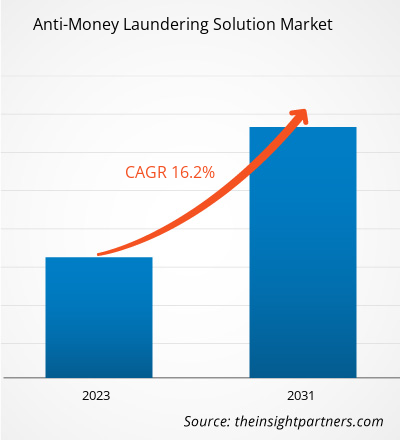

反洗钱市场规模预计将从 2024 年的 42.1 亿美元增至 2031 年的 135.4 亿美元。预计 2025-2031 年期间该市场的复合年增长率将达到 18.3%。

反洗钱市场分析

监管压力不断加大、金融犯罪日益猖獗以及数字银行和金融科技服务的全球扩张,是推动反洗钱市场增长的关键因素。各国政府和监管机构正在实施更严格的合规措施,以打击洗钱、恐怖主义融资和其他金融犯罪,这迫使金融机构投资于强大的反洗钱解决方案。此外,将人工智能、机器学习和数据分析融入反洗钱系统,可以改善实时监控、风险评估和模式检测,从而提高这些程序的效率。

反洗钱市场概况

反洗钱 (AML) 涵盖一系列法律、法规和程序,旨在防止犯罪分子将非法所得资金合法化。其主要目标是阻断洗钱过程,防止将非法获得的“脏钱”转化为看似合法的“干净钱”。反洗钱措施对于金融机构和其他受监管实体发现、预防和报告金融犯罪至关重要。反洗钱的重点是防止犯罪分子利用金融系统洗钱。它涉及监控交易和客户活动以发现可疑行为,并要求金融机构向当局报告此类活动。反洗钱合规计划可确保组织履行法律义务并降低金融犯罪风险。

您可以免费定制任何报告,包括本报告的部分内容、国家级分析、Excel 数据包,以及为初创企业和大学提供优惠和折扣

反洗钱市场:战略洞察

-

获取此报告的顶级关键市场趋势。此免费样品将包括数据分析,从市场趋势到估计和预测。

反洗钱市场驱动因素和机遇

市场驱动因素:

-

全球金融犯罪增加

洗钱、恐怖主义融资和欺诈事件的增多,促使对先进的反洗钱技术的需求激增,以检测和防止非法金融活动。AML technologies to detect and prevent illicit financial activities.

-

采用数字银行和金融科技Fintech

向数字金融服务的快速转变扩大了风险格局,导致对实时反洗钱监控工具的需求更大,尤其是在在线交易和加密货币市场。AML monitoring tools, especially in online transactions and cryptocurrency markets.

-

人工智能和分析技术的进步

人工智能、机器学习和大数据分析领域的创新使得反洗钱解决方案更加有效、高效,随着企业合规运营的现代化,推动了市场增长。AML solutions, driving market growth as firms modernize their compliance operations.

-

跨境交易与全球化

国际贸易和跨境金融流动的增加增加了监控交易的复杂性,促使金融机构采用跨司法管辖区的强大反洗钱系统。

市场机会:

-

人工智能与机器学习的融合

利用人工智能/机器学习来更智能地检测可疑活动、减少误报、增强风险分析的机会越来越多,从而提高反洗钱系统的效率和准确性。

-

拓展新兴市场

随着新兴经济体的金融体系不断现代化,对反洗钱解决方案的需求不断增长,以符合不断变化的法规,这为全球反洗钱供应商提供了巨大的增长潜力。

-

加密货币和虚拟资产的增长

随着加密货币和去中心化金融 (DeFi) 的兴起,这些行业对量身定制的反洗钱工具的需求强烈,从而为专门的反洗钱解决方案和服务创造了新的市场。

-

基于云的反洗钱解决方案

云技术的日益普及为可扩展、经济高效且灵活的反洗钱系统提供了机会,尤其是对于寻求数字化转型的中小型金融机构而言。

反洗钱市场报告细分分析

反洗钱市场被划分为不同的细分市场,以便更清晰地了解其运作方式、增长潜力和最新趋势。以下是大多数行业报告中使用的标准细分方法:

按类型:

-

解决方案

反洗钱解决方案是指旨在检测、监控和预防洗钱活动的软件工具和平台。这些包括交易监控系统、客户尽职调查工具和制裁筛查软件。

-

服务

反洗钱服务涵盖咨询、系统集成、培训和合规管理等专家支持,帮助企业实施、维护和优化反洗钱系统,并确保合规性。

按解决方案:

-

本地部署

内部部署 AML 解决方案在组织自己的服务器和基础设施上本地安装和运行,提供对数据和安全的完全控制。 -

基于云

基于云的反洗钱解决方案托管在远程服务器上并通过互联网访问,提供可扩展性、灵活性并降低前期成本。

按企业规模:

- 大型企业

- 中小企业

按最终用途行业:

- 银行和金融机构

- 保险

- 游戏和赌博

- 其他的

按地域划分:

- 北美

- 欧洲

- 亚太地区

- 中东和非洲

- 南美洲和中美洲

亚太地区的反洗钱市场预计将迎来最快的增长。亚太地区数字银行、移动支付和金融科技初创企业的迅速崛起,催生了对强大的反洗钱解决方案的需求,以监控和保护数字金融生态系统。

反洗钱解决方案

反洗钱市场区域洞察

Insight Partners 的分析师已详尽阐述了预测期内影响反洗钱市场的区域趋势和因素。本节还讨论了北美、欧洲、亚太地区、中东和非洲以及南美和中美洲的反洗钱市场细分和地域分布。

反洗钱市场报告范围

| 报告属性 | 细节 |

|---|---|

| 2024年的市场规模 | 42.1亿美元 |

| 2031年的市场规模 | 135.4亿美元 |

| 全球复合年增长率(2025-2031) | 18.3% |

| 史料 | 2021-2023 |

| 预测期 | 2025-2031 |

| 涵盖的领域 |

按奉献

|

| 覆盖地区和国家 |

北美

|

| 市场领导者和主要公司简介 |

|

反洗钱市场参与者密度:了解其对业务动态的影响

反洗钱市场正在快速增长,这得益于终端用户需求的不断增长,而这些需求的驱动因素包括消费者偏好的演变、技术进步以及对产品优势的认知度的提升。随着需求的增长,企业正在扩展产品线,不断创新以满足消费者需求,并抓住新兴趋势,从而进一步推动市场增长。

- 获取反洗钱市场顶级关键参与者概览

反洗钱市场份额地域分析

预计未来几年亚太地区将增长最快。南美和中美、中东和非洲等新兴市场也为反洗钱服务提供商提供了许多尚未开发的扩张机会。

反洗钱市场在各个地区的增长情况各不相同。这受到数字化转型、政府监管、金融犯罪趋势、跨境交易等因素的影响。以下是各地区市场份额和趋势的总结:

1. 北美

-

市场份额:

占据全球市场的很大份额 -

关键驱动因素:

- 强有力的监管执行和合规要求

- 大量数字和跨境金融交易

- 金融机构对人工智能和分析的先进应用

-

趋势:

人工智能驱动的反洗钱工具的使用日益增多,对实时交易监控的关注度不断提高,对基于云的合规解决方案的需求不断增长

2.欧洲

-

市场份额:

严格的监管框架带来巨大份额 -

关键驱动因素:

- 严格的监管框架,例如欧盟反洗钱指令

- 国际银行和金融机构的强大影响力

- 日益重视防止恐怖主义融资和逃税

-

趋势:

欧盟成员国越来越多地采用中心化的 KYC 工具,并越来越重视跨境交易监控

3. 亚太地区

-

市场份额:

成为全球反洗钱市场增长最快的地区之一 -

关键驱动因素:

- 金融科技和数字支付的快速数字化转型和增长

- 加强中国和印度等主要经济体的反洗钱监管

- 跨境贸易和汇款流动的增加提高了合规性的需求

-

趋势:

采用人工智能驱动的反洗钱工具,扩展数字化 KYC 流程,加强政府与金融机构之间的合作,以增强监管合规性

4.南美洲和中美洲

-

市场份额:

反洗钱市场稳步增长,整个地区的监管力度不断加大 -

关键驱动因素:

- 金融犯罪不断增加,包括贩毒和与腐败有关的洗钱

- 需要安全灵活的支付系统

-

趋势:

本地银行和金融科技公司越来越多地采用反洗钱合规解决方案,区域合作以改善监管协调,对经济实惠的基于云的反洗钱工具的需求不断增长

5.中东和非洲

-

市场份额:

反洗钱市场发展,合规基础设施投资不断增加 -

关键驱动因素:

- 不断推进监管改革,与国际反洗钱标准接轨

- 恐怖主义融资和非法跨境金融活动的威胁日益增加

-

趋势:

银行和金融机构逐步采用反洗钱技术,政府主导合规系统的现代化,以及人们对用于降低风险的人工智能反洗钱工具的兴趣日益浓厚。

反洗钱市场参与者密度:了解其对业务动态的影响

市场密度高,竞争激烈

由于埃森哲公司、ACI Worldwide Inc、BAE Systems Plc、EastNets、Open Text Corp、甲骨文公司、纳斯达克公司、SAS Institute Inc、NICE Ltd、LexisNexis Risk Solutions Group、Assent Business Technology, Inc.、Ascent Technologies, Inc. 和 Fiserv Inc. 等老牌企业的存在,竞争十分激烈,也加剧了不同地区的竞争格局。

这种激烈的竞争促使公司通过提供以下产品脱颖而出:

- 人工智能驱动的交易监控和实时风险评分

- 针对特定行业合规需求定制的解决方案

- 与现有银行系统和监管平台的整合

- 可扩展的基于云的部署选项

机遇与战略举措

- 扩大与监管机构和金融机构的合作,加强合规网络

- 投资人工智能、机器学习和区块链,以提高反洗钱流程的准确性和速度

- 以经济高效的云原生反洗钱解决方案瞄准服务不足的市场和中小企业

在反洗钱市场运营的主要公司有:

- ACI Worldwide Inc.(美国)

- BAE系统公司(伦敦)

- EastNets(阿联酋)

- 甲骨文公司(美国)

- 纳斯达克公司(美国)

- SAS Institute Inc.(美国)

- NICE有限公司(以色列)

- LexisNexis Risk Solutions Group(美国)

- Ascent Technologies, Inc.(美国)

- Fiserv Inc.(美国)

免责声明:以上列出的公司没有按照任何特定顺序排列。

研究过程中分析的其他公司:

- ComplyAdvantage

- 维拉芬

- Shufti Pro

- 了解你的客户(Pliance)

- 甲骨文金融服务

- 费内戈

- 链式分析

- 费德扎伊

- 泰米诺斯

- 穆迪分析

- LexisNexis 风险解决方案

- 菲舍尔

- ACI 全球

- NetReveal

- HAWK.AI

- 明亮度

- 纳皮尔

- 翁达托

- 制裁扫描仪

- 第21单元

反洗钱市场新闻及最新发展

-

ACI Worldwide 宣布与 NationsBenefits 建立合作伙伴关系

全球支付技术的原创者 ACI Worldwide 宣布与医疗金融科技、补充福利和成果平台 NationsBenefits 建立合作伙伴关系,以增强零售商连接性、扩展支付选项并提高接受 NationsBenefits 的 Benefits Mastercard Prepaid Flex Card 的商家的安全性和合规性。 -

Fiserv, Inc. 和 PayPal Holdings, Inc. 宣布合作,建立 FIUSD 和 PayPal USD (PYUSD) 之间的未来互操作性

Fiserv, Inc. 与 PayPal Holdings, Inc. 宣布合作,构建 FIUSD 与 PayPal USD (PYUSD) 之间的未来互操作性,使消费者和企业能够进行国内外资金转移。此次互操作性将结合 Fiserv 和 PayPal 在银行、消费者和商户支付领域的全球影响力,使两家公司能够进一步扩大稳定币和可编程支付在全球范围内的使用范围。

反洗钱市场报告覆盖范围和交付成果

《反洗钱市场规模和预测(2021-2031)》报告对以下领域进行了详细的市场分析:

- 反洗钱市场规模以及涵盖范围之内所有主要细分市场的全球、区域和国家层面的预测

- 反洗钱市场趋势以及市场动态,例如驱动因素、限制因素和关键机遇

- 详细的 PEST 和 SWOT 分析

- 反洗钱市场分析涵盖主要市场趋势、全球和区域框架、主要参与者、法规和最新市场发展

- 行业格局和竞争分析,涵盖市场集中度、热图分析、知名参与者以及反洗钱市场的最新发展

- 详细的公司简介

- 历史分析(2 年)、基准年、预测(7 年)及复合年增长率

- PEST和SWOT分析

- 市场规模、价值/数量 - 全球、区域、国家

- 行业和竞争格局

- Excel 数据集

近期报告

客户评价

购买理由

- 明智的决策

- 了解市场动态

- 竞争分析

- 客户洞察

- 市场预测

- 风险规避

- 战略规划

- 投资论证

- 识别新兴市场

- 优化营销策略

- 提升运营效率

- 顺应监管趋势

获取免费样品 - 反洗钱市场

获取免费样品 - 反洗钱市场