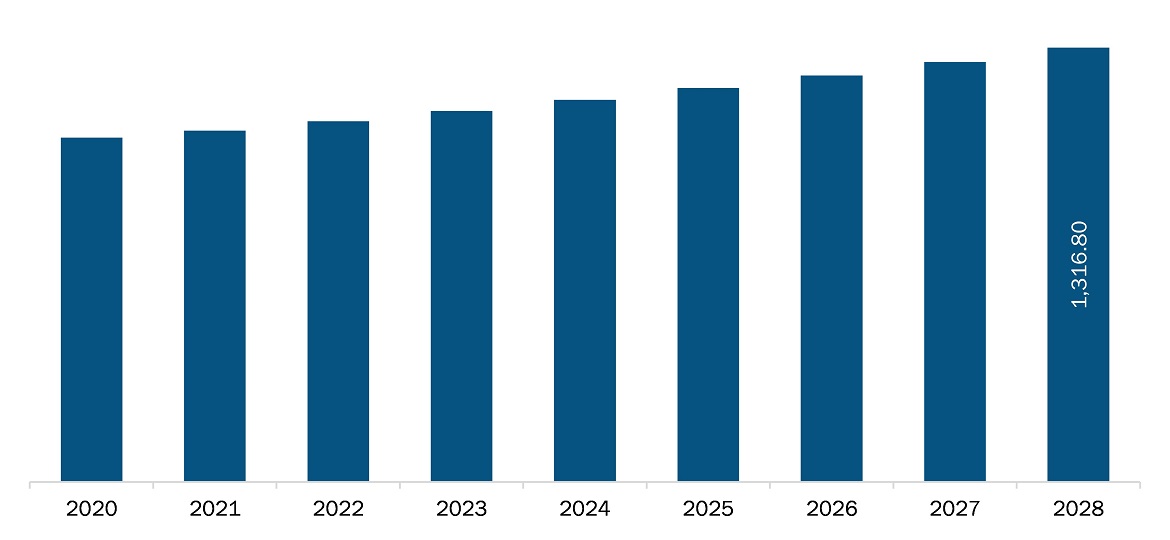

The medical imaging market in South and Central America is expected to grow from US$ 1,065.0 million in 2021 to US$ 1,316.8 million by 2028; it is estimated to grow at a CAGR of 3.1% from 2021 to 2028.

Big data analytics is revolutionizing healthcare in general, so it is no surprise that there is much to look forward to in the future of analytics in medical imaging. For example, analytics are often used to detect patterns specific to a certain pathology. Imaging algorithms can derive metrics using intensive analysis of these patterns in a digital image, and then deliver scores that complement any analyses made by the radiologist, resulting in quicker, customized, and accurate diagnoses. In an article on ITN, Dhaval Shah and Prashanth Kollaikal of CitiusTech discussed the promising potential of big data in diagnostic imaging. “We can look forward to new and interesting features in the radiology information system (RIS) and PACS systems, especially those in the cloud, which might include analytics and impressive reports on operational and clinical data,” states Shah. Enterprise-wide key performance indicators (KPIs) derive from a variety of existing sources. Then, these KPIs are used to suit the needs of the provider, taking clinical efficiency, operational efficiency, and patient comfort into consideration. Even though these KPIs have been used for optimization for many years now, overall efficiency can be easily measured and greatly improved with the technological aptitude of devices, increased modalities, advanced software systems, and mobile devices.

Countries like Brazil and Argentina have also registered many positive coronavirus infection cases. These regions are developing in terms of the healthcare and medical service industry. The countries in these regions are highly dependent on medical devices imported from developed countries. Therefore, countries have faced several challenges with their requirements for medical imaging systems due to severe disruption in supply chains. Health authorities are worrying that attempting to fight the coronavirus will indirectly contribute to an increase in deaths of ill patients, including cancer patients, gynecology patients, and other causes. The death pool of ill patients in low-cost regions is expected to increase because healthcare professionals are having limited their patients checking as many clinics as possible, diagnostic centers, ambulatory surgery centers have limited resources and staff. However, there has been a spur in demand for imaging modalities such as computed tomography and ultrasound systems to manage the treatment of patients suffering with COVID-19. Countries were severely hit by the pandemic and deployed large number of chests imaging every single day. These factors thus encouraged the growth of the medical imaging market in this region.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the medical imaging market. The South and Central America medical imaging market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

South and Central America Medical Imaging Market Segmentation

By Product

- CT Systems

- X-ray Systems

- PET Systems

- MRI systems

- Ultrasound Systems

- Others

By End User

- Hospitals

- OP Centres

- Clinicians Offices

- Emergency Care Centres

By Country

-

South and Central America

- Brazil

- Argentina

- Rest of South and Central America

Companies Mentioned

- General Electric Company

- Siemens AG

- Koninklijke Philips N.V.

- Shimadzu Corporation

- Hitachi, Ltd.

- Canon Inc.

- Hologic, Inc.

- Carestream Health Inc.

- ESAOTE SPA

- Samsung Group

South and Central America Medical Imaging Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 1,065.0 Million |

| Market Size by 2028 | US$ 1,316.8 Million |

| CAGR (2021 - 2028) | 3.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

South and Central America

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For