The Europe polypropylene compounds market was valued at valued at US$ 2,928.947 million in 2020 and is projected to reach US$ 4,179.15 million by 2028; it is expected to grow at a CAGR of 4.7% from 2021 to 2028.

Polypropylene, a thermoplastic polymer, is used in a variety of applications. It is basically produced through chain-growth polymerization derived from the monomer propylene. Polypropylene compounds are basically thermoplastic resins that are produced by a mixture of one or more polyolefins base along with various components such as strengtheners, fillers, impact modifiers, additives, and pigment. These compounds offer many features and are used in a variety of applications.

In 2020, Germany hold largest share in the Europe polypropylene compounds market. The growth of Europe polypropylene compounds market in Germany is primarily attributable to the presence of prominent market players. Germany is an attractive market for polypropylene compounds owing to the significant presence of food packaging industries; consumer goods industries; and automotive, electrical, and other industries. Germany is a leader in terms of polymer production and consumption. Polypropylene is considered an essential part of all end-use industries these days. Polypropylene is highly being employed in the manufacturing of interior parts as well as instrument panel dashboards for automotive vehicles. The material has replaced engineering plastics as well as metals, mainly in automotive parts, as it ensures significant weight reduction along with cost savings. Further, new product launch, business expansion, merger, and other strategies by different companies are supporting the in the polypropylene compounds market growth in Germany. In September 2019, LyondellBasell opened its fifth production line at a polypropylene compounding plant in Knapsack, Germany, and the facility is capable of producing 25 kt/yr. The capacity of this facility is covering 200 kt/yr, making the site is one of the largest polypropylene compounding facilities in the world. 12 new jobs were created with the opening of the new line. Lightweight polypropylene materials created by LyondellBasell are utilized in applications such as automobiles and electrical appliances.

The ongoing COVID-19 pandemic has drastically altered the status of the plastic industry and has negatively impacted the growth of the polypropylene compounds market. The outbreak has interrupted the operational efficiency and created agitation in value chains owing to the sudden shutdown of national as well as international boundaries. The disrupted value chains have been hampering raw material supply, which, in turn, is impacting the growth of the polypropylene compounds market in Europe. However, economies in Europe are planning to revive their operations, which is likely to boost the demand for polypropylene compounds in the coming quarters. The food packaging industry is a dynamically growing contributor to this demand since consumers are inclined toward ordering food products online. Moreover, the previously postponed construction projects are presumed to resume, which would further provide an opportunity for the polypropylene compounds market players to regain normalcy. Since most of the people are confined to their homes amid the pandemic, re-designing and home improvement projects are expected to increase. Moreover, the automotive segment is likely to bring growth opportunities for the market as polypropylene compounds are highly used in interior and exterior parts of cars. The corporate sectors have resumed their operations with the imposition of several safety measures such as ensuring limited direct contact with visitors, strengthening and communicating proper hygiene practices, conducting complete sanitations, and eliminating personnel contact during shift changes. Further, the pace of the COVID-19 vaccination campaigns in Europe has picked up, and the infection rates are falling in some countries. Lockdowns are slowly being eased to host tourists amid the upcoming summer vacation season. In June 2021, 27 member states in the region further aim to offer a digital vaccination certificate to those who has taken vaccine for uninterrupted travelling by July.

Europe Polypropylene Compounds Market

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Market Insights

Increasing Demand from Industries such as Building and Construction, Textiles, Electrical and Electronics, and Automobile

Polypropylene (PP) is a thermoplastic polymer produced via chain-growth polymerization of monomer propylene. The polypropylene compounds market in Europe is mainly driven by the increasing demand for these products from the building and construction, textiles, electrical and electronics, and automobile industries, among others. In the automotive industry, polypropylene is popularly being used as an alternative to engineering plastics as well as for metals used in automotive products. Using polypropylene as a cost-effective alternative to expensive plastics of similar strength and durability further helps lower the cost of manufacturing. In the automotive industry, the material is mainly being used in battery cases and trays, bumpers, interior trim, fender liners, instrumental panels, and door trims owing to its features such as low coefficient of linear thermal expansion and specific gravity, high chemical resistance, good weatherability and processability, and impact/stiffness balance. The low density of polypropylene compounds helps enhance the fuel economy of vehicles and also reduces the overall raw material costs. Furthermore, high flexibility conferred by polypropylene allows automotive products designers to come up with innovative designs with enhanced passenger safety and comfort. Sumitomo Chemical Co., Ltd.; LyondellBasell Industries Holdings B.V.; and Trinseo are among the European companies offering polypropylene for automotive applications. Polypropylene compounds offered by LyondellBasell are used mainly in exterior automotive applications such as bumpers, mirrors, roof trim or integrated, front grille, cladding, wheel covers, and painted rocker panels owing to their high stiffness, low thermal expansion, and good scratch resistance, coupled with greater resistance at low temperatures. With high melt-flow indices and low-density grades, LyondellBasell resins can facilitate the molding of large thin-walled components, further leading to the part weight reduction.

Polypropylene compounds are being used in piping systems for manufacturing plants, products for laboratory use, and production of clear bags and food containers. High strength, rigidity, and purity makes these compounds an ideal option in the manufacturing of piping systems. These systems are often used in hydronic heating, portable plumbing, and reclaimed water. Applications of polypropylene in the building and construction industry include siding, air and moisture barrier membranes, carpet textiles, building insulation wrap films and sheets, industrial adhesives and tapes, and plastic parts. Polypropylene is employed in roofing sheets and insulation, and it is also being molded to form roofing products such as interlocking dry verge, slate roof vents, and tile roof vents. Polypropylene roofing products are gaining popularity due to their characteristics such as thermal stability, UV stability, durability, material strength, color fade resistance, flexibility, resilience, and minimal environmental impact. Further, polypropylene fabrics, i.e., usually nonwoven textile, meant for applications in the textile industry are produced directly from a material without spinning or weaving. The main advantage of polypropylene as a fabric is its moisture transfer abilities as it does not absorb moisture; this further results in quicker evaporation of moisture as compared to a moisture-retaining garment. Hence, this fabric is commonly used in body hugging clothing products. Rilon LTD, located in Europe, is offering production and sale of PP synthetic fibers, BCF filament, CF yarn, and staple fibers with a wide range of deceit and colors.

Type Insights

Based on type, the Europe polypropylene compounds market is segmented into mineral filled PP compounds, compounded TPO, compounded TPV, glass reinforced, and others. The mineral filled PP compounds segment led the Europe polypropylene compounds market with the highest market share in 2020. Mineral filled (MF) compounds consist of calcium carbonate, talc, and mica, among others, which deliver a low-cost filler option in case of price sensitivity. The mineral filled compounds deliver improvements over unfilled resins, terms of dimensional stability, stiffness, and others. Mineral-filled polypropylene provides high mechanical stiffness, thermal stability, good low-temperature properties, and good dimensional stability over a wide temperature range. These compounds are available in naturally colored, colorable, UV stabilized forms. Mineral filled compounds may also be used in high volume, low-cost applications, including appliances, automotive, and packaging. Conversely, they can be used as low-cost alternatives to expensive polymers.

Europe Polypropylene Compounds Market, by Type – 2020 and 2028

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

End-User Insights

Based on end user, the Europe polypropylene compounds market is segmented into automotive,

electricals and electronics, packaging, building and construction, and textiles. The automotive segment led the Europe polypropylene compounds market with the highest market share in 2020. Polypropylene compound is highly utilized in automotive manufacturing industries. Being a thermoplastic polymer, polypropylene compounds can easily be formed into nearly any shape. Furthermore, it is being used as an economical alternative to any expensive plastics of similar strength and durability, which further helps lower the cost of manufacturing. Polypropylene compounds are being used in exterior automotive parts such as bumpers, mirrors, wheel covers, front grilles, cladding, roof trim, and integrated and painted rocker panels owing to their low thermal expansion, high stiffness, and good scratch resistance, combined with high impact resistance.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Europe Polypropylene Compounds Market: Strategic Insights

Market Size Value in US$ 2,928.947 Million in 2020 Market Size Value by US$ 4,179.15 Million by 2028 Growth rate CAGR of 4.7% from 2021-2028 Forecast Period 2021-2028 Base Year 2021

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Europe Polypropylene Compounds Market: Strategic Insights

| Market Size Value in | US$ 2,928.947 Million in 2020 |

| Market Size Value by | US$ 4,179.15 Million by 2028 |

| Growth rate | CAGR of 4.7% from 2021-2028 |

| Forecast Period | 2021-2028 |

| Base Year | 2021 |

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

LyondellBasell Industries Holdings B.V.; Total; Borealis AG; Sumitomo Chemical Co., Ltd.; and Exxon Mobil Corporation are among the key players in the market. Major players in the Europe polypropylene compounds market are focused on strategies such as mergers and acquisitions and product launch to increase the geographical presence and consumer base in Europe.

Report Spotlights

- Progressive industry trends in the Europe polypropylene compounds market to help players develop effective long-term strategies

- Business growth strategies adopted by developed and developing markets

- Quantitative analysis of the Europe polypropylene compounds market from 2017 to 2028

- Estimation of the demand for Europe polypropylene compounds across various industries

- PEST analysis to illustrate the efficacy of buyers and suppliers operating in the industry to predict market growth

- Recent developments to understand the competitive market scenario and the demand for Europe polypropylene compounds

- Market trends and outlook coupled with factors driving and restraining the growth of the Europe polypropylene compounds market

- Decision-making process by understanding strategies that underpin commercial interest with regard to Europe polypropylene compounds market growth

- Europe polypropylene compounds market size at various nodes of market

- Detailed overview and segmentation of the Europe polypropylene compounds market as well as its dynamics in the industry

- Europe polypropylene compounds market size in various regions with promising growth opportunities

Europe Polypropylene Compounds Market, by Type

- Mineral Filled PP Compounds

- Compounded TPO

- Compounded TPV

- Glass Reinforced

- Others

Europe Polypropylene Compounds Market, by End-User

- Automotive

- Electricals and Electronics

- Packaging

- Building and Construction

- Textiles

Europe Polypropylene Compounds Market, By Country

- Germany

- France

- Italy

- Spain

- United Kingdom

- Austria

- Switzerland

- Sweden

- Norway

- Denmark

- Finland

- Rest of Europe

Company Profiles

- LyondellBasell Industries Holdings B.V.

- Total

- Sumitomo Chemical Co., Ltd.

- Exxon Mobil Corporation

- SABIC

- Borealis AG

- Trinseo

- Rialti S.p.A.

- Axia Plastics

- FKuR Polymers GmbH

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type and End User

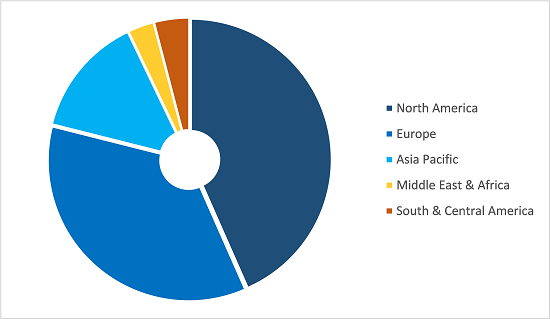

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

UK, Germany, France, Italy, Russia

1. Introduction. 17

1.1 Study Scope. 17

1.2 The Insight Partners Research Report Guidance. 17

1.3 Market Segmentation. 19

2. Key Takeaways. 22

3. Research Methodology. 26

3.1 Scope of the Study. 26

3.2 Research Methodology. 26

3.2.1 Data Collection. 27

3.2.2 Primary Interviews. 28

3.2.3 Hypothesis Formulation. 28

3.2.4 Macro-economic Factor Analysis. 29

3.2.5 Developing Base Number 29

3.2.6 Data Triangulation. 29

3.2.7 Country Level Data. 30

4. Europe Polypropylene Compounds Market Landscape. 31

4.1 Market Overview.. 31

4.2 PEST Analysis. 32

4.2.1 Europe. 32

4.2.2 Expert Opinion. 33

5. Europe Polypropylene Compounds Market – Key Market Dynamics. 34

5.1 Market Drivers. 34

5.1.1 Increasing Demand from Industries such as Building and Construction, Textiles, Electrical and Electronics, and Automobile. 34

5.1.2 Wide Use of Mineral-Filled Polypropylene Compounds. 35

5.2 Market Restraints. 36

5.2.1 Volatility in Raw Material Prices and Negative Effect of COVID-19 Pandemic. 36

5.3 Market Opportunities. 37

5.3.1 Growing Scope of Applications in Packaging Industry. 37

5.4 Future Trends. 38

5.4.1 Development of Eco-Friendly Polypropylene Compounds. 38

5.5 Impact Analysis of Drivers and Restraints. 39

6. Europe Polypropylene Compounds– Country Market Analysis. 40

6.1 Europe Polypropylene Compounds Market –Revenue and Forecast To 2028 (US$ Million) 40

6.2 Competitive Positioning – Key Market Players. 41

7. Europe Polypropylene Compounds Market Analysis – By Type. 43

7.1 Overview.. 43

7.2 Polypropylene Compounds Market, by Type (2020 and 2028) 43

7.3 Mineral Filled Polypropylene Compounds. 44

7.3.1 Overview.. 44

7.3.2 Mineral Filled Polypropylene Compound: Polypropylene Compounds Market – Revenue and Forecast to 2028 (US$ Million) 44

7.4 Compounded TPOs. 45

7.4.1 Overview.. 45

7.4.2 Compounded TPO: Polypropylene Compounds Market – Revenue and Forecast to 2028 (US$ Million) 45

7.5 Compounded TPV. 46

7.5.1 Overview.. 46

7.5.2 Compounded TPV: Polypropylene Compounds Market – Revenue and Forecast to 2028 (US$ Million) 46

7.6 Glass Reinforced. 47

7.6.1 Overview.. 47

7.6.2 Glass Reinforced: Polypropylene Compounds Market – Revenue and Forecast to 2028 (US$ Million) 47

7.7 Others. 48

7.7.1 Overview.. 48

7.7.2 Others: Polypropylene Compounds Market – Revenue and Forecast to 2028 (US$ Million) 49

8. Polypropylene Compounds Market Analysis – By End-Use. 50

8.1 Overview.. 50

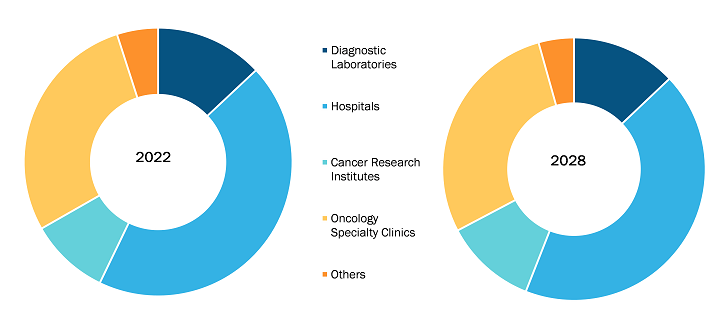

8.2 Polypropylene Compounds Market, by End-Use (2020 and 2028) 50

8.3 Automotive. 51

8.3.1 Overview.. 51

8.3.2 Automotive: Polypropylene Compounds Market – Revenue and Forecast to 2028 (US$ Million) 51

8.4 Electricals and Electronics. 52

8.4.1 Overview.. 52

8.4.2 Electricals and Electronics: Polypropylene Compounds Market – Revenue and Forecast to 2028 (US$ Million) 52

8.5 Packaging. 53

8.5.1 Overview.. 53

8.5.2 Packaging: Polypropylene Compounds Market – Revenue and Forecast to 2028 (US$ Million) 53

8.6 Building and Construction. 54

8.6.1 Overview.. 54

8.6.2 Building and Construction: Polypropylene Compounds Market – Revenue and Forecast to 2028 (US$ Million) 55

8.7 Textile. 55

8.7.1 Overview.. 55

8.7.2 Textile: Polypropylene Compounds Market – Revenue and Forecast to 2028 (US$ Million) 56

8.8 Others. 56

8.8.1 Overview.. 56

8.8.2 Others: Polypropylene Compounds Market – Revenue and Forecast to 2028 (US$ Million) 57

9. Europe Polypropylene Compounds Market – Country Analysis. 58

9.1 Europe: Polypropylene Compounds Market 58

9.1.1 Europe: Polypropylene Compounds Market –Revenue and Forecast to 2028(US$ Million) 59

9.1.2 Europe: Polypropylene Compounds Market, Type. 60

9.1.3 Europe: Polypropylene Compounds Market, End-Use. 61

9.1.4 Europe: Polypropylene Compounds Market, by Key Country. 62

9.1.4.1 Germany: Polypropylene Compounds Market –Revenue and Forecast to 2028 (US$ Million) 63

9.1.4.1.1 Germany: Polypropylene Compounds Market, Type. 64

9.1.4.1.2 Germany: Polypropylene Compounds Market, End-User 65

9.1.4.2 France: Polypropylene Compounds Market –Revenue and Forecast to 2028 (US$ Million) 66

9.1.4.2.1 France: Polypropylene Compounds Market, Type. 68

9.1.4.2.2 France: Polypropylene Compounds Market, End-User 69

9.1.4.3 Italy: Polypropylene Compounds Market –Revenue and Forecast to 2028 (US$ Million) 70

9.1.4.3.1 Italy: Polypropylene Compounds Market, Type. 71

9.1.4.3.2 Italy: Polypropylene Compounds Market, End-User 72

9.1.4.4 UK: Polypropylene Compounds Market –Revenue and Forecast to 2028 (US$ Million) 73

9.1.4.4.1 UK: Polypropylene Compounds Market, Type. 74

9.1.4.4.2 UK: Polypropylene Compounds Market, End-Use. 75

9.1.4.5 Spain: Polypropylene Compounds Market –Revenue and Forecast to 2028 (US$ Million) 76

9.1.4.5.1 Spain: Polypropylene Compounds Market, Type. 77

9.1.4.5.2 Spain: Polypropylene Compounds Market, End-Use. 78

9.1.4.6 Austria: Polypropylene Compounds Market –Revenue and Forecast to 2028 (US$ Million) 79

9.1.4.6.1 Austria: Polypropylene Compounds Market, Type. 80

9.1.4.6.2 Austria: Polypropylene Compounds Market, End-Use. 81

9.1.4.7 Switzerland: Polypropylene Compounds Market –Revenue and Forecast to 2028 (US$ Million) 82

9.1.4.7.1 Switzerland: Polypropylene Compounds Market, Type. 83

9.1.4.7.2 Switzerland: Polypropylene Compounds Market, End-Use. 84

9.1.4.8 Sweden: Polypropylene Compounds Market –Revenue and Forecast to 2028 (US$ Million) 85

9.1.4.8.1 Sweden: Polypropylene Compounds Market, Type. 86

9.1.4.8.2 Sweden: Polypropylene Compounds Market, End-Use. 87

9.1.4.9 Norway: Polypropylene Compounds Market –Revenue and Forecast to 2028 (US$ Million) 88

9.1.4.9.1 Norway: Polypropylene Compounds Market, Type. 89

9.1.4.9.2 Norway: Polypropylene Compounds Market, End-Use. 90

9.1.4.10 Denmark: Polypropylene Compounds Market –Revenue and Forecast to 2028 (US$ Million) 91

9.1.4.10.1 Denmark: Polypropylene Compounds Market, Type. 92

9.1.4.10.2 Denmark: Polypropylene Compounds Market, End-Use. 93

9.1.4.11 Finland: Polypropylene Compounds Market –Revenue and Forecast to 2028 (US$ Million) 94

9.1.4.11.1 Finland: Polypropylene Compounds Market, Type. 95

9.1.4.11.2 Finland: Polypropylene Compounds Market, End-Use. 96

9.1.4.12 Rest of Europe: Polypropylene compounds Market –Revenue and Forecast to 2028 (US$ Million) 97

9.1.4.12.1 Rest of Europe: Polypropylene Compounds Market, Type. 98

9.1.4.12.2 Rest of Europe: Polypropylene Compounds Market, End-Use. 99

10. Overview- Impact of Coronavirus Outbreak. 100

10.1 Overview.. 100

10.2 Impact of COVID-19 on Polypropylene Compounds Market 100

10.3 Europe: Impact Assessment of COVID-19 Pandemic. 101

11. Industry Landscape. 103

11.1 Product Launch. 103

11.2 Product News. 104

11.3 Market Initiatives. 104

12. Company Profiles. 105

12.1 LyondellBasell Industries Holdings B.V. 105

12.1.1 Key Facts. 105

12.1.2 Business Description. 105

12.1.3 Products and Services. 106

12.1.4 Financial Overview.. 106

12.1.5 SWOT Analysis. 107

12.1.6 Key Developments. 108

12.2 EXXON MOBIL CORPORATION.. 109

12.2.1 Key Facts. 109

12.2.2 Business Description. 109

12.2.3 Products and Services. 110

12.2.4 Financial Overview.. 111

12.2.5 SWOT Analysis. 112

12.2.6 Key Developments. 113

12.3 SABIC. 114

12.3.1 Key Facts. 114

12.3.2 Business Description. 114

12.3.3 Products and Services. 115

12.3.4 Financial Overview.. 115

12.3.5 SWOT Analysis. 117

12.3.6 Key Developments. 118

12.4 Sumitomo Chemical Co., Ltd. 119

12.4.1 Key Facts. 119

12.4.2 Business Description. 119

12.4.3 Products and Services. 120

12.4.4 Financial Overview.. 120

12.4.5 SWOT Analysis. 122

12.4.6 Key Developments. 123

12.5 Borealis AG.. 124

12.5.1 Key Facts. 124

12.5.2 Business Description. 124

12.5.3 Products and Services. 125

12.5.4 Financial Overview.. 125

12.5.5 SWOT Analysis. 127

12.5.6 Key Developments. 128

12.6 Total 129

12.6.1 Key Facts. 129

12.6.2 Business Description. 129

12.6.3 Products and Services. 130

12.6.4 Financial Overview.. 130

12.6.5 SWOT Analysis. 132

12.6.6 Key Developments. 132

12.7 Trinseo. 133

12.7.1 Key Facts. 133

12.7.2 Business Description. 133

12.7.3 Products and Services. 134

12.7.4 Financial Overview.. 134

12.7.5 SWOT Analysis. 136

12.7.6 Key Developments. 136

12.8 Rialti S.p.A. 137

12.8.1 Key Facts. 137

12.8.2 Business Description. 137

12.8.3 Products and Services. 137

12.8.4 Financial Overview.. 138

12.8.5 SWOT Analysis. 138

12.8.6 Key Developments. 138

13. Appendix. 139

13.1 About The Insight Partners. 139

13.2 Word Index. 139

LIST OF TABLES

Table 1. Europe Polypropylene Compounds Market –Revenue and Forecast To 2028 (US$ Million) 41

Table 2. Europe Polypropylene Compounds Market, Type – Revenue and Forecast to 2028 (USD Million) 60

Table 3. Europe Polypropylene compounds Market, End-Use – Revenue and Forecast to 2028 (USD Million) 61

Table 4. Germany Polypropylene Compounds Market, Type- Revenue and Forecast to 2028 (USD Million) 64

Table 5. Germany Polypropylene Compounds Market, End-User– Revenue and Forecast to 2028 (USD Million) 65

Table 6. France Polypropylene Compounds Market, Type– Revenue and Forecast to 2028 (USD Million) 68

Table 7. France Polypropylene Compounds Market, End-User– Revenue and Forecast to 2028 (USD Million) 69

Table 8. Italy Polypropylene Compounds Market, Type– Revenue and Forecast to 2028 (USD Million) 71

Table 9. Italy Polypropylene Compounds Market, End-User– Revenue and Forecast to 2028 (USD Million) 72

Table 10. UK Polypropylene Compounds Market, Type– Revenue and Forecast to 2028 (USD Million) 74

Table 11. UK Polypropylene Compounds Market, End-Use– Revenue and Forecast to 2028 (USD Million) 75

Table 12. Spain Polypropylene Compounds Market, Type– Revenue and Forecast to 2028 (USD Million) 77

Table 13. Spain Polypropylene Compounds Market, End-Use– Revenue and Forecast to 2028 (USD Million) 78

Table 14. Austria Polypropylene Compounds Market, Type– Revenue and Forecast to 2028 (USD Million) 80

Table 15. Austria Polypropylene Compounds Market, End-Use– Revenue and Forecast to 2028 (USD Million) 81

Table 16. Switzerland Polypropylene Compounds Market, Type– Revenue and Forecast to 2028 (USD Million) 83

Table 17. Switzerland Polypropylene Compounds Market, End-Use– Revenue and Forecast to 2028 (USD Million) 84

Table 18. Sweden Polypropylene Compounds Market, Type– Revenue and Forecast to 2028 (USD Million) 86

Table 19. Sweden Polypropylene Compounds Market, End-Use– Revenue and Forecast to 2028 (USD Million) 87

Table 20. Norway Polypropylene Compounds Market, Type– Revenue and Forecast to 2028 (USD Million) 89

Table 21. Norway Polypropylene Compounds Market, End-Use– Revenue and Forecast to 2028 (USD Million) 90

Table 22. Denmark Polypropylene Compounds Market, Type– Revenue and Forecast to 2028 (USD Million) 92

Table 23. Denmark Polypropylene Compounds Market, End-Use– Revenue and Forecast to 2028 (USD Million) 93

Table 24. Finland Polypropylene Compounds Market, Type– Revenue and Forecast to 2028 (USD Million) 95

Table 25. Finland Polypropylene Compounds Market, End-Use– Revenue and Forecast to 2028 (USD Million) 96

Table 26. Rest of Europe Polypropylene Compounds Market, Type– Revenue and Forecast to 2028 (USD Million) 98

Table 27. Rest of Europe Polypropylene Compounds Market, End-Use– Revenue and Forecast to 2028 (USD Million) 99

Table 28. List of Abbreviation. 139

LIST OF FIGURES

Figure 1. Europe Polypropylene Compounds Market Segmentation. 19

Figure 2. Europe Polypropylene Compounds Market Segmentation – By Geography. 20

Figure 3. Europe Polypropylene Compounds Market Overview.. 22

Figure 4. Mineral Filled PP Compounds Segment Held Largest Share of Europe Polypropylene Compounds Market 23

Figure 5. Germany Region Held Largest Share of Europe Polypropylene Compounds Market 24

Figure 6. Europe Polypropylene Compounds Market, Industry Landscape. 25

Figure 7. Europe: PEST Analysis. 32

Figure 8. Expert Opinion. 33

Figure 9. Europe Polypropylene Compounds market Impact Analysis of Drivers and Restraints. 39

Figure 10. Europe Polypropylene Compounds Market – Revenue and Forecast To 2028 (US$ Million) 40

Figure 11. Polypropylene Compounds Market Revenue Share, by Type (2020 and 2028) 43

Figure 12. Mineral Filled PP Compound: Polypropylene Compounds Market – Revenue and Forecast To 2028 (US$ Million) 44

Figure 13. Compounded TPO: Polypropylene Compounds Market – Revenue and Forecast To 2028 (US$ Million) 45

Figure 14. Compounded TPV: Polypropylene Compounds Market – Revenue and Forecast To 2028 (US$ Million) 47

Figure 15. Glass Reinforced: Polypropylene Compounds Market – Revenue and Forecast To 2028 (US$ Million) 48

Figure 16. Others: Polypropylene Compounds Market – Revenue and Forecast To 2028 (US$ Million) 49

Figure 17. Polypropylene Compounds Market Revenue Share, by End-Use (2020 and 2028) 50

Figure 18. Automotive: Polypropylene Compounds Market – Revenue and Forecast To 2028 (US$ Million) 51

Figure 19. Electricals and electronics: Polypropylene Compounds Market – Revenue and Forecast To 2028 (US$ Million) 53

Figure 20. Packaging: Polypropylene Compounds Market – Revenue and Forecast To 2028 (US$ Million) 54

Figure 21. Building and Construction: Polypropylene Compounds Market – Revenue and Forecast To 2028 (US$ Million) 55

Figure 22. Textile: Polypropylene Compounds Market – Revenue and Forecast To 2028 (US$ Million) 56

Figure 23. Others: Polypropylene Compounds Market – Revenue and Forecast To 2028 (US$ Million) 57

Figure 24. Europe: Polypropylene Compounds Market – Revenue and Forecast to 2028 (US$ Million) 59

Figure 25. Europe: Polypropylene Compounds Market Revenue Share, Type (2020 and 2028) 60

Figure 26. Europe: Polypropylene Compounds Market Revenue Share, End-Use (2020 and 2028) 61

Figure 27. Europe: Polypropylene Compounds Market Revenue Share, by Key Country (2020 and 2028) 62

Figure 28. Germany: Polypropylene Compounds Market –Revenue and Forecast to 2028 (US$ Million) 63

Figure 29. France: Polypropylene Compounds Market –Revenue and Forecast to 2028 (US$ Million) 66

Figure 30. Italy: Polypropylene Compounds Market –Revenue and Forecast to 2028 (US$ Million) 70

Figure 31. UK: Polypropylene Compounds Market –Revenue and Forecast to 2028 (US$ Million) 73

Figure 32. Spain: Polypropylene Compounds Market –Revenue and Forecast to 2028 (US$ Million) 76

Figure 33. Austria: Polypropylene Compounds Market –Revenue and Forecast to 2028 (US$ Million) 79

Figure 34. Switzerland: Polypropylene Compounds Market –Revenue and Forecast to 2028 (US$ Million) 82

Figure 35. Sweden: Polypropylene Compounds Market –Revenue and Forecast to 2028 (US$ Million) 85

Figure 36. Norway: Polypropylene Compounds Market –Revenue and Forecast to 2028 (US$ Million) 88

Figure 37. Denmark: Polypropylene Compounds Market –Revenue and Forecast to 2028 (US$ Million) 91

Figure 38. Finland: Polypropylene Compounds Market –Revenue and Forecast to 2028 (US$ Million) 94

Figure 39. Rest of Europe: Polypropylene compounds Market –Revenue and Forecast to 2028 (US$ Million) 97

Figure 40. Impact of COVID-19 Pandemic on Polypropylene Compounds Market in European Countries. 102

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely - analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You'll receive access to the report within 4-6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we'll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we're happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you're considering, and we'll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report's scope, methodology, customization options, or which license suits you best, we're here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we'll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we'll ensure the issue is resolved quickly so you can access your report without interruption.

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Jun 2021

Crude Steel Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage:By Product Type (Plates, Tubes, Bars, Wire Rod, and Others), Manufacturing Process (Basic Oxygen Furnace and Electric Arc Furnace), and End-Use Industry (Building and Construction, Automotive, Industrial Machinery, Energy and Power, Consumer Goods, Marine, Oil and Gas, and Others)

Jun 2021

Americas, Europe, and Asia Pacific Ester for Synthetic and Bio-Based Lubricants Market

Size and Forecast (2021 - 2031), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Ester Type [Monoesters, Diesters, Polyol Esters (Trimethylolpropane Esters, Pentaerythritol Esters, Neopentyl Glycol Esters, Trimethylol Ethane Esters, and Dipentaerythritol Esters), Trimellitate Esters, Complex Esters, and Others], Lubricant Type (Synthetic Lubricants and Biobased Lubricants), Application [Engine Oil (MCO, PCMO, HDEO, and Other Engines), Compressor Oil, (Refrigeration, Air Compressors, Natural Gas Compressors, and Other Compressors), Hydraulic Fluids, Gear Oil, Transmission Oil, Coolants, and Others], and End Use [Automotive (Conventional Vehicles and Electric Vehicles), Textile, Marine, Mining and Metallurgy, Aviation, Energy and Power, and Others]

Jun 2021

Amorphous Silica Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Grade (High-Purity, Medium-Purity, and Low-Purity), Product Type (Precipitated Silica, Silica Gel, Colloidal Silica, Fumed Silica, and Others), Application (Rubber, Electrical and Electronics, Building and Construction, Personal Care and Cosmetics, Food and Beverages, Oil and Gas, Pulp and Paper, Agrochemicals, and Others), and Geography

Jun 2021

Leather for Automotive Seats Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type [Genuine Leather and Artificial Leather (Polyurethane, Polyvinyl Chloride, and Others)], Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, and Others), and Geography

Jun 2021

Leather for Aviation Application Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type [Genuine Leather and Artificial Leather (Polyurethane, Polyvinyl Chloride, and Others)], Application [Seats, Headrests, Armrests, Cushions, Cabin Interiors, and Others], Aircraft Type [Private Aircraft, Commercial Aircraft, Military Aircraft, and Others], and Geography

Jun 2021

Leather for Railway Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Genuine Leather and Artificial Leather [Polyurethane, Polyvinyl Chloride, and Others]), Application (Train Seats, Traction Bellows, Handle and Grip Bars, Cushions and Pillows, and Others), Train Type (Passenger Trains, Freight Trains, Mining Trains, and Others), and Geography

Jun 2021

Insect Pest Control Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Insect Type (Termites, Cockroaches, Bedbugs, Mosquitoes, Ants, Flies, and Others), Form (Dry and Liquid), Control Method (Chemical, Biological, and Physical), Category (Synthetic and Herbal/Natural), and End User (Residential/Household, Commercial Facilities, Animal Husbandry, Industrial, and Crop Protection)

Jun 2021

Re-Refined Paraffinic Base Oil Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Process (Acid Treatment, Clay Treatment, Solvent Extraction, and Hydrotreating), Application (Engine Oil, Hydraulic Oil, Metalworking Fluid, Compressor Oil, Grease, Turbine Oil, and Others), End Use (Automotive, Construction, Mining and Metallurgy, Marine, Energy and Power, Oil and Gas, and Others), and Geography

Get Free Sample For

Get Free Sample For