Edge Banding Materials Market Size, Share & Demand by 2034

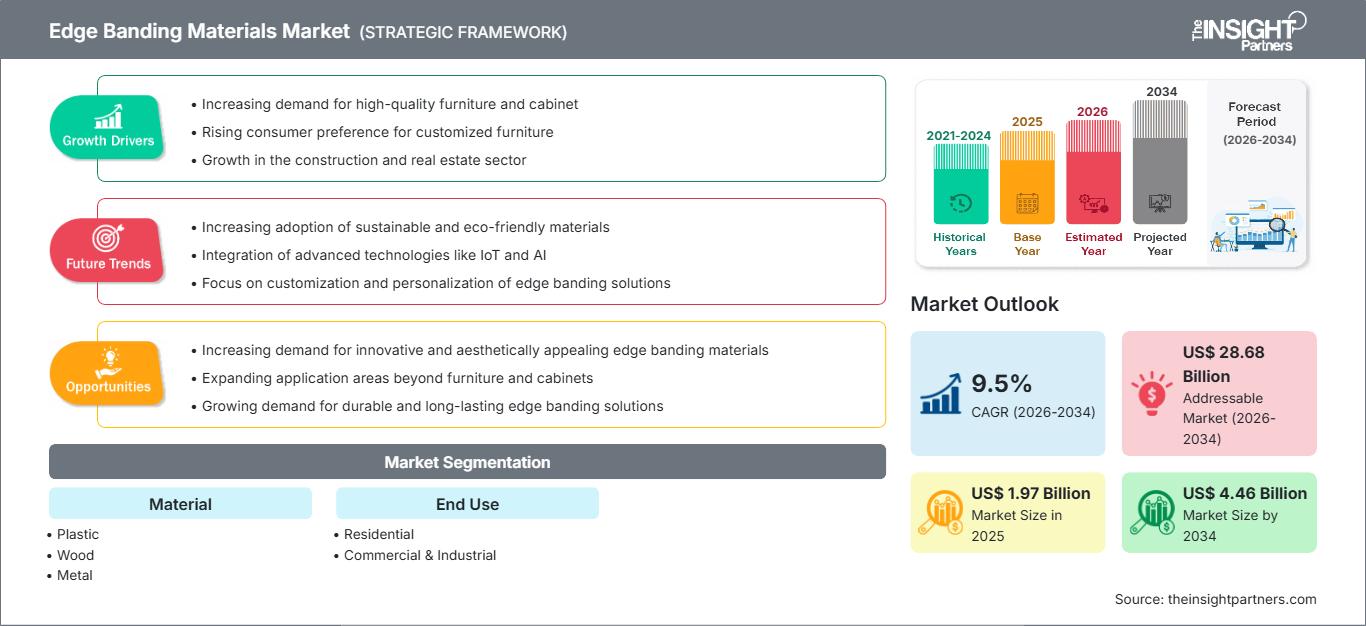

Edge Banding Materials Market Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Material [Plastic (PVC, ABS, Acrylic, and Others), Wood, Metal, and Others] and End Use (Residential and Commercial & Industrial)

Historic Data: 2021-2024 | Base Year: 2025 | Forecast Period: 2026-2034- Report Date : Mar 2026

- Report Code : TIPRE00019639

- Category : Chemicals and Materials

- Status : Upcoming

- Available Report Formats :

- No. of Pages : 150

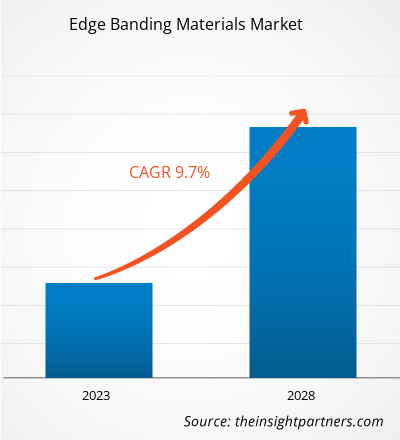

The global edge banding materials market size is projected to reach US$ 4.46 billion by 2034 from US$ 1.97 billion in 2025. The market is anticipated to register a CAGR of 9.5% during the forecast period 2026–2034. Key market dynamics include rising demand for customized furniture in residential and commercial sectors, growing adoption of eco-friendly materials like PVC-free alternatives, and expansion in modular kitchen and office fit-outs. Additionally, the market is expected to benefit from automation in woodworking machinery, surging e-commerce for ready-to-assemble (RTA) furniture, and increasing use in high-end cabinetry segments like melamine and wood veneers.

Edge Banding Materials Market Analysis

The edge banding materials market analysis reveals a trend towards more sustainable and durable profiles, driven by the focus on aesthetics and sustainability. Market procurement trends suggest that the market is dividing into the traditional flatline PVC markets and the new export markets for thermoplastics in Asia. Opportunities are arising in prefabricated housing and healthcare furniture, where the edge banding material’s water resistance and seamless surface provide a significant market advantage. Market analysis also suggests that market growth is contingent on the adhesive compatibility of high-speed processing and UV stability for outdoor use. Competitive differentiation is now evident based on branding that tells a story, emphasizing recycled materials, low VOC emissions, and traceability. This strategy enables small companies to command a premium price in a market with many small suppliers.

Edge Banding Materials Market Overview

Edge banding materials are shifting from a commodity input to a global value-added component. While historically focused on PVC for mass-market cabinets, edge banding materials are expanding into premium products like acrylic, wood veneer, and ABS tapes. Both small custom fabricators and large industrial suppliers are part of this market, making use of advanced co-extrusion technologies for color-matching. Design-conscious consumers in North America and Asia-Pacific are seeking hassle-free, long-lasting edges for RTA furniture, which has contributed to the growing popularity of edge banding as a "finishing essential." Europe is still the innovation leader, but China is now the volume leader in exports, particularly through B2B websites to Southeast Asia.

For instance, the US market is experiencing strong growth, with North American demand growing every year, thanks to housing renovation and office modularization, fueled by local manufacturers increasing capacity in PVC and wood alternatives.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONEdge Banding Materials Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Edge Banding Materials Market Drivers and Opportunities

Market Drivers:

- Superior Durability and Aesthetic Appeal: Edge banding materials such as ABS and PVC are moisture-resistant and chip-proof, making them suitable for high-traffic furniture, thus driving the market with the increasing popularity of modular interiors.

- Premiumization of Furniture and Cabinetry: The growth of designer showrooms and contract manufacturing continues to drive strong demand for similar edge profiles. With consumers seeking premium experiences, pre-finished banding continues to register stable volume growth.

- Rapid Expansion of Digital and E-commerce Channels: The internet has removed the geographical barrier for custom edge banding rolls, as seen in the acceptance of the Asia-Pacific and North America markets for RTA kits.

Market Opportunities:

- Entering Commercial and Hospitality Sector Projects: In addition to the residential market, edge banding has the potential to enter high-volume hotel and healthcare sector projects requiring antimicrobial and fire-resistant types.

- Growth in Emerging APAC Corridors: Partnerships between European producers and Asian distributors can leverage high-margin markets in India and Indonesia, where sustainable PVC alternatives are in growing demand.

- Diversification into Specialty Certifications: There are opportunities for producers focusing on eco-regulations through certifications such as FSC, REACH-compliant, and low-VOC, as witnessed in North American retail growth.

Edge Banding Materials Market Report Segmentation Analysis

The Edge Banding Materials Market share is analyzed across various segments to provide a clearer understanding of its structure, growth potential, and emerging trends. Below is the standard segmentation approach used in most industry reports:

By Material:

- Plastic: A fast-growing niche aligning with cost-effective, versatile trends; preferred by mid-market fabricators for color variety and flexibility, including PVC and ABS sub-types.

- Wood: Dominant in premium cabinetry and custom furniture due to natural aesthetics and superior impact resistance.

- Metal: Gaining traction in industrial applications for added strength and modern finishes.

By End Use:

- Residential: Primary channel for RTA kits, kitchen remodels, and home furniture with basic and premium banding.

- Commercial & Industrial: Fastest-rising for office fit-outs, hospitality, and large-scale manufacturing.

By Geography:

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa

Edge Banding Materials Market Regional Insights

The regional trends and factors influencing the Edge Banding Materials Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Edge Banding Materials Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Edge Banding Materials Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 1.97 Billion |

| Market Size by 2034 | US$ 4.46 Billion |

| Global CAGR (2026 - 2034) | 9.5% |

| Historical Data | 2021-2024 |

| Forecast period | 2026-2034 |

| Segments Covered |

By Material

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Edge Banding Materials Market Players Density: Understanding Its Impact on Business Dynamics

The Edge Banding Materials Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Edge Banding Materials Market top key players overview

Edge Banding Materials Market Share Analysis by Geography

Asia-Pacific is expected to grow fastest in the coming years. Emerging markets in South & Central America, the Middle East, and Africa also have many untapped opportunities for premium banding suppliers and modular furniture manufacturers to expand.

The edge banding materials market is undergoing a significant transformation, moving from a basic woodworking input to a global high-value finishing solution. Growth is driven by booming residential construction, customization trends in RTA furniture, and regulatory pushes for sustainable materials. Below is a summary of market share and trends by region:

North America

- Market Share: A niche but rapidly expanding segment driven by housing booms and commercial refits.

- Key Drivers:

- Rising demand for durable ABS in kitchen remodels.

- Mainstreaming of eco-edge options in chains like Home Depot.

- Imports of European veneers alongside local PVC production.

- Trends: Scaling of digital custom orders and adoption of certifications (e.g., GREENGUARD, FSC) for health-focused buyers.

Europe

- Market Share: Holds the largest share globally, anchored by advanced woodworking in Germany, Italy, and Poland.

- Key Drivers:

- High consumption in flat-pack exports like IKEA-style furniture.

- Strict REACH regulations favoring low-VOC materials.

- Government incentives for sustainable timber processing.

- Trends: Shift to wood veneers for premium lines and focus on recycled thermoplastics for circular economy compliance.

Asia-Pacific

- Market Share: The fastest-growing region, with China as the volume leader for exports.

- Key Drivers:

- Massive urbanization in India and Indonesia boosting modular housing.

- Investments in CNC machinery for precise banding.

- Rising incomes favoring aesthetic upgrades.

- Trends: E-commerce B2B for co-extruded profiles in electronics housing and furniture.

South and Central America

- Market Share: Emerging with artisanal growth in Brazil and Chile.

- Key Drivers:

- Awareness of durable edges for humid climates.

- Shift of small shops to commercial production.

- Interest in affordable PVC for urban apartments.

- Trends: Rise of local brands with melamine banding for cost-competitive cabinetry.

Middle East and Africa

- Market Share: Developing with roots in construction booms.

- Key Drivers:

- Demand for heat-resistant banding in hospitality projects.

- Investments in prefab housing tech.

- Focus on import substitution.

- Trends: Modern lines for stable profiles in arid regions.

High Market Density and Competition

Competition is intensifying due to established leaders such as Doellken, Rehau, and Surteco. Regional experts and niche players like EGGER (Austria), Timberlake (US), and VT Dimension (US) also contribute to a diverse landscape.

This competitive environment pushes vendors to differentiate through:

- Premiumization positioning edge banding as superior via impact resistance, texture-matching, and sustainability claims.

- Expanded portfolios beyond PVC to acrylic, veneer, and TPU for curved edges.

- Vertically integrated supply from extrusion to slitting for quality control.

- New tech like laser-edge and primerless adhesives for flawless joints.

Opportunities and Strategic Moves

- Partner with high-end retail and e-commerce for sustainable banding in Asia-Pacific and North America.

- Adopt circular economy certifications to attract eco-buyers.

Major Companies operating in the Edge Banding Materials Market are:

- Product Resources, Inc.

- EdgeCo Incorporated

- Surteco USA Inc.

- A Charter Industries, LLC.

- JSO Wood Product

- Sauers & Company Veneers

- Aero Plastics Inc.

- LIGNADECOR

- Edgebanding Services, Inc. (ESI)

Disclaimer: The companies listed above are not ranked in any particular order.

Edge Banding Materials Market News and Recent Developments

- In May 2025, HOMAG presented a wide range of future-oriented edge banding machines, from entry-level models to those for large-scale, industrial production. The latest models are synonymous with digital production, automation, and perfect edge quality. The range is supplemented by the innovative digital edge printing technology with the EDGETEQ P-200 and the new woodCommander 6 software generation, which simplifies the operation of the machines and increases production efficiency.

- In February 2024, Akij Board introduced ProEDGE, a premium PVC Edgeband that sets a new standard for quality and design in the furniture industry. ProEDGE not only elevates the durability of furniture but also enhances its aesthetic appeal with a myriad of exceptional features.

Edge Banding Materials Market Report Coverage and Deliverables

The "Edge Banding Materials Market Size and Forecast (2021–2034)" report provides a detailed analysis of the market covering below areas:

- Edge Banding Materials Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Edge Banding Materials Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Edge Banding Materials Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the Edge Banding Materials Market.

- Detailed company profiles

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For