Vascular Closure Device Market Analysis and Opportunities by 2030

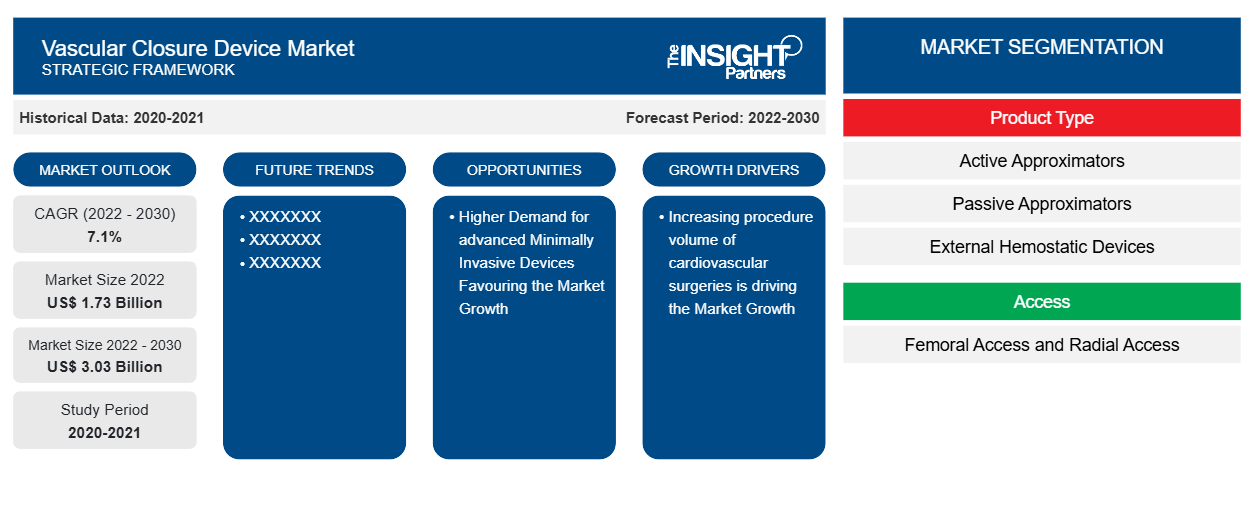

Vascular Closure Device Market Size and Forecast (2020-2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Active Approximators, Passive Approximators, and External Hemostatic Devices), Access (Femoral Access and Radial Access), Procedure (Interventional Cardiology, Interventional Radiology, and Endovascular Surgery), and End User (Hospitals, Ambulatory Surgical Centers, and Others), and Geography

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2022-2030- Report Date : Nov 2023

- Report Code : TIPHE100001123

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 197

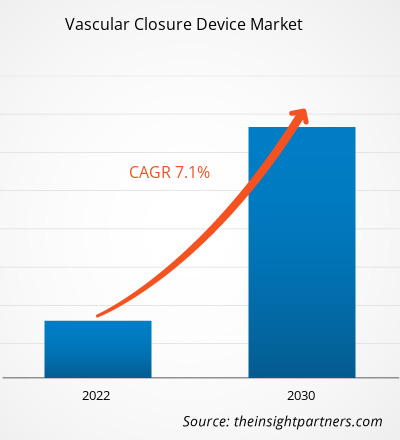

The vascular closure device market size is projected to reach US$ 3.03 billion by 2030 from US$ 1.73 billion in 2022. The market is expected to register a CAGR of 7.1% in 2022–2030. The global market's growth is primarily attributed to the higher prevalence of cardiovascular diseases and the burgeoning demand for minimally invasive devices. However, the risk of infection related to vascular closure devices may hinder the market growth.

Vascular Closure Device Market Analysis

Vascular closure devices (VCDs) are medical devices that are utilized following endovascular surgery or other cardiovascular procedures that need catheterization to achieve hemostasis of the small hole in the artery. Catheterization is necessary for a variety of cardiovascular operations, including interventional procedures like coronary thrombectomy, angioplasty, and stent insertion that aid in the diagnosis of damaged blood arteries. One of the leading causes of death worldwide is cardiovascular illnesses, which include acute myocardial infarction, angina pectoris, and atherosclerosis. Therefore, the market expansion for vascular closure devices is driven by the higher demand for minimally invasive devices.

Vascular Closure Device Market Overview

Cardiovascular diseases such as atherosclerosis, angina pectoris, and acute myocardial infarction are the major causes of mortality in the world. As per data provided by the World Health Organization (WHO), cardiovascular diseases cause nearly 17.9 million deaths every year, which makes it a leading cause of mortality among all noncommunicable diseases, followed by cancer, chronic respiratory diseases, and diabetes (including deaths associated with renal disorders). According to the World Heart Federation, high cholesterol causes 4.4 million deaths yearly, and ∼24% of cardiovascular-related deaths are associated with high low-density lipoprotein (LDL) levels. According to a study published in January 2023 by NCBI, in the US, the number of people aged 50 years and older is likely to reach 221.13 million by 2050 from 137.25 million in 2020. Among people from this age group, the number of people suffering from at least one chronic disease is projected to rise by 99.5%, reaching 142.66 million by 2050 from 71.52 million in 2020. Moreover, ~14 million people aged 50 and above are likely to have comorbidities in 2050.

Vascular closure devices (VCDs) offer a new way to enhance patients’ comfort and ambulation after invasive cardiovascular treatments via femoral arterial access. Vascular closure devices are used in different therapeutic approaches to provide easy, quick, and reliable hemostasis. In the US, femoral arterial access is the most often used vascular access technique for percutaneous coronary intervention (PCI) and coronary angiography. Nevertheless, there has been an increase in traction toward cardiac catheterization and percutaneous coronary intervention (PCI) via radial access in recent years. Several femoral artery closure devices have been developed to shorten vascular closure times, with variable rates of vascular complications observed in clinical trials. Vascular closure devices (VCDs) have emerged as an effective alternative to traditional mechanical compression procedures performed after cardiac catheterization. VCDs reduce the time of hospital stays, speed up patient mobilization, and shorten the time needed to achieve hemostasis. Thus, the vascular closure device market is growing notably with the increasing prevalence of cardiovascular diseases.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONVascular Closure Device Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Vascular Closure Device Market Drivers and Opportunities

Higher Demand for Minimally Invasive Devices Favors Market

Improvements in medical science and technologies have given way to minimally invasive devices, which can aid in the replacement of traditional painful surgical methods by minimally invasive or non-invasive methods. Minimally invasive techniques have gained popularity in surgical fields such as cardiac surgery. Many of these procedures are performed using femoral cannulation for extracorporeal circulation. Vascular closure devices have gained popularity as they reduce invasiveness and supersede surgical cut-downs to cannulate the femoral artery. Vascular closure devices are mainly used in transcatheter and endovascular interventions to enable wound healing and reduce procedure time.

Angiography is one of the common procedures performed in a wide variety of specialties, including vascular surgery, interventional radiology, and diagnostic and interventional cardiology. Vascular closure devices are useful in the settings of a large body habitus, as well as anticoagulation and antiplatelet therapies. They are also used in cases where extended bed rest may not be desirable (such as a patient with extensive pressure ulcers). A vascular closure device with resorbable collagen material, which eliminates the use of suture materials, has been introduced for transfemoral transcatheter aortic valve implantation (TAVI). For instance, the MANTA device by Teleflex Medical Inc. is adequate for the closure of arterial access sites of up to 25 Fr. Safety and efficacy of the system were demonstrated in a real-world TAVI patient cohort. Thus, the increasing demand for minimally invasive devices drives the vascular closure devices market growth

Untapped Potential of Emerging Economies – An Opportunity in Vascular Closure Device Market

Vascular closure devices market players should anticipate significant growth opportunities in emerging nations like India, China, Argentina, Brazil, UAE, and South Africa because of factors like growing disposable incomes, an aging patient population, increased R&D, improved healthcare infrastructure, rising awareness of CVD, and relatively lax guidelines in comparison to developed nations. Russia, Brazil, China, India, and South Africa together accounted for one-third of all global health spending as of 2022, according to the World Economic Forum. The World Bank reports that from 2018 to 2019, health spending grew by 3.01% in India and 5.35% in China. Also, there has been an upsurge in heart failure cases over the past decade in emerging markets, which has resulted in a large number of cardiovascular disease-related deaths. As per the India Brand Equity Foundation, hospitals contribute to ~70% of the revenue of the healthcare sector in India. In China, the number of private hospitals reached up to 36,000 in 2022. Moreover, the private hospitals account for ~57% of total number of hospitals in the country. The number of surgical centers and hospitals in developing markets is estimated to grow due to rising healthcare spending and a surge in the target patient population. Thus, the development of healthcare facilities in developing economies, along with a surge in the number of hospitals, would propel the awareness and adoption of vascular closure devices in emerging economies. Further, vast competition in developed or matured markets encourages vascular closure device manufacturers to focus on developing markets, which is likely to offer growth opportunities for vascular closure device providers to attain a significant position in the market.

Vascular Closure Device Market Report Segmentation Analysis

Key segments that contributed to the derivation of the vascular closure device market analysis are product type, access, procedure, and end users.

- Based on product type, the vascular closure device market is divided into active approximators, passive approximators, and external hemostatics. The passive approximators device segment held a higher market share in 2022.

- Based on access, the market is segmented into Femoral Access and Radial Access.

- In terms of procedure, the market is segmented into interventional cardiology, interventional radiology, and endovascular surgical.

- In terms of end users, the market is segmented into Hospitals, ABSc, and Others.

Vascular Closure Device Market Share Analysis by Geography

The geographic scope of the vascular closure device market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

In North America, the vascular closure device market is currently experiencing exponential growth during the forecast years. The North America vascular closure devices market is segmented into the US, Canada, and Mexico; the US held the largest share of the market in 2022. The US is a hub for medical innovations and technological advancements in healthcare. Continuous advancements in technologies associated with minimally invasive procedures, improvements in closure device technologies, and the introduction of novel closure devices contribute to the growth of the vascular closure devices market in the US. For instance, in March 2023, Haemonetics Corporation (US) invested ~US$ 31.72 million (EUR 30 million) in Vivasure Medical Limited. In March 2023, Vivasure Medical announced FDA IDE approval to Initiate a US Pivotal Study evaluating the safety and effectiveness of the Vivasure PerQseal Closure Device System. In 2021, VASCADE MVP was the first and only FDA-approved vascular closure device indicated for use following atrial fibrillation (AF) ablation to allow same-day discharge.

Vascular Closure Device Market Regional Insights

The regional trends and factors influencing the Vascular Closure Device Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Vascular Closure Device Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Vascular Closure Device Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1.73 Billion |

| Market Size by 2030 | US$ 3.03 Billion |

| Global CAGR (2022 - 2030) | 7.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Vascular Closure Device Market Players Density: Understanding Its Impact on Business Dynamics

The Vascular Closure Device Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Vascular Closure Device Market top key players overview

Vascular Closure Device Market News and Recent Developments

The vascular closure device market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for innovations, business expansion, and strategies:

- In May 2022, Teleflex Inc., a global provider of medical technologies, announced that it received Health Canada approval for the MANTA Vascular Closure Device – the first commercially available biomechanical vascular closure device designed specifically for large bore femoral arterial access site closure. This approval marks an important milestone in the regulatory plan to expand the availability of the MANTA Device globally and provide Canadian clinicians access to another uniquely designed device from Teleflex. (Source: Teleflex Inc. company website)

Vascular Closure Device Market Report Coverage and Deliverables

The “Vascular Closure Device Market Size and Forecast (2020–2030)” report provides a detailed analysis of the market covering the following areas:

- Vascular Closure Device Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Vascular Closure Device Market trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Vascular Closure Device market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Vascular Closure Device Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For