effector Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Robot End-Effector Market are:

- ABB Ltd

- ATI Industrial Automation, Inc.

- DESTACO (Dover Corporation)

- Festo SE & Co. KG

- Schmalz GmbH

- Kuka AG

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Robot End-Effector Market top key players overview

Robot End-Effector Market News and Recent Developments

The robot end-effector market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the robot end-effector market are listed below:

- SMAC Moving Coil Actuators introduced its new LPL Series 125 low-profile electric linear actuator designed specifically for use on robot end effectors. The LPL Series actuators utilize SMAC's moving coil linear servo motors for industry-leading precision control often needed for end effector applications, such as parts finishing, pick-and-place tasks and assembly operations.

(Source: SMAC Corporation, Company Website, December 2023)

Robot End-Effector Market Report Coverage and Deliverables

The “Robot End-Effector Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Robot end-effector market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Robot end-effector market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Robot end-effector market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the robot end-effector market

- Detailed company profiles

Frequently Asked Questions

What is the expected CAGR of the robot end-effector market?

The market is projected to record a CAGR of 15.6% during 2023–2031.

What would be the estimated value of the robot end-effector market by 2031?

The market is expected to reach a value of US$ 15.4 billion by 2031.

Which are the leading players operating in the robot end-effector market?

ABB Ltd, ATI Industrial Automation, Inc., DESTACO (Dover Corporation), Festo SE & Co. KG, Schmalz GmbH, Kuka AG, Piab AB, Robotiq Inc., SCHUNK GmbH & Co. KG, and Zimmer Group are key players in the market.

What are the future trends of the robot end-effector market?

Technological advancements in robotics are a key trend in the market.

What are the driving factors impacting the robot end-effector market?

Rising industrial robot demand and automation penetration devices are driving the market.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

Get Free Sample For

Get Free Sample For