AI overview of Electronic Article Surveillance Market

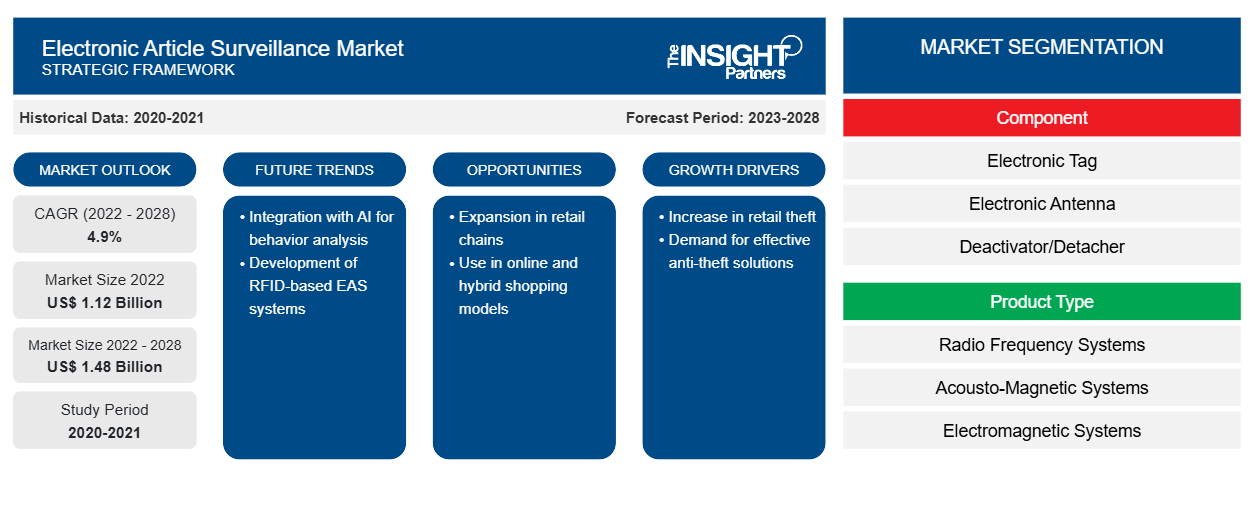

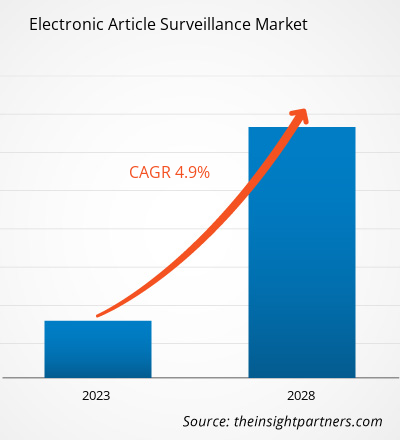

The Electronic Article Surveillance Market is poised for significant growth, projected to reach a market size of US$ 1.48 billion by 2028, up from US$ 1.12 billion in 2022, reflecting a robust CAGR of 4.9% during the forecast period from 2023 to 2028. This market is driven by the increasing incidence of retail theft and the rising demand for effective anti-theft solutions across various sectors, including apparel, cosmetics, and supermarkets. Notably, the integration of AI for behavior analysis and the development of RFID-based EAS systems are emerging trends that are shaping the future of the Electronic Article Surveillance Market. As retail chains expand and hybrid shopping models evolve, the market share for electronic article surveillance solutions is expected to grow, highlighting the importance of innovative security measures in retail.

The electronic article surveillance market is expected to grow from US$ 1,116.07 million in 2022 to US$ 1,484.00 million by 2028; it is estimated to register a CAGR of 4.9% from 2022 to 2028.

The significant presence of the retail industry in North America is one of the major factors driving the electronic article surveillance (EAS) market. Major retail brands across the region include The Kroger Co., Costco, Best Buy, Carvana, The Home Depot, Target, eBay, and Walmart. Many expansion strategies, including the opening of several new retail stores across the region, have been adopted by the abovementioned brands. For example, in 2022, Target opened 23 new stores across different locations, such as New York, Texas, Pittsburgh, and South Carolina. Thus, the increase in the number of retail stores is further increasing the demand for electronic article surveillance solutions across the region.

In addition, the increasing number of shoplifting cases across North America is driving the demand for electronic article surveillance. According to the Retail Council of Canada, the retail sector in the country experienced theft of ~US$ 200 million a year before the onset of the COVID-19 pandemic. Furthermore, the rising cost of living is one of the factors catalyzing the increasing number of shoplifting cases across the country. These factors are propelling the demand for advanced security solutions across retail stores, thereby contributing to the electronic article surveillance market growth. In addition, several stringent government regulations and certifications, such as UCODE 9 IC, are launched to standardize security products across retail checkpoints and exit points, which is further influencing the North America electronic article surveillance market players to develop enhanced products.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Electronic Article Surveillance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Electronic Article Surveillance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Electronic Article Surveillance Market

Lockdowns imposed by governments of various countries in Europe due to the onset of the COVID-19 pandemic resulted in the shutdown of several stores of apparel, fashion accessories, and cosmetics. As a result, the adoption of electronic article surveillance across these stores witnessed a decline, severely affecting the market growth. With the shutdown of nonessential businesses in 2020, clothing and apparel retail stores recorded high losses in sales. For instance, several apparel markets witnessed a step-change in the proportion of online sales due to lockdowns and shutdowns of stores. According to the Retail Economics forecasts, the UK is the most highly penetrated market, with 60% of apparel sales projected to occur online by 2025. All these factors led to a decline in the demand for electronic article surveillance in fashion stores.

Market Insights – Electronic Article Surveillance Market

The global retail industry witnessed growth owing to the rise in the standard of living of people. Major companies operating in the global electronic article surveillance market include Agon Systems, Amersec, Feltron Security Systems LLC, Johnson Controls, and Tekno Electro Solutions Pvt Ltd. These companies have been engaged in new product development over the years. A list of such developments is mentioned below:

- In July 2022, Checkpoint Systems announced the launch of its new NS40 EAS antenna. The solution is easily integrated with retail solutions to control shoplifting incidents across retail stores.

- In April 2021, Prosegur Security announced the launch of its new DoubleLock EAS tag with two separate use cases, reducing the tag defeat by 40–60%.

- In March 2021, Prosegur Security announced the launch of its D-Arm Series EAS tags. The tags are integrated with a self-alarm, which is activated if removed with a magnet. The solution is designed to reduce retail loss due to shoplifting incidents.

Thus, the rising development of new electronic article surveillance systems such as electronic tags, antennae, and deactivators is driving the global electronic article surveillance market forecast.

Component-Based Insights

Based on component, the electronic article surveillance market is segmented into electronic tag, electronic antenna, deactivator/detacher, and others. The electronic tag segment accounted for the largest market share in 2021. An electronic article surveillance (EAS) tag is a crucial component of an EAS system. The tag is a small signal transmitter that gives the signal to the EAS antennas and generates an alarm when tried to take it out of the store without removing the same. Also, every store with a problem with shrinkage generally benefits from the quality tags as EAS antennas reduce shrinkage from 50 to 90%. Moreover, every store has different security needs, and electronic tags allow retailers to track inventory at the item level, so they are better prepared to make decisions about stocking and promotions. Also, many handheld devices contain internal RFID tags which are designed to set off electronic article surveillance sensors at store entrances. A clothing store has hard tags that are premium of all tags and have multiple lock mechanisms, making it extremely hard to remove by unauthorized individuals. Grocery stores face difficulties in tagging frozen items and items containing liquids or metal. Therefore, electronic tags or labels are attached to such products, and sensors are placed at store exits.

The global electronic article surveillance market size is segmented based on component, product type, application, and geography. Based on component, the electronic article surveillance market is segmented into electronic tag, electronic antenna, deactivator/detacher, and others. Based on product type, the electronic article surveillance market is categorized into radio-frequency, acoustic-magnetic, electromagnetic, and microwave systems. Based on application, the electronic article surveillance market is classified into apparel & fashion accessories, cosmetics & pharmaceuticals, and supermarkets & grocery stores. The electronic article surveillance market size, based on region, is segmented into North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South America (SAM).

Sensormatic, Checkpoint Systems, ALL-TAG, Agon Systems, and Checkpoint Systems are among the key electronic article surveillance market players operating across the world.

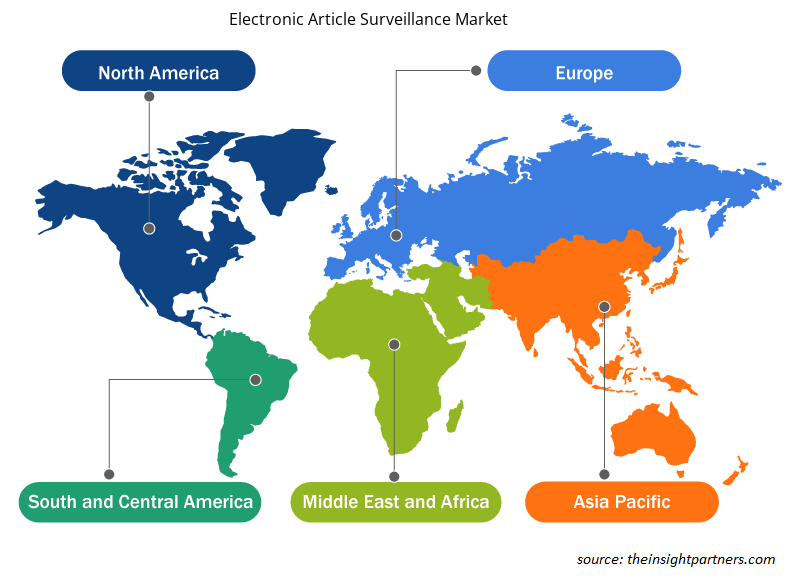

Electronic Article Surveillance Market Regional Insights

The regional trends and factors influencing the Electronic Article Surveillance Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Electronic Article Surveillance Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Electronic Article Surveillance Market

Electronic Article Surveillance Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1.12 Billion |

| Market Size by 2028 | US$ 1.48 Billion |

| Global CAGR (2022 - 2028) | 4.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Electronic Article Surveillance Market Players Density: Understanding Its Impact on Business Dynamics

The Electronic Article Surveillance Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Electronic Article Surveillance Market are:

- Agon Systems

- ALL-TAG Corporation

- Amersec s.r.o.

- Cross Point Middle East Technologies LLC

- Feltron Security Systems LLC

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Electronic Article Surveillance Market top key players overview

The electronic article surveillance market players are mainly focused on the development of advanced and efficient products.

- In 2022, Noccela has a strategy for protecting our IPR, and we have been granted several patents already. This most recent patent, especially as it is a system-level patent, is another example of the continuous innovation of our team. It proves our solutions uniqueness and innovativeness and ability to develop end-to-end solutions with a product-market fit.

- In 2022, Checkpoint System is expanding its relationship with Polish fashion retail group LPP, with the deployment of a large scale Radio Frequency Identification program to improve merchandise availability, operational efficiency, and the consumer experience. The program will be deployed across LPP’s entire supply chain from manufacturing through LLP’s eCommerce platform and to over 1,700 outlets spanning 23 countries.

Frequently Asked Questions

1. Increasing Retail Outlets by Global Brands

2. Growing Product Development Initiatives by Global Players

3. Rising Number of Supermarkets

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Electronic Article Surveillance Market

- Agon Systems

- ALL-TAG Corporation

- Amersec s.r.o.

- Cross Point Middle East Technologies LLC

- Feltron Security Systems LLC

- Ketec, Inc.

- Shopguard Limited

- Tekno Electro Solutions

- Sensormatic (Johnson Controls)

- Checkpoint Systems

- Sabel

- Nedap

Get Free Sample For

Get Free Sample For