Medical Exoskeleton Market Drivers and Forecasts by 2031

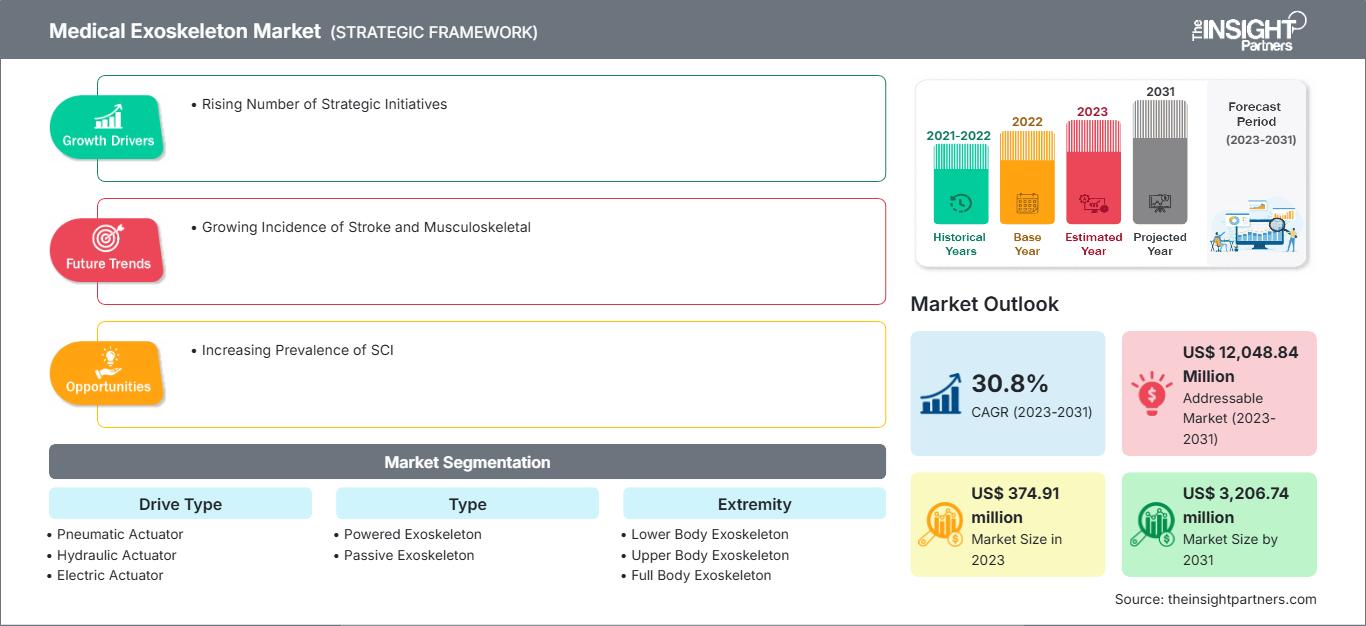

Medical Exoskeleton Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Hardware and Software), Type (Powered Exoskeleton and Passive Exoskeleton), Extremity (Lower Body Exoskeleton, Upper Body Exoskeleton, and Full Body Exoskeleton), Application (Spinal Cord Injury, Multiple Sclerosis, Stroke, Cerebral Palsy, Parkinson’s Disease, and Others), Mobility (Mobile Exoskeleton and Stationary Exoskeleton), End Users (Rehabilitation Centers, Physiotherapy Centers, Long Term Care Centers, Homecare Settings, and Others), and Geography

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2023-2031- Report Date : May 2024

- Report Code : TIPTE100000663

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 174

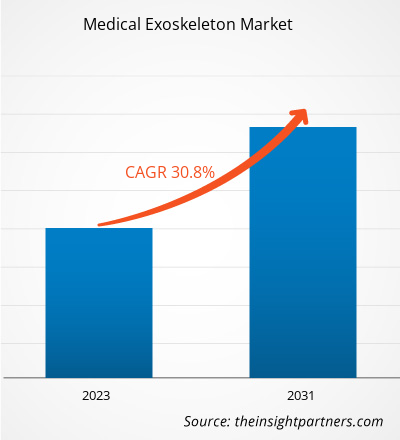

The medical exoskeleton market size is projected to reach US$ 3,206.74 million by 2031 from US$ 374.91 million in 2023. The market is expected to register a CAGR of 30.8% during 2023–2031. Increasing technological advancements and rising investments is likely to remain key trends in the market.

Medical Exoskeleton Market Analysis

Conditions such as stroke, multiple sclerosis, and spinal cord injuries can lead to mobility issues, due to which medical exoskeletons are used for mobility assistance. Increasing investments in R&D by private organizations and government bodies to improve the functionality and affordability of medical exoskeletons is further adding impetus to the market growth.

Medical Exoskeleton Market Overview

An increasing number of startups are focusing on developing medical exoskeletons for people suffering from lower-body mobility disorders. For instance, in 2020, GenElek Technologies, a New Delhi-based health tech startup, launched a robotic exoskeleton for specially abled people. This robotic exoskeleton is combined with artificial intelligence to help a paralyzed person walk effortlessly. With the help of an exoskeleton, a paralytic person can start walking if treated within 11 days of a paralysis stroke.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONMedical Exoskeleton Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Medical Exoskeleton Market Drivers and Opportunities

Increasing Longevity of Aging Population to Favor Market

These days most people in the world are anticipated to survive beyond 60 years of age, which indicates increased life expectancy. Every country is recording growth in both count and percentage of elderly individuals. According to the WHO, 1 in 6 people in the world is likely to be aged 60 or more by 2030, and the population of individuals aged 60 and above would expand from 1 billion in 2020 to 1.4 billion by 2030. Furthermore, the global population with age 60 and older is likely to double, i.e., 2.1 billion by 2050. The number of persons who have progressed 80 years or above is anticipated to triple during 2020–2050, reaching 426 billion by 2050. Elderly people are at a higher risk of hospitalization than grown-ups in middle age. Medical exoskeleton helps elderly people improve their movement and become independent. Thus, the aging population requiring care after surgeries favors the medical exoskeleton market growth.

Increasing Prevalence of Spinal Cord Injury to Promote Market

Reduced physical activity and the predominance of seated activities can lead to severe physical and psychological deterioration in people suffering from spinal cord injury. Secondary complications related to spinal cord injury can also reduce life expectancies. According to the National Library of Medicine, nearly 250,000–500,000 patients suffer from spinal cord injuries every year worldwide. According to a report published by the Association for Spinal Injury Research, Rehabilitation and Reintegration (Aspire, UK), ~2,500 people are diagnosed with spinal cord injuries annually in the UK. Currently, ~50,000 people are living with these injuries in the UK. The National Spinal Cord Injury Statistical Center estimates that ~320,000 people are living with traumatic spinal cord injuries in the US. An elevated number of cases is attributed to motocross and motorcycling competitions emerging as the most popular sporting activities worldwide, as per the National Institute of Health report. According to the WHO, globally, ~1.19 million people die every year in road crashes, and 20–50 million people suffer non-fatal injuries, with many incurring disabilities. Similarly, according to the Mayo Clinic estimates, sports and athletic activities such as diving in shallow water, basketball, and football cause ~10% of spinal cord injuries. Companies such as Lifeward are focusing on developing exoskeletons that help patients with spinal cord injury perform physical activities without pain. For instance, about 20% of the spinal cord injury population can be considered candidates for clinical trials of the current ReWalk Personal Exoskeleton or ReWalk Rehabilitation Exoskeleton. Moreover, soft exo-suit devices in medical exoskeletons can be used for patients suffering from spinal cord injury. Thus, the increase in the prevalence of spinal cord injury and ongoing research for the use of exoskeletons for spinal cord injury patients can be expected to fuel the market growth during the forecast period.

Medical Exoskeleton Market Report Segmentation Analysis

Key segments that contributed to the derivation of the medical exoskeleton market analysis are component, type, extremity, application, mobility, and end user.

- Based on component, the medical exoskeleton market is bifurcated into hardware and software. The hardware subsegment is divided into sensors, actuators, power sources, control systems, and others. Actuators are further segmented into pneumatic actuators, hydraulic actuators, electric actuators, mechanical actuators, shape memory alloy actuators, and others. The hardware segment held a larger market share in 2023.

- By type, the market is segmented into powered exoskeleton and passive exoskeleton. The powered exoskeleton segment held a larger share of the market in 2023.

- In terms of extremity, the medical exoskeleton market is segmented into lower body exoskeleton, upper body exoskeleton, and full body exoskeleton. The lower body exoskeleton segment held the largest market share in 2023.

- Based on application, the market is segmented into spinal cord injury, multiple sclerosis, stroke, cerebral palsy, Parkinson’s disease, and others. The spinal cord injury segment held the largest share of the market in 2023.

- By mobility, the medical exoskeleton market is segmented into mobile exoskeleton and stationary exoskeleton. The mobile exoskeleton segment held a larger market share in 2023.

- Based on end user, the market is segmented into rehabilitation centers, physiotherapy centers, long term care centers, homecare settings, and others. The rehabilitation centers segment dominated the market in 2023.

Medical Exoskeleton Market Share Analysis by Geography

The geographic scope of the medical exoskeleton market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America has dominated the market. The increasing acceptance of technologically advanced products, a rise in research and development activities, presence of large healthcare businesses, and increasing approvals from the FDA for medical exoskeletons are among the key factors propelling the growth of the medical exoskeleton market in North America.

Medical Exoskeleton

Medical Exoskeleton Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 374.91 million |

| Market Size by 2031 | US$ 3,206.74 million |

| Global CAGR (2023 - 2031) | 30.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Drive Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Medical Exoskeleton Market Players Density: Understanding Its Impact on Business Dynamics

The Medical Exoskeleton Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Medical Exoskeleton Market News and Recent Developments

The medical exoskeleton market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the medical exoskeleton market are listed below:

- Ekso Bionics acquired the Human Motion and Control business unit from Parker Hannifin Corporation, a global leader in motion and control technologies. The acquisition includes the Indego lower limb exoskeleton line of products and the planned development of robotic-assisted orthotic and prosthetic devices. The acquisition expands Ekso’s product offering across the continuum of care to home and community use markets, expands the company’s product pipeline, and enhances strategic relationships with key commercial and research partners. (Source: Ekso Bionics Holdings Inc, Company Website, December 2022)

- ReWalk Robotics Ltd. unveiled its new corporate name, Lifeward Inc., a global market leader delivering life-changing solutions to revolutionize what is possible in rehabilitation, recovery, and pursuing life’s passions in the face of physical limitation or disability. The transformation of ReWalk Robotics into Lifeward focuses on the broader goal of the company to be the driving force to elevate the standard of care in overcoming physical limitations and disabilities. (Source: Lifeward, Inc, Company Website, January 2024)

Medical Exoskeleton Market Report Coverage and Deliverables

The “Medical Exoskeleton Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Medical exoskeleton market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Medical exoskeleton market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Medical exoskeleton market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the medical exoskeleton market

- Detailed company profiles

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For