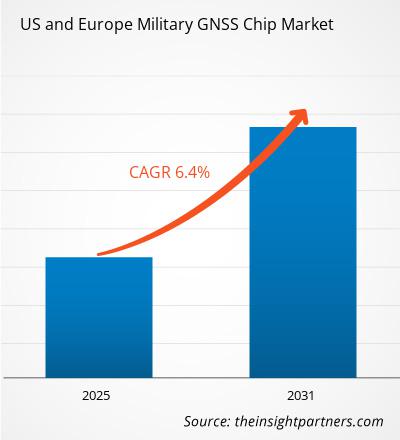

The US and Europe Military GNSS Chip Market size is expected to reach US$ 825.29 million by 2031 from US$ 539.91 million in 2024. The market is anticipated to register a CAGR of 6.4% from 2025–2031. The integration of GNSS with Inertial Navigation Systems (INS) is likely to bring new trends to the market in the coming years.

US and Europe Military GNSS Chip Market Analysis

The increasing demand for secure and resilient navigation solutions in contested or GPS-denied environments is pushing the adoption of GNSS technologies with anti-jamming, anti-spoofing, and encrypted signal capabilities. The US military’s M-Code and Galileo’s Public Regulated Service are among the examples of such capabilities. Growing investments in autonomous and unmanned systems, including drones, ground vehicles, and maritime platforms, are fueling demand for GNSS chips capable of supporting complex defense operations. Geopolitical tensions and the rising need for real-time situational awareness and force coordination are compelling defense agencies to modernize and diversify their PNT capabilities, further fueling the demand.

US and Europe Military GNSS Chip Market Overview

A GNSS (Global Navigation Satellite System) chip is a semiconductor component integrated into electronic devices to enable the reception and processing of signals from satellite navigation systems such as GPS (the US), Galileo (EU), and GLONASS (Russia). They provide positioning, navigation, and timing (PNT) information crucial for applications, including military, automotive, aviation, and consumer electronics. GNSS receivers are electronic devices that process signals from multiple GNSS to determine precise position, velocity, and timing information. GNSS modules are integrated components containing the receiver and related hardware designed for easy integration into larger systems. In military and defense applications, these receivers and modules enable accurate navigation, targeting, reconnaissance, and secure communication in diverse and challenging environments. It supports mission-critical operations with enhanced precision, reliability, and resistance to jamming and spoofing.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US and Europe Military GNSS Chip Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US and Europe Military GNSS Chip Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

US and Europe Military GNSS Chip Market Drivers and Opportunities

Rising Military Spending

With nearly 1.3 million active-duty personnel, the US is investing in advanced defense technologies, surpassing the total combined defense spending of the 30 other NATO member nations between 2014 and 2022. This escalating investment in the military & defense sectors globally has direct implications for the GNSS chip market, particularly in military and aerospace applications. GNSS chips are critical for defense operations. They support precision-guided munitions, unmanned aerial vehicles (UAVs), missile navigation, surveillance, and secure communication systems. The demand for high-accuracy, multi-frequency, and anti-spoofing GNSS solutions is accelerating as armed forces modernize and prioritize situational awareness, real-time geolocation, and interoperability in complex combat environments. Defense-specific GNSS applications require robust, hardened chipsets that can function reliably under extreme conditions, driving innovation in chip architecture and satellite signal integration.

Expansion of Secure Multi-GNSS Capabilities in Military-Grade Chipsets

Published on October 31, 2024, Vaisala’s announcement of multi-GNSS support and industry-first message authentication within its weather monitoring equipment underscores a strategic shift toward more resilient and secure satellite navigation infrastructures. These technologies, originally tailored for meteorological agencies, offer defense applications—especially in enhancing the reliability of atmospheric data crucial to military operations and national security planning. The introduction of multi-GNSS capabilities allows systems to access multiple satellite constellations simultaneously. It reduces the risk posed by signal interference, whether caused by adverse environmental conditions or hostile jamming. This introduction is a direct value proposition for defense sectors in the US and Europe, where the ability to maintain situational awareness and coordinate logistics in GPS-denied environments is critical. Vaisala’s testing demonstrates a 60% improvement in data availability through multi-GNSS. It offers a benchmark for military-grade chip manufacturers to meet defense specifications in navigation and timing applications.

The implementation of message authentication technologies by Vaisala represents a leap forward in cybersecurity for GNSS-based systems. The military sector, highly sensitive to cyber threats and signal spoofing, stands to benefit from chips that embed similar data integrity features. As adversarial tactics become digitally sophisticated, GNSS chips designed with embedded authentication can safeguard command-and-control systems, weather forecasting tools, drone operations, and other assets dependent on precise geolocation and telemetry.

US and Europe Military GNSS Chip Market Report Segmentation Analysis

Key segments that contributed to the derivation of the US and Europe Military GNSS Chip Market analysis are product type, torque, speed, and end-user.

- Based on type, the market is divided into GPS, GLONASS, Galileo, and others. The GPS segment dominated the market in 2024.

- By platform, the market is categorized into ground, air, maritime, and precision-guided munitions (PGM). The ground segment is divided into handheld and portable, mounted system, and infrastructure-based. Similarly, the air segment is categorized into UAVs and aircraft. The maritime segment is classified into surface vessels, submarines, and unmanned maritime systems. The precision-guided munitions (PGM) segment is categorized into missiles and artillery. The ground segment dominated the market in 2024.

- Per application, the market is divided into navigation, target tracking, missile and projectile guidance, search and rescue, reconnaissance, nuclear detonation detectors, and asset tracking ( GNSS+GPRS). The navigation segment dominated the market in 2024.

US and Europe Military GNSS Chip Market Share Analysis by Geography

The US and Europe Military GNSS Chip Market is segmented into the US and European countries. Of all the countries US dominated the market in 2024.

The US Department of Defense (DoD) is currently upgrading its military systems by incorporating advanced GNSS technology to bring improvements in its positioning, navigation, and timing (PNT) capabilities. This modernization effort aims to enhance operational efficiency, security, and strategic decision-making across defense platforms. The DoD's alternative PNT science and technology strategy focuses on two key areas. These areas include enhancing sensor technology to deliver accurate relative positioning and navigation, and leveraging external sources to provide reliable absolute location data. In February 2024, BAE Systems completed the Critical Design Review for the MGUE Increment 2 program as a part of a US$247 million contract with the US Space Force. This initiative is focused on developing a Next-Generation Application-Specific Integrated Circuit (NG ASIC) to strengthen M-Code capabilities, ensuring reliable PNT in environments where GPS signals are unavailable or compromised. The program targets the development of a compact GNSS receiver designed for integration across a range of military platforms, including handheld systems and precision-guided weapons. The project is scheduled for completion in 2025.

In March 2025, the US Army authorized a full-rate production of the MAPS Generation II system, developed by Collins Aerospace. This vehicle-mounted solution leverages sensor fusion algorithms and non-radio frequency sensors to deliver reliable PNT data in GPS-denied environments. Designed to support multiple users on a single platform, it reduces the requirement for duplicate GPS receivers and antennas. The program has a budget allocation of approximately US$500 million, with plans to acquire 619 units during fiscal year 2025. Thus, such investments in R-GPS drive the growth of the US military GNSS chip market.

US and Europe Military GNSS Chip Market Regional Insights

The regional trends and factors influencing the US and Europe Military GNSS Chip Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses US and Europe Military GNSS Chip Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for US and Europe Military GNSS Chip Market

US and Europe Military GNSS Chip Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 539.91 Million |

| Market Size by 2031 | US$ 825.29 Million |

| Global CAGR (2025 - 2031) | 6.4% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | US

|

| Market leaders and key company profiles |

US and Europe Military GNSS Chip Market Players Density: Understanding Its Impact on Business Dynamics

The US and Europe Military GNSS Chip Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the US and Europe Military GNSS Chip Market are:

- Thales SA

- BAE Systems Plc

- General Dynamics Mission Systems Inc

- Leonardo S.p.A.

- Northrop Grumman Corp

- L3Harris Technologies Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the US and Europe Military GNSS Chip Market top key players overview

US and Europe Military GNSS Chip Market News and Recent Developments

The US and Europe Military GNSS Chip Market is evaluated by gathering qualitative and quantitative data post primary and secondary research. This data includes important corporate publications, association data, and databases. A few of the developments in the US and Europe Military GNSS Chip Market are listed below:

- Thales, the European leader in resilient navigation, announced a €55 million investment to strengthen its industrial sites in Châtellerault and Valence, France. This investment, which will be made between 2025 and 2028, will meet the growing demand for high-performance navigation solutions, both civilian and military. It will strengthen its sovereign and cutting-edge industrial base.

(Source: Thales, Press Release, March 2025)

- L3Harris Technologies received a contract from the US Space Force’s Space Systems Command to design concepts for Phase 0 of the Resilient Global Positioning System (R-GPS) program. The R-GPS program is a procurement of cost-effective small satellites that will augment the existing 31-satellite GPS constellation. It provides resilience to military and civil GPS users. Space Force plans to produce and launch up to eight satellites to address jamming, spoofing, and more permanent disruptions.

(Source: L3Harris Technologies, Press Release, January 2025)

US and Europe Military GNSS Chip Market Report Coverage and Deliverables

The "US and Europe Military GNSS Chip Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering the areas mentioned below:

- US and Europe Military GNSS Chip Market size and forecast at regional and country levels for all the key market segments covered under the scope

- US and Europe Military GNSS Chip Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- US and Europe Military GNSS Chip Market analysis covering key market trends, regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the US and Europe Military GNSS Chip Market

- Detailed company profiles

Frequently Asked Questions

What is the expected CAGR of the US and Europe military GNSS chip market?

The market is expected to register a CAGR of 6.4% during 2025–2031.

What are the factors driving the US and Europe military GNSS chip market?

growing population and urbanization and rising global temperatures drive the market growth.

Which are the leading players operating in the US and Europe military GNSS chip market?

Thales SA, BAE Systems Plc, General Dynamics Mission Systems Inc, Leonardo S.p.A., Northrop Grumman Corp, L3Harris Technologies Inc, Hertz Systems Ltd Sp. z o. o., Hexagon AB, Juniper Systems Inc, Safran SA, and RTX CORPORATION are key players operating in the market.

What are the future trends in the US and Europe military GNSS chip market?

Accelerated Manufacturing Expansion is expected to emerge as a future trend in the market during the forecast period.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - US and Europe Military GNSS Chip Market

- Thales SA

- BAE Systems Plc

- General Dynamics Mission Systems Inc#Leonardo S.p.A.

- Northrop Grumman Corp

- L3Harris Technologies Inc

- Hertz Systems Ltd Sp. z o. o.

- Hexagon AB

- Juniper Systems Inc

- Safran SA

- RTX CORPORATION

Get Free Sample For

Get Free Sample For