Continuous Glucose Monitoring Device (CGMD) Market Drivers and Forecasts by 2031

Continuous Glucose Monitoring Device (CGMD) Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: Product (Sensors, Transmitters, and Receivers), Application (Type 1 Diabetes and Type 2 Diabetes), Testing Sites (Fingertip Testing and Alternate Site Testing), End User (Hospitals and Clinics and Self or Homecare), and Geography

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Aug 2025

- Report Code : TIPRE00018031

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 275

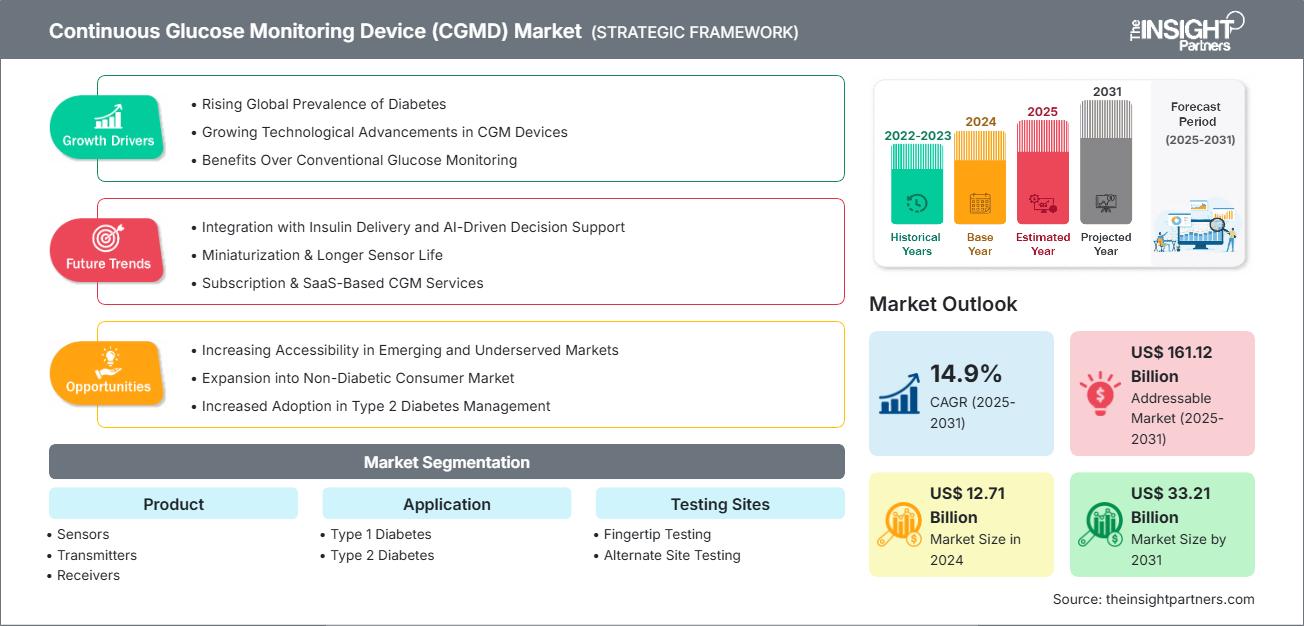

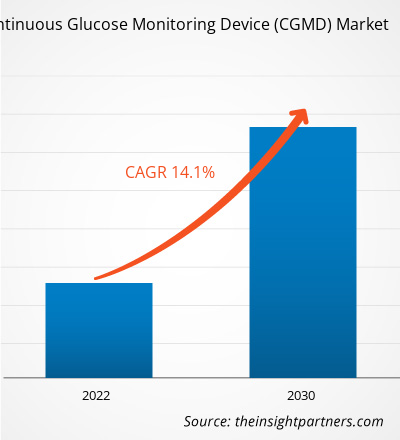

The continuous glucose monitoring device (CGMD) market size is projected to reach US$ 33.21 billion by 2031 from US$ 12.71 billion in 2024. The market is expected to register a CAGR of 14.9% during 2025–2031.

Continuous Glucose Monitoring Device (CGMD) Market Analysis

The rising global prevalence of diabetes, technological advancements in CGMDs, and benefits over conventional glucose monitoring drive the continuous glucose monitoring device (CGMD) market growth. Additionally, integration with insulin delivery and AI-driven support contributes to market growth. Increasing accessibility in emerging and underserved markets is expected to create ample opportunities for the continuous glucose monitoring device (CGMD) market in the coming years.

Continuous Glucose Monitoring Device (CGMD) Market Overview

North America is projected to dominate the continuous glucose monitoring device (CGMD) market, accounting for the largest share during the forecast period. Moreover, Asia Pacific is expected to register a significant CAGR during the forecast period due to increasing prevalence attributed to urbanization, sedentary lifestyles, dietary changes, and technological advancements. China is confronting a considerable and escalating diabetes epidemic, with projections indicating that by 2050, the country will have ~168 million individuals living with type 2 diabetes, a substantial increase from 2024 figures (148 million), as per the data of IDF. This surge is attributed to urbanization, dietary changes, and aging demographics. The government of China has set ambitious targets to enhance diabetes awareness and management. By 2030, the National Health Commission aims to achieve a 60% awareness rate among individuals aged 18 and above and ensure that 70% of type 2 diabetes patients receive standardized management services at the local level. The growing prevalence of diabetes has spurred advancements in medical technology, particularly in continuous glucose monitoring (CGM).

In response to the growing need for effective diabetes management, the Indian healthcare system has made significant advancements in the availability and reimbursement of CGM devices. Notably, in March 2022, the Ministry of Health, Labour and Welfare (MHLW) approved the extension of reimbursement coverage for Abbott's FreeStyle Libre system to include all individuals with diabetes who use insulin at least once daily. Similarly, in December 2022, Terumo Corporation announced that the Japanese medical insurance system expanded payment coverage for the Dexcom G6 CGM System, making the device more accessible to diabetic patients in Japan. These policy changes have significantly increased the adoption of CGM devices nationwide. The growth is driven by domestic and international companies, including Dexcom, Abbott, Medtronic, and Terumo Corporation, which are actively involved in developing and distributing CGM systems in India.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONContinuous Glucose Monitoring Device (CGMD) Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Continuous Glucose Monitoring Device (CGMD) Market Drivers and Opportunities

Market Drivers:

- Rising Global Prevalence of Diabetes: The surge in global diabetes prevalence stands as a fundamental growth engine for the CGM market. Recent data reveal a dramatic transformation: the proportion of adults with diabetes has doubled over roughly the past three decades, climbing from ~7% in 1990 to 14% by 2022, now encompassing more than 800 million people worldwide. This puts current prevalence at ~11.1% (or one in nine adults), with projections soaring to 853 million (one in eight adults) by 2050, marking a 46% increase, per the International Diabetes Federation.

- Growing Technological Advancements in CGM Devices: Technological progress in continuous glucose monitoring (CGM) drives market growth by enhancing device accuracy, user experience, and expanding potential use cases. The integration of AI-driven predictive algorithms marks another leap forward. Systems such as Medtronic's Guardian Sensor 4 can forecast glucose fluctuations up to 60 minutes ahead, enabling preemptive alerts and interventions. Broader industry trends indicate growing use of machine learning to model user-specific glucose trends, personalize alerts, and enhance interaction with other health data, pushing CGMs into truly predictive and personalized health tools.

- Benefits Over Conventional Glucose Monitoring: CGMs eliminate the practical and psychological burden of frequent finger sticks, a limitation that impaired adherence and quality of life with earlier methods. Children particularly value this finger-prick-free approach, and patients undergoing intensive therapy report higher treatment satisfaction and long-term device retention rates despite cost and device complexity challenges.

Market Opportunities:

- Increasing Accessibility in Emerging and Underserved Markets: A key growth opportunity in the continuous glucose monitoring (CGM) devices market lies in increasing accessibility across emerging and underserved regions, where diabetes prevalence is rising sharply. Yet, access to modern diabetes management tools remains severely limited. However, CGM penetration remains under 5% in many regions, mainly due to high upfront costs, lack of awareness, limited reimbursement, and inadequate healthcare infrastructure. This disparity presents a significant untapped opportunity for both global and local players aiming to expand their reach.

- Expanding in Emerging Economies: Rapid economic growth drives investments in healthcare infrastructure and new medical technologies in countries such as China, India, and South Africa. Initiatives toward reinforcing healthcare sectors include modernizing urological care, raising awareness about early diagnosis, and expanding health insurance coverage.

- Rising Strategic Initiatives by Market Players: Companies operating in the continuous glucose monitoring device (CGMD) market frequently pursue strategic initiatives such as product approvals, collaborations, funding, agreements, and new product launches, to improve their sales, increase their geographic reach, expand their customer base, and strengthen market presence.

- Public-Private Partnerships: Public-private partnerships offer significant opportunities in the continuous glucose monitoring device (CGMD) market by fostering collaboration between governments and private companies to improve healthcare access. These partnerships can support the development and distribution of advanced CGM technologies, enhance funding for screening programs, and facilitate training initiatives. Such cooperation promotes innovation while expanding the availability of CGM solutions in underserved or remote regions.

Continuous Glucose Monitoring Device (CGMD) Market Report Segmentation Analysis

The continuous glucose monitoring device (CGMD) market is divided into different segments to give a clearer view of how it works, its growth potential, and the latest trends. Below is the standard segmentation approach used in most industry reports:

By Product:

- Sensors: Sensors remain the technological and economic keystone of continuous glucose monitoring (CGM) systems in diabetes care. These small, wearable components are inserted subcutaneously to continuously measure interstitial glucose levels, typically at 5-minute intervals, transmitting real-time data to receivers or smartphones. The CGM sensor market has seen substantial momentum over the past few years, driven by rapid innovation, growing global diabetes prevalence, and greater adoption among Type 1 and, increasingly, Type 2 diabetes patients.

- Transmitters: Transmitters are placed on the skin to communicate wirelessly with a sensor inserted beneath the skin. This sensor measures glucose levels in the interstitial fluid. The transmitter sends this data to a receiver or smartphone app, enabling users to monitor their glucose levels and receive high or low blood sugar alerts. CGM devices typically use radiofrequency transmitters, which utilize radio waves to transmit data from the sensor to the receiver or smartphone application. Near-Field Communication (NFC) and Bluetooth transmitters are also used in CGM devices.

- Receivers: Receivers, the devices or interfaces that display CGM sensors' glucose readings, are a critical link between sensing and user interpretation. Yet, they often fall into the background amid the spotlight on sensors and transmitters. Recent advancements have reshaped their functionality, format, and integration within broader diabetes-care ecosystems. Historically, many CGM systems offered dedicated standalone receivers.

By Application:

- Type 1 Diabetes

- Type 2 Diabetes

By Testing Sites:

- Fingertip Testing

- Alternate Site Testing

By End User:

- Hospitals and Clinics

- Self or Homecare

By Geography:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

The continuous glucose monitoring device (CGMD) market in North America is expected to hold a significant share of the market. Rising global prevalence of diabetes, technological advancements in CGM devices, and benefits over conventional glucose monitoring by the market players drive the market growth.

Continuous Glucose Monitoring Device (CGMD)

Continuous Glucose Monitoring Device (CGMD) Market Regional InsightsThe regional trends influencing the Continuous Glucose Monitoring Device (CGMD) Market have been analyzed across key geographies.

Continuous Glucose Monitoring Device (CGMD) Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 12.71 Billion |

| Market Size by 2031 | US$ 33.21 Billion |

| Global CAGR (2025 - 2031) | 14.9% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Continuous Glucose Monitoring Device (CGMD) Market Players Density: Understanding Its Impact on Business Dynamics

The Continuous Glucose Monitoring Device (CGMD) Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Continuous Glucose Monitoring Device (CGMD) Market Share Analysis by Geography

Asia Pacific is expected to grow the fastest in the next few years. Emerging markets in Latin America, the Middle East, and Africa also have many untapped opportunities for continuous glucose monitoring devices providers to expand.

The continuous glucose monitoring device (CGMD) market growth is attributed to the increasing prevalence of diabetes, well-established healthcare infrastructure, and rapid adoption of cutting-edge technologies. Below is a summary of market share and trends by region:

1. North America

- Market Share: Holds a significant portion of the global market

-

Key Drivers:

- Increasing prevalence of diabetes

- Technological advancement

- Favorable regulatory & reimbursement environment

-

Trends:

AI Integration Across the Value Chain.

2. Europe

- Market Share: Substantial share due to the increasing prevalence of diabetes

-

Key Drivers:

- Increasing prevalence of diabetes

- Intensified research and development activities

- The launch of advanced technologies across Europe

- Trends: Device miniaturization & smart tech integration

3. Asia Pacific

- Market Share: Fastest-growing region with a rising market share every year

-

Key Drivers:

- Demand for smart and innovative CGMDs

- Rising prevalence of diabetes

- Rapid improvements in healthcare infrastructure, supported by increasing government investments in public health.

- Trends: Technological advancement

4. South and Central America

- Market Share: Growing market with steady progress

-

Key Drivers:

- High prevalence of diabetes

- Growing healthcare investments and infrastructure development

- Trends: Growing adoption of cutting-edge CGMD technology

5. Middle East and Africa

- Market Share: Although small, but growing quickly

-

Key Drivers:

- Expanding healthcare infrastructure

- Increased public awareness emphasizes the importance of early diabetes condition diagnosis

- Trends: The adoption of telemedicine and remote device support

Continuous Glucose Monitoring Device (CGMD) Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

Competition is strong due to the presence of established players such as Abbott Laboratories; Dexcom Inc.; Ypsomed Holding AG. Regional and niche providers such as A. Menarini Diagnostics s.r.l and Medtrum Technologies Inc. are also adding to the competitive landscape across different regions.

This high level of competition urges companies to stand out by offering:

- Advanced Products

- Value-added services such as customization and sustainable solutions

- Competitive pricing models

- Compliance with regulatory guidelines

Opportunities and Strategic Moves

- Growing preference for innovative and advanced glucose monitoring drives demand for CGMDs. Opportunity for innovation in portable, easy-to-use monitoring devices.

- Companies emphasize clinical studies and regulatory approvals (including FDA clearances for new product categories), building strong clinical evidence to support adoption in hospitals and outpatient settings.

- Companies are targeting high-growth, under-penetrated markets in Asia Pacific and Latin America to expand, build local partnerships, and increase training initiatives. Manufacturers from Asia Pacific are launching hybrid and price-competitive solutions for emerging markets.

Major Companies operating in the Continuous Glucose Monitoring Device (CGMD) Market are:

- Abbott Laboratories

- Dexcom Inc.

- Ypsomed Holding AG

- Medtronic

- F. Hoffmann-La Roche Ltd

- Senseonics Holdings Inc

- i-SENS Inc.

- A. Menarini Diagnostics s.r.l

- Tandem Diabetes Care, Inc.

- Medtrum Technologies Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

Other companies analysed during the course of research:

- GlySens Incorporated

- Echo Therapeutics, Inc.

- B. Braun SE

- Agamatrix Inc

- PHC Holdings Corporation

- Nemaura Medical Inc.

- Zhejiang POCTech Co., Ltd.

- MicroTech Medical

- Sinocare

- Med Trust

- Bigfoot Biomedical Inc.

Continuous Glucose Monitoring Device (CGMD) Market News and Recent Developments

- Tracky launches India's first bluetooth-connected continuous glucose monitor To tackle one of the country's most pressing health challenges, Thane-based startup Tracky, an innovative healthtech brand by DrStore Healthcare Services, has officially launched - India's first Bluetooth-enabled Continuous Glucose Monitor (CGM).

- FDA clears Dexcom G7 15-Day continuous glucose monitor Dexcom announced it had received FDA clearance for its Dexcom G7 15-Day continuous glucose monitoring system for use in adults aged 18 and older. The system extends wear time to 15.5 days. It reports a mean absolute relative difference of 8.0%, making it one of the most durable and high-performing continuous glucose monitoring devices currently authorized in the US market.

Continuous Glucose Monitoring Device (CGMD) Market Report Coverage and Deliverables

The "Continuous glucose monitoring device (CGMD) market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Continuous glucose monitoring device (CGMD) market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Continuous glucose monitoring device (CGMD) market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Continuous glucose monitoring device (CGMD) market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the continuous glucose monitoring device (CGMD) market

- Detailed company profiles

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For