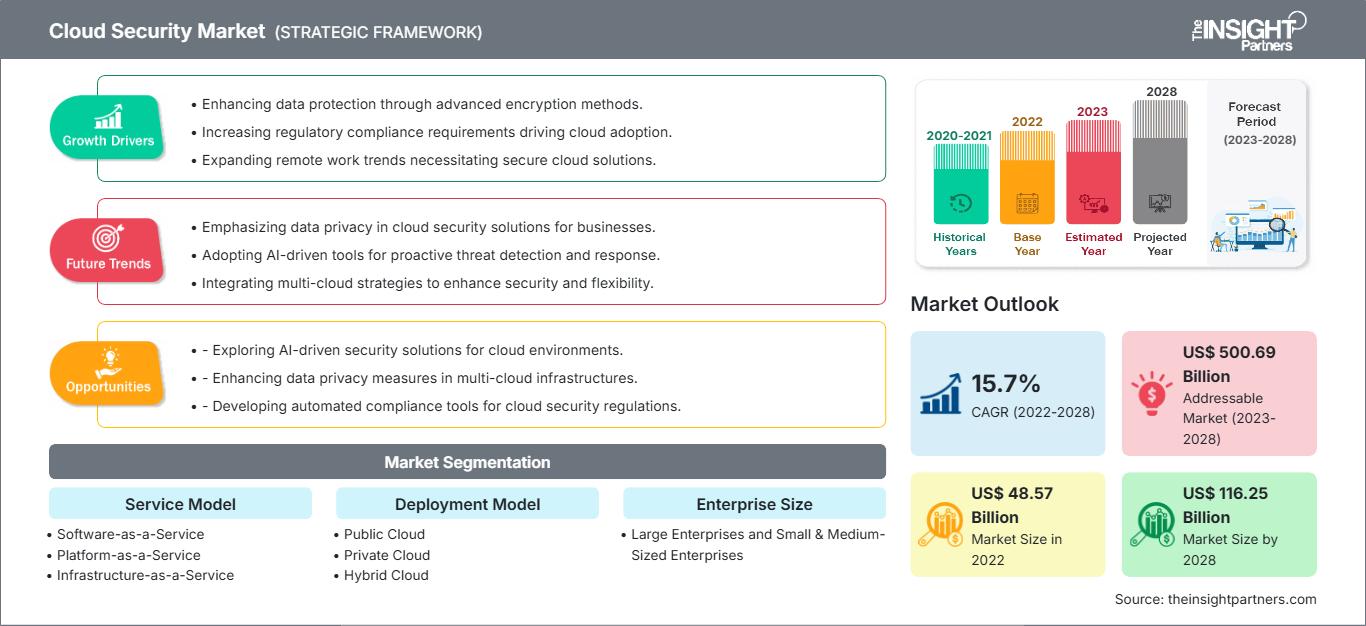

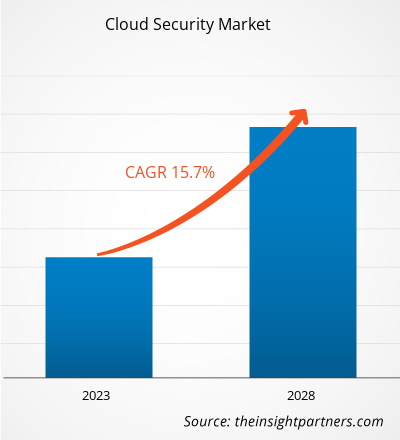

Se espera que el mercado de seguridad en la nube crezca de US$ 48,57 mil millones en 2022 a US$ 116,25 mil millones en 2028; se estima que crecerá a una CAGR del 15,7% entre 2022 y 2028.

El mantenimiento de la seguridad se ha vuelto crucial en las empresas debido al creciente número de infracciones en línea y ataques tecnológicos. La seguridad en la nube proporciona numerosos niveles de protección dentro de la infraestructura de red contra accesos no autorizados, filtraciones de datos y ataques de denegación de servicio distribuido (DDoS). En 2022, Flexera, una empresa estadounidense de software, realizó un estudio y proyectó que casi el 57 % de las organizaciones están migrando sus cargas de trabajo a la nube. Además, casi 6 de cada 10 empresas migraron su trabajo a la nube. Por lo tanto, el creciente número de empresas que utilizan infraestructura en la nube está impulsando la adopción de soluciones de seguridad en la nube.

La presencia de grandes empresas reconocidas y con sólidas finanzas en la industria global de la seguridad en la nube incluye a Amazon Web Services, Inc.; Microsoft; IBM Corporation; Oracle; y Google, Inc. Por ello, el poder de negociación de los compradores en el mercado de la seguridad en la nube es bastante alto. Además, gracias a los avances tecnológicos en seguridad en la nube y al auge de los servicios de contenedores gestionados, se estima que dicho poder se mantendrá alto durante el período 2019-2028. Las principales empresas del mercado de la seguridad en la nube utilizan diferentes estrategias al planificar sus soluciones y modelos de servicio para los distintos sectores de la industria. Se prevé que los continuos avances en el sector tecnológico presionen a los proveedores de seguridad en la nube para que se adapten a los cambios y mantengan su posición en el mercado.

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

Mercado de seguridad en la nube: perspectivas estratégicas

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Impacto de la pandemia de COVID-19 en la cuota de mercado de la seguridad en la nube

El brote de COVID-19 impactó drásticamente la economía global durante su pico en 2020, obstaculizando las actividades comerciales en varios sectores a nivel mundial. También interrumpió las operaciones de varias empresas, clientes y socios por tiempo indefinido debido a las restricciones de viaje y el cierre de negocios. El modelo de trabajo remoto e híbrido estaba en rápido crecimiento gracias a la enorme inversión en transformación digital. Además, se produjo una adopción masiva de la seguridad en la nube, impulsada por la pandemia, la expansión de los centros de datos, el gasto público en grandes ciudades inteligentes y los proyectos de la administración pública que apoyaban la adopción empresarial de tecnologías emergentes. La industria del software no se vio afectada durante la pandemia, ya que varias empresas permitieron a sus empleados trabajar desde casa. Asimismo, las empresas adoptaron cada vez más soluciones y servicios de seguridad en la nube para reducir la necesidad de personal para el mantenimiento de datos. Esto les permitió proteger a su fuerza laboral de posibles infecciones y, al mismo tiempo, garantizar que la producción no se viera obstaculizada.

Perspectivas del mercado: mercado de seguridad en la nube

El creciente uso de soluciones basadas en la nube y servicios de seguridad gestionados impulsa el crecimiento del mercado de seguridad en la nube

La demanda de servicios en la nube aumentó significativamente durante la pandemia de COVID-19 debido a la adopción generalizada del modelo de teletrabajo. Microsoft registró un aumento del 775% en la demanda de su plataforma de servicios en la nube durante 2021. Las pequeñas y medianas empresas (pymes) están adoptando servicios de seguridad gestionados, ya que carecen de la experiencia interna necesaria para gestionar eficazmente los servicios en la nube. Según OTAVA, estas estrategias les permiten combinar las ventajas de una nube pública con la seguridad de un entorno de nube privada local. Según el Informe sobre el Estado de la Nube 2020 de Flexera, las empresas están adoptando los servicios en la nube: el 93% utiliza una estrategia multinube y el 87% prefiere una estrategia de nube híbrida. Existe una notable demanda de servicios de seguridad en la nube ofrecidos por importantes proveedores de ciberseguridad como Google, Microsoft y Amazon. Algunos beneficios potenciales de integrar la computación en la nube en los procedimientos y operaciones de las pymes son el acceso simplificado, la rápida implementación, los bajos requisitos de infraestructura de TI y los bajos costos de instalación.SMEs) are embracing managed security services since they lack the internal expertise to effectively manage cloud services. According to OTAVA, these strategies allow them to combine the advantages of a public cloud with the security of a private on-premises cloud environment. According to Flexera's 2020 State of the Cloud Report, enterprises are embracing cloud services, with 93% of them utilizing a multi-cloud strategy and 87% preferring a hybrid cloud strategy. There is a notable demand for cloud security services offered by significant cybersecurity suppliers such as Google, Microsoft, and Amazon. A few potential benefits of integrating cloud computing in the procedures and operations of SMEs are simplified access, rapid implementation, low IT infrastructure requirement, and low installation costs.

Información basada en modelos de implementación

Según el modelo de implementación, el mercado de seguridad en la nube se segmenta en nubes públicas, privadas e híbridas. En 2022, el segmento de la nube pública representó la mayor cuota de mercado. Las empresas están implementando la nube pública a través de proveedores de servicios en la nube (CSP) externos para gestionar aplicaciones y datos dentro de su infraestructura. Además, los principales actores del mercado siguen ofreciendo herramientas de seguridad integradas que ayudan a proteger los datos críticos para el negocio. El público en general, los particulares y las empresas se sienten atraídos por las infraestructuras de nube pública, ya que ofrecen escalabilidad de servicios y facilitan la gestión del personal de TI interno. Estos factores impulsan el crecimiento del mercado de seguridad en la nube en el segmento de la nube pública.

Los actores que operan en el mercado de seguridad en la nube se centran principalmente en el desarrollo de productos avanzados y eficientes.

- En agosto de 2022, VMware Inc introdujo mejoras significativas en sus exclusivas capacidades de seguridad lateral para ayudar a los clientes a lograr seguridad para aplicaciones modernas y tradicionales para entornos de múltiples nubes, impulsando así el crecimiento del mercado de seguridad en la nube.

- En junio de 2022, Palo Alto Networks amplió la plataforma de protección de aplicaciones nativa de la nube con capacidades como análisis de composición de software sensible al contexto y lista de materiales de software.

Perspectivas regionales del mercado de seguridad en la nube

Los analistas de The Insight Partners han explicado detalladamente las tendencias y los factores regionales que influyen en el mercado de seguridad en la nube durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de seguridad en la nube en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

Alcance del informe de mercado de seguridad en la nube

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2022 | US$ 48.57 mil millones |

| Tamaño del mercado en 2028 | US$ 116.25 mil millones |

| CAGR global (2022-2028) | 15,7% |

| Datos históricos | 2020-2021 |

| Período de pronóstico | 2023-2028 |

| Segmentos cubiertos |

Por modelo de servicio

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de seguridad en la nube: comprensión de su impacto en la dinámica empresarial

El mercado de la seguridad en la nube está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y un mayor conocimiento de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían su oferta, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

- Obtenga una descripción general de los principales actores clave del mercado de seguridad en la nube

El mercado de la seguridad en la nube se segmenta en cinco regiones principales: Norteamérica, Europa, Asia Pacífico (APAC), Oriente Medio y África, y Sudamérica. En 2022, Norteamérica lideró el mercado con una cuota de ingresos considerable, seguida de Europa. Además, se espera que Asia Pacífico registre la tasa de crecimiento anual compuesta (TCAC) más alta del mercado entre 2022 y 2028.

Amazon Web Services, Inc.; Microsoft; IBM Corporation; Oracle; Trend Micro Incorporated; VMware, Inc.; Palo Alto Networks, Inc.; Cisco Systems, Inc.; Check Point Software Technologies Ltd.; y Google, Inc. se encuentran entre los actores clave del mercado de la seguridad en la nube. El informe de mercado proporciona información detallada que ayuda a los actores clave a planificar su crecimiento en los próximos años.

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Informes relacionados

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de seguridad en la nube

Obtenga una muestra gratuita para - Mercado de seguridad en la nube