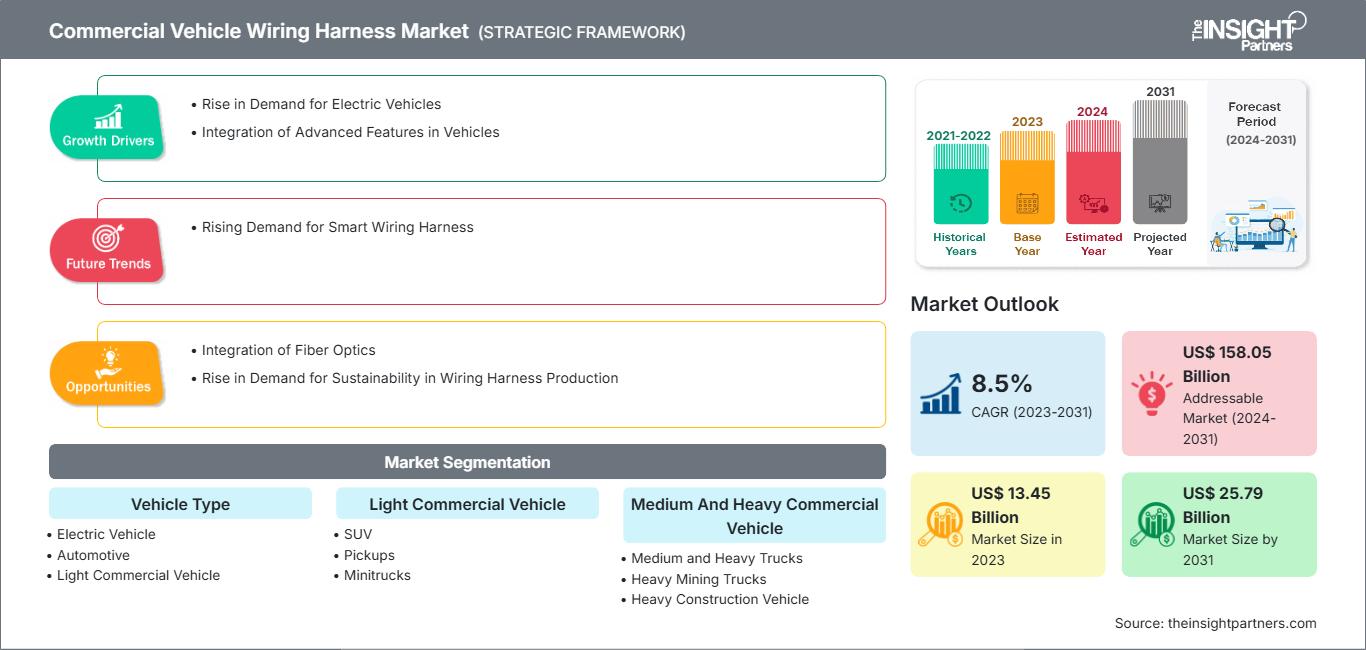

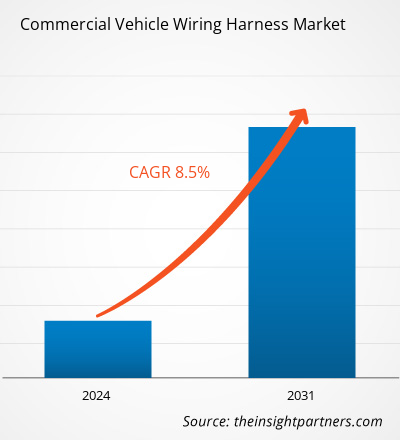

Le marché des faisceaux de câbles pour véhicules utilitaires devrait atteindre 25,79 milliards de dollars américains d'ici 2031, contre 13,45 milliards de dollars américains en 2023. Le marché devrait enregistrer un TCAC de 8,5 % entre 2023 et 2031. L'émergence des faisceaux de câbles intelligents devrait entraîner de nouvelles tendances sur le marché.

Analyse du marché des faisceaux de câbles pour véhicules utilitaires

La demande de véhicules électriques (VE) augmente dans le monde entier, notamment en raison des politiques gouvernementales fortes qui soutiennent leur adoption et des préoccupations environnementales croissantes. Cette augmentation de la demande de VE alimente la croissance du marché des faisceaux de câbles pour véhicules utilitaires, car les faisceaux de câbles jouent un rôle essentiel dans la gestion des flux d'énergie et d'informations dans les véhicules. De plus, l'intégration croissante de fonctionnalités avancées telles que les voitures autonomes et les systèmes avancés d'aide à la conduite (ADAS) alimente la croissance du marché. De plus, l'intégration croissante de la fibre optique pour une connectivité élevée et la demande croissante de durabilité dans la production de faisceaux de câbles devraient créer une opportunité de croissance pour le marché des faisceaux de câbles pour véhicules utilitaires. De plus, la demande croissante de faisceaux de câbles intelligents, compatibles avec tous les véhicules, devrait stimuler la croissance du marché au cours de la période de prévision.

Aperçu du marché des faisceaux de câbles pour véhicules utilitaires

Le faisceau de câbles est un ensemble de câbles électriques ou d'assemblages de fils reliant tous les composants électriques et électroniques d'une automobile, tels que les capteurs, les unités de commande électroniques, les batteries et les actionneurs. Le faisceau de câbles gère le flux d'énergie et d'informations au sein du système électrique pour permettre les principales fonctions automobiles, telles que la direction et le freinage, ainsi que les fonctions secondaires, comme la ventilation et l'infodivertissement. Les faisceaux de câbles relient plusieurs fils en faisceaux non flexibles, ce qui les rend plus sûrs que les fils libres et réduit les risques de courts-circuits. De plus, les faisceaux de câbles sont composés de matériaux durables. Ils sont conçus pour fonctionner efficacement dans des conditions difficiles tout en supportant d'importantes charges électriques. De plus, les faisceaux de câbles contribuent à améliorer l’efficacité énergétique de n’importe quelle voiture, ce qui augmente encore leur demande dans l’industrie automobile.

Personnalisez ce rapport en fonction de vos besoins

Vous bénéficierez d’une personnalisation sur n’importe quel rapport - gratuitement - y compris des parties de ce rapport, ou une analyse au niveau du pays, un pack de données Excel, ainsi que de profiter d’offres exceptionnelles et de réductions pour les start-ups et les universités

Marché des faisceaux de câbles pour véhicules commerciaux: Perspectives stratégiques

-

Obtenez les principales tendances clés du marché de ce rapport.Cet échantillon GRATUIT comprendra une analyse de données, allant des tendances du marché aux estimations et prévisions.

Moteurs et opportunités du marché des faisceaux de câbles pour véhicules utilitaires

Augmentation de la demande de véhicules électriques

Les ventes de véhicules électriques (VE) augmentent en raison des préoccupations liées à la protection de l'environnement et des politiques gouvernementales favorisant l'adoption de véhicules à faibles émissions ou à zéro émission. De plus, les gouvernements de différents pays offrent des subventions et des réductions d'impôts aux citoyens pour encourager l'adoption des VE. Les autorités gouvernementales prennent diverses initiatives pour promouvoir les VE à l'échelle mondiale. Plusieurs États américains prennent des initiatives en offrant des incitations financières, notamment des rabais, des crédits d'impôt et des réductions des frais d'immatriculation, favorisant ainsi l'adoption des VE dans le pays. Par exemple, en 2021, le gouvernement du Colorado a offert un crédit d'impôt de 4 000 $ US à l'achat d'un VE léger. De même, le gouvernement du Connecticut accepte une réduction des frais d'immatriculation semestriels de 38 $ US pour les VE. Ces initiatives gouvernementales entraînent une augmentation des ventes de VE dans le monde. Français Selon le rapport annuel Global EV Outlook 2024 de l'AIE, environ 14 millions de nouvelles voitures électriques ont été immatriculées en 2023 dans le monde.

En 2023, les ventes de voitures électriques ont augmenté de 3,5 millions par rapport à 2022, soit une augmentation de 35 % par rapport à l'année précédente. Selon la même source, les voitures électriques ont représenté environ 18 % de toutes les voitures vendues en 2023, contre 14 % en 2022. De plus, en 2023, sur le nombre total de nouvelles voitures électriques immatriculées dans le monde, la Chine a enregistré environ 60 % des nouvelles voitures électriques, l'Europe 25 % des nouvelles voitures électriques et les États-Unis 10 % des nouvelles voitures électriques. Le nombre de nouvelles immatriculations de voitures électriques a atteint 8,1 millions en Chine en 2023, soit une augmentation de 35 % par rapport à 2022. La Chine est le plus grand producteur mondial de véhicules électriques, produisant 64 % du volume mondial de véhicules électriques. Ainsi, l'augmentation des ventes de véhicules électriques stimule la demande de faisceaux de câbles, car ils jouent un rôle essentiel dans la gestion des flux d'énergie et d'informations au sein des véhicules.

Intégration de la fibre optique

Le recours croissant aux câbles à fibre optique devient un pilier de l'innovation et de l'efficacité dans un secteur automobile en constante évolution. À mesure que les automobiles sont de plus en plus connectées grâce aux nouvelles technologies, l'utilisation de câbles à fibre optique automobile devient essentielle pour répondre au besoin croissant de transmission de données plus rapide et de meilleures performances. Les câbles à fibre optique optimisent les systèmes de divertissement et d'information embarqués, offrant aux passagers et aux conducteurs une expérience audiovisuelle inégalée qui améliore considérablement le bien-être des utilisateurs et l'expérience de conduite globale. De plus, la fibre optique peut fournir des diagnostics de véhicule en temps réel, des systèmes d'assistance à la conduite améliorés et des capacités de conduite autonome en permettant un transfert de données rapide, essentiel à la prise de décision en une fraction de seconde. Son application à la conception automobile réduit le poids des véhicules, ce qui se traduit par des véhicules plus économes en carburant et plus respectueux de l'environnement.

La fibre optique est essentielle dans des systèmes tels que le régulateur de vitesse adaptatif, l'évitement des collisions et les avertisseurs de franchissement de ligne, qui nécessitent un transfert de données rapide. Son application garantit des mesures de sécurité non seulement plus efficaces, mais aussi plus fiables, renforçant ainsi le sentiment de confiance des conducteurs. De plus, l'utilisation de câbles à fibre optique dans les systèmes de communication embarqués permet un flux d'informations plus fluide et plus efficace, essentiel au bon fonctionnement des mesures de sécurité modernes. Cette communication en temps réel améliore les performances des véhicules et marque une étape importante dans l'innovation en matière de sécurité automobile, ouvrant la voie à de futures avancées technologiques et permettant au secteur d'atteindre des niveaux de protection des passagers plus élevés. Français Ainsi, l'intégration croissante de la fibre optique dans les véhicules devrait stimuler la demande de faisceaux de câbles au cours de la période de prévision.

Analyse de segmentation du rapport sur le marché des faisceaux de câbles pour véhicules utilitaires

Les principaux segments qui ont contribué à l'élaboration de l'analyse du marché des faisceaux de câbles pour véhicules utilitaires sont le type de véhicule, les véhicules utilitaires légers et les véhicules utilitaires moyens et lourds.

- Par type de véhicule, le marché des faisceaux de câbles pour véhicules utilitaires est segmenté en véhicules électriques, automobiles, véhicules utilitaires légers (VUL) et véhicules utilitaires moyens et lourds (VML). Le segment automobile détenait la plus grande part du marché des faisceaux de câbles pour véhicules utilitaires en 2023.

- Le marché des faisceaux de câbles pour véhicules utilitaires légers (VUL) est sous-segmenté en SUV, pick-up, mini-camions et mini-fourgonnettes. Français Le segment des SUV détenait la plus grande part du marché des faisceaux de câbles pour véhicules utilitaires en 2023.

- Le marché des faisceaux de câbles pour véhicules utilitaires moyens et lourds (MHCV) est sous-segmenté en camions moyens et lourds, véhicules miniers lourds, véhicules de construction lourds, véhicules agricoles lourds et véhicules/tracteurs agricoles moyens. Le segment des camions moyens et lourds a dominé le marché des faisceaux de câbles pour véhicules utilitaires en 2023.

Analyse des parts de marché des faisceaux de câbles pour véhicules utilitaires par zone géographique

- Le marché des faisceaux de câbles pour véhicules utilitaires est segmenté en cinq grandes régions : l'Amérique du Nord, l'Europe, l'Asie-Pacifique (APAC), le Moyen-Orient et l'Afrique (MEA) et l'Amérique du Sud et centrale. L'Asie-Pacifique a dominé le marché en 2023, suivie de l'Amérique du Nord et de l'Europe.

- L'Amérique du Nord a connu une croissance considérable des ventes de véhicules électriques en 2023. Selon le rapport annuel Global EV Outlook 2024 de l'Agence internationale de l'énergie (AIE), les immatriculations de nouvelles voitures électriques aux États-Unis ont atteint 1,4 million en 2023, soit une hausse de plus de 40 % par rapport à 2022. Différents acteurs du marché des faisceaux de câbles pour véhicules utilitaires dans la région prennent diverses initiatives pour sensibiliser aux avantages de ces composants. Par exemple, fort du succès des conférences organisées en 2022 et 2023, Süddeutscher Verlag Events GmbH prévoit d'organiser sa troisième conférence américaine sur les faisceaux de câbles et les véhicules automobiles. Conférence EDS à Dearborn, Michigan, les 28 et 29 octobre 2024. Ces événements sont prévus pour former et fournir aux OEM, aux développeurs de faisceaux de câbles, aux fournisseurs Tier 1 et Tier 2, aux spécialistes de la haute tension et à d'autres fournisseurs innovants des connaissances sur la fabrication et la conception de faisceaux de câbles pour véhicules commerciaux ainsi que sur leurs avantages dans des conditions difficiles.

Faisceau de câbles pour véhicules commerciaux

Aperçu régional du marché des faisceaux de câbles pour véhicules commerciaux

Les tendances régionales et les facteurs influençant le marché des faisceaux de câbles pour véhicules utilitaires tout au long de la période de prévision ont été analysés en détail par les analystes de The Insight Partners. Cette section aborde également les segments et la géographie du marché des faisceaux de câbles pour véhicules utilitaires en Amérique du Nord, en Europe, en Asie-Pacifique, au Moyen-Orient et en Afrique, ainsi qu'en Amérique du Sud et en Amérique centrale.

Portée du rapport sur le marché des faisceaux de câbles pour véhicules commerciaux

| Attribut de rapport | Détails |

|---|---|

| Taille du marché en 2023 | US$ 13.45 Billion |

| Taille du marché par 2031 | US$ 25.79 Billion |

| TCAC mondial (2023 - 2031) | 8.5% |

| Données historiques | 2021-2022 |

| Période de prévision | 2024-2031 |

| Segments couverts |

By Type de véhicule

|

| Régions et pays couverts |

Amérique du Nord

|

| Leaders du marché et profils d'entreprises clés |

|

Densité des acteurs du marché des faisceaux de câbles pour véhicules commerciaux : comprendre son impact sur la dynamique commerciale

Le marché des faisceaux de câbles pour véhicules utilitaires connaît une croissance rapide, portée par une demande croissante des utilisateurs finaux, due à des facteurs tels que l'évolution des préférences des consommateurs, les avancées technologiques et une meilleure connaissance des avantages du produit. Face à cette demande croissante, les entreprises élargissent leur offre, innovent pour répondre aux besoins des consommateurs et capitalisent sur les nouvelles tendances, ce qui alimente la croissance du marché.

- Obtenez le Marché des faisceaux de câbles pour véhicules commerciaux Aperçu des principaux acteurs clés

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWOT

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

Rapports récents

Rapports connexes

Témoignages

Raison d'acheter

- Prise de décision éclairée

- Compréhension de la dynamique du marché

- Analyse concurrentielle

- Connaissances clients

- Prévisions de marché

- Atténuation des risques

- Planification stratégique

- Justification des investissements

- Identification des marchés émergents

- Amélioration des stratégies marketing

- Amélioration de l'efficacité opérationnelle

- Alignement sur les tendances réglementaires

Obtenez un échantillon gratuit pour - Marché des faisceaux de câbles pour véhicules commerciaux

Obtenez un échantillon gratuit pour - Marché des faisceaux de câbles pour véhicules commerciaux