Aquatic Veterinary Market Size, Trends & Forecast to 2031

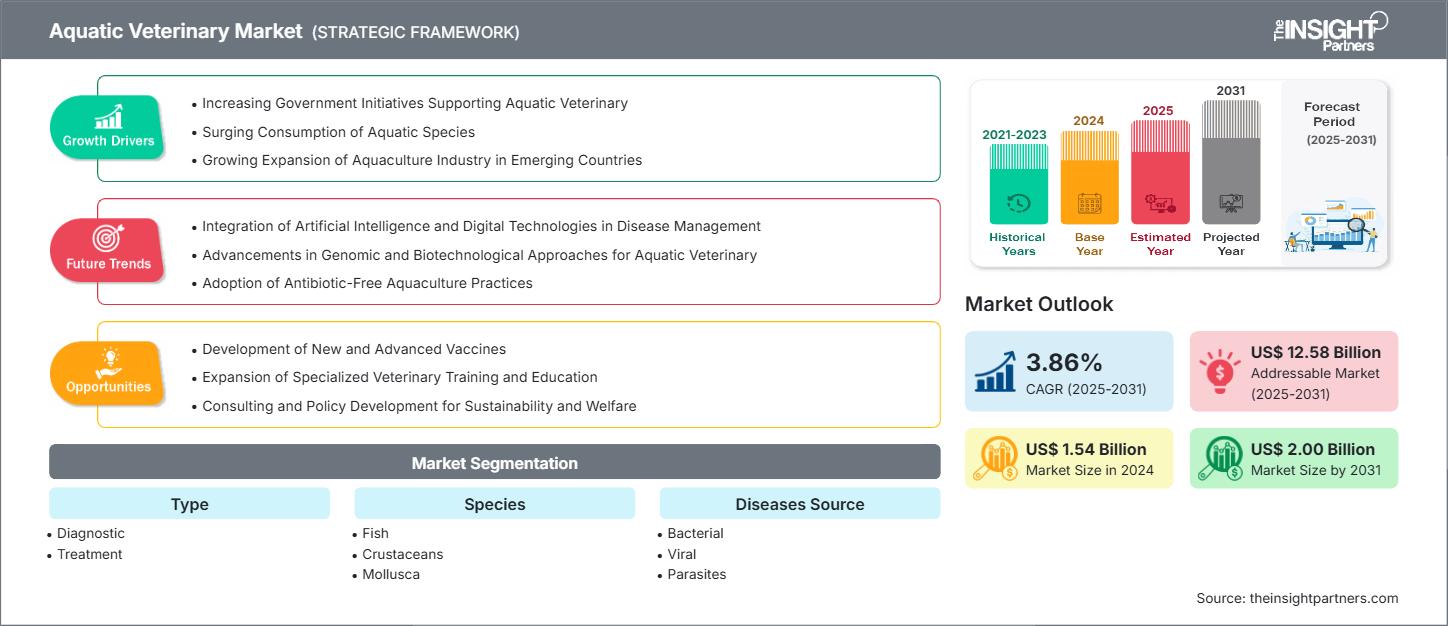

Aquatic Veterinary Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: ByType (Diagnostic and Treatment), Species (Fish, Crustaceans, Mollusca, and Others), Diseases Source (Bacterial, Viral, Parasites, and Others), Route Of Administration (Water Medication, Medicated Feed, and Other Route of Administrations), and Geography

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Sep 2025

- Report Code : TIPRE00038847

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 323

The aquatic veterinary market size is projected to reach US$2.00 billion by 2031 from US$1.54 billion in 2024. The market is expected to register a CAGR of 3.9% during 2025–2031.

Aquatic Veterinary Market Analysis

The growing demand for seafood products and surging government initiatives favoring aquatic veterinary services are propelling the aquatic veterinary market growth. According to the Organization for Economic Cooperation and Development (OECD), global fish production volume is expected to reach 200 metric tons by 2029. Further, ~90% of the fish produced (i.e., ~180 metric tons) would be consumed as food by humans by 2029. With the increasing consumption of seafood, there is a growing need for high-quality produce. The increasing seafood consumption drives the growth of the aquatic veterinary market. Additionally, the development of advanced vaccines with robust administration processes presents a significant opportunity for the aquatic veterinary market.

Aquatic Veterinary Market Overview

North America is projected to dominate the aquatic veterinary market with the largest share, and Asia Pacific is expected to register a significant CAGR during the forecast period. The market in Asia Pacific is segmented into China, Japan, India, South Korea, Australia, and the Rest of Asia Pacific. Governments in China, India, Singapore, and Australia are promoting sustainable aquaculture practices through funding research, development of aquatic vaccines, biosecurity measures, and improved farming techniques, encouraging market growth.

Aquaculture businesses in China are increasingly focusing on business development activities to expand fish farming operations. In November 2023, Merck Animal Health released two training modules under its Fish Welfare series, intended to prepare aquaculture businesses with the best practices to maintain fish health. These modules accepting applications to augment biodiversity certification programs and, at the same time, bolster disease management in Chinese fish farms as a part of government efforts to bring about the standardization of veterinary care.

Customizee This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONAquatic Veterinary Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Aquatic Veterinary Market Drivers and Opportunities

Market Drivers:

- Surging Consumption of Aquatic Species: The increased demand for seafood is driven by a growing population and more health-conscious consumers who prefer aquatic protein.

- Rising Government Initiatives Supporting Aquatic Veterinary: Government Initiatives include investing in the development of vaccines, putting biosecurity measures in place, and promoting sustainable aquaculture through initiatives such as India's Blue Economy initiative and Singapore's Aquaculture Plan.

- Growing Expansion of Aquaculture Industry: The growth of commercial aquaculture, driven by the increasing demand for seafood, is leading to larger-scale fish and shellfish farming operations. This expansion also raises the risk of infectious diseases, which can result in significant economic losses.

Market Opportunities:

- Development of New and Advanced Vaccines: The development of Recombinant DNA-based and oral vaccines provides benefits such as improved efficacy, ease of administration, and cost-effectiveness. With growing concerns about antimicrobial resistance (AMR), there is an increasing push to adopt vaccines as alternatives to antibiotics in aquaculture.

- Expansion of Specialized Veterinary Training and Education: The growing complexity of managing aquatic animal health requires more specialized veterinary education and training programs. These programs help build a skilled workforce equipped to manage aquatic animal health. Training in disease diagnosis, vaccine administration, biosecurity practices, and new technologies can help veterinarians and farm managers run effective health programs.

- Consulting and Policy Development for Sustainability and Welfare: Aquaculture operators, policymakers, and public agencies need support with regulatory compliance, responsible antibiotic use, biosecurity measures, and ethical farming standards. Developing frameworks and market-based tools that balance productivity with environmental sustainability and animal welfare offers a significant opportunity for veterinary consultancies and research organizations.

Aquatic Veterinary Market Report Segmentation Analysis

The aquatic veterinary market is segmented to analyze its growth potential and the latest trends. Below is the standard segmentation approach used in most industry reports:

By Type:

- Diagnostic: Innovations in artificial intelligence (AI), genomics, and point-of-care (POC) testing have made diagnostics faster, more accurate, and suitable for remote or resource-limited farms.

- Treatment: Aquatic veterinary treatments address various health issues in fish, crustaceans, and mollusks. These treatments target bacterial, viral, and parasitic infections, along with environmental stressors affecting aquatic species.

By Species:

- Fish: Due to advanced aquaculture methods, there is an increasing demand for veterinary products such as vaccines, antibiotics, antiparasitics, and diagnostic interventions to maintain good animal health and avoid economic losses.

- Crustaceans: The rapid expansion of crustacean aquaculture, particularly in shrimp, prawns, crabs, and lobsters, has significantly heightened the demand for aquatic medicine due to intensified farming practices that facilitate disease spread.

- Mollusca: The mollusc aquaculture sector plays a significant role in the global output, accounting for over 80% of US marine aquaculture by value, as per the NOAA Fisheries.

- Others: The other organisms farmed or caught in fisheries include seaweeds, trout, sea bass, sea bream, and rainbow wrasse. An upsurge in seaweed farming practices due to the growing preference for the consumption of seaweed as a snack product is a major factor driving the demand for aquatic veterinary products and services in these farms.

By Disease Source

- Bacterial

- Viral

- Parasites

- Other Disease Sources

By Route of Administration:

- Water Medication

- Medicated Feed

- Other Route of Administrations

By Geography:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

The aquatic veterinary market in North America is expected to hold a significant share of the market. An increasing number of surgical procedures and business expansion strategies by the market players are factors likely to drive the market.

Aquatic Veterinary Market Regional Insights

The regional trends and factors influencing the Aquatic Veterinary Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Aquatic Veterinary Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Aquatic Veterinary Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 1.54 Billion |

| Market Size by 2031 | US$ 2.00 Billion |

| Global CAGR (2025 - 2031) | 3.86% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Aquatic Veterinary Market Players Density: Understanding Its Impact on Business Dynamics

The Aquatic Veterinary Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Aquatic Veterinary Market top key players overview

Aquatic Veterinary Market Share Analysis by Geography

The market in Asia Pacific is expected to grow fastest in the coming years. Emerging markets in Latin America, the Middle East, and Africa present massive untapped opportunities for aquatic veterinary services for expansion.

The aquatic veterinary market develops differently in every region. This has to do with factors such as the rapid spread of aquaculture production, increased seafood consumption, and mounting government initiatives. The following is a brief overview of market shares and trends by region:

1. North America

- Market Share: Holds a significant portion of the global market

-

Key Drivers:

- Well-established aquaculture farming practices focus on disease control and health management.

- High investment in research and development for vaccines, diagnostics, and treatments for aquatic species.

- Strong regulations support animal health and biosecurity

.

- Trends: The growing use of biotechnology, personalized aquatic veterinary medicine, and telemedicine solutions for remote diagnostics and treatment

2. Europe

- Market Share: Substantial share, driven by advanced healthcare systems and early adoption of innovative therapies

-

Key Drivers:

- Aquaculture production is rising with an emphasis on sustainable and health-conscious farming.

- Government regulations and subsidies promote aquatic animal health.

- Advanced veterinary services and clinical trial networks focus on aquatic diseases.

- Trends: Focus on integrated pest and disease management, combination therapies, and digital health monitoring technologies.

3. Asia Pacific

- Market Share: Fastest-growing region with a rising market share every year

-

Key Drivers:

- Rapid improvements in healthcare infrastructure across China, India, and Southeast Asia.

- A growing population of aquatic species exposed to environmental stressors and limited use of protective measures.

- Increasing government funding for aquatic health research, vaccine development, and sustainable aquaculture.

- Trends: Rise in aquaculture production, increased development of aquatic vaccines, and collaborations between domestic and global veterinary pharmaceutical companies.

4. South and Central America

- Market Share: Growing market with steady progress

-

Key Drivers:

- Increasing demand for seafood is driving growth in aquaculture activities.

- Access to aquatic veterinary services and medications is improving.

- There is an import of modern veterinary products and veterinary biotechnology solutions.

- Trends: Expansion of disease surveillance programs, increased awareness of aquatic animal health, and the gradual integration of new vaccines and therapeutics.

5. Middle East and Africa

- Market Share: Although small, the market is growing quickly

-

Key Drivers:

- Investments in aquaculture infrastructure and veterinary healthcare are increasing.

- Government initiatives are supporting aquaculture development and health management.

- There are collaborations with international organizations to improve aquatic veterinary capacity.

- Trends: Focus on better aquatic welfare, the use of tele-veterinary technologies in remote areas, and the development of regulatory frameworks for aquatic animal health.

Aquatic Veterinary Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

Competition is high because there exist dominant players in the market like Zoetis Inc, Merck KGaA, and Thermo Fisher Scientific Inc. Regional and niche players like Aquatic Diagnostics Ltd also contribute to the competition in various regions.

With high competition existing, companies are forced to differentiate themselves through:

- Sophisticated Products

- Value-Added Services Such As Sustainability And Personalization

- Aggressive Pricing Structures

- Compliance With Law Regulations

Opportunities and Strategic Moves

- Focusing on developing and clinically investigating new combination therapies for aquatic animal diseases is an emerging opportunity

- Combining antimicrobial agents with antiparasitic and antiviral treatments or immune stimulants can improve effectiveness, reduce treatment resistance, and boost survival rates in fish and shrimp farming

- Leading companies are moving toward noninvasive therapies such as topical treatments, bath immersions, and photodynamic therapies.

Major Companies operating in the Aquatic Veterinary Market are:

- Zoetis Inc.

- Esox Biologics Ltd.

- Merck KGaA

- HIPRA SA

- Ceva Polchem Pvt. Ltd.

- Virbac SA

- Phibro Animal Health Corp.

- Elanco Animal Health Inc.

- Aquatic Diagnostics Ltd.

- Thermo Fisher Scientific Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

Other companies analysed during the course of research:

- Ingelheim Boehringer

- Alltech Inc.

- AquaGen

- AquaBioTech Group

- Immucell.

- Dechra Pharmaceuticals

- Animal Care Group Plc

- SeQuent Scientific

- Hester Biosciences Ltd.

- Vetnation Pharmaceutical

- Mediwin Labs

- Vee Treatments

- Medicinal Animal Health

- The Vesper Group

- GMT Pharma International

Aquatic Veterinary Market News and Recent Developments

- Esox Biologics Ltd announced a partnership with London Aquatic Veterinary Services. The partnership will develop novel diagnostic assays that reveal the entire community of microorganisms within a harmless water or swab sample.

- Zoetis received a US$15.3 million grant from the Bill & Melinda Gates Foundation to develop and integrate innovative solutions to advance veterinary care and diagnostic services to improve livestock health and productivity in Sub-Saharan Africa.

Aquatic Veterinary Market Report Coverage and Deliverables

The "Aquatic Veterinary Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Aquatic Veterinary Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Aquatic Veterinary Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Aquatic Veterinary Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Aquatic Veterinary Market

- Detailed company profiles

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For