Cerebral Aneurysm Clips Market Future Scope 2034

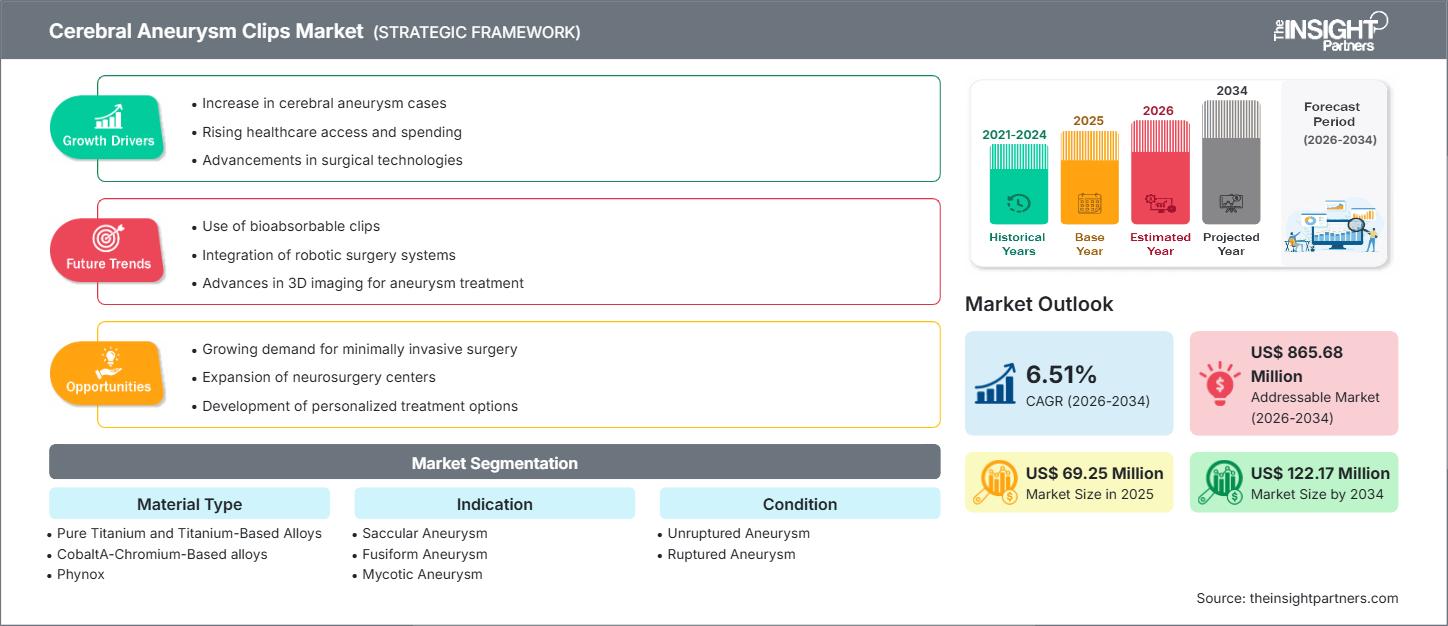

Cerebral Aneurysm Clips Market Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Material Type (Pure Titanium and Titanium-Based Alloys, CobaltA-Chromium-Based alloys, Phynox); Indication (Saccular Aneurysm, Fusiform Aneurysm, Mycotic Aneurysm); Condition (Unruptured Aneurysm, Ruptured Aneurysm); End-User (Hospitals, Neurology Centers, Ambulatory Surgical Centers); and Geography

Historic Data: 2021-2024 | Base Year: 2025 | Forecast Period: 2026-2034- Report Date : Mar 2026

- Report Code : TIPRE00029541

- Category : Life Sciences

- Status : Upcoming

- Available Report Formats :

- No. of Pages : 150

The cerebral aneurysm clips market size is expected to reach US$ 122.17 million by 2034 from US$ 69.25 million in 2025. The market is anticipated to register a CAGR of 6.51% during 2026–2034.

Cerebral Aneurysm Clips Market Analysis

The Cerebral Aneurysm Clips market is expanding due to the increasing prevalence of cerebral aneurysms and advancements in neurosurgical techniques. The market is primarily driven by the need for effective treatment options for intracranial aneurysms. The adoption of titanium aneurysm clips is dominant due to their superior biocompatibility, MRI compatibility, and mechanical strength, making them the preferred choice for surgeons worldwide. The market is also being propelled by factors such as the rising geriatric population, which is more susceptible to aneurysms, and growing awareness and improved diagnostic capabilities, leading to earlier detection. The leading players in the space include companies specializing in neurosurgical devices and instruments. These players are focusing on innovation, collaboration with clinical centers, and developing advanced alloys and low-profile clip designs to improve surgical outcomes and clip efficacy.

Cerebral Aneurysm Clips Market Overview

Cerebral aneurysm clips are small, metallic surgical devices used in the open surgical treatment of brain aneurysms. The primary function of clipping is to isolate the aneurysm from the main blood circulation by placing a clip across its neck. This prevents blood from entering the aneurysm and causing it to rupture. The implementation of advanced materials, particularly titanium and titanium alloys, in aneurysm clips helps to ensure biocompatibility, high tensile strength, and minimal imaging artifacts during post-operative scans like MRI.

Aneurysm clipping is a common and effective surgical treatment method. Companies are continuously focused on enhancing clip design for better sealing precision, reduced neurovascular trauma, and easier application. The effectiveness and long-term durability of surgical clipping keep it a relevant procedure in neurosurgery, even with the rise of endovascular alternatives.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONCerebral Aneurysm Clips Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Cerebral Aneurysm Clips Market Drivers and Opportunities

Market Drivers:

- Increasing Prevalence of Cerebral Aneurysms: A key driver is the rising incidence of cerebral aneurysms globally, often linked to factors like the aging population, high blood pressure, and lifestyle-related health issues (e.g., smoking). This demographic shift directly increases the demand for treatment options like clipping.

- Technological Advancements in Clips: Continuous product innovation, including the development of advanced titanium alloys and low-profile clip designs, enhances the efficacy, safety, and MRI compatibility of the clips, driving surgeon preference.

- Advancements in Neurosurgical Techniques: Ongoing improvements in microsurgical equipment and imaging technologies enable surgeons to perform more precise and minimally invasive clipping procedures, leading to better patient outcomes.

Market Opportunities:

- Growing Adoption of Minimally Invasive Neurosurgical Techniques: The development of clips and clip appliers compatible with minimally invasive approaches and hybrid procedures presents an opportunity for market players to address the demand for less invasive treatments.

- Continuous Product Innovation Efforts: Opportunities exist in developing next-generation clips with bioactive coatings, improved durability, and specialized designs for complex or giant aneurysms.

- Expansion in Emerging Markets: Regions like Asia-Pacific are emerging as the fastest-growing regions due to healthcare modernization, increasing awareness, and rising neurology case volumes, offering untapped market potential.

Cerebral Aneurysm Clips Market Report Segmentation Analysis

The Cerebral Aneurysm Clips market share is analyzed across various segments to provide a clearer understanding of its structure, growth potential, and emerging trends.

By Material Type:

- Pure Titanium and Titanium-Based Alloys

- CobaltA-Chromium-Based alloys

- Phynox

By Indication:

- Saccular Aneurysm

- Fusiform Aneurysm

- Mycotic Aneurysm

By Condition:

- Unruptured Aneurysm

- Ruptured Aneurysm

By End-User:

- Hospitals

- Neurology Centers

- Ambulatory Surgical Centers

By Geography:

- North America

- Europe

- Asia-Pacific

- South & Central America

- Middle East & Africa

Cerebral Aneurysm Clips Market Regional Insights

The regional trends and factors influencing the Cerebral Aneurysm Clips Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Cerebral Aneurysm Clips Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Cerebral Aneurysm Clips Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 69.25 Million |

| Market Size by 2034 | US$ 122.17 Million |

| Global CAGR (2026 - 2034) | 6.51% |

| Historical Data | 2021-2024 |

| Forecast period | 2026-2034 |

| Segments Covered |

By Material Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Cerebral Aneurysm Clips Market Players Density: Understanding Its Impact on Business Dynamics

The Cerebral Aneurysm Clips Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Cerebral Aneurysm Clips Market top key players overview

Cerebral Aneurysm Clips Market Share Analysis by Geography

North America dominated the Cerebral Aneurysm Clips market. The dominance of this region is due to factors such as advanced healthcare infrastructure, high incidence rates of aneurysms, significant investments in R&D, and favorable reimbursement policies. Asia-Pacific is emerging as the fastest-growing region, driven by healthcare modernization, increasing awareness of neurological disorders, and a large, aging population base.

The Cerebral Aneurysm Clips market shows a different growth trajectory in each region due to factors such as varying healthcare expenditure, regulatory environments, and the adoption rate of alternative endovascular procedures.

Below is a summary of market share and trends by region:

-

North America

- Market Share: Holds the highest market share, primarily due to the presence of well-established healthcare facilities, high aneurysm incidence, and significant R&D spending.

- Key Drivers: High adoption of advanced neurosurgical techniques and medical devices; strong reimbursement support; high prevalence of lifestyle-related risk factors (e.g., hypertension).

- Trends: Continued focus on developing MRI-compatible and high-precision titanium clips; strategic partnerships among key market players.

-

Europe

- Market Share: Follows North America, with growth supported by a focus on regulatory compliance and innovation.

- Key Drivers: Aging population contributing to higher aneurysm incidence; strong emphasis on patient safety and innovative product design.

- Trends: Investment in novel alloy compositions and clip designs to meet stringent EU medical device regulations; high adoption of advanced neurosurgical methods.

-

Asia Pacific

- Market Share: The fastest-growing regional market, driven by improving healthcare access and infrastructure.

- Key Drivers: Rapidly growing population, rising geriatric population, increasing prevalence of brain aneurysms, and government initiatives for healthcare modernization in countries like China and India.

- Trends: Rising investment in healthcare and medical device manufacturing; increasing patient awareness and improving diagnostic services are accelerating demand for surgical treatments.

-

South and Central America

- Market Share: Emerging region with gradual modernization of digital infrastructure supporting social analytics platforms.

- Key Drivers: Increasing awareness of neurovascular diseases; expansion of access to specialized treatment centers.

- Trends: Growth of affordable medical device imports; increasing number of neurosurgical procedures performed.

-

Middle East and Africa

- Market Share: Emerging market with strong growth potential, led by digital transformation initiatives.

- Key Drivers: Growing investments in healthcare infrastructure in the GCC countries; increasing prevalence of risk factors such as hypertension.

- Trends: Focus on attracting specialized medical professionals and adopting advanced neurosurgical technology.

Cerebral Aneurysm Clips Market Players Density: Understanding Its Impact on Business Dynamics

The Cerebral Aneurysm Clips market is moderately concentrated, with top medical device firms securing a significant share. Competition is intensifying as neurosurgical device makers emphasize innovation, high-quality materials, and clinical acceptance strategies.

The competitive landscape is driving vendors to differentiate through:

- Companies are heavily investing in R&D to develop clips made from advanced alloys like pure titanium, enhancing biocompatibility and minimizing MRI artifacts.

- Developing low-profile clip designs and specialized applicators for improved surgical handling, precision, and application in narrow anatomical spaces.

- Strategic partnerships with neurosurgery centers and academic institutions to drive clinical adoption and gather evidence for improved surgical reliability.

Opportunities and Strategic Moves

- Acquisitions and Mergers: Large players often acquire or merge with smaller, specialized medical technology companies to expand their neurovascular portfolio and incorporate innovative clip designs. For instance, Integra LifeSciences acquired Surgical Innovation Associates (SIA) to grow its presence.

- Product Portfolio Expansion: Developing comprehensive systems that include a wide array of clip shapes, lengths, and appliers to accommodate the patient-specific variability and technical complexity of different aneurysm characteristics.

- Targeting Emerging Markets: Strategic expansion into high-growth regions like Asia-Pacific through establishing local distribution channels and engaging in regional collaborations.

Major Companies Operating in the Cerebral Aneurysm Clips Market Are:

- B. BRAUN MELSUNGEN AG

- REBSTOCK INSTRUMENTS GMBH

- KLS MARTIN GROUP

- INTEGRA LIFESCIENCES CORPORATION

- ORTHO-MEDICAL GMBH

- MIZUHO AMERICA

- ADEOR MEDICAL AG

- PETER LAZIC GMBH

Disclaimer: The companies listed above are not ranked in any particular order.

Cerebral Aneurysm Clips Market Report Coverage and Deliverables

The "Cerebral Aneurysm Clips Market Size and Forecast (2021–2034)" report provides a detailed analysis of the market covering below areas:

- Cerebral Aneurysm Clips Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Cerebral Aneurysm Clips Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Cerebral Aneurysm Clips Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the Cerebral Aneurysm Clips Market. Detailed company profiles.

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For