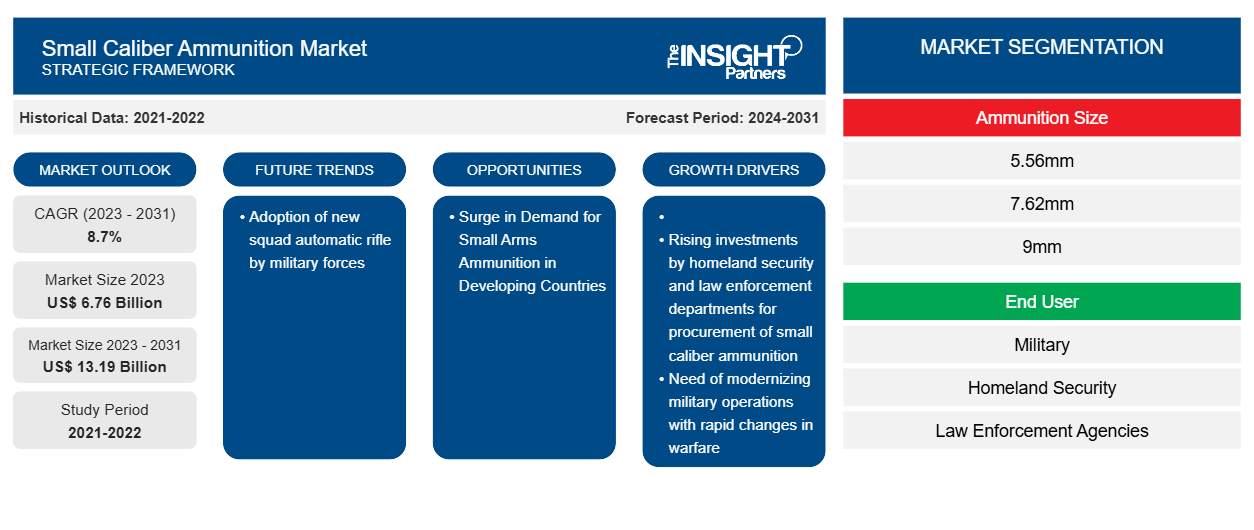

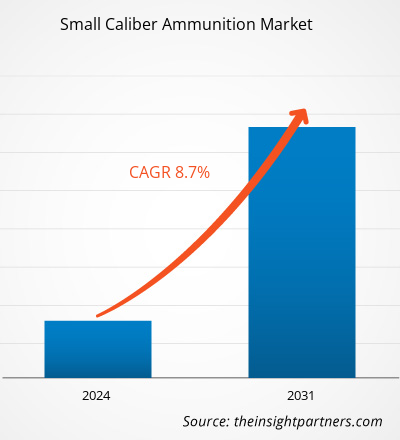

The small caliber ammunition market size is projected to reach US$ 13.19 billion by 2031 from US$ 6.76 billion in 2023. The market is expected to register a CAGR of 8.7% during 2023–2031. Adoption of new squad automatic rifle by military forces is likely to remain a key trend in the market.

Small Caliber Ammunition Market Analysis

The key players in the small caliber ammunition market include General Dynamics Ordnance and Tactical Systems, Thales Group, Northrop Grumman Corporation, BAE Systems, and Vista Outdoor. The ranking has been analyzed on the basis of product portfolio, annual segmental revenues, brand image, and contracts, among other parameters. These companies are actively participating in continuous development of different types of small caliber ammunitions. In addition, these players invest substantial capitals in respective R&D teams to design and develop small caliber ammunitions that meet the demands of military, homeland security, law enforcement, and weapon manufacturers. Owing to this, the players mentioned in the figure are the key contractors among the global weapon manufacturers and end users, which help them to generate higher revenues year on year through small caliber ammunitions.

Small Caliber Ammunition Market Overview

Key stakeholders in the small caliber ammunition market include raw material suppliers, small caliber ammunition manufactures, and end users. The raw materials used in production of small caliber ammunition include chemical energy substance (nitrocellulose and black gunpowder components), metals, and shells. The availability of large number of raw material suppliers enables the small caliber ammunitions market players to choose the appropriate supplier. This enhances the supply chain of the small caliber ammunition industry. Upon procuring raw materials, the small caliber ammunition market players produce significant volumes of small caliber ammunition with varied calibers, thereby, meeting respective customer demands. The end users in the small caliber ammunitions market include law enforcement agencies and military.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Small Caliber Ammunition Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Small Caliber Ammunition Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Small Caliber Ammunition Market Drivers and Opportunities

Need of Modernizing Military Operations with Rapid Changes in Warfare

Rapid changes in modern warfare are urging governments of different countries to allocate higher amounts toward respective military forces. The forces are focusing on caliber sizes such as 7.62 mm for attaining greater projectile ranges, as the existing calibers such as 5.56 mm are becoming ineffective in piercing tougher armors. The military budget allocation enables the military forces to engage themselves in the development of robust indigenous technologies alongside procuring advanced weapons, ammunition, vehicles, and other equipment from domestic and international manufacturers. Moreover, the solider and military vehicle modernization practices help them keep their personnel and vehicles mission-ready. The increased military investments are being channelized toward the procurement of newer technologies, including different types of ammunition, which is boosting the growth of the small caliber ammunitions market.

Surge in Demand for Small Arms Ammunition in Developing Countries

The rising terrorist attacks and political instability among various developed and developing countries is increasing the defense and homeland security forces to increase their procurement of advanced solutions such as radar systems, communication systems and anti-drone technologies amongst others. For instance, the department of defense of US, European Union and other authorities like Indian defense ministry has increased their spending on the procurement of anti-drones over the years. This is leading the small caliber ammunition manufacturers to adopt organic and inorganic growth strategies, such as high investments, product offerings, and global expansion, further creating growth opportunities for the global small caliber ammunition market.

Small Caliber Ammunition Market Report Segmentation Analysis

Key segments that contributed to the derivation of the small caliber ammunition market analysis are ammunition size, end user, and gun type.

- Based on ammunition size, the small caliber ammunition market is segmented into 5.56mm, 7.62mm, 9mm, 12.7mm, 14.5mm, 45ACP, .338mm, .22LR, 223 REM, .308 Winchester, and Others. The 9mm segment held a larger market share in 2023.

- Based on end user, the small caliber ammunition market is segmented into military, homeland security, and law enforcement agencies. The military segment held a larger market share in 2023.

- Based on gun type, the small caliber ammunition market is segmented into pistols, rifles, and shot guns. The pistols segment held a larger market share in 2023.

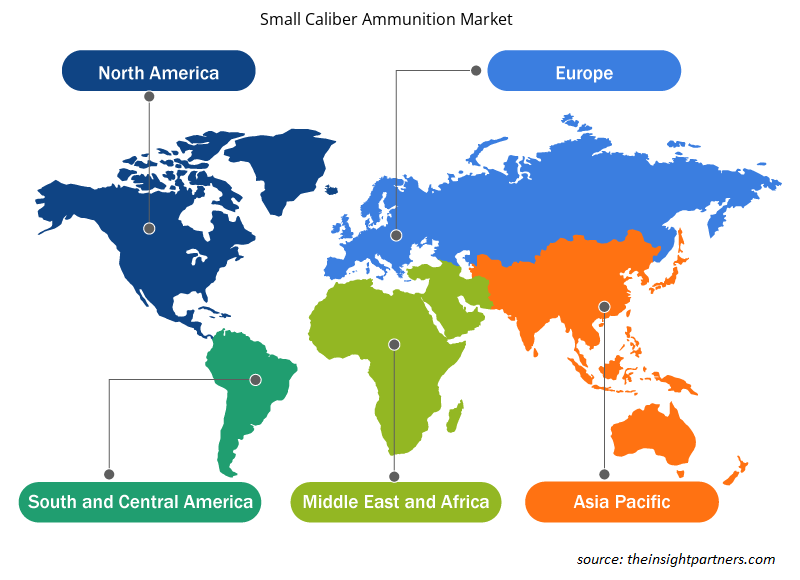

Small Caliber Ammunition Market Share Analysis by Geography

The geographic scope of the small caliber ammunition market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America has dominated the market in 2023 followed by Europe and Asia Pacific regions. Further, Asia Pacific is also likely to witness highest CAGR in the coming years. The US accounted for major share in the North American small caliber ammunition market. The US contributes to the world’s largest military expenditure and has the largest army size, spends significantly on the procurement of ammunition due to its widespread operations inside the US and in other countries. This contributes to the growing demand for ammunitions in the country. In addition, the country’s army is deployed in various foreign locations for peacekeeping operations as a part of NATO forces that further adds to the rising demand. Moreover, the US Army’s involvement in the operations such as Iraq and Afghanistan and ownership of more than a dozen plants that manufacture ammunition, ammunition components, and other ordnance materiel such as gun tubes and gun mounts has bolstered the expenditure on ammunition since the last decade. Also, the US Army is planning to adopt 6.8mm weapons and has chosen General Dynamics-OTS Inc., AAI Corporation Textron Systems, and Sig Sauer Inc. to deliver prototypes of both the automatic rifle and rifle versions of the Next Generation Squad Weapon (NGSW) and hundreds of thousands of rounds of special 6.8 mm ammunition. Furthermore, the US Army had awarded a major long-term contract worth US$194 million in 2019 to Alliant Techsystems Operations LLC to supply small caliber ammunition for the next ten years and to modernize and operate its Lake city Army Ammunition Plant, thereby driving the market growth.

Small Caliber Ammunition Market Regional Insights

The regional trends and factors influencing the Small Caliber Ammunition Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Small Caliber Ammunition Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Small Caliber Ammunition Market

Small Caliber Ammunition Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 6.76 Billion |

| Market Size by 2031 | US$ 13.19 Billion |

| Global CAGR (2023 - 2031) | 8.7% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Ammunition Size

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

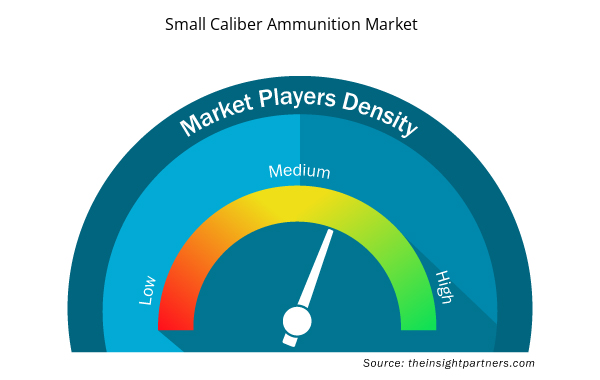

Small Caliber Ammunition Market Players Density: Understanding Its Impact on Business Dynamics

The Small Caliber Ammunition Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Small Caliber Ammunition Market are:

- BAE Systems

- CBC Global Ammunition

- Denel Pretoria Metal Pressing

- Elbit Systems Ltd.

- FN Herstel

- General Dynamics OTS

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Small Caliber Ammunition Market top key players overview

Small Caliber Ammunition Market News and Recent Developments

The small caliber ammunition market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the small caliber ammunition market are listed below:

- Colt CZ Group SE (“Colt CZ”, the “Group” or the “Company”) hereby announces that on December 18, 2023, it executed an agreement with CBC Europe S.à r.l. (“CBC”) to purchase 100% interest in Sellier & Bellot a.s. (“Sellier & Bellot”). (Source: Colt CZ Group SE, Press Release, Dec 2023)

- Czechoslovak Group (CSG) acquired 70% stake in Fiocchi Munizioni, a global leader in premium and super premium small caliber ammunition wherein CSG will partner with other stakeholders and continued growth path envisaged for Fiocchi Munizioni. (Source: Czechoslovak Group, Press Release, Nov 2022)

Small Caliber Ammunition Market Report Coverage and Deliverables

The “Small Caliber Ammunition Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Small caliber ammunition market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Small caliber ammunition market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed porter’s five forces analysis

- Small caliber ammunition market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the small caliber ammunition market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Ammunition Size , End User , Gun Type , and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Which region dominated the small caliber ammunition market in 2023?

North America region dominated the small caliber ammunition market in 2023.

What are the driving factors impacting the small caliber ammunition market?

Rising investments by homeland security and law enforcement departments for procurement of small caliber ammunition and need of modernizing military operations with rapid changes in warfare are some of the factors driving the growth for small caliber ammunition market.

What are the future trends of the small caliber ammunition market?

Adoption of new squad automatic rifle by military forces is one of the major trends of the market.

Which are the leading players operating in the small caliber ammunition market?

General Dynamics Ordnance and Tactical Systems, Thales Group, Northrop Grumman Corporation, BAE Systems Plc, Vista Outdoor Inc, CBC Global Ammunition, NAMMO AS, Remington Ammunition, Elbit Systems Ltd, FN Herstal, Winchester Ammunition, and Denel PMP are some of the key players profiled under the report.

What would be the estimated value of the small caliber ammunition market by 2031?

The estimated value of the small caliber ammunition market by 2031 would be around US$ 13.19 billion.

What is the expected CAGR of the small caliber ammunition market?

The small caliber ammunition market is likely to register of 8.7% during 2023-2031.

Get Free Sample For

Get Free Sample For