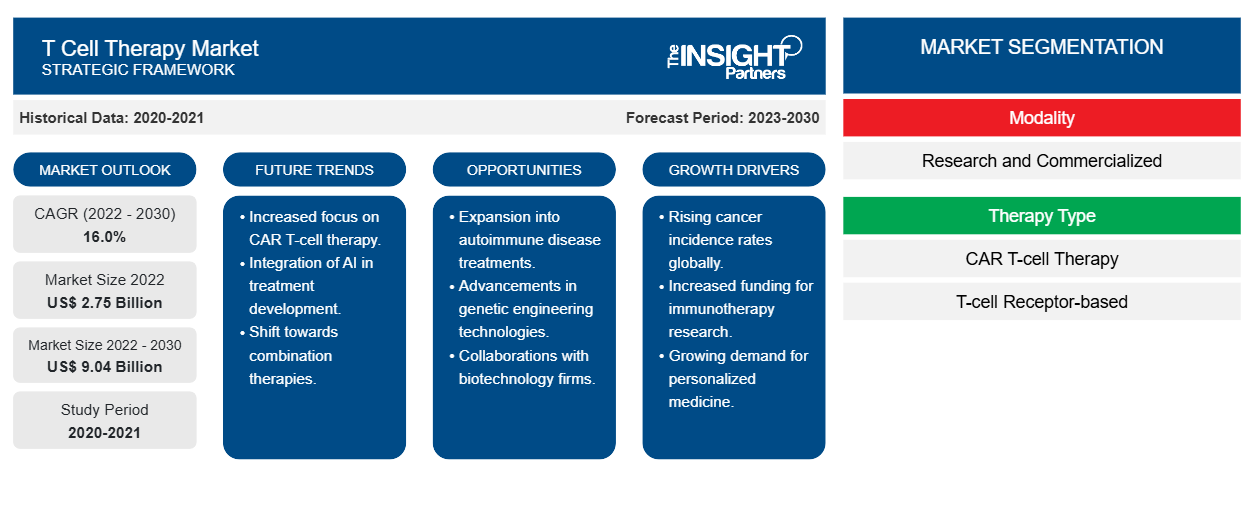

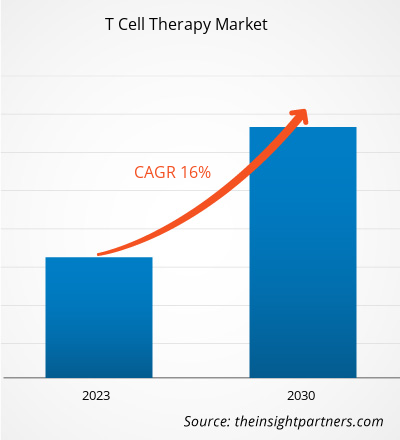

[研究报告] 2022年T细胞治疗市场规模价值27.54亿美元,预计到2030年将达到90.3501亿美元。预计2022-2030年期间的复合年增长率为16.0%。

市场洞察和分析师观点:

最有前景的癌症治疗方法之一是嵌合抗原受体 (CAR) T 细胞疗法,每年都有越来越多的临床前和临床研究开展,以扩大其应用范围。CAR T 细胞疗法也引起了肿瘤学家和学者的兴趣。尽管 CAR T 细胞疗法显示出同样的能力,可以摧毁极晚期白血病和淋巴瘤,并阻止疾病持续多年,但免疫检查点抑制剂比 CAR T 细胞疗法更常见且应用更广泛。预计医院将广泛采用 CAR-T 细胞疗法;然而,为了提供这种疗法,制造和医疗领域必须建立一个生态系统来收集原材料、加工产品、分配产品和监测患者。由于全球癌症负担不断增加以及 T 细胞疗法获批数量不断增加,对 T 细胞疗法的需求不断增长。

在T 细胞治疗市场运营的公司专注于战略发展,例如合作、协议和投资,以提高销售额、扩大地理覆盖范围并增强满足现有客户群更大需求的能力。例如,2023 年 8 月,安斯泰来向 Poseida 的 CAR T 细胞疗法投资了 5000 万美元。作为协议的一部分,安斯泰来将对 P-MUC1C-ALLO1 在实体瘤中的许可拥有独家谈判权和优先购买权。

增长动力和挑战:

根据世界卫生组织 (WHO) 的数据,2020 年癌症是全球主要死因,导致约 1000 万人死亡。根据国际癌症研究机构的数据,到 2040 年,全球癌症负担将增加 3020 万例新病例。嵌合抗原受体 (CAR) T 细胞疗法可以潜在地治疗一种利用免疫系统对抗癌症的新型癌症治疗方法。CAR T 细胞是一种创新药物,由于其成功的临床结果而获得 FDA 的批准,它已经扭转了治疗弥漫性大 B 细胞淋巴瘤 (DLBCL) 和 B 细胞急性淋巴细胞白血病 (B-ALL) 等血液系统恶性肿瘤的局面。根据白血病和淋巴瘤协会的数据,在美国,每 3 分钟大约有一人被诊断出患有白血病、淋巴瘤或骨髓瘤。到 2023 年,预计美国将有近 180,000 人被诊断出患有淋巴瘤和白血病。

T 细胞技术因其较高的成功率而经常用于癌症免疫治疗。2021 年,Labiotech.eu(欧洲生物技术行业领先的在线媒体)表示,全球正在进行 500 多项用于癌症治疗的 CAR T 细胞临床试验。大多数在东亚、美国和欧洲进行。因此,日益加重的癌症负担正在推动 T 细胞治疗市场的增长。

由于 CAR T 细胞疗法很复杂,因此会产生一些高风险的副作用。CAR T 细胞疗法引起的最常见和最严重的副作用之一是细胞因子释放综合征 (CRS)。CAR T 细胞疗法的其他副作用是神经系统影响,包括严重的意识模糊、癫痫样活动和言语障碍。神经毒性是大多数抗 CD19 CAR T 细胞疗法患者的副作用。ICANS 是 CAR T 细胞疗法的常见且具有挑战性的不良反应,25-44% 的血液系统恶性肿瘤儿童会出现这种不良反应。ICANS 通常在 CAR T 细胞输注后 7-10 天内发生,有时长达 3 周,并且可以同时发生或在 CRS 后不久发生。因此,治疗副作用的挑战限制了 T 细胞疗法市场的增长。

定制此报告以满足您的需求

您可以免费定制任何报告,包括本报告的部分内容、国家级分析、Excel 数据包,以及为初创企业和大学提供优惠和折扣

T 细胞治疗市场:战略洞察

-

获取此报告的关键市场趋势。这个免费样品将包括数据分析,从市场趋势到估计和预测。

报告细分和范围:

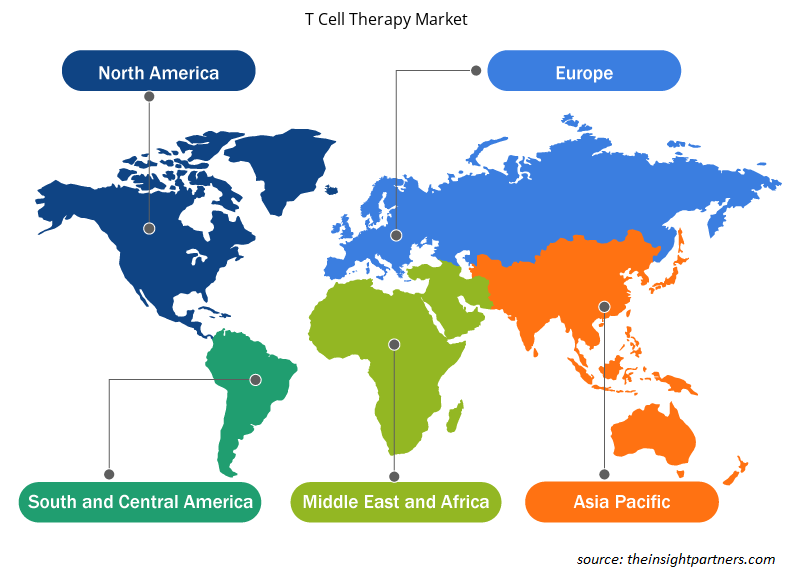

“全球 T 细胞治疗市场”根据治疗方式、治疗类型和适应症进行细分。根据治疗方式,分为研究和商业化。2022 年,商业化部分占据了更大的市场份额。根据治疗类型,T 细胞市场分为CAR T 细胞治疗和基于 T 细胞受体 (TCR) 的治疗。就适应症而言,T 细胞治疗市场分为血液系统恶性肿瘤和实体肿瘤。根据地理位置,T 细胞治疗市场分为北美(美国、加拿大和墨西哥)、欧洲(法国、德国、意大利、英国、西班牙和欧洲其他地区)、亚太地区(澳大利亚、中国、日本、韩国和亚太其他地区)、中东和非洲(沙特阿拉伯、以色列和中东和非洲其他地区)以及南美洲和中美洲(巴西)。

节段分析:

根据方式,T 细胞治疗市场分为研究和商业化。2022 年,商业化部分占据了最大的市场份额。此外,预计同一部分在预测期内增长最快。产品发布的增加以及对 T 细胞疗法对癌症治疗益处的认识的提高推动了商业化部分的增长。以下是一些用于癌症治疗的商业化产品。

- 2022年,FDA批准了Janssen Biotech, Inc.生产的CARVYKTI,它是一种利用慢病毒改造的自体CAR-T细胞,用于攻击表达BCMA的肿瘤细胞,以治疗某些类型的难治性多发性骨髓瘤。

- 2022年1月,美国FDA批准了Immunocare生产的KIMMTRAK,用于治疗不可切除或转移性葡萄膜黑色素瘤。

根据治疗类型,T 细胞治疗市场分为 CAR T 细胞治疗和基于 T 细胞受体 (TCR) 的治疗。2022 年,CAR T 细胞治疗细分市场占据了更大的市场份额。此外,在预测期内,同一细分市场将以显着的增长率增长。在嵌合抗原受体 (CAR) T 细胞治疗技术中,从患者身上获得的 T 细胞经过人工生物工程改造,以表达能够识别和附着在肿瘤细胞上的 CAR。这些公司正在进行战略发展,例如合作、扩张、协议、伙伴关系以及 CAR T 细胞细分市场中的公司推出新产品,从而推动 T 细胞治疗市场的增长。例如,2022 年,FDA 批准了 Janssen Biotech, Inc. 生产的 CARVYKTI。CARVYKTI 是一种称为 CAR-T 的疗法,代表嵌合抗原受体 T 细胞。 CARVYKTI(ciltacabtagene autoleucel)是一种用于治疗骨髓癌(称为多发性骨髓瘤)的成年患者的药物。CARVYKTI 治疗已接受过四种或更多种疗法的复发或难治性多发性骨髓瘤成年患者,这些疗法包括蛋白酶体抑制剂、免疫调节剂和抗 CD38单克隆抗体。

根据适应症,T 细胞治疗市场分为血液系统恶性肿瘤和实体肿瘤。2022 年,血液系统恶性肿瘤细分市场占据了最大的市场份额;预计同一细分市场在预测期内将以显着的增长率增长。血液系统恶性肿瘤是影响人体血液、骨髓和淋巴结的癌症类型。白血病、淋巴瘤、髓系和骨髓瘤是一些血液系统恶性肿瘤。根据白血病和淋巴瘤协会的数据,到 2023 年,预计美国将有约 184,000 人被诊断出患有白血病、淋巴瘤或骨髓瘤。根据同一来源,美国约有 1,629,000 人患有血液系统恶性肿瘤或处于缓解期。由于全球血液系统恶性肿瘤患病率的增加,治疗方法得到了迅速发展。

区域分析:

根据地理位置,T 细胞治疗市场分为五个主要区域:北美、欧洲、亚太地区、南美和中美以及中东和非洲。北美市场分析主要集中在三个主要国家——美国、加拿大和墨西哥。2022 年,北美占据了最大的 T 细胞治疗市场份额。由于癌症和自身免疫性疾病等慢性疾病负担的增加、研发活动的增长以及强大而成熟的市场参与者,北美的 T 细胞治疗市场预计将增长。此外,随着 CAR T 细胞疗法临床研究的增加,北美市场预计将在预测期内增长。

T 细胞治疗市场机会:

T 细胞疗法投资不断增长

在 T 细胞治疗市场运营的公司专注于战略发展,例如合作、扩张、协议和投资,这些有助于他们提高销售额、扩大地理覆盖范围并增强满足现有客户群需求的能力。下面提到了 T 细胞治疗市场的一些值得注意的发展。

- 2023 年 5 月,交易完成后,Laurus Labs 在 ImmunoACT 的股份将按完全摊薄后增至 33.86%。该公司已于 2021 年 11 月收购了 ImmunoACT 26.62% 的股份。ImmunoACT 拥有一系列处于不同开发阶段的 CAR T 细胞疗法资产,用于治疗多种自身免疫性疾病和肿瘤适应症。这项投资进一步加强了 Laurus Labs 对获取新型细胞和基因治疗技术的承诺,并提高了患者负担得起的价格。这项投资将进一步帮助 ImmunoACT 为生产更多治疗方法做好准备。

- 2023 年 1 月,加州再生医学研究所 (CIRM) 投资 400 万美元开发和测试 CAR T 细胞疗法,用于治疗从淋巴瘤到白血病的各种 B 细胞恶性肿瘤。

- 2021 年 11 月,Autolus Therapeutics plc(一家开发下一代程序化 T 细胞疗法的临床阶段生物制药公司)与 Blackstone Life Sciences 达成合作和融资协议,根据该协议,资金由 Blackstone 管理。Blackstone 提供了高达 2.5 亿美元的股权和产品融资,以支持 Autolus 开发其 CD19 CAR T 细胞研究治疗产品 obecabtagene autoleucel(obe-cel),以及 obe-cel 在 B 细胞恶性肿瘤中的下一代产品疗法。

因此,这些投资在 T 细胞治疗市场创造了有利可图的机会。

T 细胞治疗市场区域洞察

Insight Partners 的分析师详细解释了预测期内影响 T 细胞治疗市场的区域趋势和因素。本节还讨论了北美、欧洲、亚太地区、中东和非洲以及南美和中美洲的 T 细胞治疗市场细分和地理位置。

- 获取 T 细胞治疗市场的区域特定数据

T 细胞治疗市场报告范围

| 报告属性 | 细节 |

|---|---|

| 2022 年市场规模 | 27.5亿美元 |

| 2030 年的市场规模 | 90.4 亿美元 |

| 全球复合年增长率(2022 - 2030 年) | 16.0% |

| 史料 | 2020-2021 |

| 预测期 | 2023-2030 |

| 涵盖的领域 |

按方式

|

| 覆盖地区和国家 |

北美

|

| 市场领导者和主要公司简介 |

|

T 细胞治疗市场参与者密度:了解其对业务动态的影响

T 细胞治疗市场正在快速增长,这得益于终端用户需求的不断增长,而这些需求又源于消费者偏好的不断变化、技术进步以及对产品优势的认识不断提高等因素。随着需求的增加,企业正在扩大其产品范围,进行创新以满足消费者的需求,并利用新兴趋势,从而进一步推动市场增长。

市场参与者密度是指在特定市场或行业内运营的企业或公司的分布情况。它表明在给定市场空间中,相对于其规模或总市场价值,有多少竞争对手(市场参与者)存在。

在 T 细胞治疗市场运营的主要公司有:

- Immunocore 控股有限公司

- 传奇生物科技公司

- 詹森全球服务有限公司

- 吉利德科学公司

- 百时美施贵宝公司

免责声明:上面列出的公司没有按照任何特定顺序排列。

- 了解 T 细胞治疗市场主要参与者概况

竞争格局和重点公司:

全球 T 细胞治疗市场中的一些知名参与者包括 Immunocore Holdings Plc、Legend Biotech Corp、Janssen Global Services LLC、Gilead Sciences Inc、Bristol-Myers Squibb Co、Bluebird Bio Inc、Novartis AG、JW (Cayman) Therapeutics Co Ltd、Cartesian Therapeutics Inc 和 Innovent Biologics Inc。这些公司专注于新技术、现有产品的进步和地域扩张,以满足全球不断增长的消费者需求并增加其专业产品组合的产品范围。这些公司在全球 T 细胞治疗市场实施各种无机和有机开发。以下是一些例子:

- 2023年5月,传奇生物科技股份有限公司宣布,根据CARTITUDE-4研究(NCT04181827)的数据,向欧洲药品管理局(EMA)提交了CARVYKTI的II型变异申请,该研究研究了对已接受过一至三种先前治疗方案的复发和来那度胺难治性多发性骨髓瘤成年患者的治疗。

- 2023年3月,专注于开发、制造和商业化细胞免疫治疗产品的独立创新型生物技术公司JW Therapeutics启动了Carteyva(relmacabtagene autoleucel注射液)用于高危大B细胞淋巴瘤患者一线治疗的临床研究及首例患者输注。

- 2022年6月,美国食品药品监督管理局(FDA)批准了Breyanzi(lisocabtagene maraleucel),一种针对CD19的嵌合抗原受体(CAR)T细胞疗法,用于治疗大B细胞淋巴瘤(LBCL)成人患者,包括未另行指定的弥漫大B细胞淋巴瘤(DLBCL)(包括源自惰性淋巴瘤的DLBCL)、高级别B细胞淋巴瘤、原发性纵隔大B细胞淋巴瘤和3B级滤泡性淋巴瘤。

- 历史分析(2 年)、基准年、预测(7 年)及复合年增长率

- PEST和SWOT分析

- 市场规模、价值/数量 - 全球、区域、国家

- 行业和竞争格局

- Excel 数据集

近期报告

相关报告

客户评价

购买理由

- 明智的决策

- 了解市场动态

- 竞争分析

- 客户洞察

- 市场预测

- 风险规避

- 战略规划

- 投资论证

- 识别新兴市场

- 优化营销策略

- 提升运营效率

- 顺应监管趋势

获取免费样品 - T细胞治疗市场

获取免费样品 - T细胞治疗市场