[Research Report] The dimethyl ether market size was valued at US$ 6,216.45 million in 2022 and is expected to reach US$ 12,808.32 million by 2030; it is estimated to register a CAGR of 9.5% from 2022 to 2030.

Market Insights and Analyst View:

Dimethyl ether is a colorless, flammable gas at room temperature and pressure. It is primarily used as a propellant in aerosol spray and as a blending component in LPG. The dimethyl ether market has undergone significant transformations in recent years, driven by its versatile applications and environmentally friendly properties. In response to global concerns about air quality and greenhouse gas emissions, dimethyl ether has emerged as a promising candidate to replace traditional diesel fuel. This shift is particularly in regions where reducing emissions from diesel engines is a top priority. When burned, dimethyl ether produces significantly fewer emissions, particularly in particulate matter, than conventional diesel fuels. As a result, dimethyl ether has garnered attention as a cleaner-burning fuel option that aligns with sustainability goals and regulatory requirements. Moreover, dimethyl ether can be produced from a variety of feedstocks, including natural gas, coal, and biomass. This adaptability in feedstock sources enhances its appeal as a renewable and sustainable energy solution and is expected to drive the dimethyl ether market growth.

Growth Drivers and Challenges:

The compatibility of DME and LPG makes blending a seamless process. DME has similar physical properties to LPG, such as being gaseous at room temperature and readily liquified under moderate pressure. This compatibility ensures that DME-LPG blends can be stored, transported, and dispensed using existing LPG infrastructure, such as storage tanks, distribution networks, and refueling stations. This aspect significantly lowers the barriers to entry for adopting DME-LPG blends and enables more rapid integration into existing energy systems. DME-LPG blends offer a transitional solution as industries and governments seek to diversify their energy sources and reduce dependency on traditional fossil fuels. The increasing awareness regarding the advantages of DME-LPG blends promotes a more sustainable and efficient energy landscape, thereby driving the dimethyl ether market growth.

However, the presence of potential substitutes such as compressed natural gas (CNG) and ethanol could limit the dimethyl ether market growth. Due to its lower emissions profile, CNG is extensively used as an alternative to conventional gasoline and diesel fuels in the transportation sector. Like DME, CNG offers reduced greenhouse gas emissions and air pollutants compared to traditional fossil fuels. This overlap in benefits could lead to competition between DME and CNG, especially in regions with well-developed CNG infrastructure. In addition, ethanol is another substitute that could impact the dimethyl ether market, particularly in terms of its use as an alternative fuel and oxygenate in gasoline. Ethanol derived from renewable sources, such as biomass and agricultural feedstocks, has gained attention as a cleaner alternative fuel. Therefore, the availability of substitute products could negatively impact the dimethyl ether market growth.

Strategic Insights

Report Segmentation and Scope:

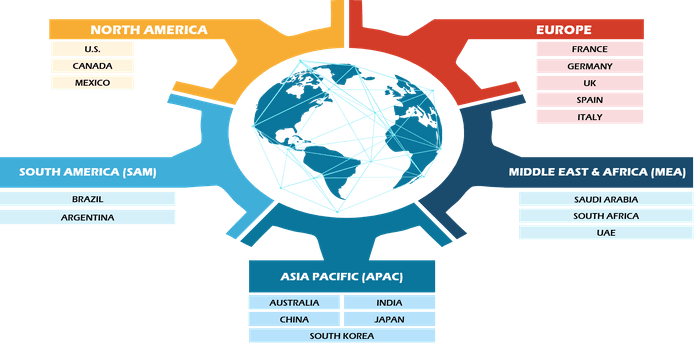

The global dimethyl ether market is segmented on the basis of application and geography. Based on application, the dimethyl ether market is segmented into aerosol propellants, LPG blending, transportation fuel, power generation fuel, chemical feedstock, and others. By geography, the dimethyl ether market is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Russia, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

Based on application, the dimethyl ether market is segmented into aerosol propellants, LPG blending, transportation fuel, power generation fuel, chemical feedstock, and others. The transportation fuel segment is expected to register significant growth from 2022 to 2030. As governments, industries, and consumers worldwide increasingly prioritize environmental sustainability and seek alternatives to conventional fossil fuels, DME emerges as a promising candidate due to its unique properties and compatibility with clean transportation needs. One of the key drivers behind the demand for clean transportation fuels is the urgent requirement to lessen greenhouse gas emissions and air pollutants. Conventional diesel fuels contribute to air pollution and are a considerable source of carbon dioxide emissions. DME, on the other hand, offers several environmental advantages. It produces lower particulate matter emissions, sulfur dioxide, and nitrogen oxides than traditional source of carbon dioxide emissions. DME, on the other hand, offers several environmental advantages. It produces lower particulate matter emissions, sulfur dioxide, and nitrogen oxides than traditional diesel. Moreover, DME combustion generates fewer greenhouse gases, contributing to cleaner air quality and a more sustainable future. Clean transportation fuels such as DME align well with the global push to meet emission reduction targets defined in international agreements such as the Paris Agreement. Governments are implementing stricter regulations to curb vehicle emissions, providing a favorable environment for the adoption of cleaner fuels. As DME can be easily integrated into existing diesel engines with minimal modifications, it provides an attractive solution for industries seeking immediate emissions reduction with extensive infrastructural changes. All these factors are driving the growth of the transportation fuel segment in the dimethyl ether market.

Regional Analysis:

Based on geography, the dimethyl ether market is segmented into five key regions—North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. Asia Pacific region was estimated to be around ~US$ 1,000 million in 2022. The region has become a global manufacturing hub, with industries spanning chemicals, LPG, aerosol propellant, and power production. The government's focus on the replacement of traditional fuel sources with alternative sources can offer potential opportunities in the dimethyl ether market. Thus, as the region progresses and industrializes, the demand for dimethyl ether is expected to remain strong, which is expected to boost the dimethyl ether market growth in Asia Pacific from 2022 to 2030. Europe is expected to register a CAGR of approximately 9% from 2022 to 2030. Europe's sustainability goals and transition toward clean energy sources have prompted the manufacturers to produce DME from renewable feedstock. In 2021, SHV Energy and UGI International received approval from the European Commission to form a joint venture to produce and utilize renewable dimethyl ether. All these factors are driving the dimethyl ether market growth in Europe. Furthermore, North America is forecasted to be valued at around US$ 4,000 million in 2030.

Industry Developments and Future Opportunities:

Various initiatives taken by the key players operating in the dimethyl ether market are listed below:

- In January 2021, Mitsubishi Corp launched commercial operations at its methanol and dimethyl ether (DME) plant in Trinidad and Tobago. The plant has an annual production capacity of 1 million tonnes of methanol and 20,000 metric tons of DME. The plant began operating commercially on December 18, 2020. The plant is run by Caribbean Gas Chemical Ltd (CGCL).

- In May 2021, Oberon Fuels, producer of clean-burning dimethyl ether (DME) transportation fuel, began production of the renewable DME (rDME) in the US, and the only current commercial production.

Dimethyl Ether Market Report Scope

COVID-19 Impact:

The COVID-19 pandemic adversely affected almost all industries in various countries. Lockdowns, travel restrictions, and business shutdowns in North America, Europe, Asia Pacific (APAC), South & Central America, and the Middle East & Africa (MEA) hampered the growth of several industries, including the chemical & materials industry. The shutdown of manufacturing units of dimethyl ether companies disturbed global supply chains, manufacturing activities, and delivery schedules. Various companies reported delays in product deliveries and a slump in their product sales in 2020. Most of the industrial manufacturing facilities were shut down during the pandemic, decreasing the consumption of dimethyl ether. In addition, the COVID-19 pandemic has caused fluctuations in dimethyl ether prices. However, various industries revived their operations after supply constraints were resolved, which led to a revival of the dimethyl ether market. Moreover, the rising demand for dimethyl ether from the applications sectors such as LPG blending, aerosol propellants, and chemicals is substantially promoting the dimethyl ether market growth.

Competitive Landscape and Key Companies:

Nouryon Chemicals Holding BV, Shell Plc, Mitsubishi Gas Chemical Co Inc, The Chemours Co, Aerosolex, Oberon Fuels Inc, Merck KGaA, Jiangsu July Chemical Co Ltd, Sichuan Lutianhua Co Ltd, and Grillo-Werke AG are among the players operating in the global dimethyl ether market. The global dimethyl ether market players focus on providing high-quality products to fulfill customer demand.

REGIONAL FRAMEWORK

Have a question?

Shejal

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

In 2022, North America accounted for the largest share of the global dimethyl ether market. The rising focus on research and development of dimethyl ether is favoring the market expansion in North America. The concerns about climate change, the need for clean transportation fuel, and the requirement for alternative fuel are a few factors led to the dominance of North America in 2022.

In 2022, the LPG blending segment held the largest market share. Dimethyl ether (DME)-LPG blends offer a transitional solution as industries and governments seek to diversify their energy sources and reduce dependency on traditional fossil fuels. The increasing awareness regarding the advantages of DME-LPG blends promotes a more sustainable and efficient energy landscape, that led to the dominance of the LPG blending segment in 2022.

From 2022 to 2030, the Asia Pacific is expected to be the fastest-growing segment. The region has become a global manufacturing hub, with industries spanning chemicals, LPG, aerosol propellant, and power production. The government's focus on the replacement of traditional fuel sources with alternative sources can offer potential opportunities in the dimethyl ether market. Thus, as the region progresses and industrializes, the demand for dimethyl ether is expected to remain strong, which is expected to boost the dimethyl ether market growth in Asia Pacific from 2022 to 2030.

The major players operating in the dimethyl ether market are Nouryon Chemicals Holding BV, Shell Plc, Mitsubishi Gas Chemical Co Inc, The Chemours Co, Aerosolex, Oberon Fuels Inc, Merck KGaA, Jiangsu July Chemical Co Ltd, Sichuan Lutianhua Co Ltd, and Grillo-Werke AG.

The global push for energy security and reduced reliance on fossil fuels also drives the adoption of dimethyl ether. As dimethyl ether can be produced locally from diverse feedstocks, it offers a degree of energy independence and resilience against supply disruption that can occur with traditional fuels subject to geopolitical factors. Government strategies to promote renewable energy and reduce emissions further accelerate the adoption of dimethyl ether. Financial incentives, grants, and mandates for incorporating renewable fuels into transportation fleets encourage industries to invest in dimethyl ether production and utilization. These factors are driving the dimethyl ether market growth.

From 2022 to 2030, the transportation fuel is expected to be the fastest-growing segment. As governments, industries, and consumers worldwide increasingly prioritize environmental sustainability and seek alternatives to conventional fossil fuels, DME emerges as a promising candidate due to its unique properties and compatibility with clean transportation needs. These factors led to the dominance of the transportation fuel segment in 2022.

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

2. Executive Summary

2.1 Key Insights

2.2 Market Attractiveness

2.2.1 Market Attractiveness

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Dimethyl Ether Market Landscape

4.1 Overview

4.2 Porter's Five Forces Analysis

4.2.1 List of Vendors in the Value Chain

4.3 Ecosystem Analysis

5. Global Dimethyl Ether Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Growing Use of Dimethyl Ether in LPG Blending

5.1.2 Flourishment of Aerosol Propellant Manufacturing Industry

5.2 Market Restraints

5.2.1 Availability of Substitute Products

5.3 Market Opportunities

5.3.1 Growing Demand for Clean Transportation Fuel

5.4 Future Trends

5.4.1 Rising Adoption of Renewable Dimethyl Ether

5.5 Impact Analysis

6. Dimethyl Ether Market - Global Market Analysis

6.1 Dimethyl Ether Market Revenue (Tons)

6.2 Dimethyl Ether Market Revenue (US$ Million)

6.3 Dimethyl Ether Market Forecast and Analysis

7. Dimethyl Ether Market Analysis - Application

7.1 Aerosol Propellants

7.1.1 Overview

7.1.2 Aerosol Propellants Market, Revenue, and Forecast to 2030 (US$ Million)

7.1.3 Aerosol Propellants Market, Revenue, and Forecast to 2030 (Tons)

7.2 LPG Blending

7.2.1 Overview

7.2.2 LPG Blending Market Revenue, and Forecast to 2030 (US$ Million)

7.2.3 LPG Blending Market, Revenue, and Forecast to 2030 (Tons)

7.3 Transportation Fuel

7.3.1 Overview

7.3.2 Transportation Fuel Market Revenue and Forecast to 2030 (US$ Million)

7.3.3 Transportation Fuel Market, Revenue, and Forecast to 2030 (Tons)

7.4 Power Generation Fuel

7.4.1 Overview

7.4.2 Power Generation Fuel Market Revenue and Forecast to 2030 (US$ Million)

7.4.3 Power Generation Fuel Market, Revenue, and Forecast to 2030 (Tons)

7.5 Chemical Feedstock

7.5.1 Overview

7.5.2 Chemical Feedstock Market Revenue and Forecast to 2030 (US$ Million)

7.5.3 Chemical Feedstock Market, Revenue, and Forecast to 2030 (Tons)

7.6 Others

7.6.1 Overview

7.6.2 Others Market Revenue and Forecast to 2030 (US$ Million)

7.6.3 Others Market, Revenue, and Forecast to 2030 (Tons)

8. Dimethyl Ether Market - Geographical Analysis

8.1 North America

8.1.1 North America Dimethyl Ether Market Overview

8.1.2 North America Dimethyl Ether Market Volume and Forecasts to 2030 (Tons)

8.1.3 North America Dimethyl Ether Market Revenue and Forecasts to 2030 (US$ Million)

8.1.4 North America Dimethyl Ether Market Breakdown by Application

8.1.4.1 North America Dimethyl Ether Market Volume and Forecasts and Analysis - By Application

8.1.4.2 North America Dimethyl Ether Market Revenue and Forecasts and Analysis - By Application

8.1.5 North America Dimethyl Ether Market Revenue and Forecasts and Analysis - By Countries

8.1.5.1 Dimethyl Ether market Breakdown by Country

8.1.5.2 US Dimethyl Ether Market Volume and Forecasts to 2030 (Tons)

8.1.5.3 US Dimethyl Ether Market Revenue and Forecasts to 2030 (US$ Million)

8.1.5.3.1 US Dimethyl Ether Market Breakdown by Application

8.1.5.3.2 US Dimethyl Ether Market Breakdown by Application

8.1.5.4 Canada Dimethyl Ether Market Volume and Forecasts to 2030 (Tons)

8.1.5.5 Canada Dimethyl Ether Market Revenue and Forecasts to 2030 (US$ Million)

8.1.5.5.1 Canada Dimethyl Ether Market Breakdown by Application

8.1.5.5.2 Canada Dimethyl Ether Market Breakdown by Application

8.1.5.6 Mexico Dimethyl Ether Market Volume and Forecasts to 2030 (Tons)

8.1.5.7 Mexico Dimethyl Ether Market Revenue and Forecasts to 2030 (US$ Million)

8.1.5.7.1 Mexico Dimethyl Ether Market Breakdown by Application

8.1.5.7.2 Mexico Dimethyl Ether Market Breakdown by Application

8.2 Europe

8.2.1 Europe Dimethyl Ether Market Overview

8.2.2 Europe Dimethyl Ether Market Volume and Forecasts to 2030 (Tons)

8.2.3 Europe Dimethyl Ether Market Revenue and Forecasts to 2030 (US$ Million)

8.2.4 Europe Dimethyl Ether Market Breakdown by Application

8.2.4.1 Europe Dimethyl Ether Market Volume and Forecasts and Analysis - By Application

8.2.4.2 Europe Dimethyl Ether Market Revenue and Forecasts and Analysis - By Application

8.2.5 Europe Dimethyl Ether Market Revenue and Forecasts and Analysis - By Countries

8.2.5.1 Dimethyl Ether market Breakdown by Country

8.2.5.2 Germany Dimethyl Ether Market Volume and Forecasts to 2030 (Tons)

8.2.5.3 Germany Dimethyl Ether Market Revenue and Forecasts to 2030 (US$ Million)

8.2.5.3.1 Germany Dimethyl Ether Market Breakdown by Application

8.2.5.3.2 Germany Dimethyl Ether Market Breakdown by Application

8.2.5.4 France Dimethyl Ether Market Volume and Forecasts to 2030 (Tons)

8.2.5.5 France Dimethyl Ether Market Revenue and Forecasts to 2030 (US$ Million)

8.2.5.5.1 France Dimethyl Ether Market Breakdown by Application

8.2.5.5.2 France Dimethyl Ether Market Breakdown by Application

8.2.5.6 Italy Dimethyl Ether Market Volume and Forecasts to 2030 (Tons)

8.2.5.7 Italy Dimethyl Ether Market Revenue and Forecasts to 2030 (US$ Million)

8.2.5.7.1 Italy Dimethyl Ether Market Breakdown by Application

8.2.5.7.2 Italy Dimethyl Ether Market Breakdown by Application

8.2.5.8 UK Dimethyl Ether Market Volume and Forecasts to 2030 (Tons)

8.2.5.9 UK Dimethyl Ether Market Revenue and Forecasts to 2030 (US$ Million)

8.2.5.9.1 UK Dimethyl Ether Market Breakdown by Application

8.2.5.9.2 UK Dimethyl Ether Market Breakdown by Application

8.2.5.10 Russia Dimethyl Ether Market Volume and Forecasts to 2030 (Tons)

8.2.5.11 Russia Dimethyl Ether Market Revenue and Forecasts to 2030 (US$ Million)

8.2.5.11.1 Russia Dimethyl Ether Market Breakdown by Application

8.2.5.11.2 Russia Dimethyl Ether Market Breakdown by Application

8.2.5.12 Rest of Europe Dimethyl Ether Market Volume and Forecasts to 2030 (Tons)

8.2.5.13 Rest of Europe Dimethyl Ether Market Revenue and Forecasts to 2030 (US$ Million)

8.2.5.13.1 Rest of Europe Dimethyl Ether Market Breakdown by Application

8.2.5.13.2 Rest of Europe Dimethyl Ether Market Breakdown by Application

8.3 Asia Pacific

8.3.1 Asia Pacific Dimethyl Ether Market Overview

8.3.2 Asia Pacific Dimethyl Ether Market Volume and Forecasts to 2030 (Tons)

8.3.3 Asia Pacific Dimethyl Ether Market Revenue and Forecasts to 2030 (US$ Million)

8.3.4 Asia Pacific Dimethyl Ether Market Breakdown by Application

8.3.4.1 Asia Pacific Dimethyl Ether Market Volume and Forecasts and Analysis - By Application

8.3.4.2 Asia Pacific Dimethyl Ether Market Revenue and Forecasts and Analysis - By Application

8.3.5 Asia Pacific Dimethyl Ether Market Revenue and Forecasts and Analysis - By Countries

8.3.5.1 Dimethyl Ether market Breakdown by Country

8.3.5.2 Australia Dimethyl Ether Market Volume and Forecasts to 2030 (Tons)

8.3.5.3 Australia Dimethyl Ether Market Revenue and Forecasts to 2030 (US$ Million)

8.3.5.3.1 Australia Dimethyl Ether Market Breakdown by Application

8.3.5.3.2 Australia Dimethyl Ether Market Breakdown by Application

8.3.5.4 China Dimethyl Ether Market Volume and Forecasts to 2030 (Tons)

8.3.5.5 China Dimethyl Ether Market Revenue and Forecasts to 2030 (US$ Million)

8.3.5.5.1 China Dimethyl Ether Market Breakdown by Application

8.3.5.5.2 China Dimethyl Ether Market Breakdown by Application

8.3.5.6 India Dimethyl Ether Market Volume and Forecasts to 2030 (Tons)

8.3.5.7 India Dimethyl Ether Market Revenue and Forecasts to 2030 (US$ Million)

8.3.5.7.1 India Dimethyl Ether Market Breakdown by Application

8.3.5.7.2 India Dimethyl Ether Market Breakdown by Application

8.3.5.8 Japan Dimethyl Ether Market Volume and Forecasts to 2030 (Tons)

8.3.5.9 Japan Dimethyl Ether Market Revenue and Forecasts to 2030 (US$ Million)

8.3.5.9.1 Japan Dimethyl Ether Market Breakdown by Application

8.3.5.9.2 Japan Dimethyl Ether Market Breakdown by Application

8.3.5.10 South Korea Dimethyl Ether Market Volume and Forecasts to 2030 (Tons)

8.3.5.11 South Korea Dimethyl Ether Market Revenue and Forecasts to 2030 (US$ Million)

8.3.5.11.1 South Korea Dimethyl Ether Market Breakdown by Application

8.3.5.11.2 South Korea Dimethyl Ether Market Breakdown by Application

8.3.5.12 Rest of Asia Pacific Dimethyl Ether Market Volume and Forecasts to 2030 (Tons)

8.3.5.13 Rest of Asia Pacific Dimethyl Ether Market Revenue and Forecasts to 2030 (US$ Million)

8.3.5.13.1 Rest of Asia Pacific Dimethyl Ether Market Breakdown by Application

8.3.5.13.2 Rest of Asia Pacific Dimethyl Ether Market Breakdown by Application

8.4 Middle East and Africa

8.4.1 Middle East and Africa Dimethyl Ether Market Overview

8.4.2 Middle East and Africa Dimethyl Ether Market Volume and Forecasts to 2030 (Tons)

8.4.3 Middle East and Africa Dimethyl Ether Market Revenue and Forecasts to 2030 (US$ Million)

8.4.4 Middle East and Africa Dimethyl Ether Market Breakdown by Application

8.4.4.1 Middle East and Africa Dimethyl Ether Market Volume and Forecasts and Analysis - By Application

8.4.4.2 Middle East and Africa Dimethyl Ether Market Revenue and Forecasts and Analysis - By Application

8.4.5 Middle East and Africa Dimethyl Ether Market Revenue and Forecasts and Analysis - By Countries

8.4.5.1 Dimethyl Ether market Breakdown by Country

8.4.5.2 South Africa Dimethyl Ether Market Volume and Forecasts to 2030 (Tons)

8.4.5.3 South Africa Dimethyl Ether Market Revenue and Forecasts to 2030 (US$ Million)

8.4.5.3.1 South Africa Dimethyl Ether Market Breakdown by Application

8.4.5.3.2 South Africa Dimethyl Ether Market Breakdown by Application

8.4.5.4 Saudi Arabia Dimethyl Ether Market Volume and Forecasts to 2030 (Tons)

8.4.5.5 Saudi Arabia Dimethyl Ether Market Revenue and Forecasts to 2030 (US$ Million)

8.4.5.5.1 Saudi Arabia Dimethyl Ether Market Breakdown by Application

8.4.5.5.2 Saudi Arabia Dimethyl Ether Market Breakdown by Application

8.4.5.6 UAE Dimethyl Ether Market Volume and Forecasts to 2030 (Tons)

8.4.5.7 UAE Dimethyl Ether Market Revenue and Forecasts to 2030 (US$ Million)

8.4.5.7.1 UAE Dimethyl Ether Market Breakdown by Application

8.4.5.7.2 UAE Dimethyl Ether Market Breakdown by Application

8.4.5.8 Rest of MEA Dimethyl Ether Market Volume and Forecasts to 2030 (Tons)

8.4.5.9 Rest of MEA Dimethyl Ether Market Revenue and Forecasts to 2030 (US$ Million)

8.4.5.9.1 Rest of MEA Dimethyl Ether Market Breakdown by Application

8.4.5.9.2 Rest of MEA Dimethyl Ether Market Breakdown by Application

8.5 South and Central America

8.5.1 South and Central America Dimethyl Ether Market Overview

8.5.2 South and Central America Dimethyl Ether Market Volume and Forecasts to 2030 (Tons)

8.5.3 South and Central America Dimethyl Ether Market Revenue and Forecasts to 2030 (US$ Million)

8.5.4 South and Central America Dimethyl Ether Market Breakdown by Application

8.5.4.1 South and Central America Dimethyl Ether Market Volume and Forecasts and Analysis - By Application

8.5.4.2 South and Central America Dimethyl Ether Market Revenue and Forecasts and Analysis - By Application

8.5.5 South and Central America Dimethyl Ether Market Revenue and Forecasts and Analysis - By Countries

8.5.5.1 Dimethyl Ether market Breakdown by Country

8.5.5.2 Brazil Dimethyl Ether Market Volume and Forecasts to 2030 (Tons)

8.5.5.3 Brazil Dimethyl Ether Market Revenue and Forecasts to 2030 (US$ Million)

8.5.5.3.1 Brazil Dimethyl Ether Market Breakdown by Application

8.5.5.3.2 Brazil Dimethyl Ether Market Breakdown by Application

8.5.5.4 Argentina Dimethyl Ether Market Volume and Forecasts to 2030 (Tons)

8.5.5.5 Argentina Dimethyl Ether Market Revenue and Forecasts to 2030 (US$ Million)

8.5.5.5.1 Argentina Dimethyl Ether Market Breakdown by Application

8.5.5.5.2 Argentina Dimethyl Ether Market Breakdown by Application

8.5.5.6 Rest of SAM Dimethyl Ether Market Volume and Forecasts to 2030 (Tons)

8.5.5.7 Rest of SAM Dimethyl Ether Market Revenue and Forecasts to 2030 (US$ Million)

8.5.5.7.1 Rest of SAM Dimethyl Ether Market Breakdown by Application

8.5.5.7.2 Rest of SAM Dimethyl Ether Market Breakdown by Application

9. Impact of COVID-19 Pandemic on Global Dimethyl Ether Market

9.1 Pre & Post Covid-19 Impact

10. Competitive Landscape

10.1 Heat Map Analysis By Key Players

10.2 Company Positioning & Concentration

11. Industry Landscape

11.1 Overview

11.2 Market Initiative

11.3 Merger and Acquisition

12. Industry Landscape

12.1 Overview

12.2 Market Initiative

12.3 Merger and Acquisition

13. Company Profiles

13.1 Nouryon Chemicals Holding BV

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 Shell Plc

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 Mitsubishi Gas Chemical Co Inc

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 The Chemours Co

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 Key Developments

13.5 Aerosolex

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 Oberon Fuels Inc

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 Merck KGaA

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

13.8 Jiangsu July Chemical Co Ltd

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and Services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.8.6 Key Developments

13.9 Sichuan Lutianhua Co Ltd

13.9.1 Key Facts

13.9.2 Business Description

13.9.3 Products and Services

13.9.4 Financial Overview

13.9.5 SWOT Analysis

13.9.6 Key Developments

13.10 Grillo-Werke AG

13.10.1 Key Facts

13.10.2 Business Description

13.10.3 Products and Services

13.10.4 Financial Overview

13.10.5 SWOT Analysis

13.10.6 Key Developments

14. Appendix

List of Tables

Table 1. Dimethyl Ether Market Segmentation

Table 2. List of Raw Material Suppliers in Value Chain:

Table 3. List of Manufacturers in Value Chain:

Table 4. Dimethyl Ether Market Volume and Forecasts To 2030 (Tons)

Table 5. Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million)

Table 6. Dimethyl Ether Market Revenue and Forecasts To 2030 (Tons) – Application

Table 7. Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million) – Application

Table 8. North America Dimethyl Ether Market Volume and Forecasts To 2030 (Tons) – By Application

Table 9. North America Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 10. US Dimethyl Ether Market Volume and Forecasts To 2030 (Tons) – By Application

Table 11. US Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 12. Canada Dimethyl Ether Market Volume and Forecasts To 2030 (Tons) – By Application

Table 13. Canada Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 14. Mexico Dimethyl Ether Market Volume and Forecasts To 2030 (Tons) – By Application

Table 15. Mexico Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 16. Europe Dimethyl Ether Market Volume and Forecasts To 2030 (Tons) – By Application

Table 17. Europe Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 18. Germany Dimethyl Ether Market Volume and Forecasts To 2030 (Tons) – By Application

Table 19. Germany Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 20. France Dimethyl Ether Market Volume and Forecasts To 2030 (Tons) – By Application

Table 21. France Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 22. Italy Dimethyl Ether Market Volume and Forecasts To 2030 (Tons) – By Application

Table 23. Italy Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 24. UK Dimethyl Ether Market Volume and Forecasts To 2030 (Tons) – By Application

Table 25. UK Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 26. Russia Dimethyl Ether Market Revenue and Forecasts To 2030 (Tons) – By Application

Table 27. Russia Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 28. Rest of Europe Dimethyl Ether Market Volume and Forecasts To 2030 (Tons) – By Application

Table 29. Rest of Europe Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 30. Asia Pacific Dimethyl Ether Market Volume and Forecasts To 2030 (Tons) – By Application

Table 31. Asia Pacific Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 32. Australia Dimethyl Ether Market Volume and Forecasts To 2030 (Tons) – By Application

Table 33. Australia Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 34. China Dimethyl Ether Market Volume and Forecasts To 2030 (Tons) – By Application

Table 35. China Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 36. India Dimethyl Ether Market Volume and Forecasts To 2030 (Tons) – By Application

Table 37. India Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 38. Japan Dimethyl Ether Market Volume and Forecasts To 2030 (Tons) – By Application

Table 39. Japan Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 40. South Korea Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 41. South Korea Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 42. Rest of Asia Pacific Dimethyl Ether Market Volume and Forecasts To 2030 (Tons) – By Application

Table 43. Rest of Asia Pacific Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 44. Middle East and Africa Dimethyl Ether Market Volume and Forecasts To 2030 (Tons) – By Application

Table 45. Middle East and Africa Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 46. South Africa Dimethyl Ether Market Volume and Forecasts To 2030 (Tons) – By Application

Table 47. South Africa Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 48. Saudi Arabia Dimethyl Ether Market Volume and Forecasts To 2030 (Tons) – By Application

Table 49. Saudi Arabia Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 50. UAE Dimethyl Ether Market Volume and Forecasts To 2030 (Tons) – By Application

Table 51. UAE Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 52. Rest of MEA Dimethyl Ether Market Volume and Forecasts To 2030 (Tons) – By Application

Table 53. Rest of MEA Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 54. South and Central America Dimethyl Ether Market Volume and Forecasts To 2030 (Tons) – By Application

Table 55. South and Central America Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 56. Brazil Dimethyl Ether Market Volume and Forecasts To 2030 (Tons) – By Application

Table 57. Brazil Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 58. Argentina Dimethyl Ether Market Volume and Forecasts To 2030 (Tons) – By Application

Table 59. Argentina Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 60. Rest of SAM Dimethyl Ether Market Volume and Forecasts To 2030 (Tons) – By Application

Table 61. Rest of SAM Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 62. Company Positioning & Concentration

List of Figures

Figure 1. Dimethyl Ether Market Segmentation, By Geography

Figure 2. Porter's Five Forces Analysis

Figure 3. Ecosystem: Dimethyl Ether Market

Figure 4. Global Dimethyl Ether Market Impact Analysis of Drivers and Restraints

Figure 5. Dimethyl Ether Market Revenue (Tons), 2020 – 2030

Figure 6. Dimethyl Ether Market Revenue (US$ Million), 2020 – 2030

Figure 7. Dimethyl Ether Market Share (%) – Application, 2022 and 2030

Figure 8. Aerosol Propellants Market Revenue and Forecasts To 2030 (US$ Million)

Figure 9. Aerosol Propellants Market Revenue (Tons), 2020 – 2030

Figure 10. LPG Blending Market Revenue and Forecasts To 2030 (US$ Million)

Figure 11. LPG Blending Market Revenue (Tons), 2020 – 2030

Figure 12. Transportation Fuel Market Revenue and Forecasts To 2030 (US$ Million)

Figure 13. Transportation Fuel Market Revenue (Tons), 2020 – 2030

Figure 14. Power Generation Fuel Market Revenue and Forecasts To 2030 (US$ Million)

Figure 15. Power Generation Fuel Market Revenue (Tons), 2020 – 2030

Figure 16. Chemical Feedstock Market Revenue and Forecasts To 2030 (US$ Million)

Figure 17. Chemical Feedstock Market Revenue (Tons), 2020 – 2030

Figure 18. Others Market Revenue and Forecasts To 2030 (US$ Million)

Figure 19. Others Market Revenue (Tons), 2020 – 2030

Figure 20. Dimethyl Ether Market Breakdown by Geography, 2022 and 2030 (%)

Figure 21. Dimethyl Ether Market Volume and Forecasts To 2030 (Tons)

Figure 22. Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million)

Figure 23. Dimethyl Ether Market Breakdown by Application (2022 and 2030)

Figure 24. Dimethyl Ether market Breakdown by Key Countries, 2022 and 2030 (%)

Figure 25. US Dimethyl Ether Market Volume and Forecasts To 2030 (Tons)

Figure 26. US Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million)

Figure 27. Canada Dimethyl Ether Market Volume and Forecasts To 2030 (Tons)

Figure 28. Canada Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million)

Figure 29. Mexico Dimethyl Ether Market Revenue and Forecasts To 2030 (Tons)

Figure 30. Mexico Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million)

Figure 31. Dimethyl Ether Market Volume and Forecasts To 2030 (Tons)

Figure 32. Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million)

Figure 33. Dimethyl Ether Market Breakdown by Application (2022 and 2030)

Figure 34. Dimethyl Ether market Breakdown by Key Countries, 2022 and 2030 (%)

Figure 35. Germany Dimethyl Ether Market Volume and Forecasts To 2030 (Tons)

Figure 36. Germany Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million)

Figure 37. France Dimethyl Ether Market Volume and Forecasts To 2030 (Tons)

Figure 38. France Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million)

Figure 39. Italy Dimethyl Ether Market Volume and Forecasts To 2030 (Tons)

Figure 40. Italy Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million)

Figure 41. UK Dimethyl Ether Market Volume and Forecasts To 2030 (Tons)

Figure 42. UK Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million)

Figure 43. Russia Dimethyl Ether Market Volume and Forecasts To 2030 (Tons)

Figure 44. Russia Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million)

Figure 45. Rest of Europe Dimethyl Ether Market Volume and Forecasts To 2030 (Tons)

Figure 46. Rest of Europe Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million)

Figure 47. Dimethyl Ether Market Volume and Forecasts To 2030 (Tons)

Figure 48. Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million)

Figure 49. Dimethyl Ether Market Breakdown by Application (2022 and 2030)

Figure 50. Dimethyl Ether market Breakdown by Key Countries, 2022 and 2030 (%)

Figure 51. Australia Dimethyl Ether Market Volume and Forecasts To 2030 (Tons)

Figure 52. Australia Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million)

Figure 53. China Dimethyl Ether Market Volume and Forecasts To 2030 (Tons)

Figure 54. China Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million)

Figure 55. India Dimethyl Ether Market Volume and Forecasts To 2030 (Tons)

Figure 56. India Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million)

Figure 57. Japan Dimethyl Ether Market Volume and Forecasts To 2030 (Tons)

Figure 58. Japan Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million)

Figure 59. South Korea Dimethyl Ether Market Volume and Forecasts To 2030 (Tons)

Figure 60. South Korea Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million)

Figure 61. Rest of Asia Pacific Dimethyl Ether Market Volume and Forecasts To 2030 (Tons)

Figure 62. Rest of Asia Pacific Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million)

Figure 63. Dimethyl Ether Market Volume and Forecasts To 2030 (Tons)

Figure 64. Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million)

Figure 65. Dimethyl Ether Market Breakdown by Application (2022 and 2030)

Figure 66. Dimethyl Ether market Breakdown by Key Countries, 2022 and 2030 (%)

Figure 67. South Africa Dimethyl Ether Market Volume and Forecasts To 2030 (Tons)

Figure 68. South Africa Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million)

Figure 69. Saudi Arabia Dimethyl Ether Market Volume and Forecasts To 2030 (Tons)

Figure 70. Saudi Arabia Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million)

Figure 71. UAE Dimethyl Ether Market Volume and Forecasts To 2030 (Tons)

Figure 72. UAE Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million)

Figure 73. Rest of MEA Dimethyl Ether Market Volume and Forecasts To 2030 (Tons)

Figure 74. Rest of MEA Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million)

Figure 75. Dimethyl Ether Market Volume and Forecasts To 2030 (Tons)

Figure 76. Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million)

Figure 77. Dimethyl Ether Market Breakdown by Application (2022 and 2030)

Figure 78. Dimethyl Ether market Breakdown by Key Countries, 2022 and 2030 (%)

Figure 79. Brazil Dimethyl Ether Market Volume and Forecasts To 2030 (Tons)

Figure 80. Brazil Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million)

Figure 81. Argentina Dimethyl Ether Market Volume and Forecasts To 2030 (Tons)

Figure 82. Argentina Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million)

Figure 83. Rest of SAM Dimethyl Ether Market Volume and Forecasts To 2030 (Tons)

Figure 84. Rest of SAM Dimethyl Ether Market Revenue and Forecasts To 2030 (US$ Million)

Figure 85. Heat Map Analysis By Key Players

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely - analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You'll receive access to the report within 4-6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we'll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we're happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you're considering, and we'll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report's scope, methodology, customization options, or which license suits you best, we're here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we'll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we'll ensure the issue is resolved quickly so you can access your report without interruption.

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Apr 2026

Mineral Oil Lubricants Market

Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Hydraulic Fluid, Engine Oil, Driveline Lubricants, Metalworking Fluids, Grease, Process Oils, Coolants, and Others) and Application (Automotive [Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, and Others], Building and Construction, Power Generation, Mining and Metallurgy, Food Processing, Oil and Gas, Marine, Aviation, and Others)

Apr 2026

Non-Grain Oriented Electrical Steel (NGOES) Market

Size and Forecast (2021 - 2033), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Grade (Premium Grade, High Grade, and General or Standard Grade) and Application (Automotive [Traction Motors, EPS Motors, Alternators, and Others], Home Appliances [Induction Motors, Compressors, and Others], General Industrial, and Others)

Apr 2026

Rhamnolipids Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Mono-rhamnolipids and Di-rhamnolipids), Application [Daily Chemicals (Laundry Detergents, Dishwashers, Surface Cleaners, and Others), Personal Care and Cosmetics, Agriculture, Food, Pharmaceuticals, Oilfield and Petroleum, Environmental Protection, and Others] and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Apr 2026

Europe Spray Marking Paints Market

Size and Forecast (2021 - 2035), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Propellant Type [LPG, Dimethyl Ether (DME), and Others], By Technology (Solvent-Based, Water-Based, and Others), By Application [Construction (Geodesy and Topography in Building and Construction, Railway Marking, Landscaped/Agricultural/Military Site Marking, and Others), Forestry [Tree Marking, Log Marking, Plank Marking, and Others], Line Marking (Information Marking and Signaling, Parking Spaces, Safety Marking and Signage, and Space Delimitation), Packaging, and Others], and Country

Apr 2026

Adhesives Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Resin Type (Epoxy, Polyurethane, Acrylic, and Others), By End-Use Industry (Automotive, Aerospace, Paper and Packaging, Building and Construction, Electrical and Electronics, Medical, and Others), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Apr 2026

Ester for Synthetic and Bio-Based Lubricants Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Ester Type [Monoesters, Diesters, Polyol Esters (Trimethylolpropane Esters, Pentaerythritol Esters, Neopentyl Glycol Esters, Trimethylol Ethane Esters, and Dipentaerythritol Esters), Trimellitate Esters, Complex Esters, and Others], Lubricant Type (Synthetic Lubricants and Biobased Lubricants), Application [Engine Oil (MCO, PCMO, HDEO, and Other Engines), Compressor Oil, (Refrigeration, Air Compressors, Natural Gas Compressors, and Others Compressors), Hydraulic Fluids, Gear Oil, Transmission Oil, Coolants, and Others], and End Use [Automotive (Conventional Vehicles and Electric Vehicles), Textile, Marine, Mining and Metallurgy, Aviation, Energy and Power, and Others]

Apr 2026

Synthetic Ester Lubricants for the Telecommunications Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Gear Oil, Transformer Oil, Immersion Cooling Fluids, Refrigeration Oil, and Grease), End Use (Data Centers, Telecommunication Infrastructure, and Others), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America

Apr 2026

Synthetic Ester Lubricants for Electrical and Electronics Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Gear Oil, Transformer Oil, Immersion Cooling Fluids, Refrigeration Oil, Grease, Metalworking Fluids, and Others) and End Use (General Air Conditioners, Automotive Air Conditioners, Refrigerators, and Others)

Get Free Sample For

Get Free Sample For