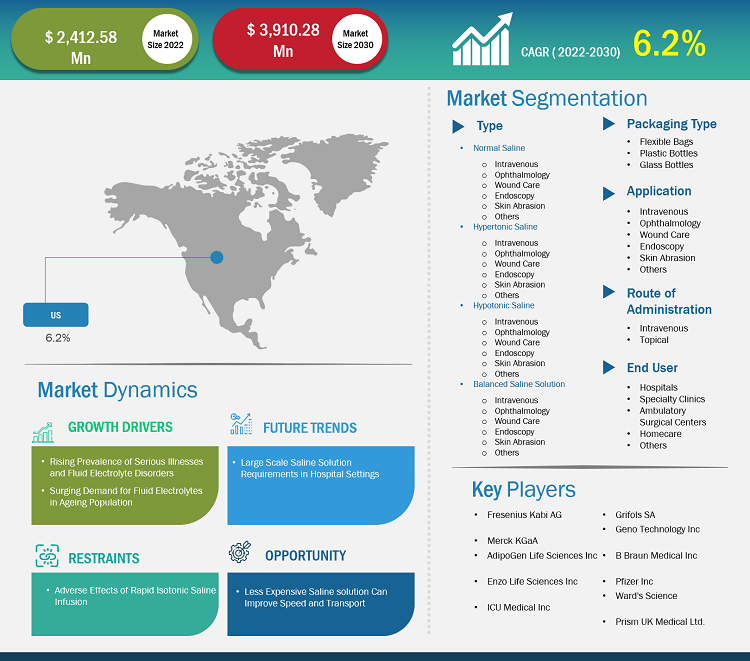

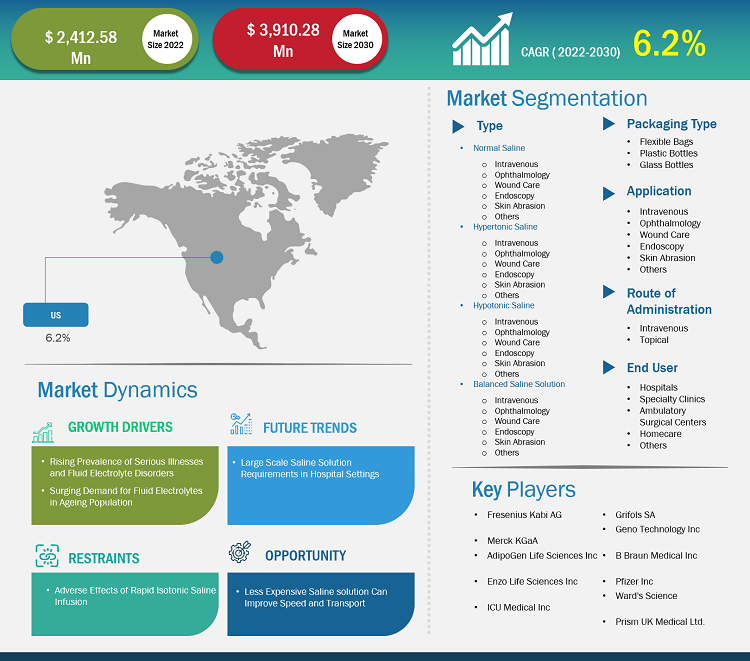

The US physiological saline market size is expected to grow from US$ 2,412.58 million in 2022 to US$ 3,910.28 million by 2030; it is estimated to register a CAGR of 6.2% from 2022 to 2030.

Analyst’s Viewpoint

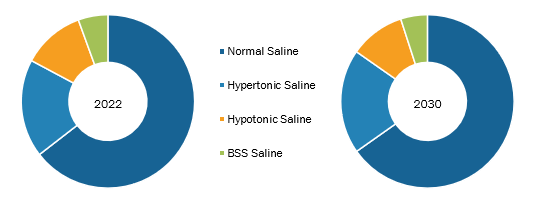

The US physiological saline market analysis explains market drivers such as the rising prevalence of serious illnesses and fluid electrolyte disorders, and surging demand for fluid electrolytes in the elderly population. Further, large-scale saline solution requirements in hospital settings are expected to emerge as new trends in the market during 2022–2030. The US physiological saline market, by type, is segmented into normal saline, hypertonic saline, hypotonic saline, and balanced saline. The normal saline segment held the largest market share in 2022. However, the hypertonic saline segment is expected to register the highest CAGR during the forecast period. The US physiological saline market, by packaging type, is segmented into flexible bags, plastic bottles, and glass bottles. The plastic bottles segment held the largest market share in 2022. The flexible bag segment is anticipated to register the highest CAGR during 2022-2030. By application, the US physiological saline market is segmented as intravenous, ophthalmology, wound care, endoscopy, skin abrasion, and others. The intravenous segment held the largest market share in 2022, and the same segment is anticipated to register the highest CAGR during 2022-2030. The US physiological saline market, by route of administration, is categorized into intravenous and topical. The intravenous segment held a larger market share in 2022, and the same segment is anticipated to register a higher CAGR during 2022-2030. The US physiological saline market, by end-user, is segmented into hospitals, specialty clinics, ambulatory surgical centers, home care, and others. The hospitals segment held the largest market share in 2022. The specialty clinics segment is anticipated to register the highest CAGR during 2022-2030.

A physiological saline solution is composed of salt solutions that are isotonic and have the same pH. An example of a physiological saline solution is Ringer's solution, composed of a mixture of sodium chloride (NaCl), sodium bicarbonate, and potassium chloride solution. The physiological solution is recommended by the physician in case of dehydration, fluid imbalances, and many more clinical abnormalities among the patients.

Market Insights

Rising Prevalence of Serious Illnesses and Fluid Electrolyte Disorders Propels US Physiological Saline Market

According to a report by the Center to Advance Palliative Care, ~90 million Americans are living with serious illnesses, and the number is expected to rise to more than double over the next 25 years. Additionally, a report by the National Health Council reveals that incurable and ongoing chronic diseases affect nearly 133 million Americans, which represents more than 40% of the total population of the country. Among these, almost 50% of all adults and nearly 8% of children aged 5–17 have a chronic condition. The National Health Council’s report also mentions that the increasing cases of incurable chronic diseases among Americans result in ~75% of the healthcare costs.

Serious illnesses result in an imbalance in body fluids, such as low levels of potassium, magnesium, calcium, and sodium in the body. Improper levels of body fluids negatively impact the body's function, muscle strength, and heart rhythm, which is associated with disorders of kidneys or endocrine glands. For example, edema occurs when the body retains excessive fluid levels, resulting in swelling and pain in the face, arms, legs, hands, and feet of the patient. Further, losing more body fluids than consumed quantities results in cases of dehydration, exhibiting a range of symptoms such as thirst, weakness, lightheadedness, fainting, and decreased urine output. Therefore, chronic illnesses may result in body fluid imbalance in the patient's body, which propels the demand for physiological saline that is administered as a part of their treatment. Thus, the rising prevalence of serious illnesses and fluid electrolyte disorders bolsters the US physiological saline market growth.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

US Physiological Saline Market: Strategic Insights

Market Size Value in US$ 2,412.58 million in 2022 Market Size Value by US$ 3,910.28 million by 2030 Growth rate CAGR of 6.2% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

US Physiological Saline Market: Strategic Insights

| Market Size Value in | US$ 2,412.58 million in 2022 |

| Market Size Value by | US$ 3,910.28 million by 2030 |

| Growth rate | CAGR of 6.2% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Future Trend

Large-Scale Saline Solution Requirements in Hospital Settings

According to a report published by the Royal Society of Chemistry, using saline solution for washing red blood cells (RBCs) and treating critically ill patients is a common practice in hospital settings. Clinical research groups have reviewed the safety of using physiological saline (0.9% NaCl) in different clinical settings and suggested that the use of saline solution is one of the safest techniques in hospital settings. For example, in transfusion medicine, saline solution is used for washing cells and salvaging procedures in cases of apheresis and the resuscitation of patients with blood or fluid loss. Washing of RBCs requires 1–2 L of sterile saline solution. In the apheresis procedure, saline solution is used in therapeutic plasma exchange procedures and intra-operative cell salvaging to wash RBCs. Therefore, the multifaceted application of physiological saline on large scales in hospital settings is likely to emerge as a new trend in the US physiological saline market.

Report Segmentation and Scope

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Market Opportunity

Rapid Sample Transportation Using Low-Cost Saline Solutions

A less expensive and readily available saline solution can be used for the safe transportation of testing samples, enabling more effective, long-distance transportation of samples to diagnostic labs. A readily available saline solution such as "Phosphate Buffered Saline," a simple salt solution commonly available in hospitals and clinical laboratories, was in use as a transport medium for coronavirus-contaminated specimens; the saline could keep the samples stable for up to 18 hours. During the COVID-19 pandemic, a shortage of viral transport media posed a major challenge in the transportation of specimens obtained from COVID-19 patients to diagnostics and testing labs, which resulted in an upsurge in the demand for sterile saline solutions. As a result, researchers recommended using inexpensive and commonly available salt solutions, such as phosphate-buffered saline solutions, for transportation. Therefore, the rising awareness of less expensive and readily available saline solutions, and their use in the transportation of medical specimens is likely to provide opportunities to the US physiological saline market during 2022–2030.

Type-Based Insights

The US physiological saline market, by type, is segmented into normal saline, hypertonic saline, hypotonic saline, and balanced saline. The normal saline segment held the largest market share in 2022. Normal saline (NS) comprises a sterile salt solution used for short-term fluid replacement, as it helps restore electrolyte/salt levels in the body. It is a 0.9% sodium chloride solution intended to treat dehydration and electrolyte disturbances among people. NS is a cornerstone of intravenous solutions that are used commonly in clinical settings. It is suitable for both pediatric and adult patient populations. Primary indications for the use of NS solutions that are approved by the Food and Drug Administration (FDA) are as follows:

- Extracellular fluid replacement to treat dehydration, hypovolemia, hemorrhage, sepsis, etc.

- Treatment of metabolic alkalosis in the presence of fluid loss

- Mild sodium depletion

Further, NS can only be administered through intravenous access, and the management of normal saline requires evaluation of the patient's health status. Pharmacists need to monitor the implementation of IV fluids while installing and recommend to order based on the clinical situation of the patient with proper counselling to the nursing department in the hospital regarding dosage and administration.

Packaging Type-Based Insights

The US physiological saline market, by packaging type, is segmented into flexible bag, plastic bottles, and glass bottles. The plastic bottles segment held a larger market share in 2022 and flexible bag segment is anticipated to register a highest CAGR during the forecast period. Sodium chloride (NaCl) USP solutions for injections are sterile and nonpyrogenic. They are parenteral solutions that contain various concentrations of NaCl in water for injection (WFI) intended for intravenous (IV) administration. Further, the flexible container is fabricated from a specially formulated polyvinyl chloride. However, solutions coming in contact with plastic containers might leach out certain chemical components from the plastic in very small amounts. Further, biological testing proves effective in supporting the safety of plastic container materials. Therefore, the plastic bottles segment is expected to account for the smallest share of the physiological saline market during the forecast period.

Application-Based Insights

The US physiological saline market, by application, is segmented as intravenous, ophthalmology, wound care, endoscopy, skin abrasion, and others. The intravenous segment held a larger market share in 2022 and the same segment is anticipated to register a highest CAGR during the forecast period. Intravenous (IV) saline solutions are the formulated for the prevention or treatment of dehydration. IV saline is prescribed by physicians of all ages for people who are injured, sick, dehydrated, or undergoing surgery. Saline IV bags provide a rapid and targeted solution to replenish fluids and relieve symptoms. Furthermore, a combination of sterile water and sodium chloride, or salt and normal saline IVs, helps restore fluid balance and hydrate tissues among patients. IV saline is commonly administered to patient’s bloodstreams when they require hydration. It is considered a suitable option for people with allergies or sensitivities to specific medications.

Various companies are producing innovative products related to IV saline; for example, Fresenius Kabi USA offers "freeflex" and "freeflex+ IV bags." These products also provide leak prevention, sterility protection, and needle-stick prevention.

Route of Administration-Based Insights

The US physiological saline market, by route of administration, is bifurcated into intravenous and topical. The intravenous segment held a larger market share in 2022 and the same segment is anticipated to register a highest CAGR during the forecast period. IV saline solutions are specially formulated liquids that are injected into a vein to prevent and treat dehydration. Also, these IV fluids are utilized among people of all ages suffering from sickness, injury, dehydration, etc. The IV saline solution is a simple, safe, and common procedure with a low risk of complications. Also, fluid resuscitation is a vital component for the management of acutely ill patients, and normal saline is considered to be the most widely used IV fluid for seriously ill or injured patients. Being a common, simple, and safe procedure, patients administered via the IV route may feel relief in a short span.

US Physiological Saline Market, by Type – 2022 and 2030

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Country Analysis

The US physiological saline market is expected to reach US$ 3,910.28 million by 2030 from US$ 2,412.58 million in 2022. The US FDA is actively working with manufacturers such as Fresenius Kabi and Grifols to address the critical shortage of intravenous (IV) administration fluids by supporting them through the enlargement of their production capabilities. The FDA also focuses on saline imports to address critical shortages. Further, according to a National Center for Biotechnology Information report, nearly 200 million liters of saline is sold annually in the US. Over 1 million liters of 0.9% NaCl is administered to patients across the country daily as per the same report. Further, according to a report by JAMA Network, there has been an upsurge in the number of surgical procedures in the US, which is evident from 3,156,240 procedures performed in 2020. Therefore, with the rising count of surgical procedures, the demand for physiological saline solutions also increases in the US.

Hospital settings in the US recorded a high demand for physiological saline during the COVID-19 pandemic. To address critical shortages, hospitals searched for alternative solutions such as 5% dextrose in water, 5% dextrose with a lower concentration of NaCl, and 5% dextrose in lactated Ringer injection to address critical demands. Such saline solution alternatives helped them overcome the challenges posed by the demand–supply gap during the COVID-19 pandemic.

The report profiles leading players operating in the US physiological saline market. These include Fresenius Kabi AG, Merck KGaA, AdipoGen Life Sciences Inc, Enzo Life Sciences Inc, ICU Medical Inc, Grifols SA, Geno Technology Inc, B Braun Medical Inc, Pfizer Inc, and Ward's Science.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Packaging Type, Application, Route of Administration, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

A physiological saline solution is composed of salt solutions that are isotonic and have the same pH. An example of physiological saline solution is Ringer's solution, composed of a mixture of sodium chloride (NaCl), sodium bicarbonate, and potassium chloride solution. The physiological solution is recommended by the physician in case of dehydration, fluid imbalances, and many more clinical abnormalities among the patients.

The CAGR value of the US Physiological Saline during the forecasted period of 2022-2030 is 6.2%.

The normal saline segment held the largest market share in 2022 segment in the US physiological saline.

The plastic bottle segment dominated the US physiological saline and held the largest market share in 2022.

Fresenius Kabi AG and ICU Medical Inc are the top two companies that hold huge market shares in the US physiological saline market.

The US physiological saline majorly consists of the players such Fresenius Kabi AG, Merck KGaA, AdipoGen Life Sciences Inc, Enzo Life Sciences Inc, ICU Medical Inc, Grifols SA, Geno Technology Inc, B Braun Medical Inc, Pfizer Inc, and Ward's Science, and among others. .

Key factors that are driving the growth of this market are rising prevalence of serious illnesses and fluid electrolyte disorders to boost the market growth for the US physiological saline over the years.

1. Introduction 13

1.1 The Insight Partners Research Report Guidance. 13

1.2 Market Segmentation. 14

2. Executive Summary 16

3. Research Methodology 17

3.1 Coverage. 19

3.2 Secondary Research. 19

3.3 Primary Research. 20

4. US Physiological Saline Market Landscape 21

4.1 Overview. 21

4.2 PEST Analysis. 22

4.2.1 US PEST Analysis. 22

4.3 Supply Chain Analysis. 22

5. US Physiological Saline Market - Key Industry Dynamics 25

5.1 Key Market Drivers. 26

5.1.1 Rising Prevalence of Serious Illnesses and Fluid Electrolytes Disorders. 26

5.2 Surging Demand for Fluid Electrolytes in Aging Population. 26

5.3 Key Market Restraints: 27

5.3.1 Adverse Effects of Rapid Isotonic Saline Infusion. 27

5.4 Key Market Opportunities: 27

5.4.1 Less Expensive Saline Solution Can Improve Speed and Transport 27

5.5 Future Trends. 28

5.5.1 Large-Scale Saline Solution Requirements in Hospital Settings. 28

5.6 Impact Analysis: 29

6. US Physiological Saline Market - Market Analysis 30

6.1 US Physiological Saline Market Revenue (US$ Mn), 2020 – 2030. 30

7. US Physiological Saline Market – Revenue and Forecast to 2030 – by Type 32

7.1 Overview. 32

7.2 US Physiological Saline Market Revenue Share, by Type 2022 & 2030 (%) 32

7.3 Normal Saline. 33

7.3.1 Overview. 33

7.3.2 Normal Saline: US Physiological Saline Market – Revenue and Forecast to 2030 (US$ Million) 33

7.4 Hypertonic Saline. 35

7.4.1 Overview. 35

7.4.2 Hypertonic Saline: US Physiological Saline Market – Revenue and Forecast to 2030 (US$ Million) 35

7.5 Hypotonic Saline. 37

7.5.1 Overview. 37

7.5.2 Hypotonic Saline: US Physiological Saline Market – Revenue and Forecast to 2030 (US$ Million) 37

7.6 Balanced Saline Solution. 39

7.6.1 Overview. 39

7.6.2 Balanced Saline Solution: US Physiological Saline Market – Revenue and Forecast to 2030 (US$ Million) 39

8. US Physiological Saline Market – Revenue and Forecast to 2030 – by Packaging Type 41

8.1 Overview. 41

8.2 US Physiological Saline Market Revenue Share, by Packaging Type 2022 & 2030 (%) 41

8.3 Flexible Bags. 42

8.3.1 Overview. 42

8.3.2 Flexible Bags: US Physiological Saline Market – Revenue and Forecast to 2030 (US$ Million) 42

8.4 Plastic Bottles. 44

8.4.1 Overview. 44

8.4.2 Plastic Bottles: US Physiological Saline Market – Revenue and Forecast to 2030 (US$ Million) 44

8.5 Glass Bottles. 46

8.5.1 Overview. 46

8.5.2 Glass Bottles: US Physiological Saline Market – Revenue and Forecast to 2030 (US$ Million) 46

9. US Physiological Saline Market – Revenue and Forecast to 2030 – by Application 48

9.1 Overview. 48

9.2 US Physiological Saline Market Revenue Share, by Application 2022 & 2030 (%) 48

9.3 Intravenous. 49

9.3.1 Overview. 49

9.3.2 Intravenous: US Physiological Saline Market – Revenue and Forecast to 2030 (US$ Million) 49

9.4 Ophthalmology. 51

9.4.1 Overview. 51

9.4.2 Ophthalmology: US Physiological Saline Market – Revenue and Forecast to 2030 (US$ Million) 51

9.5 Wound Care. 53

9.5.1 Overview. 53

9.5.2 Wound Care: US Physiological Saline Market – Revenue and Forecast to 2030 (US$ Million) 53

9.6 Endoscopy. 55

9.6.1 Overview. 55

9.6.2 Endoscopy: US Physiological Saline Market – Revenue and Forecast to 2030 (US$ Million) 55

9.7 Skin Abrasion. 56

9.7.1 Overview. 56

9.7.2 Skin Abrasion: US Physiological Saline Market – Revenue and Forecast to 2030 (US$ Million) 56

9.8 Others. 57

9.8.1 Overview. 57

9.8.2 Others: US Physiological Saline Market – Revenue and Forecast to 2030 (US$ Million) 57

10. US Physiological Saline Market – Revenue and Forecast to 2030 – by Route of Administration 58

10.1 Overview. 58

10.2 US Physiological Saline Market Revenue Share, by Route of Administration 2022 & 2030 (%) 58

10.3 Intravenous. 59

10.3.1 Overview. 59

10.3.2 Intravenous: US Physiological Saline Market – Revenue and Forecast to 2030 (US$ Million) 59

10.4 Topical 60

10.4.1 Overview. 60

10.4.2 Topical: US Physiological Saline Market – Revenue and Forecast to 2030 (US$ Million) 60

11. US Physiological Saline Market – Revenue and Forecast to 2030 – by End User 62

11.1 Overview. 62

11.2 US Physiological Saline Market Revenue Share, by End User 2022 & 2030 (%) 62

11.3 Hospitals. 63

11.3.1 Overview. 63

11.3.2 Hospitals: US Physiological Saline Market – Revenue and Forecast to 2030 (US$ Million) 63

11.4 Specialty Clinics. 64

11.4.1 Overview. 64

11.4.2 Specialty Clinics: US Physiological Saline Market – Revenue and Forecast to 2030 (US$ Million) 64

11.5 Ambulatory Surgical Centers. 65

11.5.1 Overview. 65

11.5.2 Ambulatory Surgical Centers: US Physiological Saline Market – Revenue and Forecast to 2030 (US$ Million) 65

11.6 Homecare. 66

11.6.1 Overview. 66

11.6.2 Homecare: US Physiological Saline Market – Revenue and Forecast to 2030 (US$ Million) 66

11.7 Others. 67

11.7.1 Overview. 67

11.7.2 Others: US Physiological Saline Market – Revenue and Forecast to 2030 (US$ Million) 67

12. Company Profiles 68

12.1 Fresenius Kabi AG. 68

12.1.1 Key Facts. 68

12.1.2 Business Description. 68

12.1.3 Products and Services. 69

12.1.4 Financial Overview. 69

12.1.5 SWOT Analysis. 70

12.1.6 Key Developments. 70

12.2 Merck KGaA. 71

12.2.1 Key Facts. 71

12.2.2 Business Description. 71

12.2.3 Products and Services. 72

12.2.4 Financial Overview. 74

12.2.5 SWOT Analysis. 77

12.2.6 Key Developments. 77

12.3 AdipoGen Life Sciences Inc. 78

12.3.1 Key Facts. 78

12.3.2 Business Description. 78

12.3.3 Products and Services. 79

12.3.4 Financial Overview. 82

12.3.5 SWOT Analysis. 82

12.3.6 Key Developments. 82

12.4 Enzo Life Sciences Inc. 83

12.4.1 Key Facts. 83

12.4.2 Business Description. 83

12.4.3 Products and Services. 84

12.4.4 Financial Overview. 86

12.4.5 SWOT Analysis. 87

12.4.6 Key Developments. 87

12.5 ICU Medical Inc. 88

12.5.1 Key Facts. 88

12.5.2 Business Description. 88

12.5.3 Products and Services. 89

12.5.4 Financial Overview. 90

12.5.5 SWOT Analysis. 92

12.5.6 Key Developments. 93

12.6 Grifols SA. 94

12.6.1 Key Facts. 94

12.6.2 Business Description. 94

12.6.3 Products and Services. 95

12.6.4 Financial Overview. 97

12.6.5 SWOT Analysis. 99

12.6.6 Key Developments. 100

12.7 Geno Technology Inc. 101

12.7.1 Key Facts. 101

12.7.2 Business Description. 101

12.7.3 Products and Services. 102

12.7.4 Financial Overview. 105

12.7.5 SWOT Analysis. 105

12.7.6 Key Developments. 106

12.8 B Braun Medical Inc. 107

12.8.1 Key Facts. 107

12.8.2 Business Description. 107

12.8.3 Products and Services. 108

12.8.4 Financial Overview. 111

12.8.5 SWOT Analysis. 111

12.8.6 Key Developments. 112

12.9 Pfizer Inc. 113

12.9.1 Key Facts. 113

12.9.2 Business Description. 113

12.9.3 Products and Services. 114

12.9.4 Financial Overview. 115

12.9.5 SWOT Analysis. 117

12.9.6 Key Developments. 118

12.10 Ward's Science. 119

12.10.1 Key Facts. 119

12.10.2 Business Description. 119

12.10.3 Products and Services. 120

12.10.4 Financial Overview. 127

12.10.5 SWOT Analysis. 128

12.10.6 Key Developments. 128

13. Appendix 129

13.1 About Us. 129

13.2 Glossary of Terms. 131

List of Tables

Table 1. US Physiological Saline Market Segmentation. 14

Table 2. Normal Saline 2020-2030 (US$ Mn) 34

Table 3. Normal Saline 2020-2030 (US$ Mn) 36

Table 4. Hypotonic Saline 2020-2030 (US$ Mn) 38

Table 5. Balanced Saline Solution (BSS) 2020-2030 (US$ Mn) 40

Table 6. Flexible Bags 2020-2030 (US$ Mn) 43

Table 7. Plastic Bottles 2020-2030 (US$ Mn) 45

Table 8. Glass Bottles 2020-2030 (US$ Mn) 47

Table 9. Topical 2020-2030 (US$ Mn) 61

Table 10. Glossary of Terms, US Physiological Saline Market 131

List of Figures

Figure 1. US Physiological Saline Market Segmentation, By Country. 15

Figure 2. Key Insights. 16

Figure 3. US - PEST Analysis. 22

Figure 4. US Physiological Saline Market - Key Industry Dynamics. 25

Figure 5. Impact Analysis of Drivers and Restraints. 29

Figure 6. US Physiological Saline Market Revenue (US$ Mn), 2020 – 2030. 31

Figure 7. US Physiological Saline Market Revenue Share, by Type 2022 & 2030 (%) 32

Figure 8. Normal Saline: US Physiological Saline Market – Revenue and Forecast to 2030 (US$ Million) 34

Figure 9. Hypertonic Saline: US Physiological Saline Market – Revenue and Forecast to 2030 (US$ Million) 36

Figure 10. Hypertonic Saline: US Physiological Saline Market – Revenue and Forecast to 2030 (US$ Million) 38

Figure 11. Balanced Saline Solution: US Physiological Saline Market – Revenue and Forecast to 2030 (US$ Million) 40

Figure 12. US Physiological Saline Market Revenue Share, by Packaging Type 2022 & 2030 (%) 41

Figure 13. Flexible Bags: US Physiological Saline Market – Revenue and Forecast to 2030 (US$ Million) 43

Figure 14. Plastic Bottles: US Physiological Saline Market – Revenue and Forecast to 2030 (US$ Million) 45

Figure 15. Glass Bottles: US Physiological Saline Market – Revenue and Forecast to 2030 (US$ Million) 47

Figure 16. US Physiological Saline Market Revenue Share, by Application 2022 & 2030 (%) 48

Figure 17. Intravenous: US Physiological Saline Market – Revenue and Forecast to 2030 (US$ Million) 50

Figure 18. Ophthalmology: US Physiological Saline Market – Revenue and Forecast to 2030 (US$ Million) 52

Figure 19. Wound Care: US Physiological Saline Market – Revenue and Forecast to 2030 (US$ Million) 54

Figure 20. Endoscopy: US Physiological Saline Market – Revenue and Forecast to 2030 (US$ Million) 55

Figure 21. Skin Abrasion: US Physiological Saline Market – Revenue and Forecast to 2030 (US$ Million) 56

Figure 22. Others: US Physiological Saline Market – Revenue and Forecast to 2030 (US$ Million) 57

Figure 23. US Physiological Saline Market Revenue Share, by Route of Administration 2022 & 2030 (%) 58

Figure 24. Intravenous: US Physiological Saline Market – Revenue and Forecast to 2030 (US$ Million) 59

Figure 25. Topical: US Physiological Saline Market – Revenue and Forecast to 2030 (US$ Million) 60

Figure 26. US Physiological Saline Market Revenue Share, by End User 2022 & 2030 (%) 62

Figure 27. Hospitals: US Physiological Saline Market – Revenue and Forecast to 2030 (US$ Million) 63

Figure 28. Specialty Clinics: US Physiological Saline Market – Revenue and Forecast to 2030 (US$ Million) 64

Figure 29. Ambulatory Surgical Centers: US Physiological Saline Market – Revenue and Forecast to 2030 (US$ Million) 65

Figure 30. Homecare: US Physiological Saline Market – Revenue and Forecast to 2030 (US$ Million) 66

Figure 31. Others: US Physiological Saline Market – Revenue and Forecast to 2030 (US$ Million) 67

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely - analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You'll receive access to the report within 4-6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we'll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we're happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you're considering, and we'll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report's scope, methodology, customization options, or which license suits you best, we're here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we'll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we'll ensure the issue is resolved quickly so you can access your report without interruption.

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Dec 2023

Prenatal Testing Services Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Diagnostic Type (Noninvasive and Invasive), Disease (Aneuploidy, Microdeletions, Structural Chromosomal Abnormalities, and Others), End User (Hospitals, Diagnostic Laboratories, Specialty Clinics, and Other End Users), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Dec 2023

Joint Resurfacing Devices Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Knee, Hip, Shoulder, Ankle, and Others), Material (Metal, Ceramic, and Others), End User (Hospitals, Orthopedic Clinics, Ambulatory Surgical Centers, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South and Central America)

Dec 2023

Embolization Plugs Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Application (Neurology, Peripheral Vascular Disease, Oncology, Urology, and Others), End User (Hospital, Ambulatory Centers, and Others), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Dec 2023

Aesthetic Exosomes Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Source (Human-derived, Animal-derived, and Plant-derived), Route of Administration (Topical and Injectable), Application (Skin Rejuvenation, Wrinkle Reduction and Fine Line Correction, Scar and Pigmentation, Post-procedure Recovery, Hair Restoration, and Others), and End User (Hospitals, Dermatology Clinics, Medical Spas, and Others), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Dec 2023

Carrier Testing Services Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Expanded Carrier Screening and Targeted Disease Carrier Screening), Medical Condition (Pulmonary Conditions, Hematological Conditions, Neurological Conditions, and Other Medical Conditions), End User (Hospital-Based Laboratories, Diagnostic Laboratories, and Other End Users), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Dec 2023

Natural Albumin Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Source (Human Serum Albumin, Bovine Serum Albumin, and Plant Serum Albumin), Application (Therapeutic Applications, Drug Delivery, Disease Diagnostics, Research, and Others Applications), and End User (Hospitals and Clinics, Pharmaceutical and Biotechnological Companies, Research Institutes, Diagnostic Laboratories, Homecare Settings, and Others)

Dec 2023

Recombinant Albumin Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Source (Human Recombinant Albumin, Bovine Recombinant Albumin, and Others), Application (Excipient in Biotherapeutics And Vaccines, Cell Culture, Drug Delivery, Diagnostics, and Others), and End User (Pharmaceutical and Biotechnology Companies, Research Institutes, Hospitals and Diagnostic Laboratories, and Others)

Dec 2023

Predictive Genetic Testing Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Predispositional Testing and Presymptomatic Testing), Disease (Cancer, Cardiovascular Diseases, Metabolic Diseases, and Other Diseases), End User (Hospital-Based Laboratories, Diagnostic Laboratories, and Other End Users), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Get Free Sample For

Get Free Sample For