Spiral Membrane Market Analysis, Size, and Share by 2031

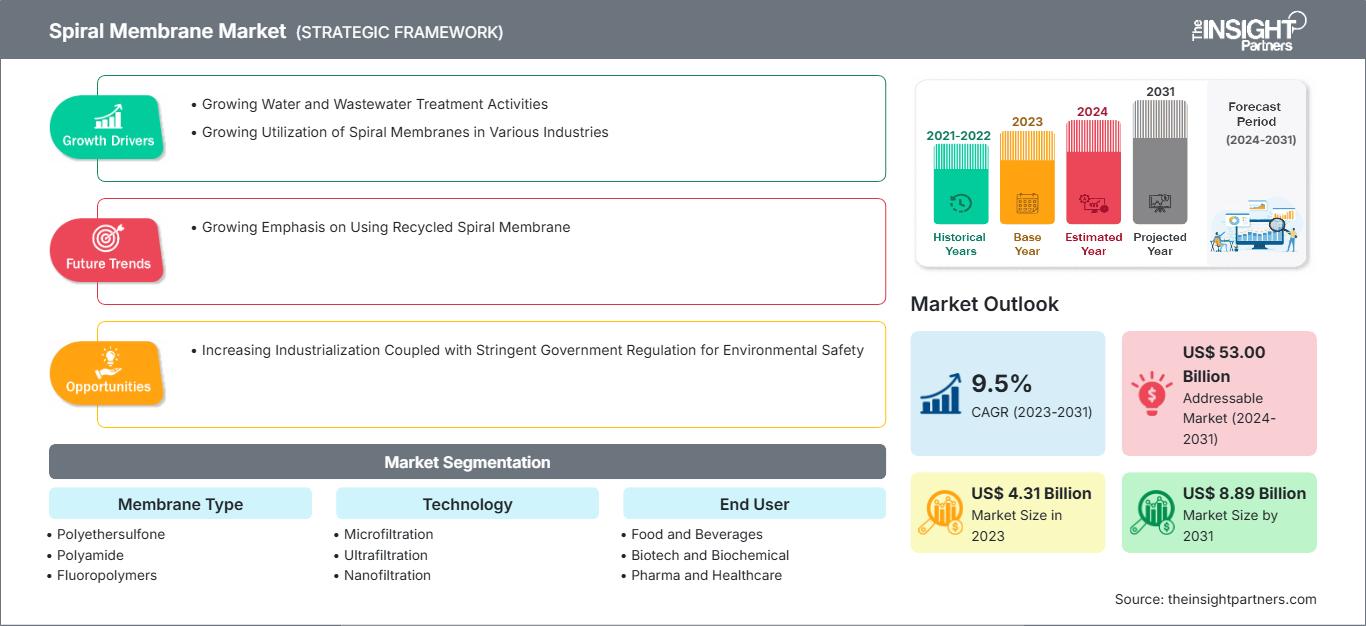

Spiral Membrane Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Membrane Type (Polyethersulfone, Polyamide, Fluoropolymers, and Others), Technology (Microfiltration, Ultrafiltration, Nanofiltration, and Reverse Osmosis), End User [Food and Beverages, Biotech and Biochemical, Pharma and Healthcare, Water Treatment (Municipal), Wastewater (Industrial), Chemicals, Oil and Gas, Textile/Pulp and Paper Industry, and Others], and Geography

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2024-2031- Report Date : Jun 2024

- Report Code : TIPRE00005118

- Category : Chemicals and Materials

- Status : Published

- Available Report Formats :

- No. of Pages : 237

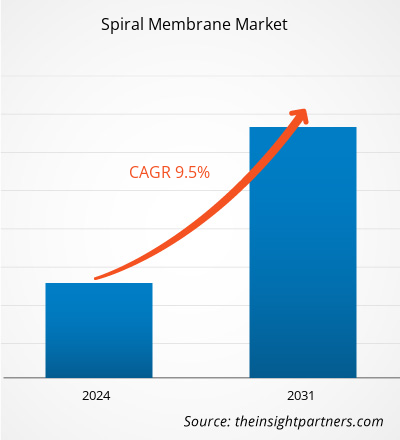

The spiral membrane market size is projected to reach US$ 8.89 billion by 2031 from US$ 4.31 billion in 2023. The market is expected to register a CAGR of 9.5% during 2023–2031. Due to the growing need for treating water and wastewater, spiral membranes have gained traction across the world. As spiral membranes help attain high-quality standards for water purification, their utilization is trending in various industries.

Spiral Membrane Market Analysis

Governments of many countries worldwide are encouraging water and wastewater treatment practices. Various countries in Europe are working toward achieving wastewater treatment targets, protecting sensitive water systems, and utilizing wastewater sludge. The ability of spiral membranes to achieve high-yield concentration and demineralization of products in the food & beverages, chemicals, biotech, and pharmaceutical industries makes them a suitable alternative for filtration purposes in these industries. Moreover, the rise in government initiatives for achieving environmental safety and sustainability goals by imposing regulations on manufacturing industries is increasing the adoption of filtration processes.

Spiral Membrane Market Overview

A spiral membrane is a firmly packed filter media, wherein a permeable membrane is wrapped around a center core in a spiral fashion manner, which tends to be similar to a fabric roll. It consists of a sandwich of flat sheet membranes, spacers, and porous permeate flow material wrapped around a central permeate collecting tube. The permeable membrane is sealed at the edges and is gapped with a spacer material that allows the flow of the liquid that is to be filtered. Spiral membrane is highly utilized in municipal water treatment applications due to its filtration efficiency. The higher packing density of the spiral membrane enhances the filtration capacity and separation performance, leading to increased demand. In April 2024, Toray Industries received a reverse osmosis membrane order for the Tseung Kwan O Desalination Plant in Hong Kong, marking the company's success in supplying RO membranes to desalination plants worldwide and providing technical support for stable operations.

Customizee This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONSpiral Membrane Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Spiral Membrane Market Drivers and Opportunities

Growing Utilization of Spiral Membranes in Various Industries

Spiral-wound elements consist of membranes, feed spacers, permeate spacers, and a permeate tube. A permeable membrane is wrapped spirally around a center core and is sealed at the edges. Gaps are created with a spacer material to allow liquid to flow for filtration. As spiral membranes help in achieving high-yield concentration and demineralization of products in the food & beverages, chemicals, biotech, and pharmaceutical industries, these are the most suitable alternatives for filtration purposes in industries. Spiral wound modules are integrated with reverse osmosis, nanofiltration, and other advanced membrane technologies to achieve desired levels of water purity.

In the food & beverage industry, spiral membranes act as selective barriers and allow water molecules to pass through while retaining any contaminants. This makes the purification process highly efficient, thus contributing to the production of food products and beverages with premium taste, quality, and shelf life. The compact design of spiral membranes leads to lower energy consumption in comparison to alternative filtration technologies. Spiral membranes are beneficial, particularly for industries where energy efficiency is a key consideration, contributing to both economic savings and reduced environmental impact. Further, the pharmaceutical industry utilizes spiral membranes in the filtration process to reduce endotoxins in processed water and pharmaceutical products. These membranes can be used for the purification, concentration, and fractionation of human blood components. Also, spiral membrane consists of excellent chemical and thermal stability with high pH and temperature resistance. The advantage of a spiral membrane makes it suitable for a variety of applications such as whey protein concentration, lactose concentration, cathodic/anodic paint recovery, dye desalting and concentration, sulfate removal, and oil separation in wastewater. Therefore, the growing utilization of spiral membranes in various industries drives the market.

Increasing Industrialization Coupled with Stringent Government Regulation for Environmental Safety

Significant investment prospects and restructured business models in the post-pandemic scenario are the main factors contributing to rapid industrialization. As developing economies undergo significant transformation, with rapid growth in manufacturing, construction, and industrial sectors, the reliance on filtration solutions has become paramount. As per the data published by the State Council Information Office of China (SCIO) in 2022, industrial output in China increased by 3.6% compared to the previous year. With a surge in production activities, the need for filtration in manufacturing processes has also increased, which requires efficient filtration membranes. Thus, spiral membranes are experiencing increased demand to ensure optimal performance and filtration efficiency in industrial processes such as industrial waste treatment. These membranes are widely used in nanofiltration or reverse osmosis across various industries, such as oil & gas, textile, paper & pulp, chemicals, petrochemicals, food & beverages, and pharmaceuticals. Moreover, the rise in government initiatives for achieving environmental safety and sustainability goals by imposing regulations on manufacturing industries is increasing the adoption of filtration processes. As a result, the demand for cleaning and recycling water technology, such as spiral membrane modules, is growing in China. The Government of China has set a target to treat 95% of wastewater in all cities and reach a 25% water reuse rate in areas with low water capacity. Also, the Clean Water Act (CWA) sets up the basic structure for monitoring discharges of pollutants into water bodies in the US. Further, the Government of India has imposed several environmental regulations to protect the environment and control growing pollution levels. Regulations such as the Water Act of 1974, the Air Act of 1981, and the Environmental Act of 1986 were placed to provide a cleaner environment in India. Thus, the rapid industrialization in developing economies and stringent government regulation for environmental safety are expected to create lucrative opportunities for the spiral membrane market growth during the forecast period.

Spiral Membrane Market Report Segmentation Analysis

Key segments that contributed to the derivation of the spiral membrane market analysis are membrane type, technology, and end user.

- Based on membrane type, the spiral membrane market is segmented into polyethersulfone, polyamide, fluoropolymers, and others. The polyamide segment held the largest market share in 2023.

- By technology, the market is categorized into microfiltration, ultrafiltration, nanofiltration, and reverse osmosis. The reverse osmosis segment held the largest share of the market in 2023.

In terms of end users, the market is segmented into food and beverages, biotech and biochemical, pharma and healthcare, water treatment (municipal), wastewater (industrial), chemicals, oil and gas, textile/pulp and paper industry, and others. In 2023, the water treatment (municipal) segment dominated the market.

Spiral Membrane Market Share Analysis by Geography

The geographic scope of the spiral membrane market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

In 2023, Asia Pacific dominated the spiral membrane market share. In recent years, the demand for oil and gas has been growing rapidly across the Asia Pacific. As per the International Energy Agency, the global oil demand rebounded in 2021, and the region is expected to account for 77% of oil demand growth by 2025. As countries in the region experience rapid industrialization and economic growth, the demand for oil and gas has also increased. The exploration, extraction, and refining processes generate large volumes of wastewater containing various contaminants, including hydrocarbons, heavy metals, and suspended solids. Spiral membranes are highly effective in treating these complex effluents, ensuring that the quality of water meets stringent environmental regulations before being discharged or reused, thereby minimizing environmental impact. Therefore, there is a rise in the need for proper wastewater management in the oil & gas industry in Asia Pacific for various applications.

Spiral Membrane Market Regional Insights

The regional trends and factors influencing the Spiral Membrane Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Spiral Membrane Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Spiral Membrane Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 4.31 Billion |

| Market Size by 2031 | US$ 8.89 Billion |

| Global CAGR (2023 - 2031) | 9.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Membrane Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Spiral Membrane Market Players Density: Understanding Its Impact on Business Dynamics

The Spiral Membrane Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Spiral Membrane Market top key players overview

Spiral Membrane Market News and Recent Developments

The spiral membrane market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the spiral membrane market are listed below:

- Toray Industries developed a durable reverse osmosis membrane that ensures long-term water quality and maintains superior removal performance for industrial wastewater treatment. (Source: Toray Industries, Press Release, March 2024)

- Veolia Water Technologies signed an agreement to expand its operations in Wuxi, China, and partner with the Administrative Committee of Wuxi National High-Tech Industrial Development Zone. (Source: Veolia Water Technologies, Press Release, May 2024)

- Sun Capital Partners acquired Koch Separation Solutions, a subsidiary of Koch Industries, transforming it into Kovalus Separation Solutions. (Source: Sun Capital Partners, Press Release, October 2023)

- Solecta Inc. and The Lubrizol Corporation announced a new partnership to develop and market novel membrane solutions that improve productivity and drive greater efficiencies in the global separations industry. (Source: Solecta Inc, Company Website, February 2023)

Spiral Membrane Market Report Coverage and Deliverables

The “Spiral Membrane Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Spiral membrane market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Spiral membrane market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter’s Five Forces and SWOT analysis

- Spiral membrane market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the spiral membrane market

- Detailed company profiles

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For