Vacuum Insulated Tubing Market Growth and Analysis by 2030

Vacuum Insulated Tubing Market Forecast to 2030 - Global Analysis by Application (Onshore and Offshore)

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Report Date : Jul 2023

- Report Code : TIPRE00029911

- Category : Manufacturing and Construction

- Status : Published

- Available Report Formats :

- No. of Pages : 108

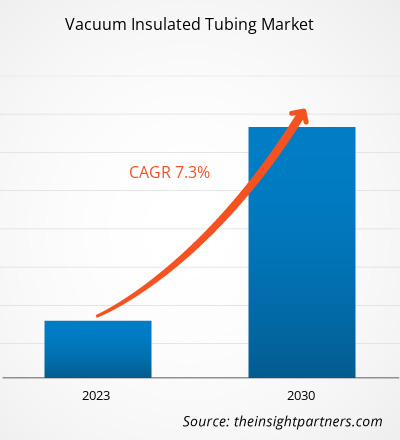

[Research Report] The vacuum insulated tubing market size is expected to grow from US$ 35.71 million in 2022 to US$ 61.38 million by 2030; it is estimated to record a CAGR of 7.3% from 2022 to 2030.

Analyst Perspective:

Based on country, the North America vacuum insulated tubing market is segmented into the US, Canada, and Mexico. North America is one of the leading oil-producing regions across the world. The US and Canada are major oil producers, with significant reserves and advanced extraction techniques such as hydraulic fracturing (fracking) and horizontal drilling. According to Energy Information Administration (EIA) report, ~100 countries across the globe produce crude oil; of these 100 countries, the top five countries contribute to the 51% share of overall crude oil production in 2021. The US and Canada contribute 14.5% and 5.8% of total global crude oil production, respectively. The US has recently experienced a surge in oil production, becoming a leading global producer which propels the vacuum insulated tubing market growth across the region due to growing demand for enhanced oil recovery.

Customizee This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONVacuum Insulated Tubing Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Vacuum Insulated Tubing Market Growth:

Material sourcing and operations of raw material suppliers were hindered due to the COVID-19 pandemic. The raw material suppliers faced several challenges related to remote operations, transportation services, and internal production operations that were largely interrupted due to a lack of manpower and other resources during the pandemic. All these factors increased the demand and supply gap between raw material suppliers and vacuum insulated tubing manufacturers across the world in 2020. Further, the vacuum insulated tubing market reported a gradual revival from supply chain disruptions in Q2 of 2020 as vacuum insulated tubing manufacturers started adopting new normal scenarios of manufacturing.

Vacuum Insulated Tubing Market Driver: Maximize Oil Reserves Recovery and Extend Field Life:

Owing to the higher exploitation of existing wells, several key oil and gas producers such as ExxonMobil, Shell plc, Chevron Corporation, PetroChina, and Saudi Aramco are focusing on maximizing the recovery factor (RF) from their existing oilfields and maintaining an economical oil rate. By implementing EOR methods, operators can revitalize reservoirs and extract additional oil, extending the field's productive life and maximizing the value of existing assets. Steam flooding EOR method technique helps improve oil displacement, reduce residual oil saturation, and enhance sweep efficiency within the reservoir. Thus, the rising need to maximize oil reserve recovery bolsters the vacuum insulation tubing market growth.

Segmental Analysis:

The offshore segment of the vacuum insulated tubing market involves the utilization of vacuum insulated tubing in oil and gas production wells located in marine environments. The segment consists of various offshore well types such as fixed platforms, floating production systems, and subsea wells. In offshore wells, vacuum insulated tubing can help to mitigate the production problem caused by the heat transfer from the produced reservoir fluids into the surrounding formation and casing annulus. Vacuum insulated tubing can effectively address issues such as hydrate plugging, paraffin deposition, annular pressure build-up in the outer casing string, and harsh environmental conditions, including saltwater corrosion, extreme temperatures, and high pressures. Increasing exploration and production activities in offshore reserves fuel the vacuum insulated tubing market size for the offshore segment. The rising number of oil and gas rigs in the US indicates growing drilling activities and potential future production. Thus, there will be a high demand for energy resources that may lead to increased offshore production and the need for vacuum insulated tubing to address heat transfer in deepwater operations. Vacuum insulated tubing enables efficient production in offshore wells by minimizing heat loss and maintaining the desired temperature of the produced fluids. The insulation properties of vacuum insulated tubing help optimize the performance of offshore production systems, enhancing production rates and overall operational efficiency.

Regional Analysis:

North America dominated the vacuum insulated tubing market in 2022 with a share of 51.3%; it would continue to dominate the market during the forecast period and account for 54.6% share by 2030. The Middle East & Africa is the second-largest contributor to the global vacuum insulated tubing market, followed by Asia Pacific.

In the Middle East & Africa (MEA), the UAE, Saudi Arabia, Iran, Oman, and Kuwait are among the key countries affected by the COVID-19 pandemic. Most economic operations in the region were suspended due to an increase in the number of COVID-19 cases in the first two quarters of 2020. Many countries in Africa are still in the developing phase. Countries in the Middle East, especially the Gulf Cooperation Council (GCC) countries, witnessed a notable decline in the oil & gas sector due to a sharp drop in oil demand from major end-user countries across Asia, Europe, and North America. As a result, countries in the MEA registered a low volume of oil and gas production, which subsequently hampered the demand for vacuum insulated tubing in the region.

Key Player Analysis:

The vacuum insulated tubing market analysis consists of the players such as Andmir Group, Exceed Oilfield Equipment Inc, Imex Canada Inc, ITP Interpipe, Lake Petro, Dongying Lake Petroleum Technology CO Ltd, Nakasawa, Shengji Group, Tenergy Equipment & Service Ltd, TMK Group, and Vallourec are among the players in the vacuum insulated tubing market TMK and Sankjack are the top two players owing to the diversified product portfolio offered.

Vacuum Insulated Tubing Market Regional InsightsThe regional trends and factors influencing the Vacuum Insulated Tubing Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Vacuum Insulated Tubing Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Vacuum Insulated Tubing Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 35.71 Million |

| Market Size by 2030 | US$ 61.38 Million |

| Global CAGR (2022 - 2030) | 7.3% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Application

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Vacuum Insulated Tubing Market Players Density: Understanding Its Impact on Business Dynamics

The Vacuum Insulated Tubing Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Vacuum Insulated Tubing Market top key players overview

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by the vacuum insulated tubing market players operating in the market. A few recent key vacuum insulated tubing market developments are listed below:

- In March 2022, ADNOC Onshore, which operates onshore and in shallow coastal waters of the Emirate of Abu Dhabi, announced a US$ 227 million contract for enhanced oil recovery (EOR) at Bab Field. The company used advanced polymers to boost recoverable reserves up to 70% while unlocking additional barrels of Murban crude.

- In April 2023, BP commenced oil production at its Argos platform located in the Gulf of Mexico. The Argos platform is a deepwater facility spread ∼200 miles south of New Orleans, Louisiana. The platform is designed with LoSal Enhanced Oil Recovery (EOR) and Dynamic Digital Twin technologies to extract oil from the Mad Dog 2 field, a large, high-quality oil reservoir located in southern Green Canyon area.

Frequently Asked Questions

Nivedita is an accomplished research professional with over 9 years of experience in Market Research and Business Consulting. Currently serving as a Project Manager in the ICT domain at The Insight Partners, she brings deep expertise in managing and executing Syndicated, Custom, Subscription-based, and Consulting research assignments across diverse technology sectors.

With a proven track record of delivering data-driven analysis and actionable insights, Nivedita has been a key contributor to several critical projects. Her work involves end-to-end project execution—right from understanding client objectives, analyzing market trends, to deriving strategic recommendations. She has collaborated extensively with leading ICT companies, helping them identify market opportunities and navigate industry shifts.

Nivedita holds an MBA in Management from IMS, Dehradun. Prior to joining The Insight Partners, she gained valuable experience at MarketsandMarkets and Future Market Insights in Pune, where she held various research roles and built a strong foundation in industry analysis and client engagement.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For