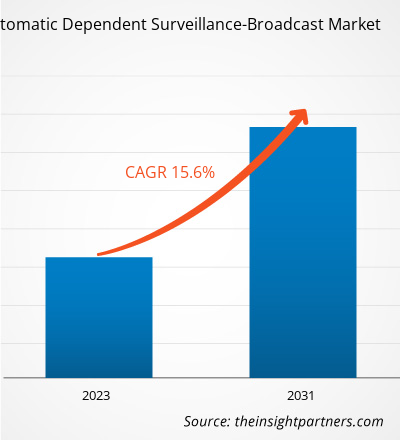

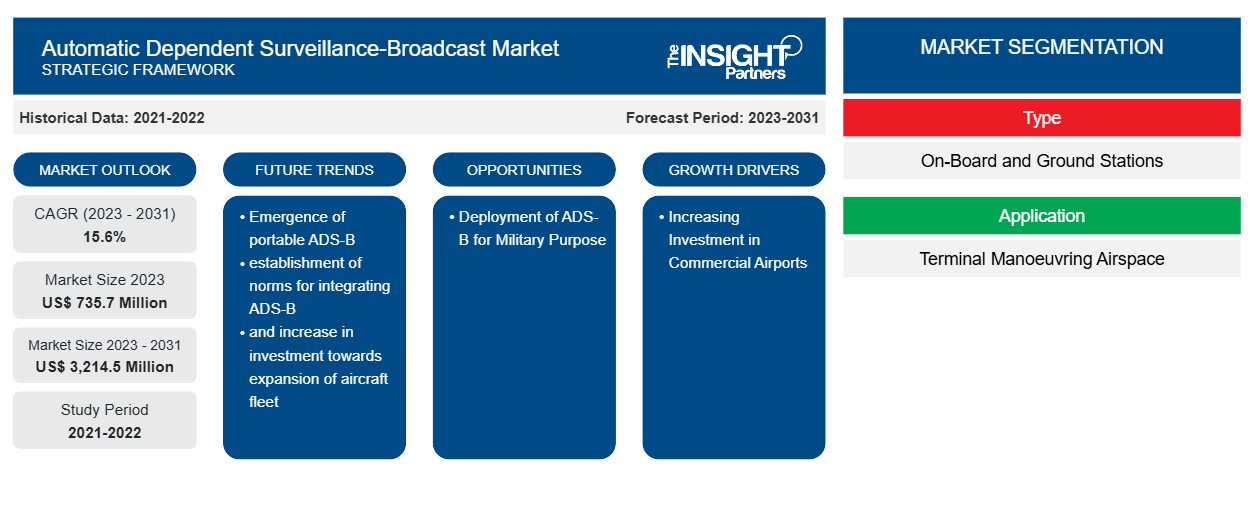

Se prevé que el tamaño del mercado de vigilancia dependiente automática y transmisión alcance los 3.214,5 millones de dólares en 2031, frente a los 735,7 millones de dólares en 2023. Se espera que el mercado registre una CAGR del 15,6 % entre 2023 y 2031. La aparición del ADS-B portátil, el establecimiento de normas para la integración del ADS-B y el aumento de la inversión en la expansión de la flota de aeronaves se encuentran entre las tendencias clave que impulsan el mercado de vigilancia dependiente automática y transmisión.CAGR of 15.6% in 2023–2031. The emergence of portable ADS-B, establishment of norms for integrating ADS-B, and increase in investment towards the expansion of aircraft fleet are among the key trends driving the automatic dependent surveillance-broadcast market.

Análisis del mercado de la vigilancia dependiente automática y la difusión

El creciente número de pedidos y entregas de flotas de aeronaves en todo el mundo, junto con los mandatos para el uso de ADS-B, está desempeñando un papel positivo en el impulso de la adopción de ADS-B. Además, se prevé que el aumento de la inversión para modernizar los aeropuertos comerciales con instalaciones y tecnologías avanzadas impulse la adopción de ADS-B. Además, se espera que los proyectos aprobados por las autoridades de aviación de países como los EE. UU. para el uso de ADS-B en aplicaciones militares brinden amplias oportunidades de crecimiento a los fabricantes de ADS-B durante el período de pronóstico. Además, se espera que la aparición de ADS-B portátiles para ahorrar el costo de fabricación e instalación del ADS-B estándar contribuya al crecimiento del mercado.

Vigilancia dependiente automática: descripción general del mercado de transmisión

ADS-B es una técnica de vigilancia en la que no se necesita ningún estímulo externo. Esta técnica depende de los vehículos y aeronaves del aeropuerto para transmitir su posición, identidad y otra información obtenida de sistemas de a bordo como GNSS. ADS-B exhibe características que incluyen alto rendimiento, sostenibilidad ambiental, interoperabilidad global y mayor capacidad y seguridad mejorada. Además, la infraestructura de vigilancia ADS-B es menos costosa que la tecnología de radar primario , lo que la hace rentable para fines de vigilancia. Se espera que un aumento en la inversión hacia la expansión de flotas de aeronaves en todo el mundo impulse el crecimiento del mercado de transmisión y vigilancia dependiente automática durante el período de pronóstico. Además, se prevé que la aviación comercial aumente en los próximos años debido al creciente número de viajeros aéreos y la adquisición de nuevas aeronaves. En América del Norte, Europa y la región de Asia Pacífico, el tráfico aéreo de pasajeros ha aumentado con el tiempo, lo que está impulsando la demanda de aeronaves comerciales. En Asia Pacífico, principalmente en China e India, se ha demostrado que las aeronaves comerciales para viajes nacionales son rentables. Se espera que esto impulse el crecimiento del mercado en los próximos años.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Impulsores y oportunidades del mercado de la vigilancia dependiente automática y la radiodifusión

Aumento de la inversión en aeropuertos comerciales

Con el aumento del número de aeropuertos comerciales en todo el mundo, la adopción de ADS-B también está aumentando. Esta tecnología se está ejecutando actualmente en regiones como Europa, América del Norte y Asia. Con el aumento de la infraestructura de los aeropuertos comerciales o la renovación de los aeropuertos existentes, también está aumentando la cantidad de equipos terrestres, como las terminales ATC, que aprovechan el ADS-B para el seguimiento de aeronaves. En países como China, el Aeropuerto Internacional de Chongqing Jiangbei (CQIA) se encuentra entre los 10 aeropuertos más grandes, que está experimentando un importante plan de expansión. A partir de la inversión, el aeropuerto recibirá el estatus de centro aéreo internacional y será el más grande en el oeste de China para 2035. Otro aeropuerto en China que presencia inversiones para desarrollar un aeropuerto es el Aeropuerto Internacional Daxing de Beijing.ATC terminals, is also increasing, thus taking advantage of ADS-B for tracking aircraft. In countries such as China, Chongqing Jiangbei International Airport (CQIA) is among the 10th largest airports, which is undergoing a significant expansion plan. From investment, the airport is to receive international air hub status and will be the largest in western China by 2035. Another airport in China witnessing investment to develop an airport is Beijing Daxing International Airport.

EspañolSE Lithuanian Airports ha firmado un acuerdo de préstamo por valor de 81 millones de dólares (70 millones de euros) con el Banco Nórdico de Inversiones para modernizar los tres aeropuertos principales de Lituania: Vilnius, Kaunas y Palanga. Se prevé que estos proyectos relacionados con la modernización de los aeropuertos impulsen la adopción de tecnologías avanzadas, incluido el ADS-B. Los siguientes datos representan las inversiones en términos de construcción, modernización y actualización de aeropuertos en regiones como América del Norte, que registrarán 20 000 millones de dólares, Asia Pacífico, 90 860 millones de dólares, Suráfrica, 1120 millones de dólares y Oriente Medio y África, 42 920 millones de dólares para el desarrollo de sus aeropuertos.Palanga. Such projects related to the modernization of airports are projected to propel the adoption of advanced technologies, including ADS-B. The following data represents the investments in terms of constructing/upgrading/modernizing airports across regions such as North America to witness US$ 20 billion, APAC to see US$ 90.86 billion, SAM to experience US$ 1.12 billion, and MEA to US$ 42.92 billion for the development of their airports.

Se prevé que las inversiones mencionadas para construir nuevos aeropuertos y modernizar los aeropuertos existentes aumenten el despliegue de técnicas avanzadas de vigilancia para rastrear mejor las aeronaves . Por lo tanto, están contribuyendo positivamente al despliegue de ADS-B, que está impulsando el mercado de vigilancia dependiente automática y transmisión.

Despliegue del ADS-B con fines militares

El alcance del ADS-B se está expandiendo para garantizar el seguimiento preciso de las aeronaves. Con los continuos avances tecnológicos, la integración del ADS-B está aumentando entre las aeronaves militares. Según la Fuerza Aérea de los EE. UU., se anticipa que el Pentágono tendrá 2,936 aeronaves equipadas con ADS-B Out guiado por el mandato de la FAA. Para 2025, el Departamento de Defensa de los EE. UU. tiene como objetivo tener casi el 62% de sus aeronaves equipadas con ADS-B (Out), incluido más del 67% de los helicópteros, el 35% de los aviones de combate y el 100% de la movilidad, aeronaves de entrenamiento, comando y control / inteligencia, vigilancia y reconocimiento (C2 / ISR). Se espera que casi 1,129 helicópteros, 259 aeronaves C2 / ISR, 923 aeronaves de movilidad y 625 entrenadores estén equipados con ADS-B según la Fuerza Aérea. En el Departamento de Defensa, se prevé que las aeronaves que reciban ADS-B Out sean los Boeing C-17 Globemasters, los helicópteros Lockheed Martin UH-60 Black Hawk, los C-130 y los aviones de transporte C-5. Se prevé que un despliegue tan masivo de ADS-B en la aviación militar influya de manera efectiva en el crecimiento del mercado de vigilancia y transmisión dependientes de la automatización.

Análisis de segmentación del informe de mercado de transmisión de vigilancia dependiente automática

Los segmentos clave que contribuyeron a la derivación del análisis del mercado de transmisión de vigilancia dependiente automática son el tipo y el usuario final.

- Según el tipo, el mercado de transmisión y vigilancia dependiente automática se ha dividido en estaciones a bordo y estaciones terrestres. El segmento de estaciones a bordo tuvo una mayor participación de mercado en 2023.

- En función de la aplicación, el mercado de vigilancia dependiente automática por radiodifusión se ha dividido en vigilancia del espacio aéreo de maniobras terminales (TMA) y vigilancia aerotransportada. El segmento de vigilancia aerotransportada tuvo una mayor participación de mercado en 2023.

- En función de los componentes, el mercado se ha segmentado en antena, receptor, transpondedor y receptores terrestres ads-b. El segmento de transpondedores dominó el mercado en 2023.

Análisis de la cuota de mercado de la vigilancia dependiente automática y la difusión por geografía

El alcance geográfico del informe de mercado de transmisión de vigilancia dependiente automática se divide principalmente en cinco regiones: América del Norte, Europa, Asia Pacífico, Medio Oriente y África, y América del Sur.

América del Norte dominó el mercado de vigilancia y transmisión dependiente automática en 2023. América del Norte es la región tecnológicamente más avanzada, con importantes economías como Estados Unidos, Canadá y México. Estas economías se clasifican por sus mayores niveles de vida, altos ingresos individuales disponibles y rápidos avances tecnológicos en ingeniería aeroespacial y construcción de aeropuertos. La región de América del Norte comprende la flota más grande de aeronaves comerciales y de defensa del mundo. La gran cantidad de flotas comerciales y militares operativas en el ámbito nacional e internacional, junto con un alto valor promedio de millas recorridas por pasajero en la región, impulsó la demanda de componentes de comunicación para aeropuertos y aeronaves. Las economías de la región tienen una presencia considerable de aeropuertos comerciales y militares. Algunas están actualizando ADS-B y sistemas asociados en estos sitios aeroportuarios para aplicaciones de recepción de señales tanto terrestres como de aeronaves.

Perspectivas regionales del mercado de transmisión y vigilancia dependiente automática

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de vigilancia dependiente automática por transmisión durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de vigilancia dependiente automática por transmisión en América del Norte, Europa, Asia Pacífico, Medio Oriente y África, y América del Sur y Central.

- Obtenga los datos regionales específicos para el mercado de transmisión de vigilancia dependiente automática

Alcance del informe sobre el mercado de transmisión de vigilancia dependiente automática

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2023 | US$ 735,7 millones |

| Tamaño del mercado en 2031 | US$ 3.214,5 millones |

| CAGR global (2023 - 2031) | 15,6% |

| Datos históricos | 2021-2022 |

| Período de pronóstico | 2023-2031 |

| Segmentos cubiertos |

Por tipo

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado: comprensión de su impacto en la dinámica empresarial

El mercado de vigilancia dependiente automática por transmisión está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de transmisión de vigilancia dependiente automática son:

- Corporación Avidyne

- Compañía aérea Aspen Avionics, Inc.

- Aeroespacial Collins

- Sistemas de vuelo libre

- Garmin Ltd

- Compañía: Honeywell International Inc.

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de transmisión de vigilancia dependiente automática

Noticias y desarrollos recientes del mercado de la vigilancia dependiente automática

El mercado de vigilancia dependiente automática por transmisión se evalúa mediante la recopilación de datos cualitativos y cuantitativos posteriores a la investigación primaria y secundaria, que incluye publicaciones corporativas importantes, datos de asociaciones y bases de datos. A continuación, se incluye una lista de los avances en el mercado de vigilancia dependiente automática por transmisión y las estrategias:

- En junio de 2023, Aireon y NAV Portugal lanzaron el sistema ADS-B basado en el espacio. Gracias a él, más del 75 % del espacio aéreo de la región del Atlántico Norte de la OACI está controlado actualmente mediante vigilancia del tráfico aéreo en tiempo real.

- En noviembre de 2020, Aireon se asoció con la Administración Federal de Aviación. Esta asociación tenía como objetivo la exploración de datos ADS-B basados en el espacio y, por lo tanto, fortaleció la posición de la empresa en este mercado.

Informe sobre el mercado de la vigilancia dependiente automática y la difusión: cobertura y resultados

El informe “Tamaño y pronóstico del mercado de transmisión de vigilancia dependiente automática (2021-2031)” proporciona un análisis detallado del mercado que cubre las siguientes áreas:

- Tamaño del mercado y pronóstico a nivel global, regional y de país para todos los segmentos clave del mercado cubiertos bajo el alcance

- Dinámica del mercado, como impulsores, restricciones y oportunidades clave

- Principales tendencias futuras

- Análisis detallado de las cinco fuerzas de Porter

- Análisis del mercado global y regional que cubre las tendencias clave del mercado, los principales actores, las regulaciones y los desarrollos recientes del mercado.

- Análisis del panorama de la industria y de la competencia que abarca la concentración del mercado, el análisis de mapas de calor, los actores destacados y los desarrollos recientes

- Perfiles de empresas detallados con análisis FODA

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Informes relacionados

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de radiodifusión de vigilancia dependiente automática

Obtenga una muestra gratuita para - Mercado de radiodifusión de vigilancia dependiente automática