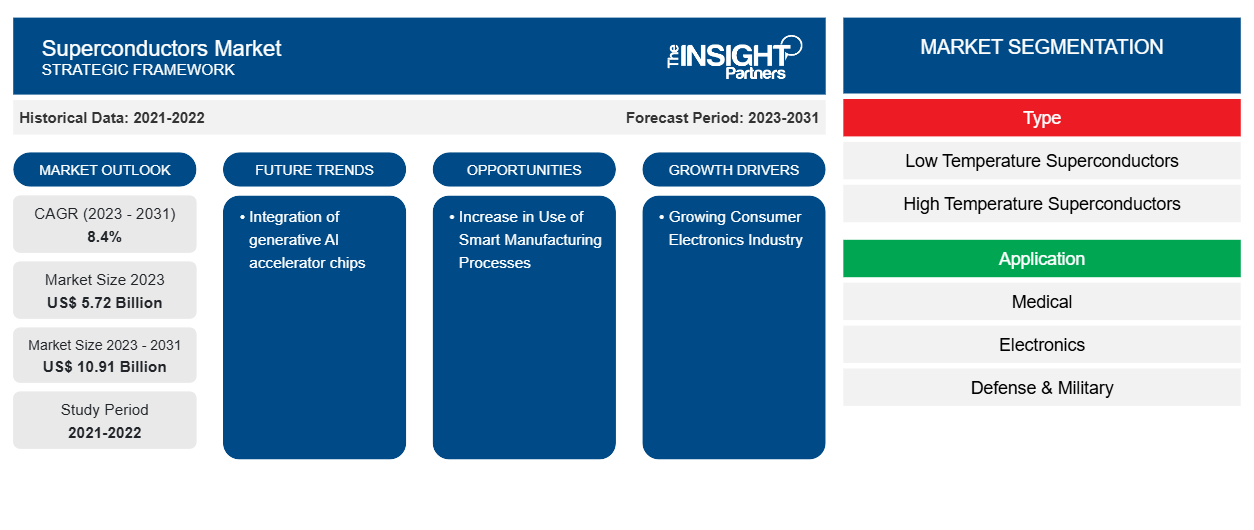

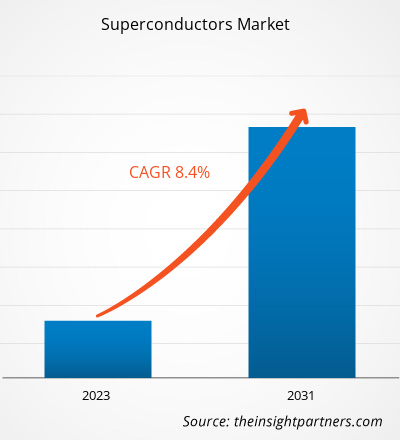

The superconductors market size is projected to reach US$ 10.91 billion by 2031 from US$ 5.72 billion in 2023. The market is expected to register a CAGR of 8.4% during 2023–2031. The integration of generative AI accelerator chips is likely to remain a key trend in the market.

Superconductors Market Analysis

Superconductors have a wide range of applications in MRI technology. This technological trend is projected to continue beyond the forecast period, indicating that the market for superconducting materials is promising. In addition, one of the primary reasons driving the demand for superconductors is the rising need for highly efficient electric motors. These factors are further contributing to the growth of the global superconductors market analysis.

Superconductors Market Overview

The term superconductor refers to those materials that conduct electricity without resistance. These can carry power for a continuous period without losing any energy. Critical magnetic field, heat capacity, critical temperature, and critical current density are all physical parameters of superconducting materials. Depending on the type of superconducting material, these qualities may differ. However, qualities like resistivity are not affected by the substance. The medical business has been changed by introducing magnetic resonance imaging (MRI) equipment that uses superconducting materials. Other industries that have benefited considerably from superconductors include transportation, military, electronics, and power utilities.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Superconductors Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Superconductors Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Superconductors Market Drivers and Opportunities

Growing Consumer Electronics Industry to Favor Market

Superconductors are critical components of electronic devices, allowing advancements in communications, computers, healthcare, military systems, transportation, clean energy, and a wide range of other uses. Computers (+34%) and TV sets (+12%) have expanded far faster than cell phones (+1%) in the last three years internationally, most likely owing to COVID-19 limitations and increased time spent working and studying from home. As a result, smartphones' proportion of total sales dollars for the three device categories has decreased from 65% to 60%. With the increasing demand for consumer electronics, the demand the superconductors is expected to rise in the coming years.

Increase in Use of Smart Manufacturing Processes

Over the years, superconductor fab facilities and outsourced superconductor test and assembly facilities (OSATs) have used IoT devices, robotics technology, artificial intelligence/machine learning (AI/ML), and analytics to achieve smart, lights-out chip factories that are completely automated. Wafer fab equipment manufacturers, integrated device manufacturers (IDMs), foundries, and back-end assembly and test (AT) facilities are all increasing their investments in smart manufacturing methods, digital tools, and technologies.

Superconductors Market Report Segmentation Analysis

Key segments that contributed to the derivation of the superconductors market analysis are type and application.

- Based on type, the market is segmented by low-temperature superconductors and high-temperature superconductors. The low-temperature superconductors segment held a significant market share in 2023.

- Based on application, the market is segmented into medical, electronics, defense & military, and others. The electronics segment held the largest share of the market in 2023.

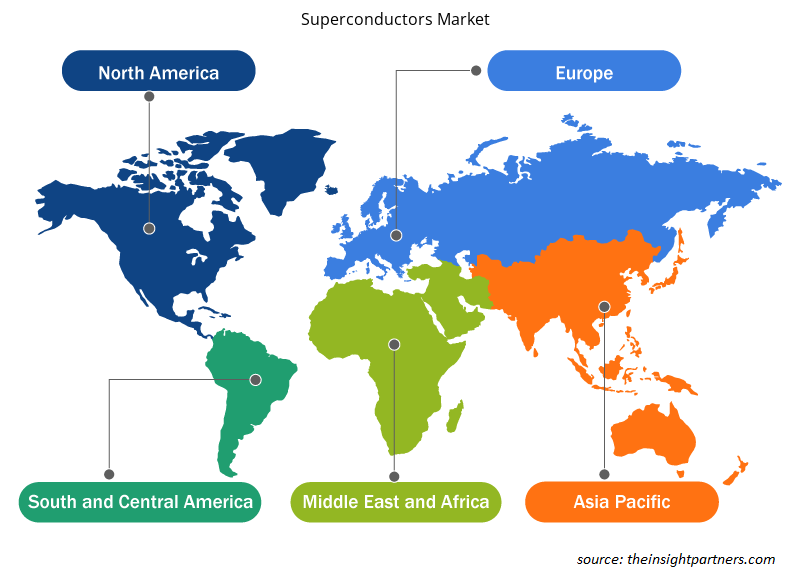

Superconductors Market Share Analysis by Geography

The geographic scope of the superconductors market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America dominated the market in 2023. North America has constantly grown in the medical and defense industries. The region has experienced a significant increase in medical infrastructure investment and the procurement of medical equipment across these infrastructures. Thus, the rising demand for magnetic resonance imaging (MRI) equipment across the region is expected to impact the demand for superconductors among medical device manufacturers directly. Moreover, countries such as the US and Canada have experienced a rise in military expenditure over the last five years, influencing the demand for power railguns and coil guns. Defense manufacturers are highly adopting superconductors to increase the resistance and efficiency of weapons. Thus, the rise in demand for power railguns and coil guns across the region is further expected to contribute to the North American superconductors market growth.

Superconductors Market Regional Insights

The regional trends and factors influencing the Superconductors Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Superconductors Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Superconductors Market

Superconductors Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 5.72 Billion |

| Market Size by 2031 | US$ 10.91 Billion |

| Global CAGR (2023 - 2031) | 8.4% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

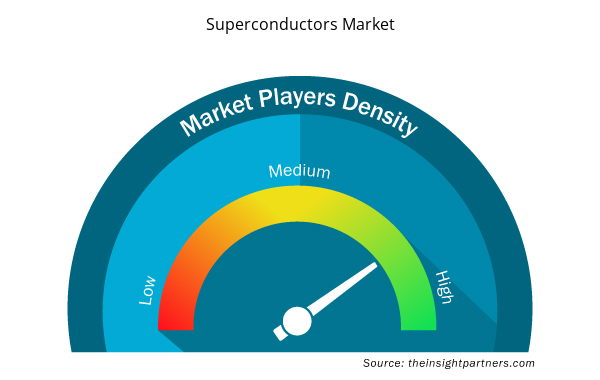

Superconductors Market Players Density: Understanding Its Impact on Business Dynamics

The Superconductors Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Superconductors Market are:

- American Superconductor Corporation

- Bruker Corporation

- Furukawa Electric Co.Ltd.

- Hitachi Ltd.

- Hyoer Tech Research, Inc.

- Japan Superconductor Technology, Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Superconductors Market top key players overview

Superconductors Market News and Recent Developments

The superconductors market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the superconductor market are listed below:

- Bruker Corporation, the leading provider of nuclear magnetic resonance (NMR) systems, announced novel magnet technology and analytical solutions to support the broad adoption of NMR in academic basic and clinical research, as well as in biopharma drug discovery, development, and process analytical technologies (PAT). (Source: Bruker Corporation, Press Release, April 2024)

- Tokamak Energy signed an agreement with leading Japanese and United States companies to supply specialist high-temperature superconducting (HTS) tape for its new advanced prototype fusion device, ST80-HTS. Furukawa Electric Co., Ltd., Tokyo, Japan, and SuperPower Inc., New York, USA, of Furukawa Electric Group, are expected to deliver more than several hundred kilometers of tape to the Oxford-based company for the next phase of construction. (Source: Furukawa Electric Co., Ltd., Press Release, January 2023)

Superconductors Market Report Coverage and Deliverables

The “Superconductors Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Superconductors market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Superconductors market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Superconductors market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the superconductor market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Which region dominated the superconductors market in 2023?

North America dominated the superconductors market in 2023.

What are the driving factors impacting the superconductors market?

Owing to the growing medical industry, the demand for superconducting materials is expected to increase significantly during the forecast period, thus driving the market.

What are the future trends of the superconductors market?

The integration of generative AI accelerator chips is likely to remain a key trend in the market.

Which are the leading players operating in the superconductors market?

American Superconductor Corporation, Bruker Corporation, Furukawa Electric Co.Ltd., Hitachi Ltd., and Hyoer Tech Research, Inc. are among the leading players in the superconductors market.

What would be the estimated value of the superconductors market by 2031?

The estimated value of the superconductors market is expected to reach US$ 10.91 billion by 2031.

What is the expected CAGR of the superconductors market?

The market is expected to grow at a CAGR of 8.4% over the forecast period.

Get Free Sample For

Get Free Sample For