Greece and Portugal Surety Market Dynamics, Recent Developments, and Strategic Insights by 2031

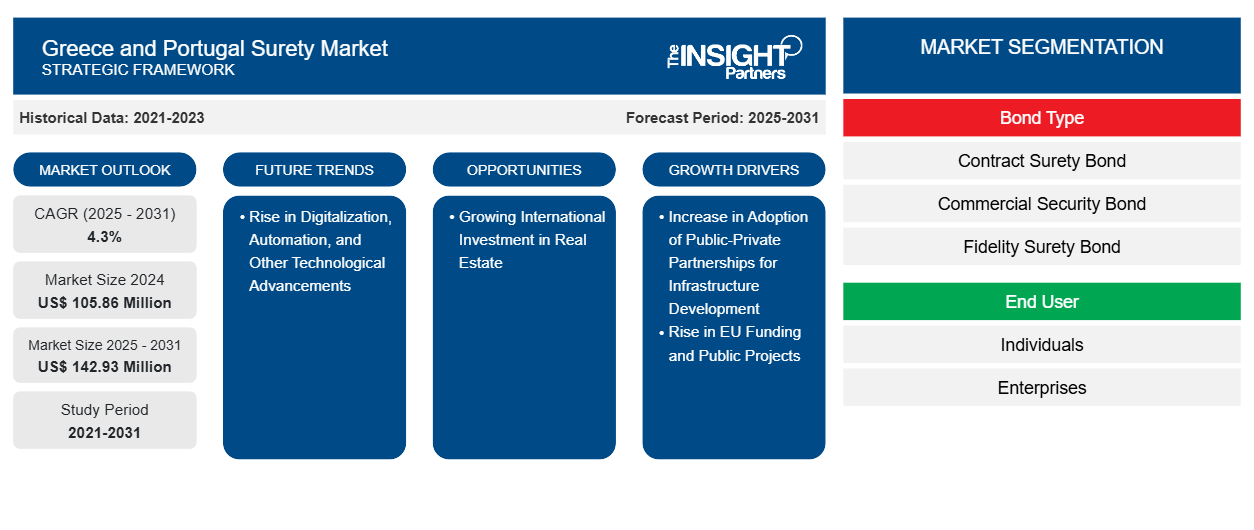

Greece and Portugal Surety Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Bond Type (Contract Surety Bond, Commercial Security Bond, Fidelity Surety Bond, and Court Surety Bond), End User (Individuals and Enterprises), and Country

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Apr 2025

- Report Code : TIPRE00040930

- Category : Banking, Financial Services, and Insurance

- Status : Published

- Available Report Formats :

- No. of Pages : 80

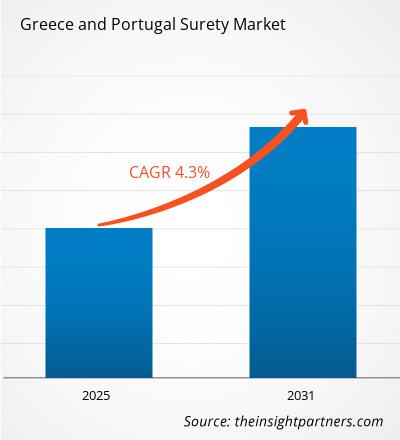

The Greece and Portugal surety market size was valued at US$ 105.86 million in 2024 and is expected to reach US$ 142.93 million by 2031; it is estimated to register a CAGR of 4.3% during 2025–2031. The rise in digitalization, automation, and other technological advancements is likely to remain a key Greece and Portugal surety market trend.

Greece and Portugal Surety Market Analysis

Infrastructure development, including transportation, energy, and utilities, drives the demand for surety bonds. Public infrastructure projects often require surety bonds to guarantee completion and adherence to contractual obligations. Surety bonds may be mandated by government agencies or private entities financing infrastructure projects to mitigate risks associated with project delays, cost overruns, and performance issues. Also, with the increasing need for restructuring the aging infrastructure of developed countries and the requirement for new infrastructural development in emerging economies, public-private partnerships (PPP) opportunities are expected to drive the Greece & Portugal surety market growth.

Greece and Portugal Surety Market Overview

Under the terms of a construction or engineering contract or in compliance with mandatory legal requirements, bonds and guarantees are typically needed to secure the obligations of the principal debtor (sometimes referred to as the principal) against the beneficiary. They provide assurances for fulfilling a wide range of duties, including commercial ventures, licenses, and construction or service contracts. A surety bond can be used to secure almost any kind of transaction, service, or compliance agreement. Surety companies issue bonds that guarantee the performance of a party (usually a contractor) in a contract. If a contractor is unable to fulfill their obligations, the surety company steps in and financially compensates the project owner.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONGreece and Portugal Surety Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Greece and Portugal Surety Market Drivers and Opportunities

Increase in Adoption of Public-Private Partnerships for Infrastructure Development

The increasing adoption of public-private partnerships (PPPs) across Southern Europe has played a pivotal role in driving the growth of the surety market, particularly in Portugal and Greece. As governments in both countries prioritize large-scale infrastructure projects to enhance connectivity and economic development, the use of PPP models has expanded significantly. This has led to a growing demand for surety bonds, such as performance and bid bonds, as essential financial instruments to secure the execution of complex construction and transport initiatives. In Portugal, significant undertakings such as the Porto–Lisbon High-Speed Line are prime examples of how PPP frameworks create substantial opportunities for the surety market. In 2023, Carlos Fernandes, Vice-Chairman of Infraestruturas de Portugal (IP), announced the launch of a public-private partnership (PPP) procedure for the Porto–Soure rail section—part of the first phase of the Porto–Lisbon High-Speed Line (HSL)—scheduled for January 2024. Similarly, in April 2022, the EBRD partnered with the Ministry of Development and Investments of Greece to launch a new Public-Private Partnership (PPP) preparation facility following a formal request from the Greek authorities. Funded by the Greek government, this facility has since supported multiple projects across the country, primarily in the areas of social infrastructure (including education, healthcare, and public buildings), sustainable urban development, and water resources management. This project is set to become the cornerstone of a broader urban regeneration plan for the municipality of Daphne-Hymettus, where the new ministerial campus will be located. These significant infrastructure investments in Portugal and Greece, particularly those involving PPP frameworks, have contributed to the surety market growth in Southern Europe, particularly in Portugal and Greece, by increasing the demand for performance and bid bonds to support large-scale public infrastructure projects.

Growing International Investment in Real Estate

As stated by Investment Visa in February 2025, Portugal's real estate sector has proven to be one of the most robust in Europe, demonstrating strong resilience in the face of global economic uncertainties. Over the past decade, the country has increasingly attracted international investors, with real estate becoming a key investment channel. The combination of a growing expatriate community—now making up 10% of the population—and a flourishing tourism industry has driven significant demand for residential and commercial properties. This steady influx of foreign capital and continued development activity signal a strong pipeline of real estate projects requiring financial and contractual guarantees. Meanwhile, Greece has witnessed a rise in property investments, particularly from Indian investors, motivated by impending amendments to the country's highly sought-after Golden Visa Programme. In just two months—July and August 2024—property acquisitions by Indian nationals jumped by 37%, as buyers moved quickly to lock in permanent residency under the existing investment threshold of € 250,000 (US$ 270,357.4) before it increases to € 800,000 (US$ 865,143.6) in premium markets such as Athens, Mykonos, and Santorini. Therefore, the rapid growth in real estate investment in Portugal and Greece is expected to present a significant opportunity for the surety market growth. As foreign investors increasingly engage in high-value property transactions—many involving government incentives such as residency programs—the need for financial guarantees, performance bonds, and contractual surety instruments becomes more prominent.

Greece and Portugal Surety Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Greece and Portugal Surety Market analysis are bond type and end user.

- Based on bond type, the surety market is bifurcated into contract surety bond, commercial surety bond, fidelity surety bond, and court surety bond. The contract surety bond segment held the largest market share in 2024.

- Based on end user, the surety market is bifurcated into individuals and enterprises. The large enterprises segment held a larger market share in 2024.

Greece and Portugal Surety Market Share Analysis by Geography

- Portugal dominated the market in 2024. Portugal's market is largely driven by key sectors such as construction, public infrastructure, and financial services. The country has benefitted from European Union investments, particularly in infrastructure and development projects, which have helped stimulate demand for surety products. For instance, The European Investment Bank (EIB) Group, comprising the European Investment Bank (EIB) and the European Investment Fund (EIF), reaffirmed its strong commitment to Portugal in 2024, with a US$ 2.32 billion (€ 2.1 billion) fund to foster the country's sustainable economic development. This financing unlocked ~€ 4.9 billion in investments, equivalent to 1.7% of the country's GDP. A large portion of this support was allocated to Portuguese initiatives focused on climate action and environmental protection, along with investments in healthcare and transportation infrastructure.

- The Greece surety market is crucial in construction, infrastructure, and commercial loans. Both domestic and international financial situations influence Greece's assurance market, as it has a smaller economy than other nations in Europe. However, the surety market has adapted to these challenges, assisting with economic growth, particularly in the building and infrastructure industries. For instance, on December 2024, at the 26th Annual Capital Link Invest in Greece Forum in New York, Minister Staikouras highlighted eight key priorities designed to enhance transport connectivity and infrastructure resilience, with the ultimate goal of strengthening Greece's regional, geopolitical, and economic role.

Greece and Portugal Surety

Greece and Portugal Surety Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 105.86 Million |

| Market Size by 2031 | US$ 142.93 Million |

| CAGR (2025 - 2031) | 4.3% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Bond Type

|

| Regions and Countries Covered |

Greece

|

| Market leaders and key company profiles |

|

Greece and Portugal Surety Market Players Density: Understanding Its Impact on Business Dynamics

The Greece and Portugal Surety Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Greece and Portugal Surety Market News and Recent Developments

The Greece and Portugal surety market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the Greece and Portugal surety market are listed below:

- Allianz Trade introduces Surety Green2Green, a bold new solution aimed at accelerating the sustainable transition of the global economy. Through this product, Allianz Trade enables its clients to engage in low-carbon technologies and renewables projects through the issuance of surety bonds and guarantees securing their proper completion. But the company takes it one step further: the amount of premiums received are then held as investments in certified green bonds, creating a circular model that continually fuels sustainability progress. (Source: Allianz SE, Press Release, October 2024)

Greece and Portugal Surety Market Report Coverage and Deliverables

The "Greece and Portugal Surety Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering the areas mentioned below:

- Greece and Portugal surety market size and forecast at country levels for all the key market segments covered under the scope

- Greece and Portugal surety market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Greece and Portugal surety market analysis covering key market trends, country framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Greece and Portugal surety market

- Detailed company profiles

Frequently Asked Questions

Ankita is a dynamic market research and consulting professional with over 8 years of experience across the technology, media, ICT, and electronics & semiconductor sectors. She has successfully led and delivered 100+ consulting and research assignments for global clients such as Microsoft, Oracle, NEC Corporation, SAP, KPMG, and Expeditors International. Her core competencies include market assessment, data analysis, forecasting, strategy formulation, competitive intelligence, and report writing.

Ankita is adept at handling complete project cycles—from pre-sales proposal design and client discussions to post-sales delivery of actionable insights. She is skilled in managing cross-functional teams, structuring complex research modules, and aligning solutions with client-specific business goals. Her excellent communication, leadership, and presentation abilities have enabled her to consistently deliver value-driven outcomes in fast-paced and evolving market environments.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For