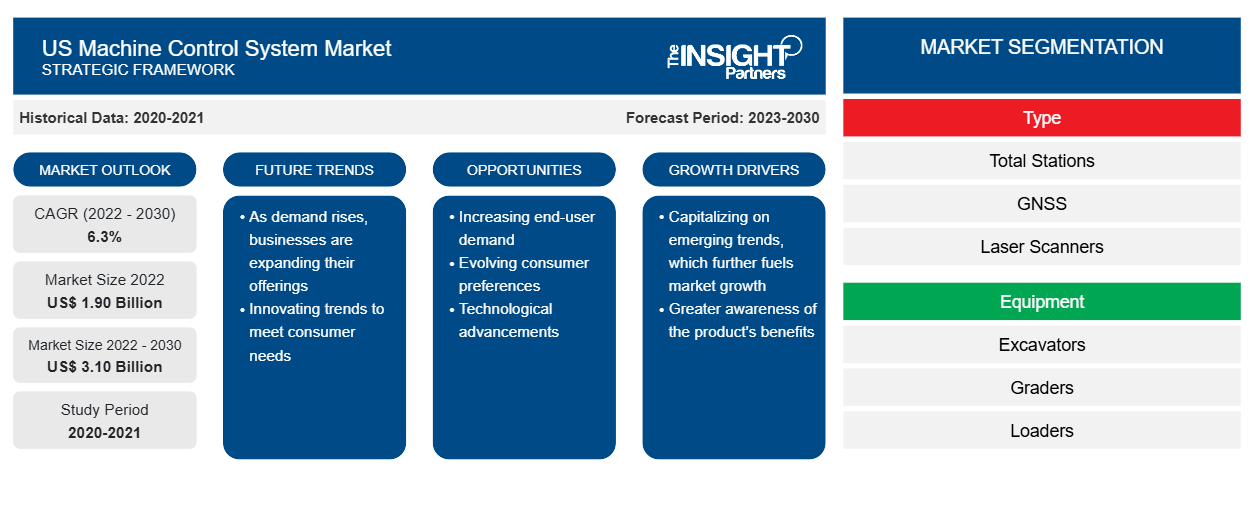

The US machine control system market was valued at US$ 1.90 billion in 2022 and is projected to reach US$ 3.10 billion by 2030; it is expected to register a CAGR of 6.3% from 2022 to 2030.

The US machine control system market forecast is estimated on the basis of various secondary and primary research findings such as key company publications, association data, and databases.

Analyst Perspective:

The integration of GPS (Global Positioning System) and GNSS (Global Navigation Satellite System) with machine control systems has significantly contributed to the accuracy and efficiency of machine control systems in the US. These advancements have revolutionized the construction industry by enabling precise control of construction and earthmoving equipment. Machine control systems use GPS and GNSS signals received by antennas on the machines to provide position and elevation references on the job site. This information is then compared to a digital terrain model of the proposed plans, allowing the machine control system to guide the cutting edge or blade to grade accurately and automatically. GPS and GNSS technology have several applications in various industries. In the construction industry, machine control systems enable grading tractors to compare a digital grading map to the position of the blade and cut it to the proper elevation and position on the job site. This eliminates the need for manual leveling and improves the efficiency of earthmoving projects.

Moreover, GNSS technology is integrated with heavy equipment, which is used in construction, mining, and precision agriculture. GNSS-based machine guidance systems help in automating the controls of construction equipment, such as excavators and bulldozers. In agriculture, GNSS technology enables automatic steering of agricultural equipment, aiding controlled traffic and row crop operations, as well as precise spraying. Market players are focusing on technological advancements. For instance, in December 2021, Trimble launched the Trimble R750 GNSS Modular Receiver, a connected base station for geospatial civil construction and agricultural applications. The R750 provides improved base station performance, delivering surveyors, contractors, and farmers with more reliable and accurate positioning in the field. Therefore, the increasing focus of market players on the integration of GPS and GNSS in machine control systems drives the US machine control system market. Moreover, the growing adoption of machine control systems in highway construction projects is considered one of the US machine control system market trends.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US Machine Control System Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Overview:

A machine control system is a technology that enables precise control and automation of machines, such as construction equipment, agricultural machinery, and industrial robots. It combines various components, including sensors, actuators, and software, to enhance the accuracy, efficiency, and productivity of these machines. Innovations in technology, such as the integration of GPS and GNSS systems, have significantly improved the accuracy and efficiency of machine control systems. This has led to increased demand from industries that rely on precise machine operations, such as construction and agriculture. The need for cost-effective and time-efficient operations drives the US machine control system market.

Machine control systems enable automation and reduce human error, resulting in improved productivity and reduced operational costs. Also, regulatory requirements and safety standards in industries such as construction and mining have increased the demand for machine control systems. These systems help ensure compliance with safety regulations, enhance worker safety, and minimize accidents. The growing trend toward digitalization and Industry 4.0 has also contributed to the expansion of the US machine control system market. The ability of these systems to integrate with cloud computing, IoT, and other digital technologies enables real-time monitoring, data analytics, and remote control, further enhancing operational efficiency and decision-making.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

US Machine Control System Market Driver:

Rising Utilization of Machine Control Systems to Streamline Earthwork Operations

A machine control system integrates computers, sensors, and communication networks to enable automated machine operation. The machine control system assists the machine operator in achieving the target plane easily and quickly in earthwork operations. The machine control system calculates the position of the instrument on a piece of machinery, including the blade of a bulldozer or the bucket of an excavator, via a display and allows the machine operator to identify the exact operation plane. Further, many companies are focused on introducing numerous advancements in the automation industry. A machine control system is integrated with hydraulics in order to automate operations. This is predominantly helpful on the site, where operators are building complex grades and site profiles. For instance, with the Leica Geosystems machine control system, earthmoving equipment operators can finish jobs in 25–75% less time. These results also vary based on the job site, machine type, and type of materials used during operations. Machine control systems are becoming the standard on an extensive range of earthmoving equipment, including dozers, graders, excavators, loaders, scrapers, and rollers. Thus, the rising utilization of machine control systems to streamline earthwork operations fuels the US machine control system market growth.

Country Analysis

All private and government real estate and commercial infrastructure developments in the US are a major source of employment. While the larger construction sector in the US is expected to remain under macroeconomic pressure, greater government spending on infrastructure projects will continue to benefit the industry in the short to medium term. In January 2023, the Federal Highway Administration (FHWA) announced an investment of US$ 2.1 billion in bridge infrastructure upgrades. The US$ 2.1 billion effort is part of the national government's large, committed investment in restoring highway bridges across the country. Thus, such construction development in the country is anticipated to propel the US machine control system market growth in the coming years.

Moreover, according to the American Road & Transportation Builders Association (ARTBA), The Infrastructure Investment and Jobs Act (IIJA)—which was changed into law on November 15, 2021—represents a significant milestone in federal highway investment, marking the largest year-to-year increase since the late 1950s. To assess the impact of this landmark legislation, economists at the American Road & Transportation Builders Association (ARTBA) analyze data from federal and state sources to quantify the ongoing highway, bridge, and safety improvements that have been initiated. As of August 30, 2023, many states have allocated a total of US$ 44.6 billion in highway and bridge formula funds to support more than 27,300 new projects. These figures are comparatively less than the US$ 53.5 billion invested in fiscal year 2022, which resulted in the support of over 29,000 additional projects. This comprehensive resource allows for tracking of highway and bridge formula funds, as well as discretionary funds, on a state and congressional district level. It provides insight into the way federal investments, including those made through the Infrastructure Investment and Jobs Act (IIJA), are being utilized in communities across the nation. Approximately 90% of the IIJA's highway resources are distributed to states through formula-based allocations. At the same time, the remaining funds are disbursed through discretionary grant awards and other designated programs. Such initiatives are expected to boost the demand for machine control systems, which contributing to the growing US machine control system market size.

Segment Analysis:

The "US machine control system market analysis” has been performed by considering the following segments: type, equipment, industry, view type, and type of delivery. In terms of type, the market is segmented into total stations, GNSS, laser scanners, airborne systems, GIS collectors, and others. Based on equipment, the market is segmented into excavators, graders, loaders, dozers, scrappers, paving systems, and others. In terms of industry, the market is categorized into infrastructure, commercial, residential, and industrial. Based on view type, the market is bifurcated into 2D and 3D. In terms of type of delivery, the market is divided into retrofit and OEM build.

Based on type, the GNSS segment holds the largest US machine control system market share in 2022 and is expected to record the highest CAGR during the forecast period. Based on equipment, the excavators held the largest US machine control system market share in 2022, and the loaders segment is expected to register the highest CAGR in the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Key Player Analysis:

Topcon Corp, Trimble Inc, Hemisphere GNSS Inc, Komatsu, Schneider Electric SE, MOBA MOBILE AUTOMATION AG, Leica Geosystems AG, ANDRITZ, M-Tech Control Corp, and AB Volvo are among the prominent players profiled in the US machine control system market report. In addition, several other players have been studied and analyzed during the study to get a holistic view of the market and its ecosystem. Several other essential market players were analyzed to get a holistic view of the market and its ecosystem.

Recent Developments:

Companies in the US machine control system market focus on both inorganic and organic strategies for their business growth. The US machine control system market report also emphasizes the key factors driving the market and prominent players' developments. As per company press releases, below are a few recent key developments:

- In February 2024, Topcon Positioning Systems announced the latest addition to its HiPer family of global navigation satellite system receivers. The HiPer CR is a compact and lightweight GNSS receiver designed for centimeter-level, real-time kinematic (RTK) accuracy for professionals engaged in a wide range of applications in the surveying, construction, engineering, forestry, and mining industries.

- In March 2023, Trimble introduced the Trimble Siteworks Machine Guidance Module, extending the capabilities of Trimble Siteworks Software from surveying and layout to support on-machine excavator guidance and operator assistance. With the addition of the new software module, contractors can use the same rugged Site Positioning Systems hardware and software to perform a variety of tasks on the job site, including surveying, machine guidance, in-field design, and reporting. Designed specifically for small site and utility contractors, the Siteworks Machine Guidance module gives users the ability to move the system between multiple excavators and job sites as an accessible and entry-level combination machine guidance and construction surveying solution.

US Machine Control System Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1.90 Billion |

| Market Size by 2030 | US$ 3.10 Billion |

| CAGR (2022 - 2030) | 6.3% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

United State

|

| Market leaders and key company profiles |

|

Frequently Asked Questions

What is the estimated global market size for the US machine control system market in 2022?

What are the driving factors impacting the US machine control system market?

What are the future trend of the US machine control system market?

What will be the market size for US machine control system market by 2030?

Which is the leading type segment in the US machine control system market?

Which are the key players holding the major market share of US machine control system market?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For