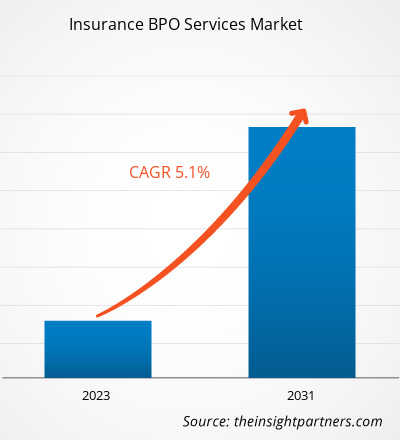

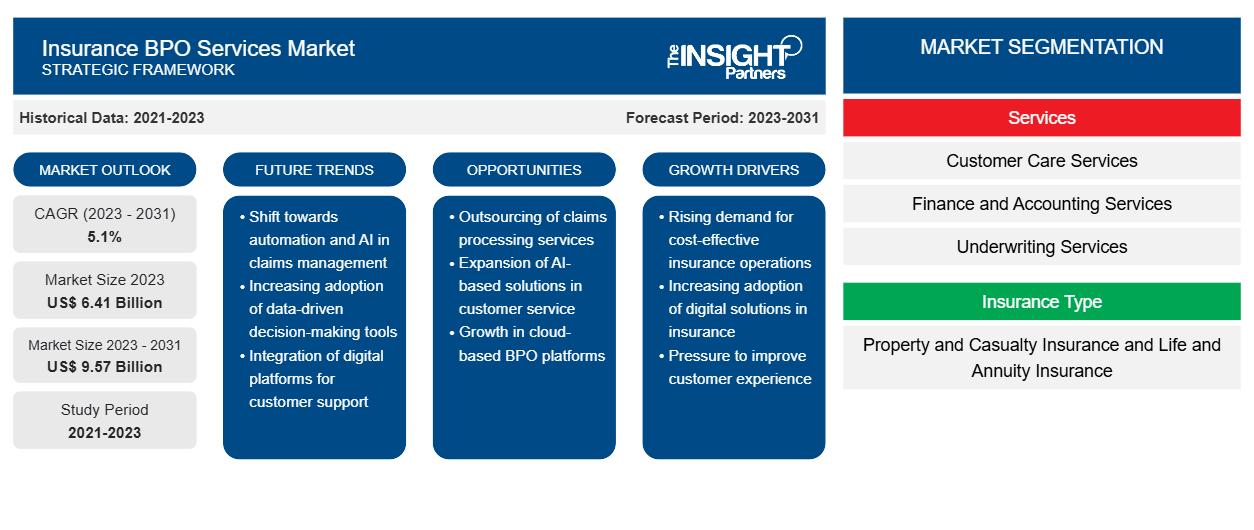

保险 BPO 服务市场规模预计将从 2023 年的 64.1 亿美元增长到 2031 年的 95.7 亿美元;预计 2023 年至 2031 年的复合年增长率为 5.1%。保险 BPO 服务市场趋势包括技术进步、对具有成本效益的服务的需求以及金融科技公司之间的战略合作伙伴关系。

保险BPO服务市场分析

报告包括当前投资银行市场趋势及其在预测期内可预见的影响所带来的增长前景。保险 BPO 服务行业正在拥抱技术进步,以增强其客户服务并扩大其全球影响力。这包括使用人工智能 (AI)、物联网 (IoT)、数据分析技术和创新金融技术。在预测期内,基于云的解决方案的日益普及以及组织对标准化业务流程的需求日益增长,预计将推动保险 BPO 服务市场的发展。

保险 BPO 服务市场概览

- 保险业务流程外包 (BPO) 服务是用于将后端办公任务和复杂功能从第三方服务提供商外包的过程。公司使用保险 BPO 服务来外包其众多后端任务,例如数据输入、簿记、会计、保单管理、索赔处理、承保和其他任务。

- 保险公司面临各种挑战,例如激烈的竞争、严格的法律、不断缩减的利润率以及客户对高质量服务的需求不断增加,从而产生了对保险 BPO 服务的需求。保险企业正在外包非核心业务,以利用 BPO 服务提供商的技术和专业知识来降低劳动力成本。

- 保险 BPO 服务旨在提高效率、改进业务流程、降低额外成本并提供更好的客户体验。这些服务通常包括数字化流程、使用数据分析技术获取业务洞察,以及专注于网络安全以保护客户的数据和公司信息。

- 公司高度采用保险 BPO 作为管理内部部门和雇用经验丰富的人员的可持续且有益的选择。全球消费者对成本效益高运营的需求不断增加,推动了预测期内保险 BPO 服务市场的增长。

定制此报告以满足您的需求

您可以免费定制任何报告,包括本报告的部分内容、国家级分析、Excel 数据包,以及为初创企业和大学提供优惠和折扣

-

获取此报告的关键市场趋势。这个免费样品将包括数据分析,从市场趋势到估计和预测。

保险 BPO 服务市场驱动因素

技术进步推动保险 BPO 服务市场增长

- 保险 BPO 服务提供商正在利用人工智能、物联网、云计算和分析技术等先进技术来提高运营效率、提升服务质量和管理整体业务成本,从而推动市场发展。

- 公司使用机器学习、数据挖掘和预测模型等多种先进的分析技术,从大量保险数据中提取见解。这些见解支持保险公司发现欺诈性索赔、简化承保程序、识别趋势并个性化消费者体验,从而改善风险管理决策。

- 保险公司越来越多地采用自动化技术来简化常规和基于规则的任务,例如保单管理、数据输入和索赔处理,这推动了市场的发展。机器人流程自动化 (RPA) 技术可帮助公司提高运营准确性、加快处理速度,并使人力资源部门能够专注于更复杂和高价值的活动。这使 BPO 公司能够以更低的成本和更高的准确性管理更大量的交易。

- 因此,技术在保险 BPO 服务市场的扩张中发挥着重要作用,它允许提供商提高运营效率、提供创新解决方案并为保险业务及其客户提供增值服务。

保险 BPO 服务市场报告细分分析

- 根据企业规模,保险 BPO 服务市场分为大型企业和中小型企业 (SME)。

- 预计到 2030 年,中小企业 (SME) 部门将占据重要的投资银行市场份额。中小企业大量将非核心保险业务外包给第三方服务提供商,以简化业务流程、提高运营效率并降低总体运营成本。

- 此外,外包通过将中小企业的重点转移到战略计划和核心竞争力上来为其提供支持。相比之下,外包合作伙伴负责处理和管理所有普通和重复的任务,例如保单服务、索赔处理和承保支持。从而推动该细分市场的发展,并在预测期内积极支持整体市场保险 BPO 服务的增长。

保险 BPO 服务市场区域分析

保险 BPO 服务市场报告的范围主要分为五个区域 - 北美、欧洲、亚太地区、中东和非洲以及南美。北美正在经历快速增长,预计将占据相当大的保险 BPO 服务市场份额。技术进步和大量服务提供商的存在,例如戴尔科技公司、Cogneesol BPO Pvt. Ltd.、Cognizant Technology Solutions Corp 等。这些参与者不断致力于开发先进的解决方案,以帮助其客户有效地管理业务流程。保险 BPO 服务提供的显著优势(例如更易于访问和具有成本效益)正在推动市场的发展。

保险业务流程外包服务

保险 BPO 服务市场区域洞察

Insight Partners 的分析师已详细解释了预测期内影响保险 BPO 服务市场的区域趋势和因素。本节还讨论了北美、欧洲、亚太地区、中东和非洲以及南美和中美洲的保险 BPO 服务市场细分和地理位置。

- 获取保险 BPO 服务市场的区域特定数据

保险 BPO 服务市场报告范围

| 报告属性 | 细节 |

|---|---|

| 2023 年的市场规模 | 64.1亿美元 |

| 2031 年市场规模 | 95.7亿美元 |

| 全球复合年增长率(2023 - 2031) | 5.1% |

| 史料 | 2021-2023 |

| 预测期 | 2023-2031 |

| 涵盖的领域 |

按服务

|

| 覆盖地区和国家 |

北美

|

| 市场领导者和主要公司简介 |

|

保险 BPO 服务市场参与者密度:了解其对业务动态的影响

保险业务流程外包服务市场正在快速增长,这得益于最终用户需求的不断增长,而这些需求又源于消费者偏好的不断变化、技术进步以及对产品优势的认识不断提高等因素。随着需求的增加,企业正在扩大其产品范围,进行创新以满足消费者的需求,并利用新兴趋势,从而进一步推动市场增长。

市场参与者密度是指在特定市场或行业内运营的企业或公司的分布情况。它表明在给定市场空间中,相对于其规模或总市场价值,有多少竞争对手(市场参与者)存在。

在保险 BPO 服务市场运营的主要公司有:

- WNS(控股)有限公司

- 威普罗有限公司

- 埃森哲公司

- 印孚瑟斯公司

- 塔塔咨询服务有限公司

免责声明:上面列出的公司没有按照任何特定顺序排列。

- 获取保险 BPO 服务市场顶级关键参与者概览

“保险BPO服务市场分析”调查基于服务、保险类型、企业规模、应用和地理位置。根据服务,市场细分为客户服务、财务和会计服务、承保服务、索赔管理等。根据保险类型,市场分为财产和意外伤害保险以及人寿和年金保险。就企业规模而言,保险 BPO 服务市场分为大型企业和中小型企业 (SME)。根据应用,保险 BPO 服务市场细分为 BFSI、制造业、医疗保健、电信等。按地区划分,保险 BPO 服务市场细分为北美、欧洲、亚太地区 (APAC)、中东和非洲 (MEA) 和南美 (SAM)。

保险 BPO 服务市场新闻及最新发展

保险 BPO 服务市场预测是根据各种二手和一手研究结果(例如主要公司出版物、协会数据和数据库)估算的。公司在保险 BPO 服务市场中采用并购等无机和有机战略。以下列出了一些近期的关键市场发展:

- 2023 年 4 月,凯捷 SE 被 Information Services Group Inc (IGS) 评为供应商镜头采购 BPO 和转型服务的领导者。凯捷 SE 强大的解决方案/平台合作伙伴网络通过提供核心采购运营、劳动力优化、风险管理、流程挖掘和高级分析以及尾部支出管理来支持其客户。

- 2022 年 8 月,Infosys BPM 被评为 ISG 提供商镜头采购 BPO 和转型服务中 BPO 服务和数字化转型服务类别的领导者。

保险 BPO 服务市场报告范围和交付成果

《保险 BPO 服务市场规模和预测(2021-2031 年)》市场报告对以下领域进行了详细的市场分析:

- 范围内涵盖的所有主要细分市场的全球、区域和国家层面的市场规模和预测。

- 市场动态,例如驱动因素、限制因素和关键机遇。

- 未来的主要趋势。

- 详细的 PEST 和 SWOT 分析

- 全球和区域市场分析涵盖主要市场趋势、主要参与者、法规和最新的市场发展。

- 行业格局和竞争分析包括市场集中度、热图分析、关键参与者和最新发展。

- 详细的公司简介。

- 历史分析(2 年)、基准年、预测(7 年)及复合年增长率

- PEST和SWOT分析

- 市场规模、价值/数量 - 全球、区域、国家

- 行业和竞争格局

- Excel 数据集

近期报告

相关报告

客户评价

购买理由

- 明智的决策

- 了解市场动态

- 竞争分析

- 客户洞察

- 市场预测

- 风险规避

- 战略规划

- 投资论证

- 识别新兴市场

- 优化营销策略

- 提升运营效率

- 顺应监管趋势

获取免费样品 - 保险BPO服务市场

获取免费样品 - 保险BPO服务市场