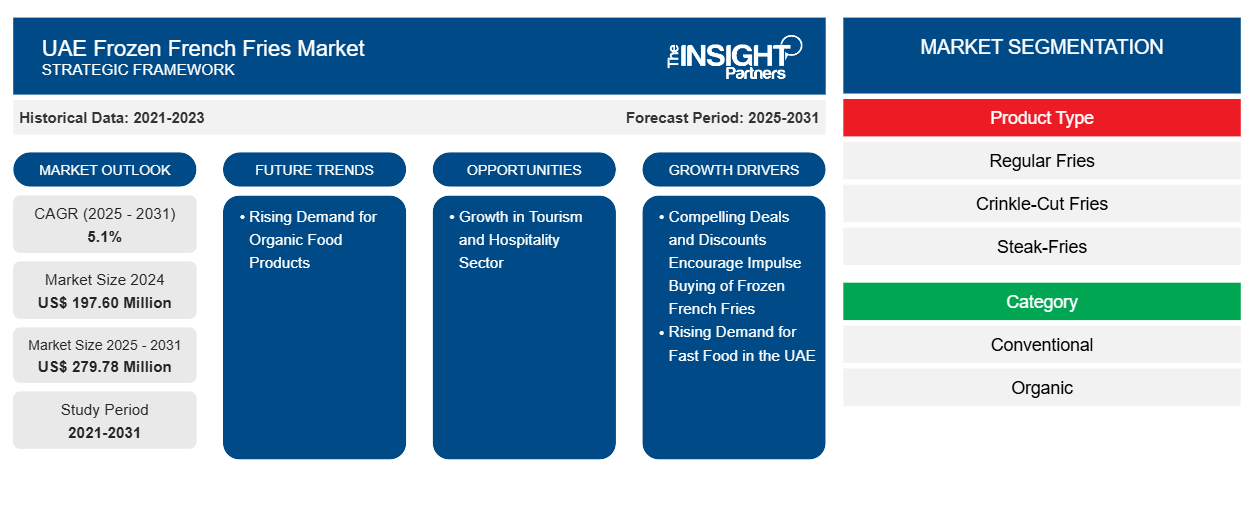

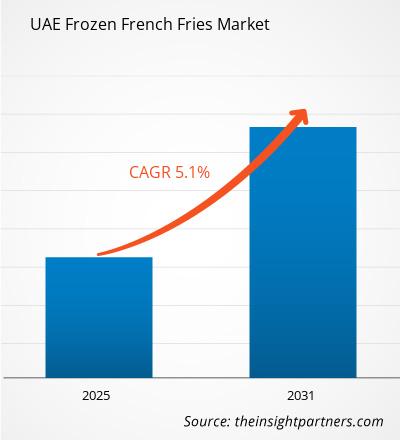

The UAE frozen French fries market size is projected to reach US$ 279.78 million by 2031 from US$ 197.60 million in 2024. The market is expected to register a CAGR of 5.1% from 2025 to 2031. The rising demand for organic food products is likely to remain a key trend in the UAE frozen French fries market.

UAE Frozen French Fries Market Analysis

Western fast-food chains such as McDonald's and Burger King have significantly influenced consumer familiarity with French fries in the UAE, leading to increased retail demand for home consumption. As a result, hypermarkets and supermarkets (e.g., Carrefour, Lulu, and Spinneys) have expanded their frozen food sections. Frozen French fries are among the notable packaged convenience food products that appeal to most consumers across the UAE. These are adaptable to local tastes and can be enjoyed with traditional dishes such as shawarma and falafel or as a standalone snack. Nonetheless, price competitiveness plays a pivotal role in shaping consumer behavior. A substantial percentage of the consumer base opts for cost-effective frozen French fries as an accessible, budget-conscious convenience food solution. To effectively capture the price-sensitive demographic, retailers frequently introduce strategic promotional initiatives by including discounts and bulk-buy offers, which encourage impulse purchases. For instance, supermarkets, such as Carrefour in the UAE, offer promotional discounts on popular frozen French fries brands, including a 28% discount on McCain Foods Ltd and a 26% discount on Lamb Weston Holdings Inc., making them appealing to consumers. These pricing tactics not only drive sales volume but also enhance consumer value perception, positioning the products of interest as affordable yet high in demand within the competitive retail landscape.

UAE Frozen French Fries Market Overview

The frozen French fries market in the UAE has experienced massive growth over the past few years, primarily because of the thriving food service sector and an increasing demand for convenience foods from consumers. Rapid urbanization and changing lifestyles have increased the number of fast-food outlets and casual dining establishments, leading to a significant demand for quality frozen potato products. The youth population in the UAE is growing, and disposable incomes are increasing. The diversified expatriate population in the UAE is another factor that increases consumption. Key players are expanding their product lines, concentrating on new flavors and healthier options to attract health-conscious consumers.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

UAE Frozen French Fries Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

UAE Frozen French Fries Market Drivers and Opportunities

Rising Demand for Fast Food in UAE

Western dietary patterns have significantly influenced the eating patterns in the UAE. French fries are a staple in many fast-food meals, contributing to their rising consumption. The increase in fast-food chains and quick-service restaurants in the country is a primary driving factor contributing to the increasing demand for frozen French fries. The UAE has a significant portion of its population living in urban areas. The demand for fast food, especially among young consumers, increases as the cities expand. To cater to this growing demand, several fast-food chains have been launched in the country. For instance, in 2023, the UAE-based burger chain Pickl planned to expand to 50 new GCC locations over the next five years. Pickl also announced plans to open its first restaurant in Qatar in 2023. In August 2024, Smacks Hamburgers launched its burger chain in Dubai. Moreover, Five Guys, a burger chain, made its debut at Dubai International Airport in the UAE in June 2024.

Growth in Tourism and Hospitality Sector

Economic growth, tourism development, government initiatives, and global events contribute to the growth of hotel establishments in the UAE. The country has experienced economic growth, attracting domestic and international investments. A thriving economy correlates with increased business activities, conferences, and tourism, leading to the development of the hospitality industry. The UAE expects to register 40 million visitors by 2030. The UAE's Tourism Strategy 2031 focuses on promoting a unified tourism identity, diversifying tourism products, building tourism capabilities, and increasing investments. Thus, the growth in the tourism and hospitality sector is expected to provide lucrative opportunities for the UAE in the coming years.

UAE Frozen French Fries Market Report Segmentation Analysis

Key segments that contributed to the derivation of the UAE frozen French fries market analysis are product type, category, and end user.

- Based on product type, the market is segmented into regular fries, crinkle-cut fries, steak-fries, and others. The regular fries segment held the largest share of the market in 2024.

- In terms of category, the market is segmented into conventional and organic. The conventional segment held a larger share of the market in 2024.

- Based on end user, the market is segmented into food retail and food service. The food service segment held a larger share of the market in 2024.

UAE Frozen French Fries Market Share Analysis

The scope of the UAE frozen French fries market report focuses on the market scenario in terms of historical market revenues and forecasts.

The UAE fast food industry is one of the region's most competitive, with established international players and emerging local chains. The high demand for convenient and affordable meals contributes to the addition of French fries to the menu by foodservice operators. Fast foods, such as French fries, are popular globally across all demographics. The country witnesses significant urbanization with a high number of consumers with busy lifestyles. Consumers have also adopted the culture of dining or eating out. Fast-food restaurants cater to this shift by offering quick and affordable meals. This is contributing to the growth of the UAE frozen French fries market.

UAE Frozen French Fries Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 197.60 Million |

| Market Size by 2031 | US$ 279.78 Million |

| CAGR (2025 - 2031) | 5.1% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

United Arab Emirates

|

| Market leaders and key company profiles |

|

UAE Frozen French Fries Market Players Density: Understanding Its Impact on Business Dynamics

The UAE Frozen French Fries Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the UAE Frozen French Fries Market top key players overview

UAE Frozen French Fries Market News and Recent Developments

The UAE frozen French fries market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the UAE frozen French fries market are listed below:

- McCain Foods Ltd acquired the predictive crop intelligence portfolio from Resson, an analytics technology firm enhancing farming efficiency. This acquisition is pivotal to McCain Foods Ltd.'s innovation to use digital technology to transform agriculture. (Source: McCain Foods Ltd, Press Release, June 2022)

- BRF SA announced the acquisition of a modern processed foods plant in Henan province, China. The facility has two food processing lines, with a current capacity of approximately 30,000 tons annually. (Source: BRF SA, Press Release, November 2024)

- McCain Foods Ltd signed a three-year partnership agreement with the Toronto Blue Jays in Canada. This partnership is expected to strengthen the company's presence in the Canadian market. (Source: McCain Foods Ltd, Press Release, April 2024)

UAE Frozen French Fries Market Report Coverage and Deliverables

The "UAE Frozen French Fries Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- UAE frozen French fries market size and forecast at country levels for all the key market segments covered under the scope

- UAE frozen French fries market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter's Five Forces and SWOT analysis

- UAE frozen French fries market analysis covering key market trends, country framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the UAE frozen French fries market

- Detailed company profiles

Frequently Asked Questions

What would be the estimated value of the UAE frozen French fries market by 2031?

What is the expected CAGR of the UAE frozen French fries market?

Which are the leading players operating in the UAE frozen French fries market?

Which product type segment dominated the UAE frozen French fries market in 2024?

What are the driving factors impacting the UAE frozen French fries market?

What are the future trends of the UAE frozen French fries market?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For