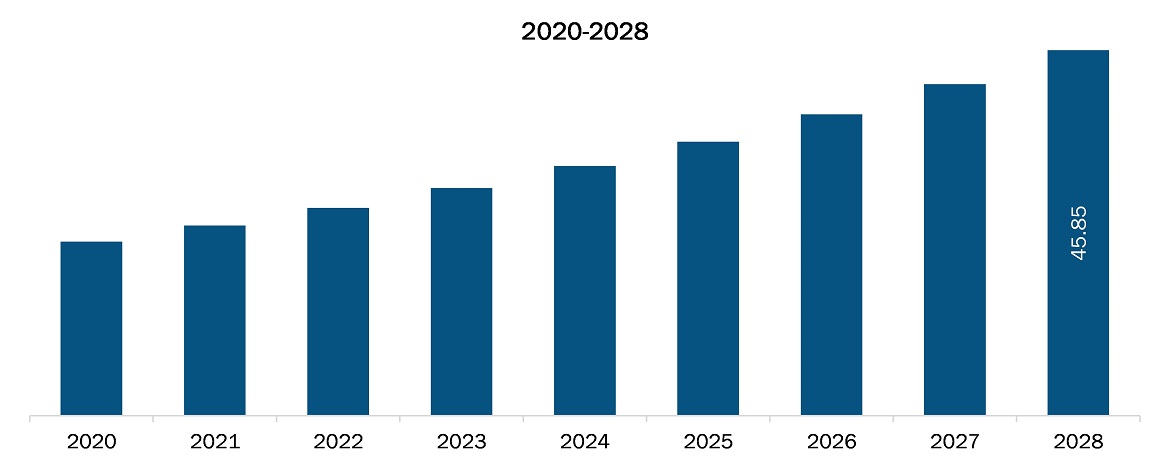

The custom antibody market in South and Central America is expected to grow from US$ 23.9 million in 2021 to US$ 45.9 million by 2028; it is estimated to grow at a CAGR of 9.8% from 2021 to 2028.

Biotechnology companies have been prominently focusing on collaborations, partnerships, acquisitions, and financial aids or funding for making progress in the markets they serve. Moreover, the COVID-19 pandemic has served opportunities to players to make some important strategic decisions. Following are a few instances of market consolidations that has leveraged growth of custom antibodies market.

- In January 2021, Morphic Therapeutic, a biotechnology company, collaborated with Janssen Pharmaceutical, Inc., a part of Johnson & Johnson Private Limited, to develop novel antibodies against third integrin target proteins (a family of ubiquitous receptors).

- In November 2020, Modern, Inc. received support from Nation Institutes of Health (NIH). The NIH has appointed a Data Safety Monitoring Board (DSMB) for Moderna, Inc.’s Phase 3 study of mRNA-1273. mRNA-1273 is being studied as vaccine against COVID-19. The study was conducted in collaboration with National Institute of Allergy and Infectious Diseases (NIAID), which is part of the NIH, and the BARDA, a part of the Office of the Assistant Secretary for Preparedness and Response at the US Department of Health and Human Services.

Although the impact of Covid-19 on antimicrobial resistance is currently impossible to predict, most studies describe extensive empirical use in contrast to a low frequency of bacterial co-infection and secondary infections. Antimicrobial exposure is a risk factor for microbial resistance development. Furthermore, prolonged hospitalization with intensive care unit stays raises the risk of infections with multidrug-resistant bacteria. Antimicrobial stewardship is one of the most critical measures for lowering this risk. Moreover, in March 2020, Hi Technologies, a Curitiba-based biotech firm, launched a test to detect coronavirus (Covid-19). The test is performed using a person's blood sample in the form of a capsule into the Nespresso-like machines. Its system is set to identify the antibodies that are reacting to coronavirus. According to SINDUSFARMA, the pharmaceutical sector in Brazil is highly robust. Every manufacturer can compete with any major corporation in the world's key markets. So much so that national enterprises now account for 65 percent of the market. Cimed also produces more than 10% of pharmaceuticals, with 450 million boxes in a $4 billion market. We also create 7 billion drugs in dosages. Almost every resident receives a dosage. In addition, the facility focuses on the areas of medical research during the COVID pandemic.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the custom antibody market. The South and Central America Custom antibody market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

South and Central America Custom Antibody Market Segmentation

By Service

- Antibody Development

- Antibody Production and Purification

- Antibody Fragmentation and Labelling

By Type

- Monoclonal Antibodies

- Polyclonal Antibodies

- Other Custom Antibodies

By Source

- Mice

- Rabbits

- Others

By Research Area

- Oncology

- Immunology

- Stem Cells

- Infectious Diseases

- Neurobiology

- Cardiovascular Diseases

- Others

By End User

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutes

- Contract Research Organizations

By Country

- South and Central America

- Brazil

- Argentina

- Rest of South and Central America

Companies Mentioned

- Thermo Fisher Scientific Inc.

- Bio-Rad Laboratories Inc.

- Merck KGAA

- Abcam

- Genscript

- Agilent Technologies, Inc.

South and Central America Custom Antibody Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 23.9 Million |

| Market Size by 2028 | US$ 45.9 Million |

| CAGR (2021 - 2028) | 9.8% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Service

|

| Regions and Countries Covered |

South and Central America

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For