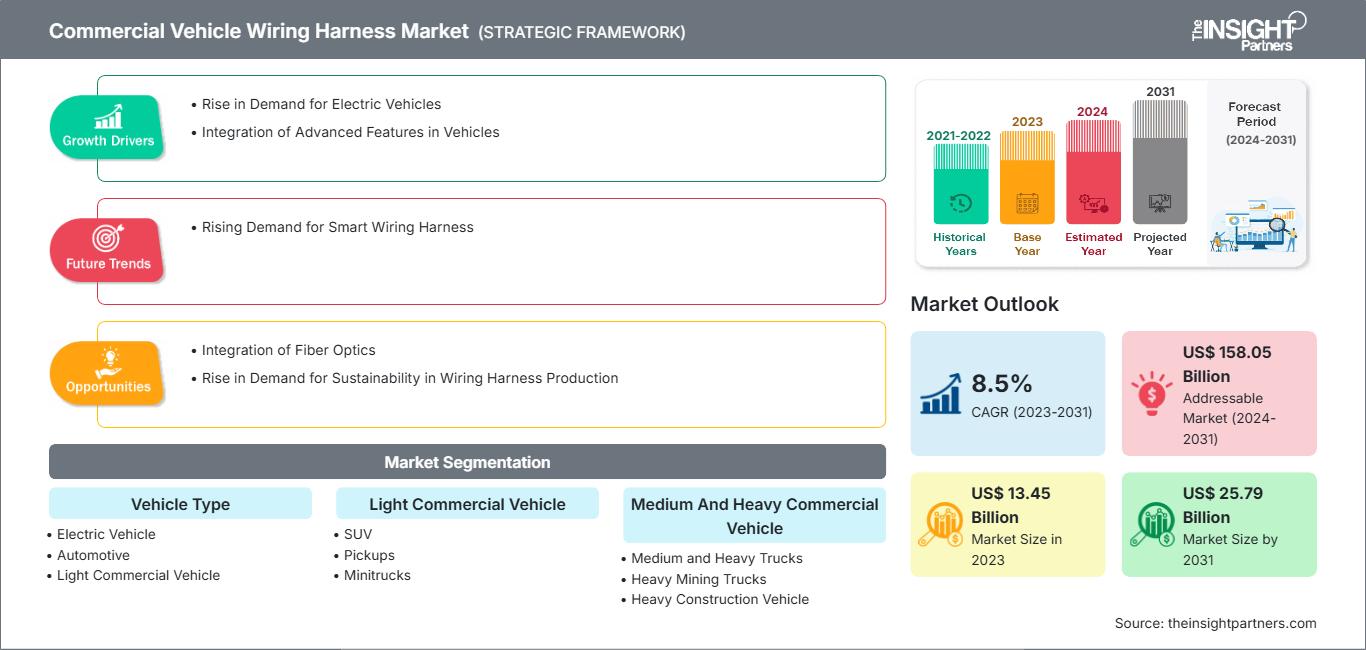

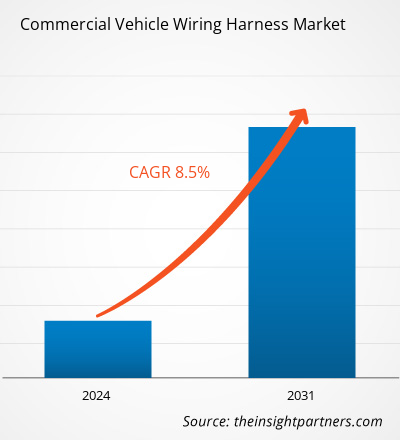

Se prevé que el mercado de arneses de cableado para vehículos comerciales alcance los 25.790 millones de dólares estadounidenses en 2031, frente a los 13.450 millones de dólares estadounidenses en 2023. Se estima que el mercado registrará una tasa de crecimiento anual compuesta (TCAC) del 8,5 % entre 2023 y 2031. Es probable que la aparición de arneses de cableado inteligentes genere nuevas tendencias en el mercado.

Análisis del mercado de arneses de cableado para vehículos comerciales

La demanda de vehículos eléctricos (VE) está aumentando a nivel mundial, principalmente debido a las sólidas políticas gubernamentales que apoyan su adopción y a la creciente preocupación por el medio ambiente. Este aumento en la demanda de VE impulsa el crecimiento del mercado de arneses de cableado para vehículos comerciales, ya que estos desempeñan un papel fundamental en la gestión del flujo de energía e información en los vehículos. Además, la creciente integración de funciones avanzadas, como los vehículos autónomos y los sistemas avanzados de asistencia al conductor (ADAS), también impulsa el crecimiento del mercado. Asimismo, se prevé que la creciente integración de la fibra óptica para una alta conectividad y la mayor demanda de sostenibilidad en la producción de arneses de cableado generen oportunidades para el crecimiento de este mercado. Por otra parte, se espera que la creciente demanda de arneses de cableado inteligentes, compatibles con cualquier vehículo, impulse aún más el crecimiento del mercado durante el período de pronóstico.

Panorama general del mercado de arneses de cableado para vehículos comerciales

El arnés de cableado es un conjunto de cables eléctricos que conectan todos los componentes eléctricos y electrónicos de un automóvil, como sensores, unidades de control electrónico, baterías y actuadores. Este arnés gestiona el flujo de energía e información dentro del sistema eléctrico para permitir las funciones principales del vehículo, como la dirección y el frenado, así como funciones secundarias, como la ventilación y el sistema de infoentretenimiento. Los arneses de cableado agrupan varios cables en haces rígidos, lo que los hace más seguros que los cables sueltos y reduce la posibilidad de cortocircuitos en los circuitos eléctricos. Además, están fabricados con materiales duraderos y diseñados para funcionar correctamente en condiciones adversas, soportando grandes cargas eléctricas. Asimismo, los arneses de cableado contribuyen a mejorar la eficiencia de combustible de cualquier automóvil, lo que incrementa aún más su demanda en la industria automotriz.

Obtendrá personalización gratuita de cualquier informe, incluyendo partes de este informe, análisis a nivel de país y paquetes de datos de Excel. Además, podrá aprovechar excelentes ofertas y descuentos para empresas emergentes y universidades.

Mercado de arneses de cableado para vehículos comerciales: Perspectivas estratégicas

-

Obtenga las principales tendencias clave del mercado que se describen en este informe.Esta muestra GRATUITA incluirá análisis de datos, que abarcarán desde tendencias de mercado hasta estimaciones y pronósticos.

Factores impulsores y oportunidades del mercado de arneses de cableado para vehículos comerciales

Aumento de la demanda de vehículos eléctricos

Las ventas de vehículos eléctricos (VE) están aumentando debido a la preocupación por la protección del medio ambiente y las políticas gubernamentales que favorecen la adopción de vehículos de bajas o cero emisiones. Además, los gobiernos de diferentes países ofrecen subsidios y desgravaciones fiscales a sus ciudadanos para fomentar la adopción de VE. Las autoridades gubernamentales están implementando diversas iniciativas para promover los VE a nivel mundial. Varios estados de EE. UU. están tomando medidas al proporcionar incentivos financieros, como desgravaciones, créditos fiscales y reducciones en las tasas de matriculación, promoviendo así la adopción de VE en el país. Por ejemplo, en 2021, el gobierno de Colorado ofreció un crédito fiscal de 4000 dólares estadounidenses para la compra de un VE ligero. De manera similar, el gobierno de Connecticut ofrece una tasa de matriculación bianual reducida de 38 dólares estadounidenses para los VE. Estas iniciativas gubernamentales están impulsando el aumento de las ventas de VE en todo el mundo. Según el informe anual Global EV Outlook 2024 de la AIE, en 2023 se matricularon aproximadamente 14 millones de coches eléctricos nuevos en todo el mundo.

En 2023, las ventas de coches eléctricos superaron en 3,5 millones a las de 2022, lo que representa un aumento del 35 % interanual. Según la misma fuente, los coches eléctricos representaron aproximadamente el 18 % del total de coches vendidos en 2023, frente al 14 % en 2022. Asimismo, en 2023, del total de coches eléctricos nuevos matriculados a nivel mundial, China registró aproximadamente el 60 %, Europa el 25 % y Estados Unidos el 10 %. El número de matriculaciones de coches eléctricos nuevos en China alcanzó los 8,1 millones en 2023, un 35 % más que en 2022. China es el mayor productor mundial de vehículos eléctricos, con el 64 % de la producción global. Por lo tanto, el aumento de las ventas de vehículos eléctricos impulsa la demanda de arneses de cableado, ya que desempeñan un papel fundamental en la gestión del flujo de energía e información dentro de estos vehículos.

Integración de fibra óptica

La creciente dependencia de los cables de fibra óptica se está convirtiendo en un pilar fundamental de la innovación y la eficiencia en la industria automotriz, que evoluciona rápidamente. A medida que los automóviles se conectan cada vez más con las nuevas tecnologías, el uso de cables de fibra óptica se vuelve crucial para satisfacer la creciente necesidad de una transmisión de datos más rápida y un mejor rendimiento. Los cables de fibra óptica mejoran los sistemas de entretenimiento e información a bordo, brindando a pasajeros y conductores una experiencia audiovisual inigualable que aumenta considerablemente la satisfacción del usuario y la experiencia de conducción en general. Además, la fibra óptica permite diagnósticos del vehículo en tiempo real, sistemas de asistencia al conductor mejorados y capacidades de conducción autónoma al posibilitar una rápida transferencia de datos, lo cual es fundamental para la toma de decisiones instantáneas. Su aplicación en el diseño automotriz reduce el peso del vehículo, lo que se traduce en vehículos más eficientes en el consumo de combustible y más respetuosos con el medio ambiente.

La fibra óptica es fundamental en sistemas como el control de crucero adaptativo, la prevención de colisiones y la alerta de cambio involuntario de carril, que requieren una rápida transferencia de datos. Su aplicación garantiza que las medidas de seguridad sean no solo más eficaces, sino también más fiables, lo que proporciona a los conductores una mayor confianza. Además, el uso de cables de fibra óptica en los sistemas de comunicación del vehículo permite un flujo de información más fluido y eficiente, esencial para el correcto funcionamiento de las medidas de seguridad modernas. Esta comunicación en tiempo real mejora el rendimiento del vehículo y supone un avance significativo en la innovación de la seguridad automotriz, allanando el camino para futuros avances tecnológicos y elevando la protección de los pasajeros en el sector. Por lo tanto, se prevé que la creciente integración de la fibra óptica en los vehículos impulse la demanda de arneses de cableado durante el período de previsión.

Análisis de segmentación del informe de mercado de arneses de cableado para vehículos comerciales

Los segmentos clave que contribuyeron a la elaboración del análisis del mercado de arneses de cableado para vehículos comerciales son el tipo de vehículo, los vehículos comerciales ligeros y los vehículos comerciales medianos y pesados.

- Por tipo de vehículo, el mercado de arneses de cableado para vehículos comerciales se segmenta en vehículos eléctricos, automóviles, vehículos comerciales ligeros (VCL) y vehículos comerciales medianos y pesados (VCMP). El segmento de automóviles representó la mayor cuota de mercado en 2023.

- El mercado de arneses de cableado para vehículos comerciales ligeros (LCV) se subdivide en SUV, camionetas pickup, minicamionetas y monovolúmenes. El segmento de SUV representó la mayor cuota de mercado en 2023.

- El mercado de arneses de cableado para vehículos comerciales medianos y pesados (MHCV) se subdivide en camiones medianos y pesados, vehículos mineros pesados, vehículos de construcción pesados, vehículos agrícolas pesados y tractores/vehículos agrícolas medianos. El segmento de camiones medianos y pesados dominó el mercado de arneses de cableado para vehículos comerciales en 2023.

Análisis de la cuota de mercado de arneses de cableado para vehículos comerciales por geografía

- El mercado de arneses de cableado para vehículos comerciales se divide en cinco regiones principales: Norteamérica, Europa, Asia Pacífico (APAC), Oriente Medio y África (MEA) y Sudamérica y Centroamérica. Asia Pacífico dominó el mercado en 2023, seguida de Norteamérica y Europa.

- En 2023, las ventas de vehículos eléctricos en Norteamérica experimentaron un crecimiento extraordinario. Según el informe anual Global EV Outlook 2024 de la Agencia Internacional de la Energía (AIE), las matriculaciones de nuevos coches eléctricos en EE. UU. alcanzaron los 1,4 millones en 2023, lo que supone un aumento de más del 40 % con respecto a 2022. Diversos actores del mercado de arneses de cableado para vehículos comerciales en la región están impulsando iniciativas para dar a conocer las ventajas de estos componentes. Por ejemplo, tras el éxito de las conferencias celebradas en 2022 y 2023, Süddeutscher Verlag Events GmbH tiene previsto organizar su tercera Conferencia Estadounidense sobre Arneses de Cableado y Sistemas de Distribución Eléctrica (EDS) para la Industria Automotriz en Dearborn, Michigan, los días 28 y 29 de octubre de 2024. Estos eventos están diseñados para capacitar y brindar a fabricantes de equipos originales (OEM), desarrolladores de arneses de cableado, proveedores de primer y segundo nivel, especialistas en alta tensión y otros proveedores innovadores conocimientos sobre la fabricación y el diseño de arneses de cableado para vehículos comerciales, así como sobre sus beneficios en condiciones extremas.

Perspectivas regionales del mercado de arneses de cableado para vehículos comerciales

Los analistas de The Insight Partners han explicado en detalle las tendencias y los factores regionales que influyen en el mercado de arneses de cableado para vehículos comerciales durante el período de previsión. Esta sección también analiza los segmentos y la geografía del mercado de arneses de cableado para vehículos comerciales en Norteamérica, Europa, Asia Pacífico, Oriente Medio y África, y Sudamérica y Centroamérica.

Alcance del informe de mercado sobre arneses de cableado para vehículos comerciales

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2023 | 13.450 millones de dólares estadounidenses |

| Tamaño del mercado para 2031 | US$ 25.790 millones |

| Tasa de crecimiento anual compuesto global (2023 - 2031) | 8,5% |

| Datos históricos | 2021-2022 |

| Período de pronóstico | 2024-2031 |

| Segmentos cubiertos |

Por tipo de vehículo

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de los participantes en el mercado de arneses de cableado para vehículos comerciales: comprensión de su impacto en la dinámica empresarial

El mercado de arneses de cableado para vehículos comerciales está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían su oferta, innovan para satisfacer las necesidades de los consumidores y aprovechan las nuevas tendencias, lo que impulsa aún más el crecimiento del mercado.

- Obtenga una visión general de los principales actores del mercado de arneses de cableado para vehículos comerciales.

Noticias y novedades recientes del mercado de arneses de cableado para vehículos comerciales

El mercado de arneses de cableado para vehículos comerciales se evalúa mediante la recopilación de datos cualitativos y cuantitativos tras una investigación primaria y secundaria, que incluye publicaciones corporativas importantes, datos de asociaciones y bases de datos. A continuación se enumeran algunos de los avances en el mercado de arneses de cableado para vehículos comerciales:

- Lear Corporation, uno de los líderes mundiales en tecnología automotriz en sistemas de asientos y sistemas eléctricos, anunció la adquisición de M&N Plastics, una empresa privada con sede en Michigan, especializada en moldeo por inyección y fabricante de componentes de plástico de ingeniería para aplicaciones de distribución eléctrica automotriz.

(Fuente: Lear Corporation, comunicado de prensa, marzo de 2024)

- La empresa japonesa Sumitomo Electric Wiring Systems Inc. firmó un acuerdo inicial con la Autoridad General de Inversiones y Zonas Francas de Egipto para establecer en el país la fábrica de arneses de cableado para vehículos eléctricos más grande del mundo. La fábrica se ubicará en una zona franca de la Ciudad del 10 de Ramadán, en una superficie de 150.000 metros cuadrados. El proyecto contempla una inversión de aproximadamente 100 millones de dólares estadounidenses para la exportación de los productos a fabricantes de automóviles de Europa y Oriente Medio.

(Fuente: Sumitomo Electric Wiring Systems Inc., Comunicado de prensa, abril de 2023)

Cobertura y resultados del informe de mercado sobre arneses de cableado para vehículos comerciales

El informe "Tamaño y pronóstico del mercado de arneses de cableado para vehículos comerciales (2021-2031)" proporciona un análisis detallado del mercado que abarca las áreas mencionadas a continuación:

- Tamaño y pronóstico del mercado de arneses de cableado para vehículos comerciales a nivel mundial, regional y nacional para todos los segmentos clave del mercado cubiertos por el alcance.

- Tendencias del mercado de arneses de cableado para vehículos comerciales, así como la dinámica del mercado, incluyendo factores impulsores, limitaciones y oportunidades clave.

- Análisis detallado de PEST y SWOT

- Análisis del mercado de arneses de cableado para vehículos comerciales que abarca las principales tendencias del mercado, el marco global y regional, los principales actores, las regulaciones y los desarrollos recientes del mercado.

- Análisis del panorama industrial y la competencia, incluyendo la concentración del mercado, el análisis de mapas de calor, los principales actores y los desarrollos recientes del mercado de arneses de cableado para vehículos comerciales.

- Perfiles detallados de las empresas

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Informes relacionados

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de arneses de cableado para vehículos comerciales

Obtenga una muestra gratuita para - Mercado de arneses de cableado para vehículos comerciales