Hardware Held Larger Medical Exoskeleton Market Share in 2023

According to our new research study on "Medical Exoskeleton Market Forecast to 2031 - Global Analysis – by Component, Type, Extremity, Application, Mobility, and End User," the market is expected to grow from US$ 374.91 million in 2023 to US$ 3,206.74 million by 2031; it is anticipated to record a CAGR of 30.8% from 2023 to 2031. The medical exoskeleton market report emphasizes the trends prevalent in the global market, along with drivers and deterrents affecting its growth.

Rising number of strategic initiatives, growing incidence of stroke and musculoskeletal, and increasing longevity of aging population are among the factors driving the market. However, the high cost of products and regulatory concerns are hampering the growth of the market. Increasing technological advancements and rising investments are expected to bring new medical exoskeleton market trends in the coming years.

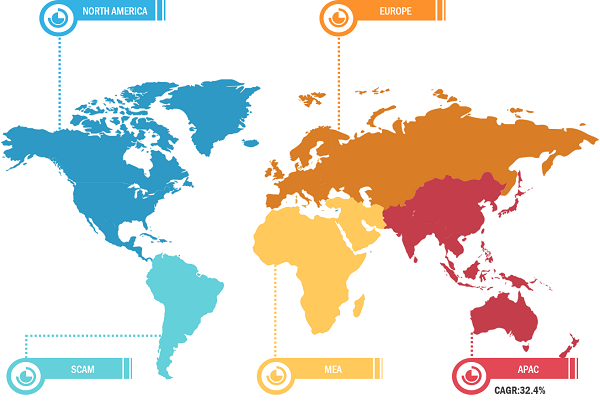

Medical Exoskeleton Market, by Region, 2023 (%)

Medical Exoskeleton Market Size and Forecast (2021-2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Hardware and Software), Type (Powered Exoskeleton and Passive Exoskeleton), Extremity (Lower Body Exoskeleton, Upper Body Exoskeleton, and Full Body Exoskeleton), Application (Spinal Cord Injury, Multiple Sclerosis, Stroke, Cerebral Palsy, Parkinsons Diseases, and Others), Mobility (Mobile Exoskeleton and Stationary Exoskeleton), End Users (Rehabilitation Centers, Physiotherapy Centers, Long Term Care Centers, Homecare Settings, and Others), and Geography

Medical Exoskeleton Market Share and Growth (2021-2031)

Download Free Sample

Source: The Insight Partners Analysis

Rising Number of Strategic Initiatives Propels Medical Exoskeleton Market Growth

Small and big companies operating in the medical exoskeleton market adopt various strategies such as geographic expansion, new product launches, and technological advancements to boost their revenues. A few recent developments in the market are mentioned below.

- In April 2023, Hyundai Motor Company partnered with Asan Medical Center and National Rehabilitation Center to support medical rehabilitation patients by donating ‘X-ble MEX’ wearable robot.

- In December 2022, Ekso Bionics Holdings Inc. acquired Parker Hannifin’s business unit for human motion and control for US$ 10 million. With this acquisition, Ekso gained Parker’s Indego lower limb exoskeleton line of products that are used to deliver individualized gait therapy to patients in outpatient facilities, inpatient, and home settings.

- In July 2022, Ekso Bionics Holdings Inc. received approval from the US Food and Drug Administration (FDA) to market its EksoNR robotic exoskeleton for patients suffering from multiple sclerosis. It was cleared for stroke and spinal cord injury (SCI) rehabilitation in 2016 and acquired brain injury in 2020. It has also received CE certification and is available in Europe.

- Samsung Electronics has received the US FDA for its assistive robot "GEMS Hip," a wearable device that acts as an exoskeleton for users with mobility issues using an active assist algorithm to improve gait and muscle movement.

- In December 2021, German Bionic launched the fifth generation of the Cray X exoskeleton. The fifth-generation Cray X underscores technology leadership in the massively growing international exoskeleton market. The company's innovations are paving the way for more people and businesses worldwide to benefit across a wider range of use cases and industries.

- In November 2021, Ottobock acquired Bay Area-based exoskeleton startup SuitX. SuitX is a spinout of UC Berkeley’s Robotics and Human Engineering Lab. Both companies effectively operate in the same category, producing robotic exoskeletons designed for two distinct purposes—work assistance and healthcare.

- In May 2021, Roam Robotics launched “Ascend,” a smart knee orthosis that helps wearers reduce knee pain and regain mobility. It senses the body movement, automatically adjusts to the wearer’s needs, and provides precise support at the right moment for target muscle groups. It is a registered Class I device with FDA approval available for purchase directly and through private and Medicare insurance, radically expanding public accessibility to wearable robotic devices.

Therefore, the active participation of market players in product launches, expansions, partnerships, and mergers & acquisitions boosts the medical exoskeleton market growth.

Based on component, the medical exoskeleton market is bifurcated into hardware and software. The hardware subsegment is divided into sensors, actuators, power sources, control systems, and others. Actuators are further categorized into pneumatic actuators, hydraulic actuators, electric actuators, mechanical actuators, shape memory alloy actuators, and others. The hardware segment held the largest market share in 2023.

By type, the market is segmented into powered exoskeleton and passive exoskeleton. The powered exoskeleton segment held a larger medical exoskeleton market share in 2023.

In terms of extremity, the market is segmented into lower body exoskeleton, upper body exoskeleton, and full body exoskeleton. The lower body exoskeleton segment held the largest market share in 2023. Lower body exoskeleton is used for patients living with disability caused by musculoskeletal disorders, spinal cord injuries, traumatic brain injuries, and other neurological disorders. The lower body exoskeleton is used for applications as a compensatory device for lost functions in patients who have amputee legs, as well as for patients undergoing rehabilitation and those who have paraplegia. The lower body exoskeleton is expected to be mainly used by older adults, which allows them to be independent while performing their routine activities. The lower body exoskeleton is commercialized widely by players such as ReWalk Robotics, B-Temia, Parker Hannfin Corporation, Cyberdyne Inc., REX Bionics, and Ekso Bionics Holdings. The market is likely to be driven by the rising technological advancements in the lower body exoskeleton and rising incidences of disabilities.

Based on application, the medical exoskeleton market is segmented into spinal cord injury, multiple sclerosis, stroke, cerebral palsy, Parkinson’s disease, and others. The spinal cord injury segment held the largest share of the market in 2023. A spinal cord injury or damage of any part of the spinal cord leads to severe issues such as permanent changes in strength, sensation, and other body functions below the site of the injury. Spinal cord injuries include symptoms such as extreme back pain or pressure in the neck, head or back, difficulty with balance & walking, twisted neck or back, numbness or loss of sensation in hands or feet. There are four types of spinal cord injury—cervical spinal cord injuries, lumbar spinal cord injuries, thoracic spinal cord injuries, and sacral spinal cord injuries.

The medical exoskeleton market size for the spinal cord injury segment is majorly driven by the geriatric population and accident victims with back injuries.

Based on mobility, the market is segmented into mobile exoskeleton and stationary exoskeleton. The mobile exoskeleton segment held a larger market share in 2023.

By end user, the market is segmented into rehabilitation centers, physiotherapy centers, long-term care centers, homecare settings, and others. The rehabilitation centers segment held the largest share of the market in 2023.

The medical exoskeleton market analysis has been carried out by considering the following segments: component, type, extremity, application, mobility, end user, and geography. Based on component, the market is bifurcated into hardware and software. The hardware subsegment is further divided into sensors, actuators, power sources, control systems, and others. Actuators are further segmented into pneumatic actuators, hydraulic actuators, electric actuators, mechanical actuators, shape memory alloy actuators, and others. By type, the market is segmented into powered exoskeleton and passive exoskeleton. In terms of extremity, the market is segmented into lower body exoskeleton, upper body exoskeleton, and full body exoskeleton. Based on application, the market is segmented into spinal cord injury, multiple sclerosis, stroke, cerebral palsy, Parkinson’s disease, and others. Based on mobility, the market is segmented into mobile exoskeleton and stationary exoskeleton. Based on end user, the market is segmented into rehabilitation centers, physiotherapy centers, long term care centers, homecare settings, and others. The geographic scope of medical exoskeleton market report entails North America (the US, Canada, and Mexico), Europe (Spain, the UK, Germany, France, Italy, and the Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com