Sports Nutrition Market Analysis, Size, and Share by 2031

Sports Nutrition Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type [Supplements (Powders, Tablets & Capsules, Gummies, and Others), Bars, RTD Beverages, and Others], Distribution Channel [Supermarkets and Hypermarkets, Specialty Stores, Online Retail, and Others], and Geography

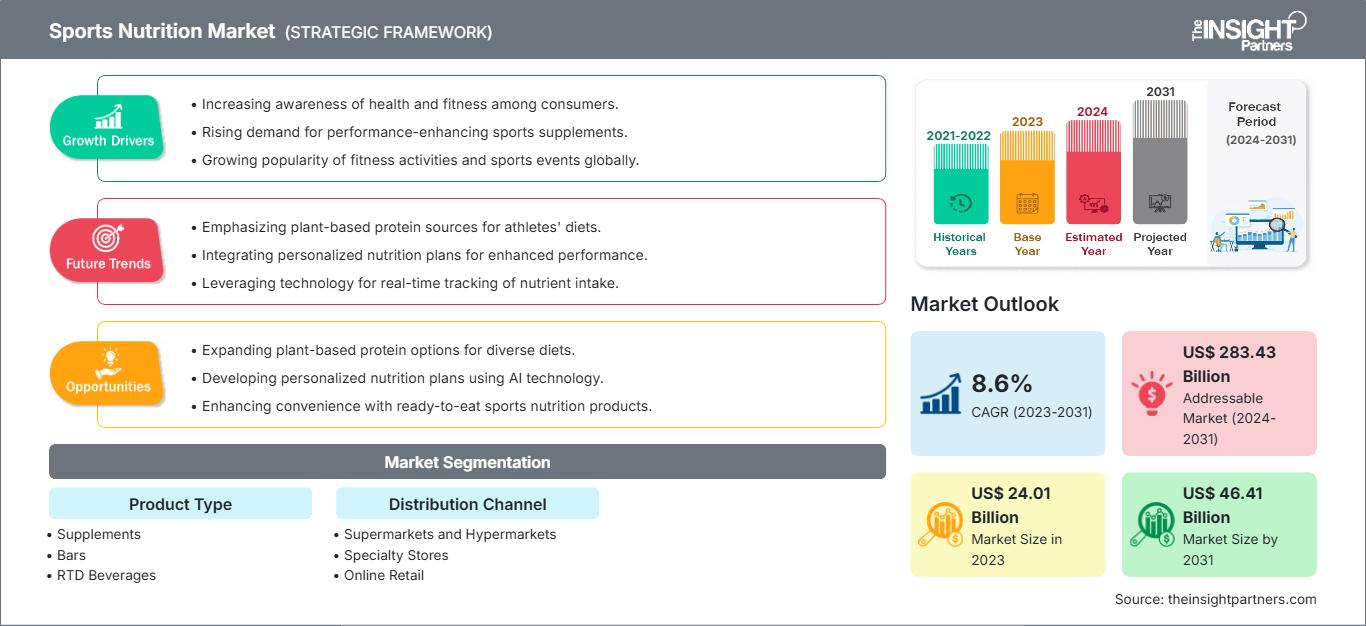

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2024-2031- Report Date : Aug 2024

- Report Code : TIPRE00006894

- Category : Consumer Goods

- Status : Published

- Available Report Formats :

- No. of Pages : 164

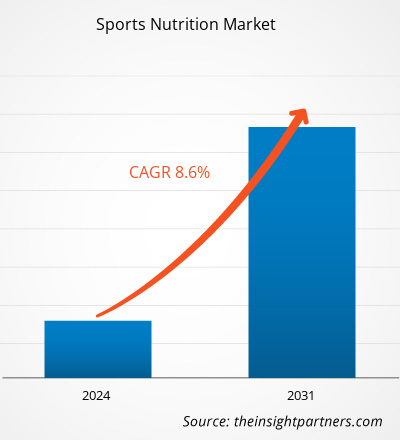

The sports nutrition market size is projected to reach US$ 46.41 billion by 2031 from US$ 24.01 billion in 2023. The market is expected to register a CAGR of 8.6% during 2023–2031. The increasing number of vegan consumers worldwide boosts the demand for sports nutrition products with vegan, organic, and plant-based ingredients. The growing awareness among consumers about plant-based sports nutrition products being more nutritious than traditional products is expected to propel the demand for plant-based sports nutrition products over the forecast period.

Sports Nutrition Market Analysis

There is an increase in the prevalence of health conditions such as diabetes and obesity worldwide. According to the WHO, as of 2022, 2.5 billion adults were overweight, out of which 890 million adults suffered from obesity. Owing to the rising health awareness and the increasing focus on a better physical appearance, consumers are increasingly shifting toward a healthy lifestyle with engagement in physical fitness activities. In addition, several sports events taking place across the globe, such as the Super Bowl, Asian Games, FIFA World Cup, and Olympics, result in increased involvement of youth in sports activities. Thus, the increasing adoption of sports activities leads to a rising demand for sports nutrition products, including protein powders, protein bars, and sports supplements, by athletes to increase their overall performance, especially during games and workouts.

Sports Nutrition Market Overview

The trend of sports and physical activities is growing considerably across the globe. Various developed and developing countries are witnessing an increase in demand for protein powders and RTD beverages as these sports nutrition products offer a wider range of health benefits. Several sports nutrition product manufacturers are opting for new sources of plant-based and organic protein ingredients, such as spirulina microalgae, to differentiate themselves from their competitors in the sports nutrition market. The ingredients such as amino acids and creatine in these sports nutrition products target specific body functions, including weight loss, energy balance, and muscle repair. For instance, in November 2023, FrieslandCampina, a sports nutrition company, announced the launch of a new whey protein powder with protein ingredients catered to boost medical nutrition, support athletic performance, and promote gut health. These factors are expected to propel the global sports nutrition market.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONSports Nutrition Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Sports Nutrition Market Drivers and Opportunities

Rising Engagement of Consumers in Physical Fitness Activities

The increasing number of fitness enthusiasts is leading to the launch of several fitness centers, gyms, and sports clubs globally. For instance, Basic-Fit, a leading gym chain, had over 1,400 gyms across Europe in 2023. Also, since the COVID-19 pandemic, there has been a rise in the population using fitness apps and taking online courses for fitness activities. This increase in fitness lifestyle results in a rise in demand for sports nutrition products, such as protein powders and other sports supplements, to enhance overall performance and energy efficiency during workouts. Moreover, social media is playing a crucial role in influencing a wide range of audiences to adopt healthy lifestyles and supporting their journey of fitness goals. Exercise, workout, and food ideas are accessible through platforms such as YouTube, Instagram, and Facebook which further grabs the attention of consumers in physical fitness activities. Thus, the increasing engagement of consumers in physical fitness activities augments the demand for sports nutrition products worldwide.

Favorable Government Initiatives Supporting Sports Activities

The sports nutrition market is driven by several favorable government initiatives and programs worldwide promoting engagement in sports and physical activities. For instance, the US government promotes the engagement of young adults in sports activities through its National Youth Sports Strategy and The International Sports Programming Initiative (ISPI) programs. In addition, the government is supporting women's participation in sports activities, giving the key players an opportunity to expand their consumer base to women. For instance, the US government supports the women's sports team through the Women's Sports Foundation. Several women's sports teams have been launched, including FIFA Women's Football Team and United States Women's National Soccer Team. In addition, the government of UK is supporting women athletes by launching a new sports strategy to get 1.25 million active women athletes in the country by 2030. The government of South Australia is supporting the girls and women in the country to pursue careers as athletes by committing an investment of US$ 18 million to build sports infrastructures and programs dedicated to women by 2027. Such factors can be considered as a market opportunity for sports nutrition product manufacturers, helping them differentiate from their competitors and strengthen their market position in the sports nutrition market over the forecast period.

Sports Nutrition Market Report Segmentation Analysis

Key segments that contributed to the derivation of the sports nutrition market analysis are product type and distribution channel

- Based on product type, the sports nutrition market is segmented into supplements, bars, RTD beverages, and others. The supplements segment accounted for the largest share in 2023.

- In terms of distribution channel, the market is segmented into supermarkets and hypermarkets, specialty stores, online retail, and others. The specialty stores segment held the largest share in 2023.

Sports Nutrition Market Share Analysis by Geography

The geographic scope of the sports nutrition market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America held the largest share in 2023, while the market in Asia Pacific is expected to register the fastest CAGR during the forecast period.

In North America, the incidence of health conditions such as diabetes and chronic diseases caused by high obesity is constantly rising. According to the Trust for America's Health, as of September 2023, 41.9% of Americans in the US were suffering from obesity and shifting toward healthier diets. To overcome the ongoing health issues, the majority of the population is adopting an active lifestyle with involvement in physical exercise and sports. In response to this trend, several key players in the region are offering a wide product portfolio of sports nutrition products. For instance, in December 2023, Barebells expanded its protein bars product portfolio by launching the Soft Bar Banana Caramel protein bar to cater to the growing trend of consumers' preference for healthy and functional foods. Additionally, the increasing demand for convenient and on-the-go healthier beverages propels the requirement for sports nutrition products such as RTD sports drinks and protein bars. Also, to boost their performance in workouts or for quick recovery, consumers are inclined toward the consumption of sports supplements. Thus, the shift in consumer lifestyle is boosting the demand for sports nutrition products such as protein bars, RTD sports drinks, and sports nutrition supplements in North America.

Sports Nutrition Market Regional Insights

The regional trends and factors influencing the Sports Nutrition Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Sports Nutrition Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Sports Nutrition Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 24.01 Billion |

| Market Size by 2031 | US$ 46.41 Billion |

| Global CAGR (2023 - 2031) | 8.6% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Sports Nutrition Market Players Density: Understanding Its Impact on Business Dynamics

The Sports Nutrition Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Sports Nutrition Market top key players overview

Sports Nutrition Market News and Recent Developments

The sports nutrition market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A key recent development in the sports nutrition market is mentioned below:

- Amway's XS Energy and Sports Nutrition entered into an exclusive partnership with The Orlando Squeeze and became the exclusive sponsor of The Orlando Squeeze with a focus on delivering positive energy and making the most of every moment for professional and non-professional pickleball athletes. (Source: Amway Corp, Company Website, March 2024)

- GNC's PRO Performance and Beyond Raw expanded their portfolios to include two new Vitapak programs to support entry-level, active, and advanced fitness performance to help consumers at any stage achieve their goals. (Source: GNC Holdings, LLC, Press Release, January 2024)

Sports Nutrition Market Report Coverage and Deliverables

The "Sports Nutrition Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Sports nutrition market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Sports nutrition market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter's Five Forces and SWOT analysis

- Sports nutrition market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the sports nutrition market

- Detailed company profiles

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For