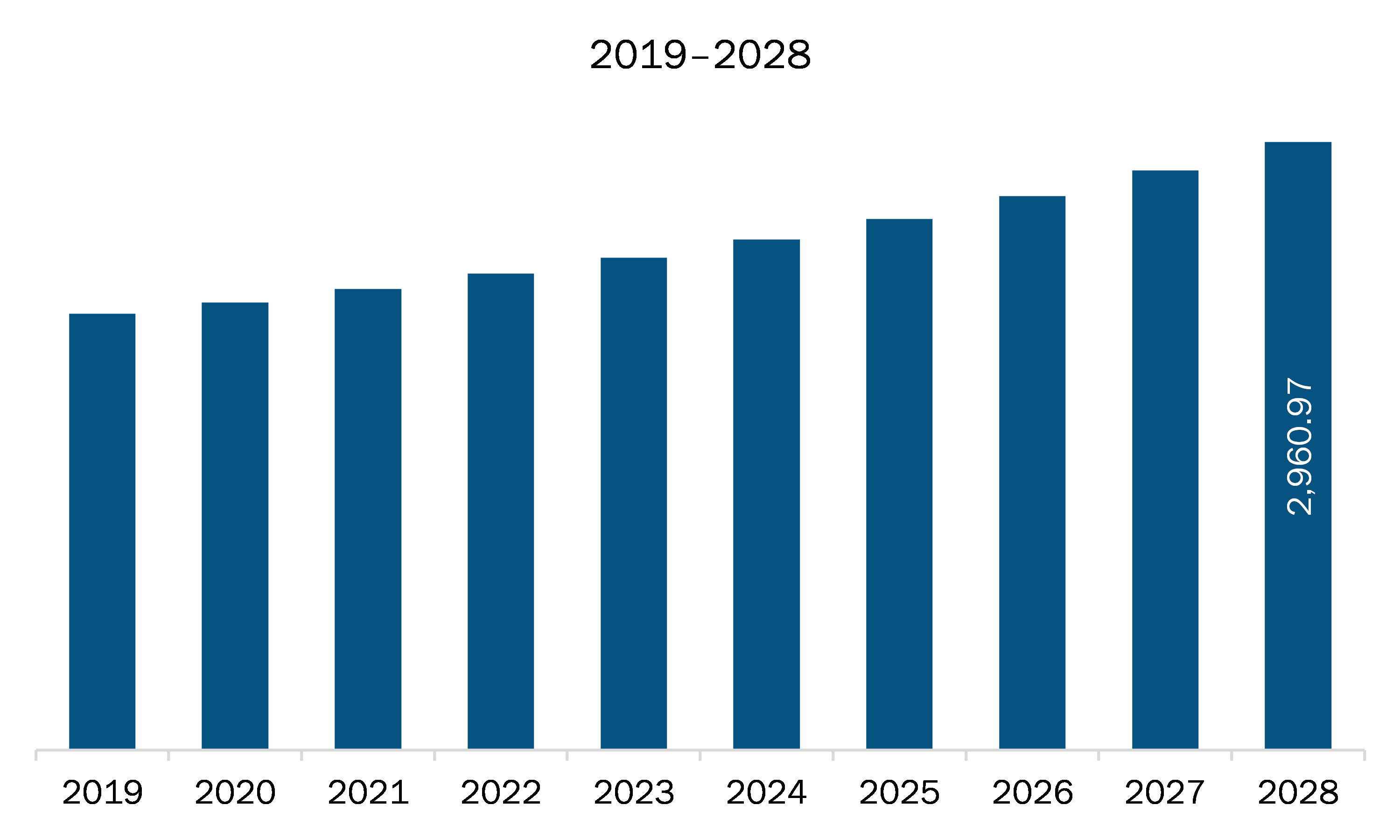

The SAM adhesive tapes market is expected to grow from US$ 2,245.52 million in 2021 to US$ 2,960.97 million by 2028; it is estimated to grow at a CAGR of 4.0% from 2021 to 2028.

Brazil and Argentina are major economies in SAM. Replacing mechanical fasteners with adhesive tape is expected to catalyze the SAM adhesive tapes market. Using adhesive tape instead of mechanical fasteners can change many product design areas and manufacturing efficiency. Screws, bolts, clips, rivets, and other mechanical fastening systems are quickly replaced by adhesive tapes due to their design and assembly advantages. Mechanical fasteners are considered the strongest and reliable joining methods. However, connecting different surfaces is a challenge because the material may tear due to tensile stress under high pressure. Therefore, it lacks reliability and long-term responsibility. These tapes eliminate the challenges related to traditional fastening systems and extend the life of a product. In addition, it eliminates rust and corrosion, lowers noise and vibration, reduces manufacturing and assembly time, and improves product design. These benefits significantly help improve efficiency and performance in various applications packaging, healthcare, automotive, electrical and electronics, building and construction, and others while reducing production and material costs. Further, many companies are manufacturing adhesive tapes for replacing mechanical fasteners. For instance, 3M has a range of VHB and Vhpb high-performance adhesive tapes, which consist of a durable acrylic adhesive with viscoelasticity. The company provides an exceptionally strong double-sided foam tape that can be adhered to a variety of substrates, such as stainless steel, aluminum, galvanized steel, composites, plastics, acrylic, polycarbonate, ABS, and painted or sealed wood and concrete. The tapes are widely used in applications across various markets, such as transportation, electrical appliances, electronics, construction, and signs and displays, as well as in general industries. 3M VHB Tape GPH060GF is a permanent adhesive solution that can replace traditional mechanical fasteners and liquid adhesives in demanding high-temperature applications. Its acrylic foam core provides a good balance between strength and adaptability. The tape has excellent temperature resistance and is very suitable for powder coating or liquid coating processes that undergo thermal baking cycles. Thus, the replacement of mechanical fasteners with adhesive tape would create lucrative opportunities for the SAM adhesive tapes market players during the forecast period.In SAM, Brazil recorded the highest number of COVID-19 cases, followed by Ecuador, Chile, Peru, and Argentina. Governments in SAM have taken an array of actions to protect their citizens and contain the virus spread. Thus, the region is facing lower export revenues, both from the drop-in commodity prices and reduction in export volumes—especially to China, Europe, and the US, which are important trade partners. Containment measures in several SAM countries would reduce economic activities in the chemical & materials sector for at least the next quarter, with a rebound once the epidemic is contained. Furthermore, many businesses have begun to actively market the product to broaden their customer base and reduce business impact.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the SAM adhesive tapes market. The SAM adhesive tapes market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

SAM Adhesive Tapes Market Segmentation

SAM Adhesive Tapes Market – By Resin Type

- Acrylic

- Rubber

- Silicone

- Others

SAM Adhesive Tapes Market – By Technology

- Water-Based Adhesive Tapes

- Solvent-Based Adhesive Tapes

- Hot-Melt- Based Adhesive Tapes

SAM Adhesive Tapes Market – By Tape Backing Material

- Polypropylene (PP)

- Paper

- Polyvinyl Chloride (PVC)

- Others

SAM Adhesive Tapes Market – ByApplication

- Packaging

- Healthcare

- Automotive

- Electrical and Electronics

- Building and Construction

- Others

SAM Adhesive Tapes Market, by Country

- Brazil

- Argentina

- Rest of SAM

SAM Adhesive Tapes Market - Companies Mentioned

- 3M

- Avery Dennison Corporation

- Berry Global Inc.

- LINTEC Corporation

- Lohmann GmbH & Co.KG

- Nitto Denko Corporation

- Scapa

- tesa SE

South America Adhesive Tapes Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 2,245.52 Million |

| Market Size by 2028 | US$ 2,960.97 Million |

| CAGR (2021 - 2028) | 4.0% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Resin Type

|

| Regions and Countries Covered |

South and Central America

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For