Occlusion Devices Market Growth, Analysis, and Forecast by 2031

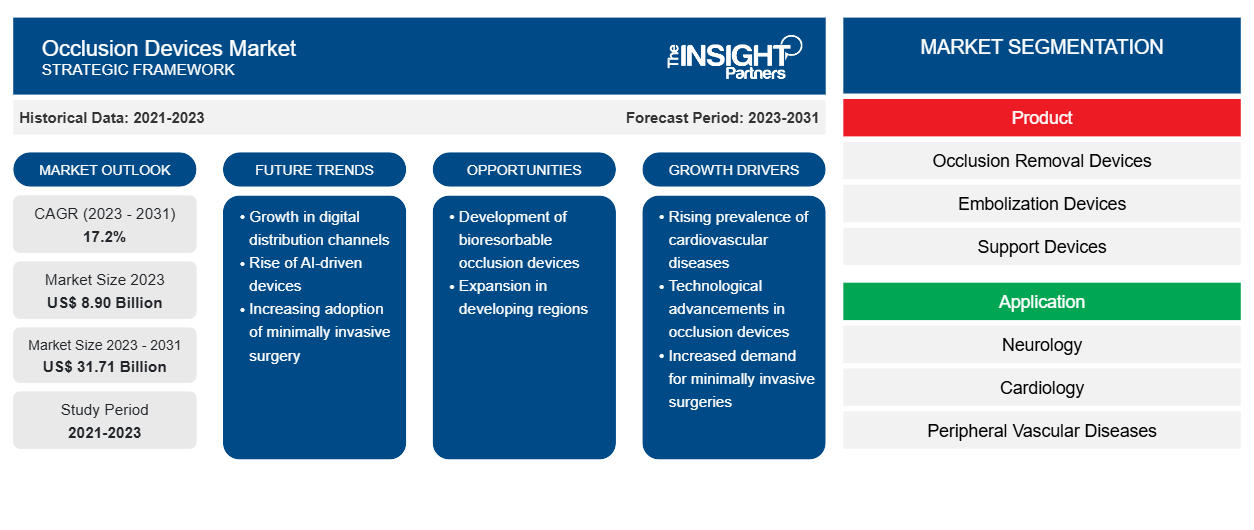

Occlusion Devices Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Occlusion Removal Devices, Embolization Devices, and Support Devices), Application (Neurology, Cardiology, Peripheral Vascular Diseases, Urology, Oncology, and Gynecology), End User (Hospitals, Diagnostic Centers & Surgical Centers, Ambulatory Care Centers, and Research Laboratories & Academic Institutes), and Geography (North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa)

Historic Data: 2021-2023 | Base Year: 2023 | Forecast Period: 2023-2031- Report Date : Apr 2026

- Report Code : TIPRE00039110

- Category : Life Sciences

- Status : Data Released

- Available Report Formats :

- No. of Pages : 150

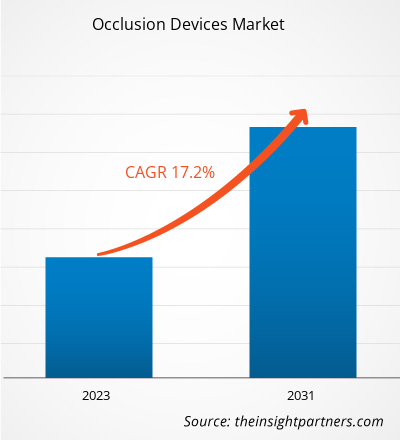

The occlusion devices market forecast can help stakeholders in this marketplace outline their growth strategies. The market is projected to grow from US$ 8.90 billion in 2023 to US$ 31.71 billion by 2031; it is estimated to record a CAGR of 17.2% during 2023–2031.

Occlusion devices are specialized tools or implants used to block abnormal blood vessels or structural defects in the heart. The occlusion device is designed with an expandable tubular body that consists of a frame with multiple interconnected parts. This frame expands inside a blood vessel and collpses for the delivery or retrieval of the device. In addition, the device features a hydrophilic polyurethane hydrogel layer attached to the interconnected components of the tubular expandable body. The polyurethane hydrogel layer expands when the device comes in contact with an aqueous environment. The report includes growth prospects owing to the current occlusion devices market trends and their foreseeable impact during the forecast period.

Growth Drivers:

A significant increase in the availability of a large number of cardiovascular diseases (CVDs) drives the growth of the occlusion devices market size. CVDs, including coronary artery disease

,

arrhythmia, and chronic total occlusion (CTO), can restrict the blood flow to the heart, causing a cardiac arrest or stroke. Based on angiographic evidence, a CTO is characterized by a complete blockage of a coronary artery for 3 or more months. According to the Centers for Disease Control and Prevention (CDC), in 2021, coronary heart disease was the most prevalent type of heart disease, affecting ~ 5% of adults aged 20 and above, and it resulted in the death of 375,476 people in the US. As per an article published in the Journal of the American College of Cardiology (JACC) in January 2022, 16–20% of patients with coronary artery disease undergoing coronary angiography are diagnosed with CTOs. Occlusion devices such as occlusion balloons, stent retrievers, and embolization devices are commonly used in interventional procedures, including angioplasty and thrombectomy, to remove blockages in blood vessels. The rising incidences of CTOs have led to an increase in the number of CTO percutaneous coronary interventions (PCIs) for the management of occlusion of arteries. Thus, the prevalence of acute and chronic heart diseases propels the occlusion devices market growth.Restraints:

The increasing number of product recalls in the occlusion devices market has raised concerns among healthcare providers and patients. These recalls can result due to factors such as design flaws, manufacturing defects, or inadequate safety standards. Consequently, trust in certain brands and products may diminish, leading to a potential decline in demand for aortic valve replacement devices. Patients and medical professionals may become more cautious while considering these devices, subsequently opting for alternatives or delaying procedures.

A few product recalls by the key players in the occlusion devices market are mentioned below:

- In June 2023, Baxter Healthcare Corporation recalled the SIGMA Spectrum Infusion Pumps with Master Drug Library and Spectrum IQ Infusion Systems with Dose IQ Safety Software. The recall was due to repeat upstream occlusion false alarms, which can interrupt or delay therapy and contribute to clinician fatigue, causing serious adverse health consequences, especially for people receiving life-sustaining medications.

- In July 2021, W. L. Gore & Associates, Inc. initiated a voluntary product recall of GORE Molding and Occlusion Balloon Catheters intended for the temporary occlusion of aortic vessels or for assisting the expansion of endovascular prostheses. The company identified a change in manufacturing equipment as the source of the device failure.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONOcclusion Devices Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The “Global Occlusion Devices Market Analysis to 2031” is a specialized and in-depth study focusing on the global market dynamics to help identify the key driving factors, future trends, and lucrative opportunities in the market, which would, in turn, aid in identifying major revenue pockets. The report aims to provide an overview of the market with detailed market segmentation by product, application, and end user. The scope of the occlusion devices market report entails North America, Europe, Asia Pacific, Middle East & Africa, and South & Central.

By product, the market is segmented into occlusion removal devices, embolization devices, and support devices. The occlusion removal devices segment is further categorized into stent retrievers, coil retrievers, balloon occlusion devices, and suction and aspiration devices. The support devices segment is further bifurcated into microcatheters and guidewires. The occlusion removal devices segment held the largest occlusion devices market share in 2023. The support devices segment is anticipated to register the highest CAGR during the forecast period.

The market, by application, is categorized into neurology, cardiology, peripheral vascular diseases, urology, oncology, and gynecology. The cardiology segment held the largest share of the occlusion devices market in 2023. It is anticipated to register the highest CAGR during the forecast period.

The market, by end user, is categorized into hospitals, diagnostic centers and surgical centers, ambulatory care centers, and research laboratories and academic institutes. The hospitals segment held the largest share of the occlusion devices market in 2023, and it is anticipated to register the highest CAGR during the forecast period.

Regional Analysis:

In terms of revenue, North America held the largest occlusion devices market share in 2023. The surging prevalence and incidence of cardiovascular diseases is a major factor fueling the growth of the market. The growing preference for minimally invasive surgeries, availability of better healthcare infrastructure, and the rising number of new occlusion device approvals are the factors bolstering the overall growth of the market. In November 2020, Abbott Laboratories received FDA approval for its Amplatzer Piccolo Occluder, which is the world's first medical device that can be implanted in babies using a minimally invasive procedure to treat patent ductus arteriosus. Therefore, contributions and market initiatives of the key players such as Abbott, Johnson & Johnson, and MicroPort Scientific Corporation are positively influencing the occlusion devices market growth in North America.

Occlusion Devices

Occlusion Devices Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 8.90 Billion |

| Market Size by 2031 | US$ 31.71 Billion |

| Global CAGR (2023 - 2031) | 17.2% |

| Historical Data | 2021-2023 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Occlusion Devices Market Players Density: Understanding Its Impact on Business Dynamics

The Occlusion Devices Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Industry Developments and Future Opportunities:

A few of the strategic developments by leading players operating in the occlusion devices market, as per company press releases, are listed below:

- In February 2024, BIOTRONIK and Interventional Medical Device Solutions (IMDS) partnered to launch an innovative Micro Rx catheter. It is a rapid exchange microcatheter designed to enhance guidewire support during percutaneous coronary interventions (PCI). This advanced device is exclusively distributed by BIOTRONIK and manufactured by IMDS.

In September 2023, MicroPort Endovastec announced the successful implantation of the Reewarm PTX Drug Coated Balloon (DCB) Catheter by a team of doctors at Paulo Sacramento Hospital in Sao Paulo, Brazil. This shows the product’s continued proliferation in international markets. This device is intended to treat stenosis or occlusion in the femoral-popliteal artery for percutaneous transluminal angioplasty (PTA) in the peripheral vessels.

Competitive Landscape and Key Companies:

Abbott; Boston Scientific Corporation; LeMaitre Vascular, Inc; Edwards Lifesciences Corporation; Medtronic; MicroPort Scientific Corporation; Johnson & Johnson; Terumo Group; Stryker Corporation; and Tokai Medical Products are among the prominent companies profiled in the occlusion devices market report. These companies focus on developing new technologies, upgrading existing products, and expanding their geographic presence to meet the growing consumer demand worldwide.

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For