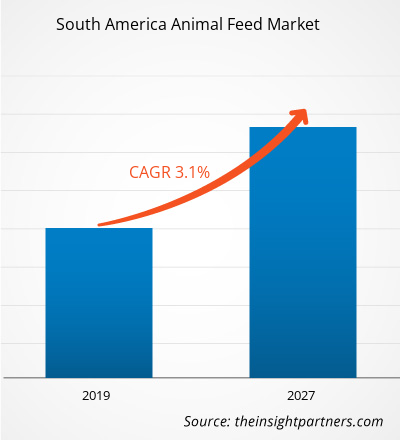

The SAM animal feed market is expected to grow from US$ 57,619.73 million in 2018 to US$ 76,302.18 million by 2027; it is estimated to grow at a CAGR of 3.1% from 2019 to 2027.

Brazil and Argentina are major economies in SAM. Industrial livestock production has undergone substantial transformation owing to technological advancements in animal vaccinations and antibiotics. According to the Food and Agriculture Organization (FAO) more than half of the world's pork and poultry, one-tenth of its beef and mutton and more than two-thirds of its egg supply have originated from industrial livestock production. The development of industrial livestock production across the globe has led to significant demand for highly nutritious animal feed products. The surge in the industrial production of mutton, beef, pork, and poultry over grazing and mixed farming has necessitated the demand for high grade animal feed products. Industrial livestock production has ensured high volume of meat production at low cost by taking advantage of economies of scales. . The availability of dairy and meat products at low prices has led to an increase in the consumption and thereby contributed to the growth of the industrial livestock production industry. The robust growth witnessed by the industrial livestock production sector has spurred the demand for high quality animal feeds used in rearing a range of livestock including cattle, swine, goats, chicken, fish, shrimps, etc. The crucial role played by industrial livestock production in meeting the nutritional requirement of humans across the globe has led to the proliferation of industrial livestock farms across the world and augmented the sales of animal feeds. Thus, a growth in production of industrial livestock is going to drive the animal feed market in SAM. As the COVID 19 pandemic continues to grow, it has hampered the animal feed market in the SAM region. The major countries in the SAM region are under lockdown. In many countries of SAM, where the newest strain of the coronavirus (COVID-19) has made an impact, isolation and social distancing measures have been put in place. The lesser production of goods and commodities is hampering the growth of animal feed market.With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the SAM animal feed market. The SAM animal feed market is expected to grow at a good CAGR during the forecast period.

SAM Animal Feed Market Revenue and Forecast to 2027 (US$ Mn)

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

SAM Animal Feed market Segmentation

SAM animal feed market – By Form

- Pellets

- Crumbles

- Mash

- Others

SAM animal feed market – By Livestock

- Poultry

- Ruminants

- Swine

- Aquaculture

- Others

SAM animal feed market– By Country

- Brazil

- Argentina

- Rest of SAM

South America Animal Feed Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 57,619.73 Million |

| Market Size by 2027 | US$ 76,302.18 Million |

| Global CAGR (2019 - 2027) | 3.1% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Form

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Form, and Livestock

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Brazil, Argentina

Trends and growth analysis reports related to Food and Beverages : READ MORE..

The List of Companies - South America Animal Feed Market

- ARCHER DANIELS MIDLAND CO.

- CARGILL INC.

- CHAROEN POKPHAND FOODS PLC

- EVONIK INDUSTRIES AG

- NUTRECO NV

- PERDUE FARMS, INC

Get Free Sample For

Get Free Sample For