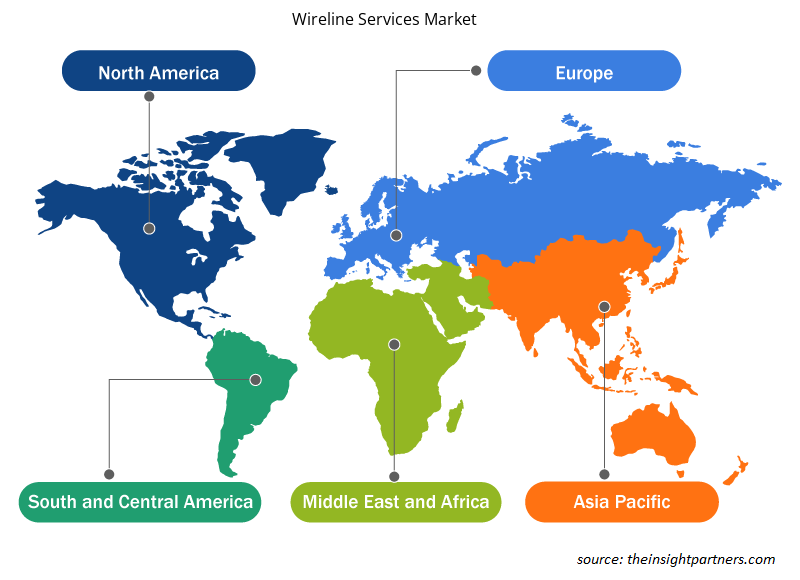

The Wireline Services Market size is expected to reach US$ 28,305.65 million by 2031 from US$ 17,648.87 million in 2024. The market is estimated to register a CAGR of 7.0% during 2025–2031. Intensive R&D is fueling the development of high-quality wireline products, which are likely to bring new trends to the market in the coming years.

Wireline Services Market Analysis

The rising drilling and exploration of oil & gas fields to address the surging oil and gas demand, soaring demand for wireline services to revitalize mature oil and gas fields, and increasing offshore oil & gas industry developments in Asia and the Middle East & Africa are major factors fueling the growth of the wireline services market

Offshore oilfields, specifically in deepwater and ultra-deepwater environments, are gaining prominence, which is boosting the demand for wireline services. In addition, unconventional and complex mature oilfields need constant monitoring and maintenance to sustain production. Wireline services are significant for intervention activities, such as identifying production concerns and improving recovery rates. The adoption of digital technologies in oilfield operations is likely to generate future opportunities for wireline service providers. For instance, the implementation of data analytics and predictive maintenance can improve intervention activities and decrease downtime. Wireline Services Market Overview

Wireline services support exploration, drilling, completion, and production operations in offshore and onshore oil and gas fields. These services are necessary for reservoir evaluation, well intervention, pipe recovery, and logging operations. Their usage facilitates operators to attain efficiency, increase well productivity, and optimize resource extraction. Wireline services incorporate tools and equipment implemented into oil and gas wells utilizing a cable or wire. These cables conduct real-time data from the well to the surface, letting operators understand the well's condition, take measurements, and perform essential interventions.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

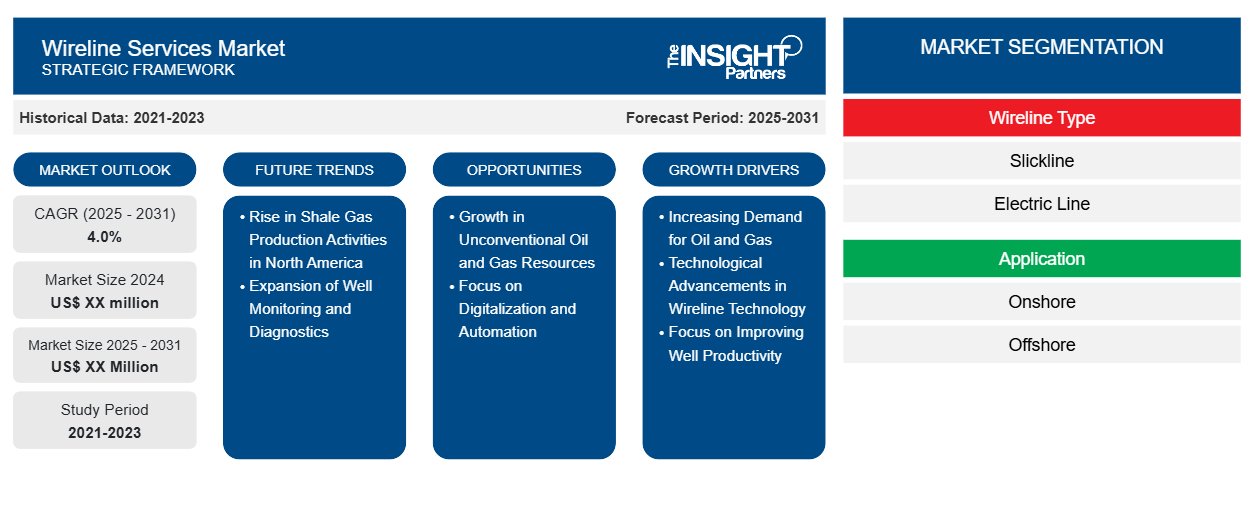

Wireline Services Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Wireline Services Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Wireline Services Market Drivers and Opportunities

Surging Drilling and Exploration of Oil & Gas Fields and Increasing Oil and Gas Demand

The increasing drilling and exploration activities in North America, the MEA, and Asia-Pacific are driving the growth of the wireline services market. In April 2025, the Turkish Minister of Energy and Natural Resources and the Minister of Petroleum and Mineral Resources signed an agreement for the exploration and production of hydrocarbons in onshore fields. Turkey discovered up to 20 billion barrels of crude oil in Somalia. The demand for oil and gas is increasing globally due to the rising demand for energy. According to the insights from the International Energy Agency (IEA), as of April 2025, global oil demand is projected to increase by 730 thousand barrels per day (kb/d) in 2025 and by 690 thousand barrels per day by 2026. Total oil demand in China continues to rise, with growth dominated by petrochemical feedstocks, which are converted into plastics and fibers rather than burned as fuels. Oil demand for petrochemical products in China increased by nearly 5% in 2024 as new plants came online, a trend expected to continue in the coming years.

Rising Investment in Oil and Gas Projects

Government initiatives and private sector capital are being directed toward the development of new drilling sites, the expansion of existing fields, and the modernization of production facilities. These financial commitments enable the consistent procurement of essential tubular products, sustaining strong industry demand. In November 2024, Brazil's state-owned oil and gas giant Petrobras unveiled its new business plan for the 2025–2029 period (BP 2025–2029) and strategic plan 2050 (SP 2050), outlining priorities to reinforce its long-term vision. While the first envisions a multibillion-dollar investment program, the second one showcases the Brazilian player's vision of striking a balancing act between oil and gas developments and low-carbon businesses. Petrobras' investment strategy for 2024–2028 allocates the largest portion of its projected US$ 102 billion investment to oil and natural gas. The company views these energy sources as critical growth drivers, essential for advancing and financing the transition toward more sustainable energy solutions.

Wireline Services Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Wireline Services Market analysis are type, hole type, service type, and application.

- Per type, the market is categorized into sickline and electric line. The electric line segment dominated the market in 2024.

- By hole type, the market is bifurcated into open hole and cased hole. The cased hole segment dominated the market in 2024.

- Based on service type, the market is divided into well completion, well intervention, and well logging. The well-logging segment dominated the market in 2024.

- By application, the market is segmented into onshore and offshore. The onshore segment dominated the market in 2024.

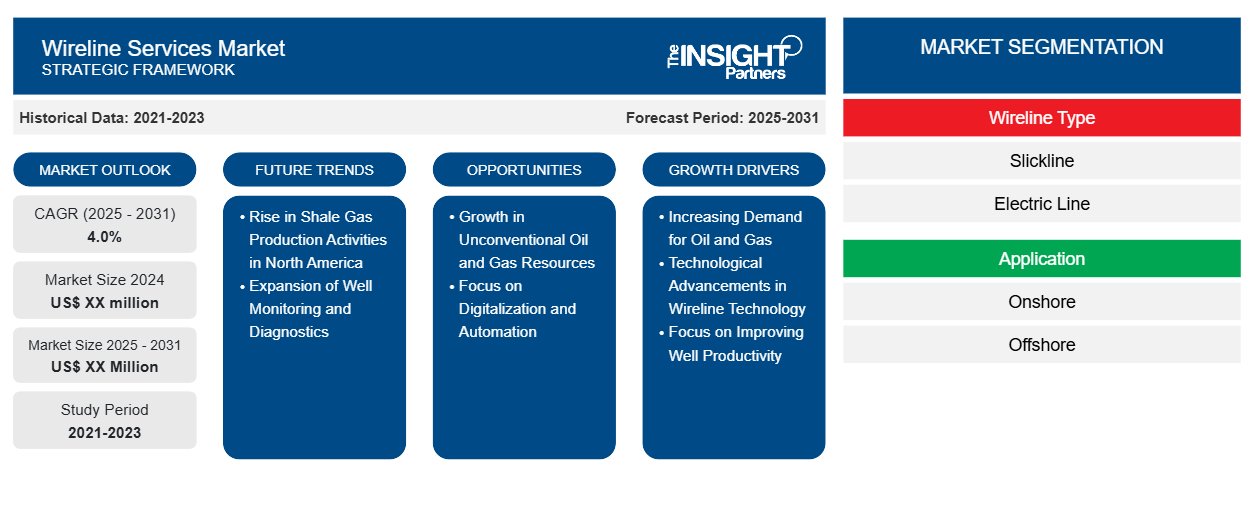

Wireline Services Market Share Analysis by Geography

The Wireline Services Market is segmented into five major regions: North America, Europe, Asia Pacific (APAC), the Middle East and Africa (MEA), and South and Central America (SAM). North America dominated the market in 2024, followed by the MEA and APAC.

The North America wireline services market is segmented into the US, Canada, and Mexico. The region is one of the world's leading oil and gas exporters. The US accounts for over 18% of global oil production, demonstrating the presence of a large number of oilfields in onshore and offshore locations throughout the region. Oil and gas fields are required to assess the production capacity of the fields in the region. The rising number of oil and gas rigs is driving the demand for wireline services to maximize reservoir knowledge and guide production decisions for oil and gas fields in the region. The surging demand for wireline services in well intervention, logging, and well-completion activities in the region is boosting the wireline services market growth. Further, the rising crude oil production is expected to generate new demand for wireline services in the coming years.

According to the International Energy Administration (IEA), the Middle East and North Africa generate approximately 95% of their electricity from oil and gas. Thermal power plants in the region consume more than 290 billion cubic meters of gas, equivalent to more than a third of the region's gas production, and 1.75 million barrels of oil per day. The producing economies of the MEA are dependent on fossil fuels, increasing the carbon intensity of their power generation by approximately one-fifth compared to the global average. Consequently, this region fuels the procurement of fixed-line telephone services. In May 2023, the Abu Dhabi National Oil Company (ADNOC) awarded three contracts totaling US$ 4 billion to reduce carbon emissions and achieve a production capacity of approximately 5 million barrels per day (mb/d) by 2030. The rising demand for reservoir intelligence, actionable wireline data, production assessment, evaluation and diagnosis of downhole issues, obtaining a full spectrum of logs, and others from the oil and gas companies to improve production is driving the adoption of wireline services. Further, the increasing offshore oil and gas drilling activities, the discovery of new locations to establish drilling wells at those locations, and increasing production targets for offshore oil and gas production are fueling market growth in the MEA. In January 2023, Masirah Oil, a subsidiary of Rex International, an independent company based in Singapore, announced that it had completed an offshore drilling campaign in Block 50 in Oman. In October 2023, KCA Deutag, a drilling, engineering, and technology partner, announced its first locally manufactured rig in Oman during a Petroleum Development Oman (PDO) ceremony. Similarly, in November 2023, Shell Egypt announced that it had completed the drilling of the 1st well in its three-well exploration campaign, Mina West, located in the northeast El-Amriya block in the Mediterranean Sea.

Wireline Services Market Regional Insights

The regional trends and factors influencing the Wireline Services Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Wireline Services Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Wireline Services Market

Wireline Services Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 17.64 Billion |

| Market Size by 2031 | US$ 28.30 Billion |

| Global CAGR (2025 - 2031) | 7.0% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Wireline Services Market Players Density: Understanding Its Impact on Business Dynamics

The Wireline Services Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Wireline Services Market are:

- MB Petroleum Services LLC

- SLB

- Halliburton Co

- Baker Hughes Co

- Geoplex

- Weatherford International Plc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Wireline Services Market top key players overview

Wireline Services Market News and Recent Developments

The Wireline Services Market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. Key developments in the Wireline Services Market are listed below:

- Shell awarded Halliburton several key projects in Brazil, Suriname, and São Tomé and Príncipe. In Brazil, Halliburton signed contracts with Shell that marked a significant milestone in the development of the Gato do Mato deepwater field in the pre-salt Santos Basin. Halliburton was selected for its integrated approach to well construction, completions, and interventions. (Source: Shell, Press Release, May 2025)

- Halliburton Co secured a contract from Petrobras to provide integrated well interventions and offshore well-plugging services in Brazil, including fluids, completion equipment, wireline, slackline, flow back services, and coiled tubing. (Source: Halliburton, Press Release, August 2024)

Wireline Services Market Report Coverage and Deliverables

The "Wireline Services Market Size and Forecast (2025–2031)" provides a detailed analysis of the market covering the areas mentioned below:

- Wireline Services Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Wireline Services Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Wireline Services Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Wireline Services Market

- Detailed company profiles

Frequently Asked Questions

What are the future trends of the global wireline services market?

Technological developments in wireline products & services is the future trends of the global wireline services market.

Which region is holding the major market share of global wireline services market?

The North America held the largest market share in 2024, followed by MEA and APAC.

What will be the global wireline services market size by 2031?

The global wireline services market is expected to reach US$ 28.30 billion in the year 2031.

Which are the key players holding the major market share of global wireline services market?

The key players, holding majority shares, in global wireline services market MB Petroleum Services LLC.; Halliburton Co; Baker Hughes Co; Geoplex, Weatherford International Plc; SLB; NexTier Oilfield Services, Inc.; Superior Energy Services Inc; Archer Ltd.; Yulin Machinery Corporation.

What is the estimated market size for the global wireline services market in 2024?

The global wireline services market was valued at US$ 17.64 billion in 2024 and is projected to reach US$ 28.30 billion by 2031; it is expected to grow at a CAGR of 7.0% during 2025–2031.

What are the driving factors impacting the global wireline services market?

Surging drilling and exploration of oil & gas fields and increasing oil and gas demand, increasing demand for wireline services to revitalize mature oil and gas fields, increasing offshore oil & gas industry developments in Asia, and Middle East & Africa are the driving factors impacting the global wireline services market.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Wireline Services Market

- MB Petroleum Services LLC.

- Halliburton Co

- Baker Hughes Co

- Geoplex

- Weatherford International Plc

- SLB

- NexTier Oilfield Services, Inc.

- Superior Energy Services Inc

- Archer Ltd.

- Yulin Machinery Corporation

Get Free Sample For

Get Free Sample For