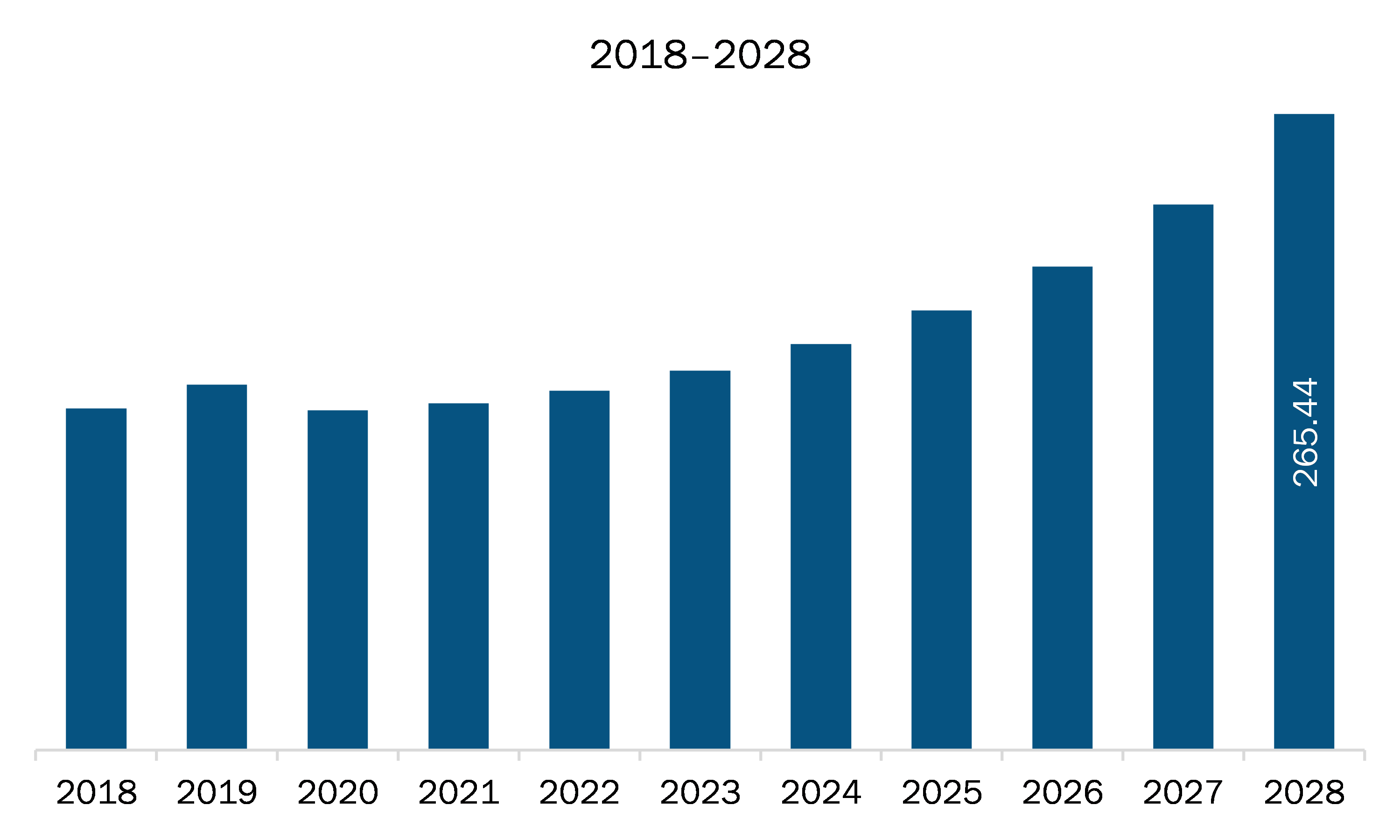

The aircraft wire & cable market in APAC is expected to grow from US$ 141.82 million in 2020 to US$ 265.44 million by 2028; it is estimated to grow at a CAGR of 9.1% from 2021 to 2028.

Australia, China, India, Japan, and South Korea are major economies in APAC. Developing economies witnessing rise in MRO activities is the major factor driving the APAC aircraft wire & cable market. MRO activities for upgrading the aircraft fleet. Rising middle-class travelers, especially in APAC: countries, such as India, China, and Singapore, is the main factor contributing to air travel growth, subsequently increasing the need for aircraft MRO services in APAC. The governments in the countries mentioned above and other emerging economies support the growth of aviation MRO services, as it is a crucial strategy to support the economic goals by focusing on enhancing the aircraft MRO activities. The constantly evolving MRO activities pose a potential opportunity for the aircraft wires and cables manufacturers and distributors to market their products to various MRO service providers in the emerging economies. Guangzhou Aircraft Maintenance Engineering Co., Ltd. (GAMECO), China: MTU Maintenance; and ExecuJet Haite Aviation Services China: Co., Ltd. Are among the aircraft MRO businesses in APAC. The rest of APAC: countries, such as Malaysia, Singapore, and Thailand, produce large revenues from aircraft MRO business. For instance, Singapore dominates the MRO market in APAC: due to its established MRO hubs and substantial footprints of major industry players such as GE Aviation, Airbus, and Rolls-Royce. According to Wisconsin Economic Development Corporation (WEDC), Singapore includes 120 aerospace companies, which account for ~25% of the APAC’s MRO business. Additionally, Singapore-based airlines observe a significant growth in passenger counts, propelling the airlines to operate their aircraft fleet for a longer period; the increase in flying hours is directly proportional to MRO activity demand. Thus, it creates various business opportunities for vendors in the region to supply their efficient and dependable aircraft wires and cables to growing MRO facilities in emerging economies.

The ongoing COVID-19 has caused havoc in the APAC region. APAC is characterized by many developing countries, a positive economic outlook, high industrial presence, huge population, and rising disposable income. These factors make APAC a major growth driving region for various markets, including aircraft wire & cable. The COVID-19 outbreak has resulted in a massive financial loss in the APAC region. The governments in APAC countries are taking possible steps to reduce its effects by announcing lockdown, negatively affecting the manufacturing sector. China is one of the leading aerospace manufacturing countries in the region and has been one of APAC's most affected countries. Due to this, the manufacturing facilities have been witnessing severe aircraft and aircraft-associated components manufacturing facilities. India and Indonesia are still combating the spread of the virus. However, the countries have eased the lockdown measures, which is reflecting the restart of manufacturing facilities. Nonetheless, the remarkable lower volumes of air travel passengers have slowed down the demand for various components among the OEMs and aftermarket players regionally and internationally. This has been negatively affecting the aircraft wire & cable market. Several airlines in APAC have retired their wide-body jets and narrow-body jets. This factor is anticipated to inhibit the aircraft wire & cable market for the next few months. For instance, Australia-based Qantas retired its Boeing B747 in mid-2020 to cope with the COVID-19 pandemic's financial pressure. Thus, the retirement of wide-body jets is foreseen to be creating tremors on aviation aftermarket and eventually on the aircraft wire & cable market.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the APAC aircraft wire & cable market. The Asia Pacific aircraft wire & cable market is expected to grow at a good CAGR during the forecast period.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

APAC Aircraft Wire & Cable Market Segmentation

APAC Aircraft Wire & Cable Market – By Type

- Cable

- Wire

- Harness

APAC Aircraft Wire & Cable Market – By Aircraft Type

- Commercial

- Military

APAC Aircraft Wire & Cable Market – By Fit Type

- Line Fit

- Retrofit

APAC Aircraft Wire & Cable Market – By Application

- Power Transfer

- Data Transfer

- Flight Control System

- Avionics

- Lighting

APAC Aircraft Wire & Cable Market, by Country

- Australia

- China

- India

- Japan

- South Korea

- Rest of APAC

APAC Aircraft Wire & Cable Market - Companies Mentioned

- A.E. Petsche Company

- AMETEK Inc.

- Amphenol Corporation

- Axon Enterprise, Inc.

- Collins Aerospace, a Raytheon Technologies Corporation Company

- Draka

- Glenair, Inc.

- Harbour Industries, LLC

- HUBER+SUHNER

- Nexans

- Radiall

- TE Connectivity Ltd.

- W. L. Gore and Associates, Inc.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Aircraft Type, Fit Type, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Australia, China, Japan, South Korea

TABLE OF CONTENTS

1. Introduction. 18

1.1 The Insight Partners Research Report Guidance. 19

1.2 Market Segmentation. 20

2. Key Takeaways. 24

3. Research Methodology. 28

3.1 Coverage. 30

3.2 Secondary Research. 30

3.3 Primary Research. 31

4. APAC Aircraft Wire & Cable Market Landscape. 32

4.1 Market Overview. 32

4.2 Ecosystem Analysis. 34

4.3 Porter’s Five Forces Analysis. 35

5. APAC Aircraft Wire & Cable Market – Key Industry Dynamics. 38

5.1 Market Drivers. 38

5.1.1 Orders and Deliveries of Aircraft are Increasing. 38

5.1.2 Upcoming of Innovative Aircraft Solutions. 39

5.2 Market Restraints. 40

5.2.1 Aircraft Models Being Pulled Back. 40

5.3 Market Opportunities. 41

5.3.1 Developing Economies Witnessing Rise in MRO Activities. 41

5.4 Future Trends. 42

5.4.1 Lightweight and Durable Aircraft Wires and Cables Becoming More Common. 42

5.5 Impact Analysis of Drivers and Restraints. 43

6. Aircraft Wire & Cable Market– APAC Analysis. 44

6.1 APAC Aircraft Wire & Cable Market Overview.. 44

6.2 APAC Aircraft Wire & Cable Market Forecast and Analysis. 45

7. APAC Aircraft Wire & Cable Market Analysis – Type. 46

7.1 Overview.. 46

7.2 APAC Aircraft Wire & Cable Market Breakdown, By Type, 2020 & 2028. 46

7.3 Cable. 47

7.3.1 Overview.. 47

7.3.2 Cable: Aircraft Wire & Cable Market Forecasts and Analysis. 47

7.4 Wire. 49

7.4.1 Overview.. 49

7.4.2 Wire: Aircraft Wire & Cable Market Forecasts and Analysis. 49

7.5 Harness. 51

7.5.1 Overview.. 51

7.5.2 Harness: Aircraft Wire & Cable Market Forecasts and Analysis. 51

8. APAC Aircraft Wire & Cable Market Analysis – By Aircraft Type. 53

8.1 Overview.. 53

8.2 APAC Aircraft Wire & Cable Market Breakdown, By Aircraft Type, 2020 & 2028. 53

8.3 Commercial 55

8.3.1 Overview.. 55

8.3.2 Commercial: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 (US$ Mn) 56

8.4 Military. 57

8.4.1 Overview.. 57

8.4.2 Military: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 (US$ Mn) 57

9. APAC Aircraft Wire & Cable Market Analysis – Fit Type. 59

9.1 Overview.. 59

9.2 APAC Aircraft Wire & Cable Market Breakdown, By Fit Type, 2020 & 2028. 59

9.3 Line Fit 61

9.3.1 Overview.. 61

9.3.2 Line Fit: Aircraft Wire & Cable Market Forecasts and Analysis. 61

9.4 Retrofit 63

9.4.1 Overview.. 63

9.4.2 Retrofit: Aircraft Wire & Cable Market Forecasts and Analysis. 63

10. APAC Aircraft Wire & Cable Market Analysis – Application. 65

10.1 Overview.. 65

10.2 APAC Aircraft Wire & Cable Market Breakdown, By Application, 2020 & 2028. 65

10.3 Power Transfer 67

10.3.1 Overview.. 67

10.3.2 Power Transfer: Aircraft Wire & Cable Market Forecasts and Analysis. 67

10.4 Data Transfer 69

10.4.1 Overview.. 69

10.4.2 Data Transfer: Aircraft Wire & Cable Market Forecasts and Analysis. 69

10.5 Avionics. 71

10.5.1 Overview.. 71

10.5.2 Avionics: Aircraft Wire & Cable Market Forecasts and Analysis. 71

10.6 Lighting. 72

10.6.1 Overview.. 72

10.6.2 Lighting: Aircraft Wire & Cable Market Forecasts and Analysis. 72

10.7 Flight Control Systems. 74

10.7.1 Overview.. 74

10.7.2 Flight Control System: Aircraft Wire & Cable Market Forecasts and Analysis. 74

11. APAC Aircraft Wire & Cable Market – Country Analysis. 76

11.1 Overview.. 76

11.1.1 APAC: Aircraft Wire & Cable Market Breakdown, by Key Countries. 79

11.1.1.1 Australia: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 (US$ Mn) 80

11.1.1.1.1 Australia: Aircraft Wire & Cable Market Breakdown by Type. 81

11.1.1.1.2 Australia: Aircraft Wire & Cable Market Breakdown by Fit Type. 82

11.1.1.1.3 Australia: Aircraft Wire & Cable Market Breakdown by Aircraft Type. 82

11.1.1.1.4 Australia: Aircraft Wire & Cable Market Breakdown by Application. 83

11.1.1.2 China Aircraft Wire & Cable Market Revenue and Forecasts to 2028 (US$ Mn) 84

11.1.1.2.1 China: Aircraft Wire & Cable Market Breakdown by Type. 85

11.1.1.2.2 China: Aircraft Wire & Cable Market Breakdown by Fit Type. 86

11.1.1.2.3 China: Aircraft Wire & Cable Market Breakdown by Aircraft Type. 86

11.1.1.2.4 China: Aircraft Wire & Cable Market Breakdown by Application. 87

11.1.1.3 India: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 (US$ Mn) 88

11.1.1.3.1 India: Aircraft Wire & Cable Market Breakdown by Type. 89

11.1.1.3.2 India: Aircraft Wire & Cable Market Breakdown by Fit Type. 90

11.1.1.3.3 India: Aircraft Wire & Cable Market Breakdown by Aircraft Type. 90

11.1.1.3.4 India: Aircraft Wire & Cable Market Breakdown by Application. 91

11.1.1.4 Japan: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 (US$ Mn) 92

11.1.1.4.1 Japan: Aircraft Wire & Cable Market Breakdown by Type. 93

11.1.1.4.2 Japan: Aircraft Wire & Cable Market Breakdown by Fit Type. 94

11.1.1.4.3 Japan: Aircraft Wire & Cable Market Breakdown by Aircraft Type. 94

11.1.1.4.4 Japan: Aircraft Wire & Cable Market Breakdown by Application. 95

11.1.1.5 South Korea: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 (US$ Mn) 96

11.1.1.5.1 South Korea: Aircraft Wire & Cable Market Breakdown by Type. 97

11.1.1.5.2 South Korea: Aircraft Wire & Cable Market Breakdown by Fit Type. 97

11.1.1.5.3 South Korea: Aircraft Wire & Cable Market Breakdown by Aircraft Type. 98

11.1.1.5.4 South Korea: Aircraft Wire & Cable Market Breakdown by Application. 99

11.1.1.6 Rest of APAC: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 (US$ Mn) 100

11.1.1.6.1 Rest of APAC: Aircraft Wire & Cable Market Breakdown by Type. 101

11.1.1.6.2 Rest of APAC: Aircraft Wire & Cable Market Breakdown by Fit Type. 102

11.1.1.6.3 Rest of APAC: Aircraft Wire & Cable Market Breakdown by Aircraft Type. 102

11.1.1.6.4 Rest of APAC: Aircraft Wire & Cable Market Breakdown by Application. 103

12. Impact of COVID-19 Pandemic on APAC Aircraft Wire & Cable Market 104

12.1 APAC. 104

13. Aircraft Wire and Cable Market - Industry Landscape. 106

13.1 Overview.. 106

13.2 Market Initiative. 106

13.3 Merger and Acquisition. 107

13.4 New Development 107

14. Company Profiles. 108

14.1 Axon Enterprise, Inc. 108

14.1.1 Key Facts. 108

14.1.2 Business Description. 108

14.1.3 Products and Services. 109

14.1.4 Financial Overview.. 109

14.1.5 SWOT Analysis. 112

14.1.6 Key Developments. 112

14.2 Harbour Industries, LLC. 113

14.2.1 Key Facts. 113

14.2.2 Business Description. 113

14.2.3 Products and Services. 113

14.2.4 Financial Overview.. 114

14.2.5 SWOT Analysis. 114

14.2.6 Key Developments. 114

14.3 Draka. 115

14.3.1 Key Facts. 115

14.3.2 Business Description. 115

14.3.3 Products and Services. 115

14.3.4 Financial Overview.. 116

14.3.5 SWOT Analysis. 116

14.3.6 Key Developments. 116

14.4 Glenair, Inc. 117

14.4.1 Key Facts. 117

14.4.2 Business Description. 117

14.4.3 Products and Services. 118

14.4.4 Financial Overview.. 118

14.4.5 SWOT Analysis. 119

14.4.6 Key Developments. 119

14.5 HUBER+SUHNER. 120

14.5.1 Key Facts. 120

14.5.2 Business Description. 120

14.5.3 120

14.5.4 Products and Services. 121

14.5.5 Financial Overview.. 121

14.5.6 SWOT Analysis. 124

14.5.7 Key Developments. 125

14.6 A.E. Petsche Company. 126

14.6.1 Key Facts. 126

14.6.2 Business Description. 126

14.6.3 Products and Services. 127

14.6.4 Financial Overview.. 127

14.6.5 SWOT Analysis. 130

14.6.6 Key Developments. 130

14.7 AMETEK Inc. 131

14.7.1 Key Facts. 131

14.7.2 Business Description. 131

14.7.3 Products and Services. 132

14.7.4 Financial Overview.. 132

14.7.5 SWOT Analysis. 135

14.7.6 Key Developments. 135

14.8 Amphenol Corporation. 136

14.8.1 Key Facts. 136

14.8.2 Business Description. 136

14.8.3 Products and Services. 137

14.8.4 Financial Overview.. 137

14.8.5 SWOT Analysis. 140

14.8.6 Key Developments. 141

14.9 Collins Aerospace, a Raytheon Technologies Corporation Company. 142

14.9.1 Key Facts. 142

14.9.2 Business Description. 142

14.9.3 Products and Services. 143

14.9.4 Financial Overview.. 143

14.9.5 SWOT Analysis. 144

14.9.6 Key Developments. 144

14.10 TE Connectivity Ltd. 145

14.10.1 Key Facts. 145

14.10.2 Business Description. 145

14.10.3 Products and Services. 146

14.10.4 Financial Overview.. 146

14.10.5 SWOT Analysis. 149

14.10.6 Key Developments. 150

14.11 W. L. Gore and Associates, Inc. 151

14.11.1 Key Facts. 151

14.11.2 Business Description. 151

14.11.3 Products and Services. 151

14.11.4 Financial Overview.. 152

14.11.5 SWOT Analysis. 152

14.11.6 Key Developments. 153

14.12 Nexans. 154

14.12.1 Key Facts. 154

14.12.2 Business Description. 154

14.12.3 Products and Services. 155

14.12.4 Financial Overview.. 156

14.12.5 SWOT Analysis. 159

14.12.6 Key Developments. 159

14.13 Radiall 160

14.13.1 Key Facts. 160

14.13.2 Business Description. 160

14.13.3 Products and Services. 161

14.13.4 Financial Overview.. 161

14.13.5 SWOT Analysis. 163

14.13.6 Key Developments. 163

15. Appendix. 164

15.1 About The Insight Partners. 164

15.2 Glossary Of Terms

LIST OF TABLES

Table 1. Boeing and Airbus: Aircraft Order and Delivery Data, 2018, 2019, and 2020. 38

Table 2. APAC Aircraft Wire & Cable Market Revenue and Forecasts to 2028 (US$ Mn) 45

Table 3. Australia: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 – By Type (US$ Million) 81

Table 4. Australia: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 – By Fit Type (US$ Million) 82

Table 5. Australia: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 – By Aircraft Type (US$ Million) 82

Table 6. Australia: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 – By Application (US$ Million) 83

Table 7. China: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 – By Type (US$ Million) 85

Table 8. China: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 – By Fit Type (US$ Million) 86

Table 9. China: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 – By Aircraft Type (US$ Million) 86

Table 10. China: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 – By Application (US$ Million) 87

Table 11. India: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 – By Type (US$ Million) 89

Table 12. India: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 – By Fit Type (US$ Million) 90

Table 13. India: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 – By Aircraft Type (US$ Million) 90

Table 14. India: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 – By Application (US$ Million) 91

Table 15. Japan: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 – By Type (US$ Million) 93

Table 16. Japan: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 – By Fit Type (US$ Million) 94

Table 17. Japan: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 – By Aircraft Type (US$ Million) 94

Table 18. Japan: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 – By Application (US$ Million) 95

Table 19. South Korea: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 – By Type (US$ Million) 97

Table 20. South Korea: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 – By Fit Type (US$ Million) 97

Table 21. South Korea: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 – By Aircraft Type (US$ Million) 98

Table 22. South Korea: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 – By Application (US$ Million) 99

Table 23. Rest of APAC: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 – By Type (US$ Million) 101

Table 24. Rest of APAC: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 – By Fit Type (US$ Million) 102

Table 25. Rest of APAC: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 – By Aircraft Type (US$ Million) 102

Table 26. Rest of APAC: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 – By Application (US$ Million) 103

Table 27. Glossary of Term: Aircraft Wire & Cable Market 165

LIST OF FIGURES

Figure 1. APAC Aircraft Wire & Cable Market Segmentation. 20

Figure 2. APAC Aircraft Wire & Cable Market Segmentation - Country. 21

Figure 3. APAC Aircraft Wire & Cable Market Overview.. 24

Figure 4. APAC Aircraft Wire & Cable Market, By Country. 25

Figure 5. APAC Aircraft Wire & Cable Market, By Type. 26

Figure 6. APAC Aircraft Wire & Cable Market, By Application. 27

Figure 7. APAC Aircraft Wire & Cable Market Ecosystem Analysis. 34

Figure 8. APAC Aircraft Wire & Cable Market - Porter’s Five Forces Analysis. 35

Figure 9. APAC Aircraft Wire & Cable Market: Impact Analysis of Drivers and Restraints. 43

Figure 10. APAC Aircraft Wire & Cable Market Forecast and Analysis, (US$ Mn) 45

Figure 11. APAC Aircraft Wire & Cable Market Breakdown, By Type, 2020 & 2028 (%) 46

Figure 12. APAC Cable: Aircraft Wire & Cable Market Revenue and Forecasts To 2028 (US$ Mn) 48

Figure 13. APAC Wire: Aircraft Wire & Cable Market Revenue and Forecasts To 2028 (US$ Mn) 50

Figure 14. APAC Harness: Aircraft Wire & Cable Market Revenue and Forecasts To 2028 (US$ Mn) 52

Figure 15. APAC Aircraft Wire & Cable Market Breakdown by Aircraft Type, 2020 & 2028 (%) 54

Figure 16. APAC Commercial: Aircraft Wire & Cable Market Revenue and Forecasts To 2028 (US$ Mn) 56

Figure 17. APAC Military: Aircraft Wire & Cable Market Revenue and Forecasts To 2028 (US$ Mn) 58

Figure 18. APAC Aircraft Wire & Cable Market Breakdown, By Fit Type, 2020 & 2028 (%) 60

Figure 19. APAC Line Fit: Aircraft Wire & Cable Market Revenue and Forecasts To 2028 (US$ Mn) 62

Figure 20. APAC Retrofit: Aircraft Wire & Cable Market Revenue and Forecasts To 2028 (US$ Mn) 64

Figure 21. APAC Aircraft Wire & Cable Market Breakdown, By Application, 2020 & 2028 (%) 66

Figure 22. APAC Power Transfer: Aircraft Wire & Cable Market Revenue and Forecasts To 2028 (US$ Mn) 68

Figure 23. APAC Data Transfer: Aircraft Wire & Cable Market Revenue and Forecasts To 2028 (US$ Mn) 70

Figure 24. APAC Avionics: Aircraft Wire & Cable Market Revenue and Forecasts To 2028 (US$ Mn) 71

Figure 25. APAC Lighting: Aircraft Wire & Cable Market Revenue and Forecasts To 2028 (US$ Mn) 73

Figure 26. APAC Flight Control System: Aircraft Wire & Cable Market Revenue and Forecasts To 2028 (US$ Mn) 75

Figure 27. APAC: Aircraft Wire & Cable Market, by Key Countries, Revenue 2020 (UD$ Million) 78

Figure 28. APAC: Aircraft Wire & Cable Market Breakdown by Key Countries, 2020 & 2028(%) 79

Figure 29. Australia: Aircraft Wire & Cable Market Revenue and Forecasts To 2028 (US$ Mn) 80

Figure 30. China Aircraft Wire & Cable Market Revenue and Forecasts To 2028 (US$ Mn) 84

Figure 31. India: Aircraft Wire & Cable Market Revenue and Forecasts To 2028 (US$ Mn) 88

Figure 32. Japan: Aircraft Wire & Cable Market Revenue and Forecasts To 2028 (US$ Mn) 92

Figure 33. South Korea: Aircraft Wire & Cable Market Revenue and Forecasts To 2028 (US$ Mn) 96

Figure 34. Rest of APAC: Aircraft Wire & Cable Market Revenue and Forecasts To 2028 (US$ Mn) 100

Figure 35. Impact of COVID-19 Pandemic in APAC Country Markets. 105

. 165

The List of Companies - Asia Pacific Aircraft Wire & Cable Market

- A.E. Petsche Company

- AMETEK Inc.

- Amphenol Corporation

- Axon Enterprise, Inc.

- Collins Aerospace, a Raytheon Technologies Corporation Company

- Draka

- Glenair, Inc.

- Harbour Industries, LLC

- HUBER+SUHNER

- Nexans

- Radiall

- TE Connectivity Ltd.

- W. L. Gore and Associates, Inc.

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Asia Pacific Aircraft Wire & Cable Market

May 2021

Helicopter Emergency Medical Services Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Helicopter Type (Light Helicopter and Medium and Heavy Helicopter), Application (Medical Aid and Transportation), End Use (Commercial and Government & Emergency Response), and Geography

May 2021

May 2021

Advanced Air Mobility Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Component (Hardware, Software), Operation Mode (Piloted, Autonomous), Propulsion Type (Fully Electric, Hybrid), End Use (Passenger, Cargo)

May 2021

Airport Fueling Equipment Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Tanker Capacity (Below 5,000 Liters; 5,000–20,000 Liters; and Above 20,000 Liters), Aircraft Type (Civil Aircraft and Military Aircraft), and Power Source (Electric and Non-Electric)

May 2021

Satellite Optical Ground Station Market

Forecast to 2028 - Global Analysis by Operation (Laser Satcom and Optical Operations), Equipment (Consumer Equipment and Network Equipment), Application (Laser Operations, Debris Identification, Earth Observation, and Space Situational Awareness), and End User (Government and Military and Commercial Enterprises)

May 2021

Electro-Optics in Naval Market

Forecast to 2028 - COVID-19 Impact and Global Analysis By Technology (Camera, Sensor, and Laser Range Finder), Application (Target Detection, Identification, and Tracking; Surveillance; Fire Control; and Others), and End Use (Defense and Commercial)