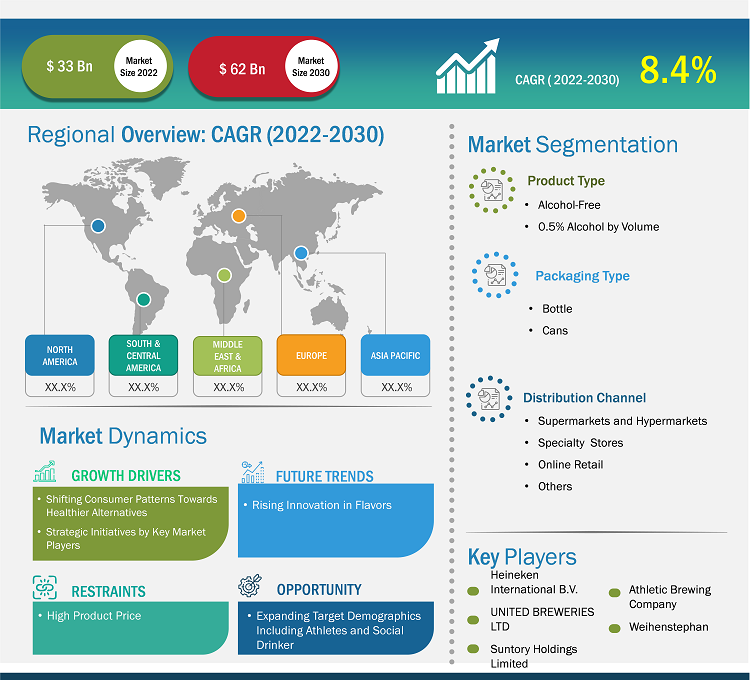

[Research Report] The non-alcoholic beer market size is projected to grow from US$ 33 billion in 2022 to US$ 62 billion by 2030; the market is expected to record a CAGR of 8.4% from 2022 to 2030.

Market Insights and Analyst View:

Non-alcoholic beer mimics the taste and appearance of traditional beer but has significantly lower alcohol content. It is produced through a brewing process similar to regular beer, including the fermentation of malted beer, including the fermentation of malted barley, hops, water, and yeast. However, techniques like vacuum distillation or reserve osmosis remove most alcohol, leaving behind the beer's flavor and aroma. Shifting consumer preferences and adopting a health-conscious lifestyle contribute to the market's growth. Key players in the market are developing new products to cater to the growing consumer demand and expand its product portfolio. Further, the non-alcoholic beer market has seen innovation in flavor profiles and marketing strategies appealing to a diverse demographic, including athletes, pregnant women, and individuals looking to reduce alcohol consumption. These factors are expected to propel the market demand.

Growth Drivers and Challenges:

Over the past few years, awareness regarding health and nutrition has increased significantly. Due to hectic working schedules and busy lifestyles, people cannot concentrate on their health and fitness. This has led to various health issues like diabetes, obesity, skin diseases, eye problems, heart diseases, and cancer. The growing prevalence of such diseases has increased health awareness among consumers. Consumers are increasingly spending on health-boosting products to reduce the risk of chronic diseases. According to the US Center for Medicare and Medicaid Services (CMS), healthcare spending in the US accounted for US$ 4.1 trillion, up 9.7% from the previous year. People are increasingly spending on nutrient-enriched food and beverages to boost their health. This factor has created a massive demand for healthy beverages. The rising popularity of functional and non-alcoholic beer has encouraged manufacturers to formulate products with the characteristics of both drinks. For instance, in 2022, Constellation Brands, Inc. launched Corona Sunbrew, 0.0% alcohol, i.e., a non-alcoholic beer added with 30% of the daily value of Vitamin D per 330 mL serving in Canada.

Strategic Insights

Report Segmentation and Scope:

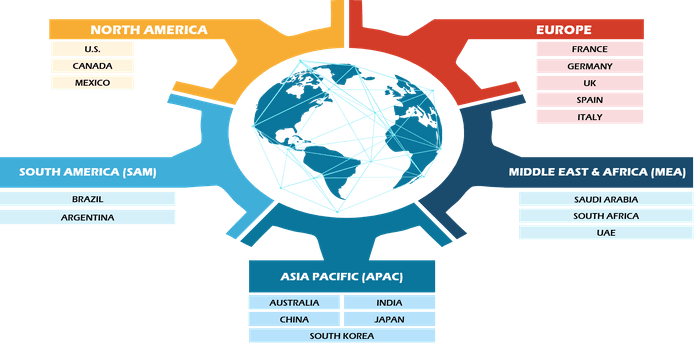

The global non-alcoholic beer market is segmented based on product type, packaging type, distribution channel, and geography. Based on product type, the non-alcoholic beer market is segmented into alcohol-free and 0.5% alcohol by volume. Based on the packaging type, the market is segmented into bottles and cans. Based on the distribution channel, the non-alcoholic beer market is segmented into supermarkets and hypermarkets, specialty stores, online retail, and others. Geographically, the market is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Russia, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

Based on distribution channel, the non-alcoholic beer market is segmented into supermarkets and hypermarkets, specialty stores, online retail, and others. The supermarkets and hypermarkets segment holds a significant market share, and online retail is expected to grow fastest during the forecast period. Online retail stores offer a wide variety of products with heavy discounts. Also, consumers can conveniently buy desirable products remotely. Additionally, home delivery service attracts many customers to shop through e-commerce platforms. Moreover, shopping websites offer descriptive product information and user reviews, which help buyers compare products and make informed decisions. During the COVID-19 pandemic, online retail channels gained popularity as they offered home delivery services. These factors are expected to boost the future non-alcoholic beer market growth for the online retail segment.

Regional Analysis:

The non-alcoholic beer market is segmented into five key regions—North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. The global non-alcoholic beer market is anticipated to be dominated by North America. Europe non-alcoholic beer market is expected to grow at a significant rate during the forecast period. North America is a significant region for the non-alcoholic beer market due to the increasing number of individuals opting for healthier alternatives. According to the Bacardi Cocktail Trends report in January 2022, in partnership with The Future Laboratory, approximately 58% of consumers globally are shifting to non-alcoholic and Low Alcoholic Volume (ABV) cocktails and beverages. With consumers' expanding acceptance of the non-alcoholic category, manufacturers in the market are offering innovative products and have been modernizing the current product portfolio, which is likely to increase future growth.

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the non-alcoholic beer market are listed below:

1. In 2023, Molson Coors announced the launch of Staropramen 0.0, an alcohol-free beer. The product will be available in 330ml bottles and multipacks across its retail channel—the launch aimed to expand its product portfolio in the non-alcoholic beer segment.

2. In 2023, AB InBev announced an investment of US$ 32.70 million in technology upgrades to expand their no-alcohol and low-alcohol brewing capabilities.

3. In 2022, AB InBev announced the launch of the non-alcoholic beer Corona Cero, brewed from 100% natural ingredients across Europe. The launch was aimed to expand its geographical reach and cater to the growing demand for non-alcoholic beer in the region.

COVID-19 Pandemic Impact:

The COVID-19 pandemic affected industries in various countries, influencing their economic conditions. Lockdowns, travel bans, and business shutdowns in leading countries in North America, Europe, Asia Pacific (APAC), South & Central America (SAM), and the Middle East & Africa (MEA) negatively affected the growth of various industries, including the food & beverages industries. The shutdown of manufacturing units disturbed global supply chains, manufacturing activities, delivery schedules, and sales of various essential and non-essential products. In 2020, various companies announced possible delays in product deliveries and a slump in future sales of their products. In addition, the bans imposed by various governments in Europe, Asia, and North America on international travel forced the companies to put their collaboration and partnership plans on a temporary hold. All these factors hampered the food & beverages industry in 2020 and early 2021, thereby restraining the growth of various markets related to this industry, including the global non-alcoholic beer market.

In the pre-pandemic period, the non-alcoholic beer market was mainly driven by rising consumer inclination towards healthy alternative and surging number of product innovations by flavors. However, many industries faced unprecedented challenges due to the COVID-19 outbreak in 2020. The food & beverage industry declined due to the shutdown of manufacturing units and supply chain disruption. The pandemic disturbed the manufacturing processes with restrictions imposed by government authorities in various countries. During the initial phase of the pandemic, almost all countries proposed lockdowns in their respective economies, where people were restricted from going outside their houses.

Competitive Landscape and Key Companies:

Heineken International B.V.; Weihenstephan; Athletic Brewing Company; Radeberger Gruppe KG; UNITED BREWERIES LTD; Anheuser-Busch InBev; Suntory Holdings Limited; Bravus Brewing Company; BrewDog; and Lagunitas Brewing Company are among the prominent players operating in the global non-alcoholic beer market. These market players are adopting strategic development initiatives to expand, further driving the market growth.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Have a question?

Shejal

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

TABLE OF CONTENTS

1. INTRODUCTION

1.1. SCOPE OF THE STUDY

1.2. THE INSIGHT PARTNERS RESEARCH REPORT GUIDANCE

1.3. MARKET SEGMENTATION

1.3.1 Non-Alcoholic Beer Market - By Product Type

1.3.2 Non-Alcoholic Beer Market - By Distribution Channel

1.3.3 Non-Alcoholic Beer Market - By Region

1.3.3.1 By Country

2. KEY TAKEAWAYS

3. RESEARCH METHODOLOGY

4. NON-ALCOHOLIC BEER MARKET LANDSCAPE

4.1. OVERVIEW

4.2. PORTER'S FIVE FORCES ANALYSIS

4.2.1 Bargaining Power of Buyers

4.2.1 Bargaining Power of Suppliers

4.2.1 Threat of Substitute

4.2.1 Threat of New Entrants

4.2.1 Competitive Rivalry

4.3. EXPERT OPINIONS

5. NON-ALCOHOLIC BEER MARKET - KEY MARKET DYNAMICS

5.1. KEY MARKET DRIVERS

5.2. KEY MARKET RESTRAINTS

5.3. KEY MARKET OPPORTUNITIES

5.4. FUTURE TRENDS

5.5. IMPACT ANALYSIS OF DRIVERS AND RESTRAINTS

6. NON-ALCOHOLIC BEER MARKET - GLOBAL MARKET ANALYSIS

6.1. NON-ALCOHOLIC BEER - GLOBAL MARKET OVERVIEW

6.2. NON-ALCOHOLIC BEER - GLOBAL MARKET AND FORECAST TO 2028

6.3. MARKET POSITIONING/MARKET SHARE

7. NON-ALCOHOLIC BEER MARKET - REVENUE AND FORECASTS TO 2028 - PRODUCT TYPE

7.1. OVERVIEW

7.2. PRODUCT TYPE MARKET FORECASTS AND ANALYSIS

7.3. ALCOHOL-FREE

7.3.1. Overview

7.3.2. Alcohol-Free Market Forecast and Analysis

7.4. 0.5% ALCOHOL BY VOLUME

7.4.1. Overview

7.4.2. 0.5% Alcohol by Volume Market Forecast and Analysis

8. NON-ALCOHOLIC BEER MARKET - REVENUE AND FORECASTS TO 2028 - DISTRIBUTION CHANNEL

8.1. OVERVIEW

8.2. DISTRIBUTION CHANNEL MARKET FORECASTS AND ANALYSIS

8.3. SUPERMARKETS AND HYPERMARKETS

8.3.1. Overview

8.3.2. Supermarkets and Hypermarkets Market Forecast and Analysis

8.4. SPECIALTY STORES

8.4.1. Overview

8.4.2. Specialty Stores Market Forecast and Analysis

8.5. ONLINE RETAIL

8.5.1. Overview

8.5.2. Online Retail Market Forecast and Analysis

8.6. OTHERS

8.6.1. Overview

8.6.2. Others Market Forecast and Analysis

9. NON-ALCOHOLIC BEER MARKET REVENUE AND FORECASTS TO 2028 - GEOGRAPHICAL ANALYSIS

9.1. NORTH AMERICA

9.1.1 North America Non-Alcoholic Beer Market Overview

9.1.2 North America Non-Alcoholic Beer Market Forecasts and Analysis

9.1.3 North America Non-Alcoholic Beer Market Forecasts and Analysis - By Product Type

9.1.4 North America Non-Alcoholic Beer Market Forecasts and Analysis - By Distribution Channel

9.1.5 North America Non-Alcoholic Beer Market Forecasts and Analysis - By Countries

9.1.5.1 Canada Non-Alcoholic Beer Market

9.1.5.1.1 Canada Non-Alcoholic Beer Market by Product Type

9.1.5.1.2 Canada Non-Alcoholic Beer Market by Distribution Channel

9.1.5.2 Mexico Non-Alcoholic Beer Market

9.1.5.2.1 Mexico Non-Alcoholic Beer Market by Product Type

9.1.5.2.2 Mexico Non-Alcoholic Beer Market by Distribution Channel

9.1.5.3 US Non-Alcoholic Beer Market

9.1.5.3.1 US Non-Alcoholic Beer Market by Product Type

9.1.5.3.2 US Non-Alcoholic Beer Market by Distribution Channel

9.2. EUROPE

9.2.1 Europe Non-Alcoholic Beer Market Overview

9.2.2 Europe Non-Alcoholic Beer Market Forecasts and Analysis

9.2.3 Europe Non-Alcoholic Beer Market Forecasts and Analysis - By Product Type

9.2.4 Europe Non-Alcoholic Beer Market Forecasts and Analysis - By Distribution Channel

9.2.5 Europe Non-Alcoholic Beer Market Forecasts and Analysis - By Countries

9.2.5.1 Germany Non-Alcoholic Beer Market

9.2.5.1.1 Germany Non-Alcoholic Beer Market by Product Type

9.2.5.1.2 Germany Non-Alcoholic Beer Market by Distribution Channel

9.2.5.2 France Non-Alcoholic Beer Market

9.2.5.2.1 France Non-Alcoholic Beer Market by Product Type

9.2.5.2.2 France Non-Alcoholic Beer Market by Distribution Channel

9.2.5.3 Italy Non-Alcoholic Beer Market

9.2.5.3.1 Italy Non-Alcoholic Beer Market by Product Type

9.2.5.3.2 Italy Non-Alcoholic Beer Market by Distribution Channel

9.2.5.4 United Kingdom Non-Alcoholic Beer Market

9.2.5.4.1 United Kingdom Non-Alcoholic Beer Market by Product Type

9.2.5.4.2 United Kingdom Non-Alcoholic Beer Market by Distribution Channel

9.2.5.5 Russia Non-Alcoholic Beer Market

9.2.5.5.1 Russia Non-Alcoholic Beer Market by Product Type

9.2.5.5.2 Russia Non-Alcoholic Beer Market by Distribution Channel

9.2.5.6 Rest of Europe Non-Alcoholic Beer Market

9.2.5.6.1 Rest of Europe Non-Alcoholic Beer Market by Product Type

9.2.5.6.2 Rest of Europe Non-Alcoholic Beer Market by Distribution Channel

9.3. ASIA-PACIFIC

9.3.1 Asia-Pacific Non-Alcoholic Beer Market Overview

9.3.2 Asia-Pacific Non-Alcoholic Beer Market Forecasts and Analysis

9.3.3 Asia-Pacific Non-Alcoholic Beer Market Forecasts and Analysis - By Product Type

9.3.4 Asia-Pacific Non-Alcoholic Beer Market Forecasts and Analysis - By Distribution Channel

9.3.5 Asia-Pacific Non-Alcoholic Beer Market Forecasts and Analysis - By Countries

9.3.5.1 Australia Non-Alcoholic Beer Market

9.3.5.1.1 Australia Non-Alcoholic Beer Market by Product Type

9.3.5.1.2 Australia Non-Alcoholic Beer Market by Distribution Channel

9.3.5.2 China Non-Alcoholic Beer Market

9.3.5.2.1 China Non-Alcoholic Beer Market by Product Type

9.3.5.2.2 China Non-Alcoholic Beer Market by Distribution Channel

9.3.5.3 India Non-Alcoholic Beer Market

9.3.5.3.1 India Non-Alcoholic Beer Market by Product Type

9.3.5.3.2 India Non-Alcoholic Beer Market by Distribution Channel

9.3.5.4 Japan Non-Alcoholic Beer Market

9.3.5.4.1 Japan Non-Alcoholic Beer Market by Product Type

9.3.5.4.2 Japan Non-Alcoholic Beer Market by Distribution Channel

9.3.5.5 South Korea Non-Alcoholic Beer Market

9.3.5.5.1 South Korea Non-Alcoholic Beer Market by Product Type

9.3.5.5.2 South Korea Non-Alcoholic Beer Market by Distribution Channel

9.3.5.6 Rest of Asia-Pacific Non-Alcoholic Beer Market

9.3.5.6.1 Rest of Asia-Pacific Non-Alcoholic Beer Market by Product Type

9.3.5.6.2 Rest of Asia-Pacific Non-Alcoholic Beer Market by Distribution Channel

9.4. MIDDLE EAST AND AFRICA

9.4.1 Middle East and Africa Non-Alcoholic Beer Market Overview

9.4.2 Middle East and Africa Non-Alcoholic Beer Market Forecasts and Analysis

9.4.3 Middle East and Africa Non-Alcoholic Beer Market Forecasts and Analysis - By Product Type

9.4.4 Middle East and Africa Non-Alcoholic Beer Market Forecasts and Analysis - By Distribution Channel

9.4.5 Middle East and Africa Non-Alcoholic Beer Market Forecasts and Analysis - By Countries

9.4.5.1 South Africa Non-Alcoholic Beer Market

9.4.5.1.1 South Africa Non-Alcoholic Beer Market by Product Type

9.4.5.1.2 South Africa Non-Alcoholic Beer Market by Distribution Channel

9.4.5.2 Saudi Arabia Non-Alcoholic Beer Market

9.4.5.2.1 Saudi Arabia Non-Alcoholic Beer Market by Product Type

9.4.5.2.2 Saudi Arabia Non-Alcoholic Beer Market by Distribution Channel

9.4.5.3 U.A.E Non-Alcoholic Beer Market

9.4.5.3.1 U.A.E Non-Alcoholic Beer Market by Product Type

9.4.5.3.2 U.A.E Non-Alcoholic Beer Market by Distribution Channel

9.4.5.4 Rest of Middle East and Africa Non-Alcoholic Beer Market

9.4.5.4.1 Rest of Middle East and Africa Non-Alcoholic Beer Market by Product Type

9.4.5.4.2 Rest of Middle East and Africa Non-Alcoholic Beer Market by Distribution Channel

9.5. SOUTH AND CENTRAL AMERICA

9.5.1 South and Central America Non-Alcoholic Beer Market Overview

9.5.2 South and Central America Non-Alcoholic Beer Market Forecasts and Analysis

9.5.3 South and Central America Non-Alcoholic Beer Market Forecasts and Analysis - By Product Type

9.5.4 South and Central America Non-Alcoholic Beer Market Forecasts and Analysis - By Distribution Channel

9.5.5 South and Central America Non-Alcoholic Beer Market Forecasts and Analysis - By Countries

9.5.5.1 Brazil Non-Alcoholic Beer Market

9.5.5.1.1 Brazil Non-Alcoholic Beer Market by Product Type

9.5.5.1.2 Brazil Non-Alcoholic Beer Market by Distribution Channel

9.5.5.2 Argentina Non-Alcoholic Beer Market

9.5.5.2.1 Argentina Non-Alcoholic Beer Market by Product Type

9.5.5.2.2 Argentina Non-Alcoholic Beer Market by Distribution Channel

9.5.5.3 Rest of South and Central America Non-Alcoholic Beer Market

9.5.5.3.1 Rest of South and Central America Non-Alcoholic Beer Market by Product Type

9.5.5.3.2 Rest of South and Central America Non-Alcoholic Beer Market by Distribution Channel

10. INDUSTRY LANDSCAPE

10.1. MERGERS AND ACQUISITIONS

10.2. AGREEMENTS, COLLABORATIONS AND JOIN VENTURES

10.3. NEW PRODUCT LAUNCHES

10.4. EXPANSIONS AND OTHER STRATEGIC DEVELOPMENTS

11. NON-ALCOHOLIC BEER MARKET, KEY COMPANY PROFILES

11.1. HEINEKEN N.V.

11.1.1. Key Facts

11.1.2. Business Description

11.1.3. Products and Services

11.1.4. Financial Overview

11.1.5. SWOT Analysis

11.1.6. Key Developments

11.2. ANHEUSER-BUSCH INBEV SA

11.2.1. Key Facts

11.2.2. Business Description

11.2.3. Products and Services

11.2.4. Financial Overview

11.2.5. SWOT Analysis

11.2.6. Key Developments

11.3. ERDINGER WEIBBRAU

11.3.1. Key Facts

11.3.2. Business Description

11.3.3. Products and Services

11.3.4. Financial Overview

11.3.5. SWOT Analysis

11.3.6. Key Developments

11.4. BIG DROP BREWING CO.

11.4.1. Key Facts

11.4.2. Business Description

11.4.3. Products and Services

11.4.4. Financial Overview

11.4.5. SWOT Analysis

11.4.6. Key Developments

11.5. MOSCOW BREWING COMPANY

11.5.1. Key Facts

11.5.2. Business Description

11.5.3. Products and Services

11.5.4. Financial Overview

11.5.5. SWOT Analysis

11.5.6. Key Developments

11.6. BERNARD BREWERY

11.6.1. Key Facts

11.6.2. Business Description

11.6.3. Products and Services

11.6.4. Financial Overview

11.6.5. SWOT Analysis

11.6.6. Key Developments

11.7. SUNTORY BEER

11.7.1. Key Facts

11.7.2. Business Description

11.7.3. Products and Services

11.7.4. Financial Overview

11.7.5. SWOT Analysis

11.7.6. Key Developments

11.8. CARLSBERG A/S

11.8.1. Key Facts

11.8.2. Business Description

11.8.3. Products and Services

11.8.4. Financial Overview

11.8.5. SWOT Analysis

11.8.6. Key Developments

11.9. KROMBACHER BRAUEREI

11.9.1. Key Facts

11.9.2. Business Description

11.9.3. Products and Services

11.9.4. Financial Overview

11.9.5. SWOT Analysis

11.9.6. Key Developments

11.10. ROYAL SWINKELS FAMILY BREWERS

11.10.1. Key Facts

11.10.2. Business Description

11.10.3. Products and Services

11.10.4. Financial Overview

11.10.5. SWOT Analysis

11.10.6. Key Developments

12. APPENDIX

12.1. ABOUT THE INSIGHT PARTNERS

12.2. GLOSSARY OF TERMS

1.Heineken International B.V

2.Weihenstephan

3.Athletic Brewing Company

4.Radeberger Gruppe KG

5.UNITED BREWERIES LTD

6.Anheuser-Busch InBev

7.Suntory Holdings Limited

8.Bravus Brewing Company

9.BrewDog

10.Lagunitas Brewing Company

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Non-Alcoholic Beer Market

Apr 2024

Corn and Wheat-Based Feed Market

Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type [Corn-Based (Corn Gluten Meal, Corn Gluten Feed, and Other Corn-Based Feed) and Wheat-Based (Wheat Gluten, Wheat Bran, and Other Wheat-Based Feed)], Livestock (Poultry, Ruminants, Swine, Aquaculture, and Others), and Geography

Apr 2024

Icing and Frosting Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Icing and Frosting), Category (Gluten-Free and Conventional), Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Online Retail, and Others), and Geography

Apr 2024

Fermented Flavor and Fragrance Ingredients Market

Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Fruity, Floral, Woody, Blends, and Others), Application (Food and Beverages, Personal Care Products, Cosmetics, and Others), and Geography

Apr 2024

Aroma Ingredients for Food and Beverages Market

Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type [Synthetic (Terpenes, Aldehydes, Aliphatic, and Others) and Natural (Essential Oils, Herbal Extracts, Oleoresins, and Others)] and Application (Bakery and Confectionery, Dairy and Frozen Desserts, Beverages, Sweet and Savory Snacks, RTE and RTC Meals, and Others)

Apr 2024

High-End Rum Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (White, Dark, and Gold), Category (Super Premium, Ultra-Premium, and Prestige & Prestige Plus), Nature (Plain and Flavored), and Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Online Retail, and Others)

Apr 2024

Edible Oils and Fats Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type [Oil (Soybean Oil, Sunflower Oil, Palm Oil, Canola Oil/Rapeseed Oil, and Others) and Fats (Butter, Margarine, Palm Oil Based Shortening, and Vegetable Oil Based Shortening, and Others)] and Application [Food and Beverages (Bakery and Confectionery, Dairy and Frozen Desserts, RTE and RTC Meals, Snacks, and Others), Animal Nutrition, and Pharmaceuticals and Nutraceuticals]

Apr 2024

Flavor Masking Agents for Food and Beverages Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type (Sweet, Salt, Fat, Bitter, and Others) and Application (Bakery and Confectionery; Dairy and Frozen Desserts; Beverages; Meat, Poultry, and Seafood; Meat Substitutes; Dairy Alternatives; RTE and RTC Meals; and Others)

Apr 2024

Chicken Powder Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type (Low-Fat and Conventional) and Application [Food & Beverages (RTE and RTC Meals; Soups, Sauces, and Dressings; Savory Snacks; Noodles and Pastas; and Others), Dietary Supplements, Pet Food, and Animal Feed]