Wind Turbine Generator Market Drivers and Forecasts by 2030

Wind Turbine Generator Market Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis By Type (Direct Current and AC Synchronous); Deployment Type (Onshore and Offshore), and Geography

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Report Date : Nov 2023

- Report Code : TIPRE00029724

- Category : Energy and Power

- Status : Published

- Available Report Formats :

- No. of Pages : 146

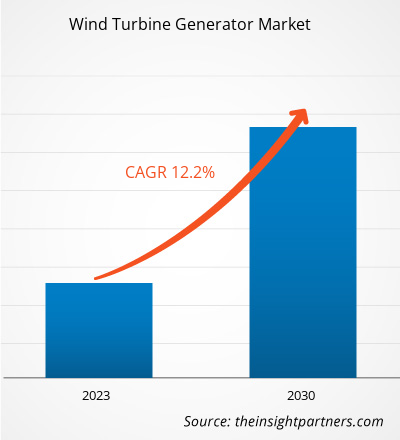

[Research Report] The wind turbine generator market was valued at US$ 3,483.84 million in 2022 and is projected to reach US$ 8,772.57 million by 2030; it is expected to grow at a CAGR of 12.2% during 2022–2030.

Analyst Perspective:

The North America wind turbine generator market is sub-segmented into the US, Canada, and Mexico. Owing to stringent government regulations, an increase in investment in wind power projects, favorable policies, and reduced cost of wind energy, the wind industry across the region is expected to register remarkable growth. With the growing consumer awareness of climate change and the role of renewable energy, the demand for wind turbines is expected to increase in North America. In 2022, the US (Texas) alone installed land-based wind turbines worth of 4,028 MW of power. Also, in 2022, the other US states, such as Nebraska and Oklahoma, added a wind power capacity of 600 MW each. All such government initiatives are driving the growth of wind turbine generator market share in the US.

The Canadian government is investing in renewable energy and working with indigenous partners to get major projects built. For instance, in May 2022, the Minister of Natural Resources announced an investment of ~US$ 50 million for the Burchill Wind Limited partnership between Wolumseket and Natural Forces Development to deploy renewable energy and grid modernization technologies. In March 2022, Canada announced its plans to invest US$ 7.2 billion in wind and solar projects to meet carbon emissions reduction targets by 2030. In November 2021, Siemens Gamesa Renewable Energy announced that they had signed an agreement with Renewable Energy Systems (RES) in Canada to supply wind turbines for the 100 MW Hilda wind project in Alberta. This deal will help the country in meeting its 30% goal of renewable energy generation by 2030. Under this agreement, Siemens Gamesa will supply 20 SG 5.0-145 turbines, providing clean and affordable power for ~50,000 homes. Also, according to the Canadian Renewable Energy Association (CanREA), in 2022, Canada installed a total of 1.8 GW of wind and solar power capacity. Thus, such investment prospects in erecting wind energy projects and the rise in the adoption of clean energy are fueling the wind turbine generator market share of North America. Various wind turbine generator market players such as TPI Composites Inc., Marmen Inc., Valmont Industries Inc., and The Timken Co. are developing innovative and more efficient components to cater to this rising demand.

The government of Mexico has invested a significant amount in the construction of wind turbines in the country. According to the Asociación Mexicana de Energía Eólica (AMDEE), an investment of ~US$ 1.3 billion was planned to develop the Mexican wind energy sector in 2020. Thus, this investment made the country enter the top 3 most attractive wind energy producers in Latin America. This allocated fund will be invested in 11 wind energy projects in Coahuila, Yucatan, and Tamaulipas.

Thus, all the above factors are fueling the growth of the North America wind turbine generator market.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONWind Turbine Generator Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Overview:

Generators convert the mechanical energy generated from the rotor blades into electrical energy through magnetic fields. In the majority of cases, generators use alternating current to operate at a constant speed that allows them to generate utility-grade 60Hz AC power. Different types of generators, including induction generators (with fixed RPM and variable RPM), doubly fed induction generators (variable RPM), and permanent magnet direct drive generators, are used in wind turbines. They have different features and operational capabilities that are used based on the requirements of wind turbine installation and power generation.

The growing government initiative for adopting wind energy for electricity generation is creating lucrative opportunities for the wind turbine generator market. The rising demand for floating wind technology for offshore wind turbines is projected to favor the growth of the wind turbine generator market during the forecast period. The technology will help in the development of offshore wind turbines where the water is very deep.

Market Driver:

Increasing Product Launches is Driving the Wind Turbine Generator Market Growth

According to the Global Wind Energy Council (GWEC), as of 2022, a total of 906 GW of wind capacity has been installed globally, of which 93% is onshore and 7% offshore. It is expected that the wind energy markets will grow fourfold in the coming 20 years, further raising the demand for advanced wind turbine components. The growing demand for wind energy will require advanced turbine components such as rotor blades, nacelle, gearbox, generator, tower, and pitch systems. This has compelled the market players to boost their investment in developing new and innovative products. Various wind turbine generator manufacturers are working on deploying advanced products to cater to the growing customer needs. For instance, in September 2023, Adani New Industries Ltd announced that it would produce a 5.2 MW series of wind turbine generators for the international wind turbine generator market.

Such advancements in wind turbine components, supported by high investments from global manufacturers and government policies for climate control to enhance their product portfolio, are fueling the growth of the wind turbine generator market. Also, the rising demand for recyclable components to protect the environment is pushing manufacturers to develop more recyclable components. In addition, manufacturers are coming up with more efficient components, which will help produce more electricity from wind turbines by reducing turbine downtime. Thus, the growing product innovation as per the changing customer requirements is driving the growth of the wind turbine generator market.

Segmental Analysis:

Based on generator type, the wind turbine generator market is bifurcated into Direct Current and AC Synchronous. In 2022, the AC Synchronous segment acquired a larger share of the global wind turbine generator market owing to its compatibility with the grid and operational efficiency. In addition, in the case of offshore wind farms, AC generators are particularly advantageous. They are well-suited for long-distance power transmission from offshore installations to the mainland, as AC power can be efficiently transported over extended undersea cable distances. Growing offshore investment is anticipated to drive the demand for AC synchronous generators in the wind turbine generator market. For instance, in 2023, the UK's Octopus announced its plans to invest US$ 20 billion in offshore wind farms. Such initiatives are expected to drive the AC synchronous generator's demand.

Regional Analysis:

The government of Italy is investing a significant amount of capital in integrating renewable energy, further propelling the wind turbine generator market share of the country. For instance, in June 2022, ERG announced that they had placed a 101MW order for the Mineo Militello Vizzini wind park in Sicily. This project adds to the more than 5.4 GW wind turbines installed or under construction by Vestas in Italy, which accounts for a market share of more than 40%. Also, in July 2021, Eni announced that they had signed an agreement to acquire 100% of a portfolio of 13 onshore wind farms in Italy, having a total capacity of 315 MW, from Glennmont Partners ("Glennmont") and PGGM Infrastructure Fund ("PGGM"). The Italian government is also working on incentives to boost the roll-out of offshore wind facilities. Also, the government has set goals to achieve 65% of the country's electricity demand through renewables, which is another major factor likely to generate new opportunities for wind turbine generator market vendors during the forecast period.

Wind Turbine Generator

Wind Turbine Generator Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 3.48 Billion |

| Market Size by 2030 | US$ 8.77 Billion |

| Global CAGR (2022 - 2030) | 12.2% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Wind Turbine Generator Market Players Density: Understanding Its Impact on Business Dynamics

The Wind Turbine Generator Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Key Player Analysis:

Siemens Gamesa Renewable Energy S.A.; ENVISION Group; Mingyang Smart Energy; Nordex SE; Xinjiang Goldwind Science & Technology Co., Ltd.; Vestas Wind Systems AS; General Electric; Zhejiang Windey Co., Ltd.; Suzlon Energy Limited; Enercon GmbH; and Nordex Group are among the key wind turbine generator market players operating in the wind turbine generator market.

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the wind turbine generator market. A few recent developments by the key wind turbine generator market players are listed below:

Date |

News |

Region |

|

October-2023 |

Mingyang Smart Energy has announced plans for a new offshore wind turbine that, at 22 M.W., will be the world's largest offshore wind turbine. According to the business, the typhoon-resistant MySE 22MW is appropriate for both fixed-bottom and floating applications. The turbine will be built between 2024 and 2025, according to the business. |

APAC |

Frequently Asked Questions

Nivedita is an accomplished research professional with over 9 years of experience in Market Research and Business Consulting. Currently serving as a Project Manager in the ICT domain at The Insight Partners, she brings deep expertise in managing and executing Syndicated, Custom, Subscription-based, and Consulting research assignments across diverse technology sectors.

With a proven track record of delivering data-driven analysis and actionable insights, Nivedita has been a key contributor to several critical projects. Her work involves end-to-end project execution—right from understanding client objectives, analyzing market trends, to deriving strategic recommendations. She has collaborated extensively with leading ICT companies, helping them identify market opportunities and navigate industry shifts.

Nivedita holds an MBA in Management from IMS, Dehradun. Prior to joining The Insight Partners, she gained valuable experience at MarketsandMarkets and Future Market Insights in Pune, where she held various research roles and built a strong foundation in industry analysis and client engagement.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For