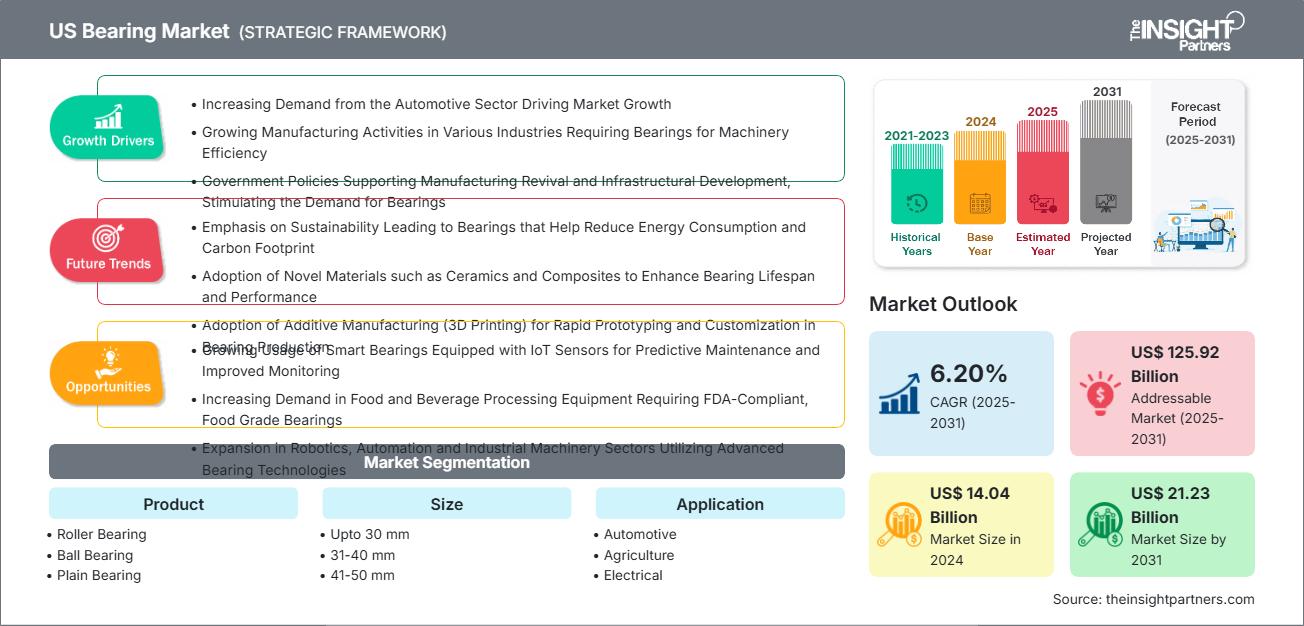

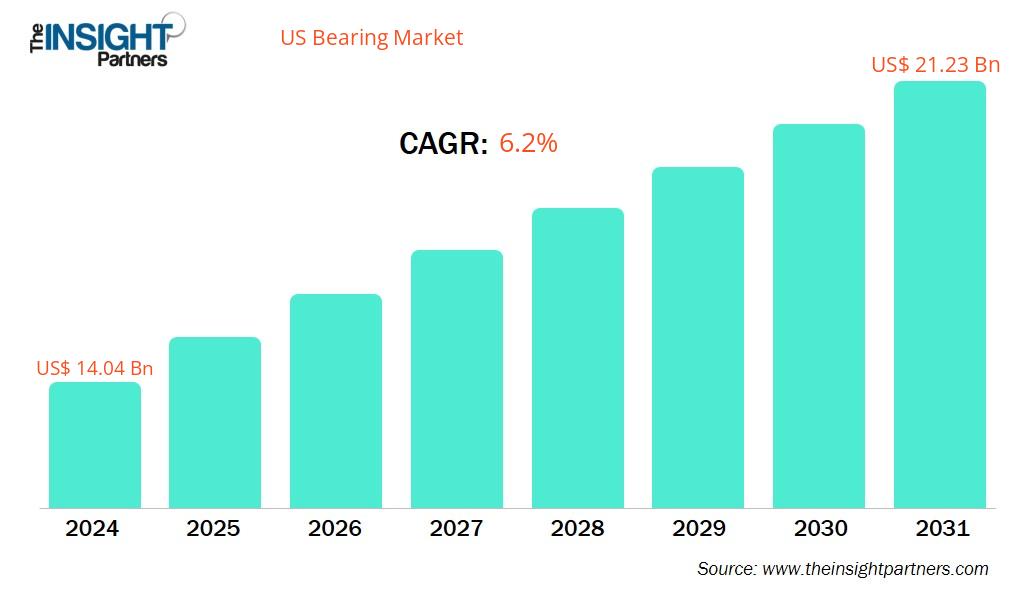

The US bearing market size is projected to reach US$ 21.23 billion by 2031 from US$14.04 billion in 2024. The market is expected to register a CAGR of 6.20% during 2025–2031.

US Bearing Market Analysis

Bearings play a critical role in enhancing the efficiency and reliability of machinery in the US, delivering significant business advantages across various industries. By providing essential support for rotating and moving components, bearings reduce direct metal-to-metal contact, thereby minimizing friction, heat generation, and wear. This results in lower maintenance costs and extended equipment lifespans, which are crucial for maintaining operational continuity and cost-effective management in the manufacturing, automotive, aerospace, and industrial sectors.

US Bearing Market Overview

The US bearing market revolves around mechanical components known as bearings, which are designed to reduce friction between rotating or moving parts in machinery, ensuring smooth and efficient motion. Bearings offer several key benefits, including minimizing wear and tear, enhancing operational efficiency, and extending equipment lifespan. They find extensive applications across diverse sectors, including automotive, aerospace, industrial machinery, agriculture, construction, and household appliances. Common types of bearings used in the US market include ball bearings, roller bearings, and plain bearings; each suited for specific load and speed conditions to optimize machine performance.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US Bearing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US Bearing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

US Bearing Market Drivers and Opportunities

Market Drivers:

- Increasing Demand from the Automotive Sector Driving Market Growth: The increasing production of automobiles and the rising adoption of technologically advanced vehicles drive the US bearing market.

- Growing Manufacturing Activities in Various Industries Requiring Bearings for Machinery Efficiency: Growing manufacturing activities in industries such as aerospace, agriculture, mining, and construction drive the US bearing market growth.

- Government Policies Supporting Manufacturing Revival and Infrastructural Development, Stimulating the Demand for Bearings: Government policies foster an environment that encourages reindustrialization by incentivizing domestic manufacturing, investing heavily in infrastructure upgrades, and promoting technological advancements in industrial processes.

- Digitalization, Sensors, and Industry 4.0 Integration: More bearings are getting smart: embedded sensors, remote monitoring, condition-based/predictive maintenance. This lets end users avoid unexpected failures.

- Focus on Energy Efficiency & Sustainability: Bearings contribute to friction losses, manufacturers are under pressure (from regulations, customers, energy cost) to reduce energy consumption.

Market Opportunities:

- Growing Usage of Smart Bearings Equipped with IoT Sensors for Predictive Maintenance and Improved Monitoring: The rising use of smart bearings equipped with IoT sensors presents a significant market opportunity in the US bearing market by driving predictive maintenance and enhanced monitoring capabilities.

- Increasing Demand in Food and Beverage Processing Equipment Requiring FDA-Compliant, Food Grade Bearings: Increasing demand for food and beverage processing equipment requiring FDA-compliant, food-grade bearings presents a significant market opportunity in the US bearing market.

- Expansion in Robotics, Automation and Industrial Machinery Sectors Utilizing Advanced Bearing Technologies: Expansion in robotics, automation, and industrial machinery is emerging as one of the most promising opportunities for the US bearing market, driven by the increasing adoption of advanced bearing technologies designed to enhance performance, efficiency, and durability.

- Lightweight / Advanced Material Bearings: Using ceramics, composites or lighter metals to reduce weight (important for EVs, aerospace), reduce inertia, improve fuel / energy efficiency.

- Expansion into Renewable Energy & Infrastructure: Wind turbines, solar energy trackers, and infrastructure (rail, heavy construction) require bearings with specialized performance. As investment in renewables and infrastructure rises, so does demand.

US Bearing Market Report Segmentation Analysis

The US bearing market is divided into different segments to give a clearer view of how it works, its growth potential, and the latest trends. Below is the standard segmentation approach used in most industry reports:

By Product:

- Roller Bearing: Roller bearings are essential mechanical components designed to reduce friction and support rotating or moving parts by using cylindrical, tapered, or spherical rollers between inner and outer rings.

- Ball Bearing: A ball bearing is a mechanical component designed to reduce rotational friction and support radial and axial loads.

- Plain Bearing: Plain bearings, also known as sliding bearings, are mechanical components designed to minimize friction between two contacting surfaces, typically supporting rotating or sliding shafts without the use of rolling elements.

By Size:

- Upto 30 mm: Bearings with diameters below 30 mm are essential components in the U.S. market, predominantly serving high-volume applications across consumer electronics, medical devices, robotics, and automotive systems.

- 31-40 mm: The "30-40mm" segmented size within the U.S. bearing market refers to bearings with diameters ranging from 30 to 40 millimeters.

- 41-50 mm: The "41-50 mm" size segment in the U.S. bearing market refers to bearings with an inner or outer diameter ranging from 41 to 50 millimeters.

- 51-60 mm: The "51-60 mm" size segment in the U.S. Bearing Market refers to bearings with diameters ranging between 51 and 60 millimeters.

- 61-70 mm: The "61-70 mm" size segment in the U.S. bearing market refers to bearings with an outer diameter ranging between 61 mm and 70 mm.

- 71 mm and Above: "70 mm and above" in the U.S. bearing market refers to bearings with an outer diameter of 70 millimeters or larger.

By Application:

- Automotive

- Agriculture

- Electrical

- Mining and Construction

- Aerospace and Defense

- Others

Each application has a specific feature that fulfills the industries requirement. It influences baring adoption and functionality preferences.

By Country:

- US

The US bearing market is expected to witness the fastest growth. Bearings contribute to energy savings by reducing frictional resistance, thereby decreasing the power required to operate equipment.

US Bearing Market Report Scope

Report Attribute

Details

Market size in 2024

US$ 14.04 Billion

Market Size by 2031

US$ 21.23 Billion

CAGR (2025 - 2031) 6.20%

Historical Data

2021-2023

Forecast period

2025-2031

Segments Covered

By Product - Roller Bearing

- Ball Bearing

- Plain Bearing

By Size - Upto 30 mm

- 31-40 mm

- 41-50 mm

- 51-60 mm

- 61-70 mm

- 71 mm

- Above

By Application - Automotive

- Agriculture

- Electrical

- Mining and Construction

- Aerospace and Defense

- Others

Regions and Countries Covered

United State- United State

Market leaders and key company profiles

- The Timken Co

- RBC Bearings Incorporated

- NSK Ltd

- Schaeffler AG

- SKF AB

- Auburn Bearing & Manufacturig

- NTN Corp

- JTEKT Corp

- Scheerer Bearing Corporation

- Pacific Bearing Company

US Bearing Market Players Density: Understanding Its Impact on Business Dynamics

US Bearing Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 14.04 Billion |

| Market Size by 2031 | US$ 21.23 Billion |

| CAGR (2025 - 2031) | 6.20% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | United State

|

| Market leaders and key company profiles |

|

US Bearing Market Players Density: Understanding Its Impact on Business Dynamics

The US Bearing Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the US Bearing Market top key players overview

US Bearing Market Share Analysis by Geography

The US bearing market grows differently in each region owing to technological advancements. American manufacturers benefit from the versatility of bearings, which accommodate a wide range of load types—radial, axial, or combined—and operate efficiently at high speeds. Below is a summary of market share and trends by region:

1. US

- Key Drivers:

- Increased demand for machinery and automation boosts bearing usage.

- Adoption of robotics and automated systems in production lines increases bearing use.

- Wind turbines require large, high-load bearings in nacelles and gearboxes.

- Trends: Development of smart bearings with sensors improves monitoring and maintenance.

US Bearing Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

Competition is strong due to the presence of established players such as The Timken Co (US) and RBC Bearings Incorporated. Regional and niche providers such as NSK Ltd (Japan), Schaeffler AG (Germany), and SKF AB (Sweden) are also adding to the competitive landscape across different regions.

This high level of competition urges companies to stand out by offering:

- High-performance and long-lasting bearing solutions

- Customized bearing configurations

- Cost-effective production and pricing strategies

- Robust technical support and local distribution networks

Opportunities and Strategic Moves

- OEMs and aftermarket players in the U.S. bearing market are increasingly collaborating with material science and sensor technology providers to develop high-performance, longer-life bearings that meet the demands of electrification, automation, and high-speed operations across industries such as automotive, aerospace, and industrial machinery.

- Suppliers are shifting toward smart, connected bearing solutions that integrate condition monitoring, temperature sensing, and vibration analysis—often enabled by IoT and AI—to support predictive maintenance and reduce downtime, with offerings commonly bundled into value-added service contracts or digital platforms.

- Modular bearing assemblies and retrofit-compatible solutions are gaining momentum, particularly in the industrial and rail segments, allowing end-users to upgrade to advanced bearing units without major re-engineering, thereby extending asset life and reducing total cost of ownership.

Major Companies operating in the US Bearing Market are:

- The Timken Co

- RBC Bearings Incorporated

- NSK Ltd

- Schaeffler AG

- SKF AB

- Auburn Bearing & Manufacturing

- NTN Corp

- JTEKT Corp

- Scheerer Bearing Corporation

- Pacific Bearing Company

Disclaimer: The companies listed above are not ranked in any particular order.

Other companies analysed during the course of research:

- Bearing Service Company

- Applied Industrial Technologies

- American Roller Bearings

- Hirschmann Engineering USA

- Baldor Electric Company (ABB)

- Frantz Manufacturing Company

- Waukesha Bearings

- Alinabal Inc.

- OILES America

- LinTech

- Carter Bearings

- JSB Great Bearings

- MRC Bearings

- Kaydon Corporation

- Frantz Manufacturing Co.

US Bearing Market News and Recent Developments

- The Timken Company Acquired CGI, Inc. The Timken Company global technology leader in engineered bearings and industrial motion, has completed its previously announced acquisition of CGI, Inc. CGI manufactures precision drive systems for a broad range of automation markets, with a concentration in medical robotics. The business employs approximately 130 people and is expected to generate around $45 million in sales in 2024.

- RBC Bearings Incorporated Acquired VACCO Industries from ESCO Technologies Inc. RBC Bearings Incorporated (NYSE: RBC), a prominent international manufacturer of highly engineered precision bearings, components and essential systems for the aerospace, defense and industrial industries, announced that it has completed its previously announced acquisition of VACCO Industries from ESCO Technologies Inc. (NYSE: ESE) for $275 million in cash, subject to post-closing adjustments. The purchase price was paid with a draw under RBC’s $500 million bank revolving credit facility and cash on hand.

US Bearing Market Report Coverage and Deliverables

The "US Bearing Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- US Bearing Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- US Bearing Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- US Bearing Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the US Bearing Market

- Detailed company profiles

Frequently Asked Questions

Which segment are growing the fastest in the US bearing market?

What future trends are shaping the sector?

What factors create opportunities in the US bearing market?

2. Increasing Demand in Food and Beverage Processing Equipment Requiring FDA-Compliant, Food Grade Bearings

3. Expansion in Robotics, Automation and Industrial Machinery Sectors Utilizing Advanced Bearing Technologies

What are the major application of US bearing?

1. Automotive

2. Agriculture

3. Electrical

4. Mining and Construction

5. Aerospace and Defense

6. Others

What are the major trends of US bearing?

1. Emphasis on Sustainability Leading to Bearings that Help Reduce Energy Consumption and Carbon Footprint

2. Adoption of Novel Materials such as Ceramics and Composites to Enhance Bearing Lifespan and Performance

3. Adoption of Additive Manufacturing (3D Printing) for Rapid Prototyping and Customization in Bearing Production

Which size are driving the demand for US bearing?

1. Upto 30 mm

2. 31-40 mm

3. 41-50 mm

4. 51-60 mm

5. 61-70 mm

6. 71 mm and Above

What is the current size of the US bearing market?

What is the expected CAGR of the US bearing market through 2031?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For