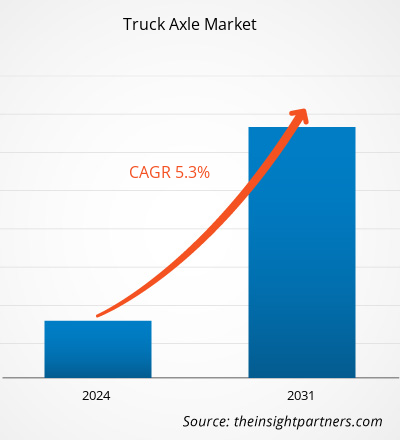

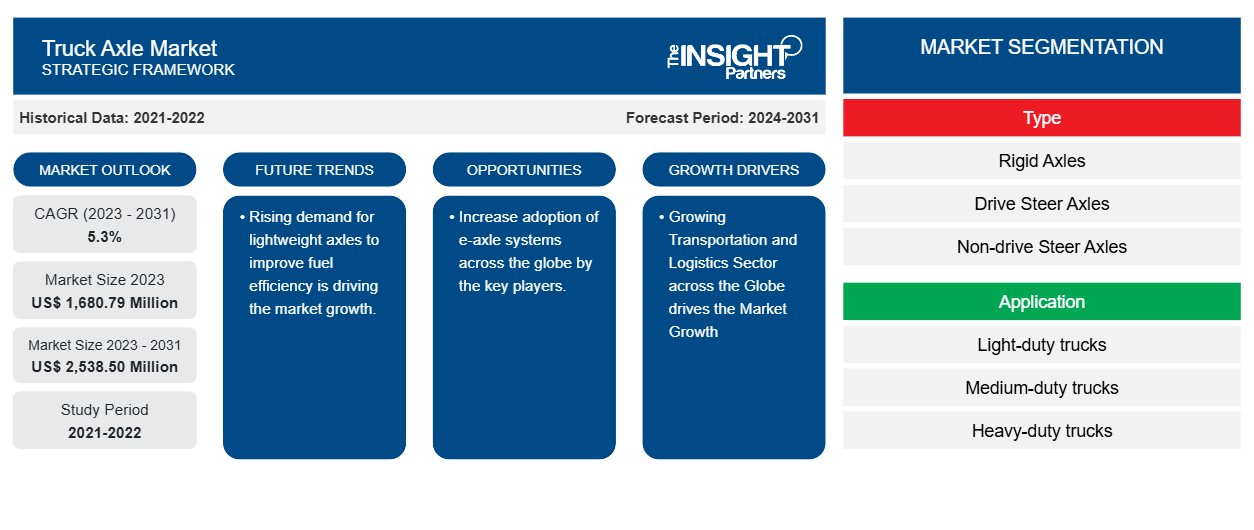

Der Markt für Lkw-Achsen soll von 1.680,79 Millionen US-Dollar im Jahr 2023 auf 2.538,50 Millionen US-Dollar im Jahr 2031 anwachsen. Der Markt soll zwischen 2023 und 2031 eine durchschnittliche jährliche Wachstumsrate (CAGR) von 5,3 % verzeichnen. Die zunehmende Verbreitung vernetzter Transportmittel auf der ganzen Welt treibt den Trend auf dem Markt voran. Die steigende Nachfrage nach leichten Achsen zur Verbesserung der Kraftstoffeffizienz treibt das Marktwachstum an.CAGR of 5.3% during 2023–2031. The increasing adoption of connected transportation across the globe is driving the trend in the market. Rising demand for lightweight axles to improve fuel efficiency is driving the market growth.

LKW-Achsen-Marktanalyse

Steigende Nutzfahrzeugverkäufe mit wachsenden Logistik- und Transportaktivitäten und einem Aufschwung in der E-Commerce-Branche treiben das Wachstum des Lkw-Achsenmarktes im Prognosezeitraum an. Der steigende Verkauf schwerer Nutzfahrzeuge in Ländern im asiatisch-pazifischen Raum wie Indien, China, Japan und Südkorea treibt das Marktwachstum an.

LKW-Achsen-Marktübersicht

Die Lkw-Achse ist ein wesentlicher Bestandteil schwerer Nutzfahrzeuge. Diese Lkw-Achsen helfen dabei, Antriebskraft auf die Räder der Fahrzeuge zu übertragen. Diese Achsen tragen die gesamte Last des Fahrzeugs. Schwere Lkw benötigen starre Achsen, um schweres Gewicht zu tragen. Steigende Verkäufe schwerer Nutzfahrzeuge auf der ganzen Welt treiben das Wachstum des Lkw-Achsenmarktes im Prognosezeitraum voran. Laut der China Passenger Car Association wurden im April 2024 in China rund 44.000 Pickup-Trucks verkauft. Die Verkäufe von Pickup-Trucks in China stiegen im April 2024 im Vergleich zum April 2023 im Jahresvergleich um 4,4 %. Dieses Wachstum beim Verkauf von Lkw in ganz China treibt das Wachstum des Lkw-Achsenmarktes im Prognosezeitraum voran.

Passen Sie diesen Bericht Ihren Anforderungen an

Sie erhalten kostenlos individuelle Anpassungen an jedem Bericht, einschließlich Teilen dieses Berichts oder einer Analyse auf Länderebene, eines Excel-Datenpakets sowie tolle Angebote und Rabatte für Start-ups und Universitäten.

-

Holen Sie sich die wichtigsten Markttrends aus diesem Bericht.Dieses KOSTENLOSE Beispiel umfasst eine Datenanalyse von Markttrends bis hin zu Schätzungen und Prognosen.

Treiber und Chancen auf dem LKW-Achsenmarkt

Der weltweit wachsende Transport- und Logistiksektor treibt das Marktwachstum voran.

Der Transportsektor ist ein wichtiger Industriezweig, der sich mit der Bewegung von Waren, Personen und Produkten befasst. Der Transportsektor wächst rasant, da der Anstieg des E-Commerce-Sektors das Marktwachstum vorantreibt. Laut dem Bureau of Transportation Statistics belief sich der Nettowert der Transportinfrastruktur, einschließlich Fahrzeugen und Ausrüstung, im Jahr 2022 auf 10,68 Billionen US-Dollar. Der Transportsektor des öffentlichen Sektors wird auf 5,96 Billionen US-Dollar geschätzt und der private Sektor auf 4,71 Billionen US-Dollar. Ein solches Wachstum im Transportsektor auf der ganzen Welt treibt das Wachstum des Lkw-Achsenmarktes im Prognosezeitraum an.

Steigern Sie die weltweite Einführung von E-Achssystemen durch die wichtigsten Akteure.

E-Achsen werden häufig in elektromechanischen Antriebssystemen eingesetzt, die mit einer Wellenstruktur, Leistungselektronik, einem Elektromotor und einem Getriebe ausgestattet sind. Dieses Gerät bietet kostengünstige elektrische Antriebslösungen für reine Elektro- und Hybrid-Lkw. Darüber hinaus wird eine E-Achse in Kombination mit Verbrennungsmotoren und Hybridantriebssystemen verwendet. Hersteller von Elektro-Lkw bauen Elektromotoren in ihre starren Hinterachsen ein, um das Fahrzeuggewicht zu reduzieren . Dies ist für die Verbesserung der Effizienz von Elektro-Lkw unabdingbar. Das E-Achssystem wird in die vorhandene Aufhängung eingebaut, sodass die Antriebssysteme entfernt werden können. Der wichtigste treibende Faktor für die E-Achse in Lkw sind die weltweit steigenden Verkaufszahlen von Elektro- und Hybrid-Lkw bei steigenden Kraftstoffkosten.electromechanical propulsion systems that are equipped with shaft structure, power electronics, an electric motor and transmission. This device offers cost-effective electric propulsion solutions for pure electric trucks and hybrid trucks. Furthermore, in combination with ICE and hybrid power systems, an e-axle is used. Electric truck manufacturers are adopting electric motors into their rigid rear axles to reduce the weight of the

Segmentierungsanalyse des LKW-Achsen-Marktberichts

Wichtige Segmente, die zur Ableitung der Marktanalyse für LKW-Achsen beigetragen haben, sind Typ, Anwendung und Geografie.

- Nach Typ wird der Markt in Starrachsen, Antriebslenkachsen und Nichtantriebslenkachsen unterteilt. Darunter dürften Starrachsen im Jahr 2023 den größten Anteil haben. Dies ist auf die steigende Nachfrage nach schweren Nutzfahrzeugen zurückzuführen.

- Je nach Anwendung wird der Markt in leichte, mittelschwere und schwere Lkw unterteilt. Darunter dürften schwere Lkw im Jahr 2023 den größten Anteil haben. Dies ist auf den steigenden Verkauf von kommerziellen schweren Lkw auf der ganzen Welt zurückzuführen.

LKW-Achsen Marktanteilsanalyse nach Geografie

Der geografische Umfang des Marktberichts für LKW-Achsen ist hauptsächlich in fünf Regionen unterteilt: Nordamerika, Asien-Pazifik, Europa, Naher Osten und Afrika sowie Süd- und Mittelamerika.

Der asiatisch-pazifische Raum dürfte aufgrund der gestiegenen Nachfrage und des Absatzes von Lkw in Entwicklungsländern wie China, Indien und Japan den größten Anteil am Lkw-Achsenmarkt haben. Die Lkw-Verkäufe im asiatisch-pazifischen Raum erreichten im Jahr 2024 2,67 Millionen Einheiten. Dieses Wachstum der Lkw-Verkäufe in China, Indien und Japan trieb das Wachstum des Lkw-Achsenmarktes im Prognosezeitraum an. Der asiatisch-pazifische Raum hat einen bedeutenden Anteil von rund 50,4 % am globalen Markt für Schwerlast-Lkw. Dies schafft reichlich Gelegenheit für das Wachstum des Lkw-Achsenmarktes im Prognosezeitraum.

Regionale Einblicke in den LKW-Achsenmarkt

Die regionalen Trends und Faktoren, die den Markt für LKW-Achsen im gesamten Prognosezeitraum beeinflussen, wurden von den Analysten von Insight Partners ausführlich erläutert. In diesem Abschnitt werden auch die Marktsegmente und die Geografie für LKW-Achsen in Nordamerika, Europa, im asiatisch-pazifischen Raum, im Nahen Osten und Afrika sowie in Süd- und Mittelamerika erörtert.

- Erhalten Sie regionale Daten zum LKW-Achsenmarkt

Umfang des Marktberichts für LKW-Achsen

| Berichtsattribut | Details |

|---|---|

| Marktgröße im Jahr 2023 | 1.680,79 Millionen US-Dollar |

| Marktgröße bis 2031 | 2.538,50 Millionen US-Dollar |

| Globale CAGR (2023 - 2031) | 5,3 % |

| Historische Daten | 2021-2022 |

| Prognosezeitraum | 2024–2031 |

| Abgedeckte Segmente |

Nach Typ

|

| Abgedeckte Regionen und Länder |

Nordamerika

|

| Marktführer und wichtige Unternehmensprofile |

|

Dichte der Marktteilnehmer für LKW-Achsen: Auswirkungen auf die Geschäftsdynamik verstehen

Der Markt für LKW-Achsen wächst rasant, angetrieben durch die steigende Nachfrage der Endnutzer aufgrund von Faktoren wie sich entwickelnden Verbraucherpräferenzen, technologischen Fortschritten und einem größeren Bewusstsein für die Vorteile des Produkts. Mit steigender Nachfrage erweitern Unternehmen ihr Angebot, entwickeln Innovationen, um die Bedürfnisse der Verbraucher zu erfüllen, und nutzen neue Trends, was das Marktwachstum weiter ankurbelt.

Die Marktteilnehmerdichte bezieht sich auf die Verteilung der Firmen oder Unternehmen, die in einem bestimmten Markt oder einer bestimmten Branche tätig sind. Sie gibt an, wie viele Wettbewerber (Marktteilnehmer) in einem bestimmten Marktraum im Verhältnis zu seiner Größe oder seinem gesamten Marktwert präsent sind.

Die wichtigsten auf dem LKW-Achsenmarkt tätigen Unternehmen sind:

- Amerikanische Achse & Fertigung, Inc.

- Dana GmbH

- Meritor, Inc.

- Qingte Group Co., Ltd.

- Raba Automotive Holding Plc.

- SAF-HOLLAND SE

Haftungsausschluss : Die oben aufgeführten Unternehmen sind nicht in einer bestimmten Reihenfolge aufgeführt.

- Überblick über die wichtigsten Akteure auf dem Markt für LKW-Achsen

Neuigkeiten und aktuelle Entwicklungen zum LKW-Achsenmarkt

Der Markt für LKW-Achsen wird durch die Erhebung qualitativer und quantitativer Daten nach Primär- und Sekundärforschung bewertet, die wichtige Unternehmensveröffentlichungen, Verbandsdaten und Datenbanken umfasst. Nachfolgend sind einige der Entwicklungen auf dem Markt für LKW-Achsen aufgeführt:

- Ashok Leyland hat einen neuen 3-achsigen 6×2 Dual Tyre Lift Axle (DTLA)-Lkw, den AVTR 3120, auf den Markt gebracht. Mit dieser Markteinführung ist Ashok Leyland der erste und einzige Akteur im Land, der eine vollständige Palette von DTLA-Lkw mit 31 t, 40,5 t und 47,5 t Gesamtgewicht anbietet. (Quelle: Pressemitteilung, Dezember 2021)

- ReFuels NV, einer der führenden europäischen Anbieter von erneuerbarem Biomethan (Bio-CNG) zur Dekarbonisierung von Schwerlastfahrzeugen, gibt heute bekannt, dass Scania UK einen neuen dreiachsigen (6×2) CNG-Lkw auf den Markt gebracht hat. Damit wird der adressierbare Markt deutlich erweitert und umfasst nun auch die bevorzugte Fahrzeugklasse britischer Flottenbetreiber. (Quelle: Pressemitteilung, Juni 2024)

Marktbericht zu LKW-Achsen – Abdeckung und Ergebnisse

Der Bericht „Marktgröße und Prognose für LKW-Achsen (2021–2031)“ bietet eine detaillierte Analyse des Marktes, die die folgenden Bereiche abdeckt:

- LKW-Achsen-Marktgröße und -prognose auf globaler, regionaler und Länderebene für alle wichtigen Marktsegmente, die im Rahmen des Berichts abgedeckt sind

- LKW-Achsen-Markttrends sowie Marktdynamik wie Treiber, Einschränkungen und wichtige Chancen

- Detaillierte PEST- und SWOT-Analyse

- Analyse des LKW-Achsen-Marktes mit wichtigen Markttrends, globalen und regionalen Rahmenbedingungen, wichtigen Akteuren, Vorschriften und aktuellen Marktentwicklungen

- Branchenlandschaft und Wettbewerbsanalyse, die die Marktkonzentration, Heatmap-Analyse, prominente Akteure und aktuelle Entwicklungen für den LKW-Achsenmarkt umfasst

- Detaillierte Firmenprofile

- Historische Analyse (2 Jahre), Basisjahr, Prognose (7 Jahre) mit CAGR

- PEST- und SWOT-Analyse

- Marktgröße Wert/Volumen – Global, Regional, Land

- Branchen- und Wettbewerbslandschaft

- Excel-Datensatz

Aktuelle Berichte

Verwandte Berichte

Erfahrungsberichte

Grund zum Kauf

- Fundierte Entscheidungsfindung

- Marktdynamik verstehen

- Wettbewerbsanalyse

- Kundeneinblicke

- Marktprognosen

- Risikominimierung

- Strategische Planung

- Investitionsbegründung

- Identifizierung neuer Märkte

- Verbesserung von Marketingstrategien

- Steigerung der Betriebseffizienz

- Anpassung an regulatorische Trends

Kostenlose Probe anfordern für - LKW-Achsenmarkt

Kostenlose Probe anfordern für - LKW-Achsenmarkt