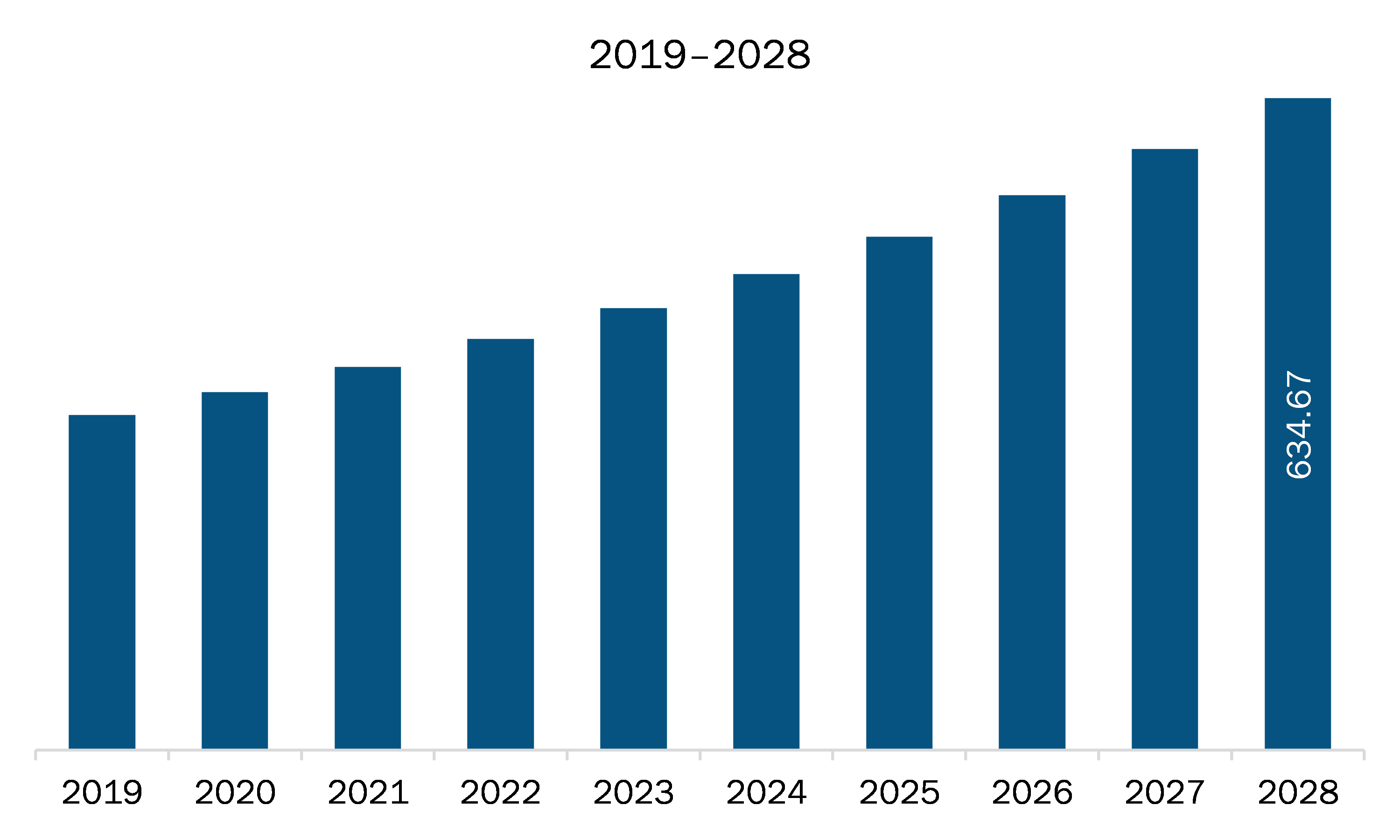

The SAM pharmaceutical isolator market is expected to grow from US$ 373.13 million in 2021 to US$ 634.67 million by 2028; it is estimated to grow at a CAGR of 7.9% from 2021 to 2028.

Brazil and Argentina are major economies in SAM. Increase in investments by pharmaceutical and biotechnology industry is expected to surge the market growth. Several big and small pharmaceutical companies are engaged in the development and manufacturing of new and novel molecules for life-threatening conditions. Pharmaceutical isolator systems have been regarded as a key technology in the drug discovery process. Thus, the adoption of pharmaceutical isolators is increasing to ensure contamination-free manufacturing and product handling. The pharmaceutical isolator provides safety to an operator from the exposure of harmful drugs, eliminates the possibilities of cross-contamination, and maintains the standard of drug quality. In the pharmaceutical industry, it is extremely important to maintain immense caution during the product manufacturing process. Different types of isolators are available in the pharmaceutical market that provide an optimum level of sterility in the product manufacturing process. The handling of pharmaceuticals with high potency ingredients, such as hormones and antibiotics. Biologic drugs need a greater level of precautions. Pharma and biotech companies have substantially invested in pharmaceutical isolator techniques in the past decade. Growing investments by pharmaceutical and biotechnology companies and extensive drug pipelines for the treatment of various chronic diseases, such as cancer, cardiovascular disorders, metabolic disorders, immunological disorders, and neurological disorders, are the prominent drivers for the growth of the SAM pharmaceutical isolator market.

In case of COVID-19, SAM is highly affected especially Brazil. The COVID-19 is expected to result in the region's worst recession, causing a 9.1% contraction in regional GDP in 2020. This is expected to increase the number of poor up by 45 million and the extremely poor number by 28 million. The increasing incidence of COVID 19 supports the growth of the market. International market players are entering the region and offering various aseptic systems required by the pharmaceutical industry. For instance, in November 2020, Optima Pharma has conducted seminar in Brazil regarding use of Isolator and RABS Solutions during pandemic. Such an initiatives will support the market growth in the region. Also, the pharmaceutical & biotechnology invested in R&D for the new molecule entity. The pandemic as no impact on R&D process, due to pandemic R&D activity increase to find better medicines to cure the life-threatening disease. These factors had a high impact on the SAM pharmaceutical isolator market. According to the Brazilian Association of Generic Medicines Industries (PróGenlicos), 75% of the pharmaceutical product is done domestically. However, it is widely dependent on the imports of APIs. The rise in the demand for aseptic processing has created several opportunities for the manufacturers in the country. Similarly, it is a vital challenge in other countries such as Brazil, and Argentina. Therefore, the government is collaborating with the private market player to supply vaccines against COVID–19. Such factors are also expected to create opportunities for countries. It is further expected to show a positive impact on market growth.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the SAM pharmaceutical isolator market. The SAM pharmaceutical isolator market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

SAM Pharmaceutical Isolator Market Segmentation

SAM Pharmaceutical Isolator Market – By Type

- Open Isolators

- Closed Isolators

SAM Pharmaceutical Isolator Market – By Pressure

- Positive Pressure

- Negative Pressure

SAM Pharmaceutical Isolator Market – By Configuration

- Floor Standing

- Modular

- Compact

- Mobile

SAM Pharmaceutical Isolator Market – By Application

- Aseptic

- Sampling & Weighing

- Fluid Dispensing

- Containment

- Others

SAM Pharmaceutical Isolator Market – By End User

- Pharmaceutical and Biotechnology Companies

- Hospitals

- Research and Academic Laboratories

- Other

SAM Pharmaceutical Isolator Market, by Country

- Brazil

- Argentina

- Rest of SAM

SAM Pharmaceutical Isolator Market -Companies Mentioned

- Azbil Telstar

- Bioquell (Ecolab Solution)

- Comecer

- Fedegari Autoclavi S.p.A.

- Getinge AB

- Hosokawa Micron Group

- Nuaire Inc.

South America Pharmaceutical Isolator Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 373.13 Million |

| Market Size by 2028 | US$ 634.67 Million |

| CAGR (2021 - 2028) | 7.9% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

South and Central America

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For