South & Southeast Asia Liquid Sodium Silicate Market Report 2031

South and Southeast Asia Liquid Sodium Silicate Market Size and Forecast (2021 - 2031), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Application (Paper Industry, Steel Industry, Packaging Industry, Soap Industry, Detergent Industry, and Others)

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Oct 2025

- Report Code : TIPRE00041006

- Category : Chemicals and Materials

- Status : Published

- Available Report Formats :

- No. of Pages : 133

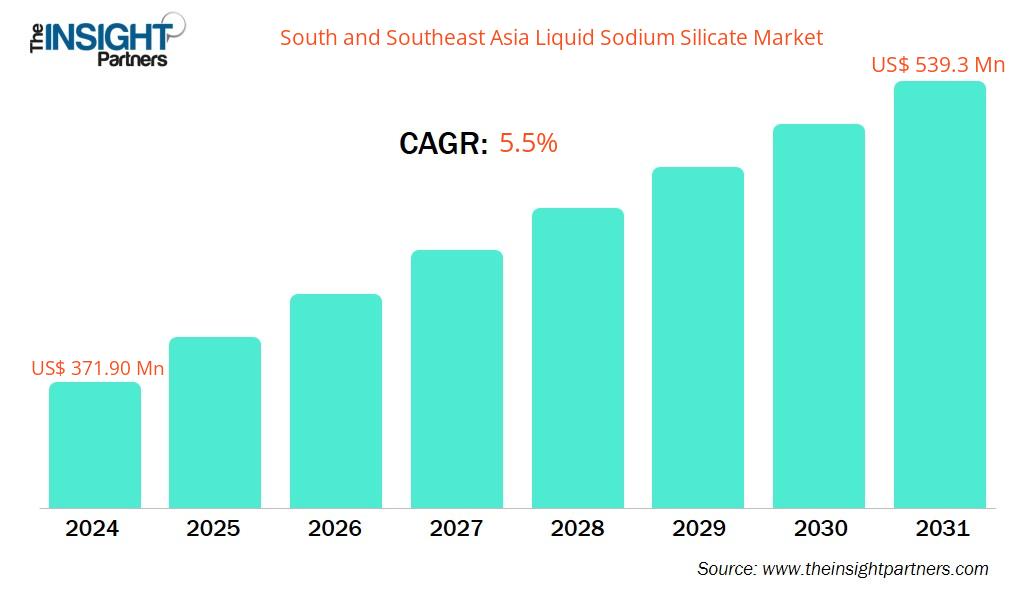

The South and Southeast Asia liquid sodium silicate market size is projected to reach US$ 539.29 million by 2031 from US$ 371.91 million in 2024. The market is expected to register a CAGR of 5.5% during 2025–2031.

South and Southeast Asia Liquid Sodium Silicate Market Analysis

Liquid sodium silicate is increasingly used in construction projects, agriculture, the automotive industry, detergents, and water treatment plants. Liquid sodium silicate is used as a binder, sealant, or adhesive. The focus on sustainable and cost-effective materials supports its use in construction and other industries. The paper and textile industries use it as a strengthening agent. Regulations are imposed due to environmental concerns, but ongoing research is being conducted to develop greener formulations that comply with sustainability initiatives.

South and Southeast Asia Liquid Sodium Silicate Market Overview

The increasing number of infrastructure projects bolsters the market growth. Manufacturers are focused on meeting the needs for sustainable, cost-effective building materials. The paper and textile markets, as well as other consumer-driven applications, contribute to the demand in the region. Improved manufacturing capacity and distribution network availability further contribute to the demand. Stringent environmental regulations push companies to innovate toward eco-friendly or environmentally compliant products.

Customizee This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONSouth and Southeast Asia Liquid Sodium Silicate Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

South and Southeast Asia Liquid Sodium Silicate Market Drivers and Opportunities

Market Drivers:

- Rapid Industrialization: The increase in industrial activities drives demand for liquid sodium silicate in the manufacturing and construction industries.

- Infrastructure Development: Infrastructure projects are creating demand for liquid sodium silicate in concrete and other construction materials.

- Demand from the Automotive and Detergent Industries: The increasing production of automobiles and detergents is driving the sales of sodium silicate coatings and cleaning agents.

- Demand for Sustainable Materials: Focus on sustainable and cost-effective construction and industrial chemicals market expansion.

- Growth in the Paper and Textile Industry: Liquid sodium silicate is utilized as a strengthening agent in the textile and paper industries.

Market Opportunities:

- Product Innovation: Development of environmentally friendly, high-performance liquid sodium silicate formulations that meet increasing regulatory standards.

- Increased Manufacturing Capacity: Manufacturers can develop and establish new product manufacturing facilities locally to meet increasing demand and limit dependence on imports.

- Government Infrastructure Investments: Public infrastructure investments provide risk capital with new opportunities.

- E-commerce, distribution, and delivery improvements: Supply chains and online platforms enhance accessibility for users in larger and more diverse regions.

South and Southeast Asia Liquid Sodium Silicate Market Report Segmentation Analysis

The South and Southeast Asia liquid sodium silicate market is segmented into various categories to provide a clearer understanding of its operations, growth potential, and current trends. Below is the standard segmentation approach used in industry reports:

By Application:

- Paper Industry: Improves the quality and durability of paper by acting as a binding and strengthening agent.

- Steel Industry: Serves as a sealer and adhesive in refractory and steel casting applications.

- Packaging Industry: Enhances the strength of packaging components and provides protective coatings.

- Soap Industry: Serves as a pH regulator and binder in the production of liquid and solid soaps.

- Detergent Industry: Improves cleaning by operating as a softener and builder in detergents.

- Others: It includes water treatment, adhesives, building chemicals, and other applications.

By Geography:

- South and Southeast Asia

Strong demand from industries such as paper, detergents, and automotive drives the demand for liquid sodium silicate. Key infrastructure development projects undertaken by governments, along with an increasing preference for inexpensive, eco-friendly alternatives, propel market expansion. Increased product availability and stringent environmental regulations facilitate the development of eco-friendly and novel liquid sodium silicate products.

South and Southeast Asia Liquid Sodium Silicate Market Report Scope| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 371.90 Million |

| Market Size by 2031 | US$ 539.29 Million |

| CAGR (2025 - 2031) | 5.5% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Application

|

| Regions and Countries Covered |

South Asia

|

| Market leaders and key company profiles |

|

South and Southeast Asia Liquid Sodium Silicate Market Players Density: Understanding Its Impact on Business Dynamics

The South and Southeast Asia Liquid Sodium Silicate Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the South and Southeast Asia Liquid Sodium Silicate Market top key players overview

South and Southeast Asia Liquid Sodium Silicate Market Share Analysis by Geography

South and Southeast Asia are expected to grow the fastest in the next few years. Emerging markets in South and Southeast Asia also have many untapped opportunities for liquid sodium silicate providers to expand.

Infrastructure and construction development, as well as growth in the automotive, detergent, paper, and printed circuit board (PCB) sectors, drive the growth of the liquid sodium silicate market in South and Southeast Asia. There is a rising awareness of cost-effective and sustainable alternatives in industries such as textiles, construction, packaging, and rubber. The prime focus of companies is to improve product quality and enhance the supply chain across the region. Companies are enhancing product quality to meet specific end-use requirements and regulatory standards.

Below is a summary of the South and Southeast Asia liquid sodium silicate market share and trends by region:

1. South Asia

- Market Share: Growing at a rapid pace, with Bangladesh, Sri Lanka, and India leading the way.

-

Key Drivers:

- The expansion of the paper, detergent, and textile industries

- The growing construction and automotive sectors

- The rapid industrialization and infrastructure development

- Trends: Strengthening chemical safety regulations, adopting innovative production technologies, and focusing more on eco-friendly formulations

2. Southeast Asia

- Market Share: Growing in new markets, with Indonesia, Thailand, and Vietnam being the leading countries.

-

Key Drivers:

- Increased manufacturing and industrial activities

- Growing construction and infrastructure projects

- Increased automotive production

- Trends: Move to eco-friendly and high-performance products, and stricter rules on following environmental laws

South and Southeast Asia Liquid Sodium Silicate Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

Competition is strong due to established players such as PQ Corp and Occidental Petroleum Corp. Regional and niche providers, including Shanti Chemical Works, Qingdao Haiwan Group, and Ankit Silicate, are adding to the competitive landscape across South and Southeast Asia.

To stand out in the competition, companies:

- Offer high-performance and eco-friendly liquid sodium silica products

- Meet increasingly strict local regulations on environmental protection and industrial safety

Opportunities and Strategic Moves

- Increasing manufacturing capacity as a response to growing demand in the region

- Investing in research and development to produce sustainable, environmentally friendly, and multifunctional products

- Building partnerships with the construction, automotive, detergent, and paper industries to provide integrated solutions

Major Companies operating in the South and Southeast Asia Liquid Sodium Silicate Market are:

- PQ Corporation

- Qemetica

- Chongqing Biogreen Engineering And Technology Co Ltd.

- POWERTECH

- Occidental Petroleum Corp

- Kiran Global Chem Limited

- Shanti Chemical Works

- Qingdao Haiwan Group Co Ltd.

- LUO YANLUO YANG QIHANG CHEMICAL INDUSTRIAL CO LTD.

- Ankit Silicate

Disclaimer: The companies listed above are not ranked in any particular order.

Other companies analyzed during the course of research:

- Sahajanand Industries Limited

- Sudarshan Group

- C.Thai Chemicals

- PT. Madhibrata

- Jay Chemical Industries

- Metro Chem Industries

- Adwan Chemical Industries

South and Southeast Asia Liquid Sodium Silicate Market News and Recent Developments

- Qemetica Vitrosilicon has built a new warehouse on its premises in Żary, Poland. Qemetica Vitrosilicon completed the construction of a new warehouse. The modern facility has been commissioned on the company's premises. With this investment, the logistical capabilities will be improved. The opening of the warehouse will help reduce the level of noise and dust in the vicinity of the plant.

South and Southeast Asia Liquid Sodium Silicate Market Report Coverage and Deliverables

The " South and Southeast Asia Liquid Sodium Silicate Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering the following areas:

- South and Southeast Asia liquid sodium silicate market size and forecast at the regional and country levels for all the key market segments covered under the scope

- South and Southeast Asia liquid sodium silicate market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porters and SWOT analysis

- South and Southeast Asia liquid sodium silicate market analysis covering key trends, regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the South and Southeast Asia liquid sodium silicate market

- Detailed company profiles

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For