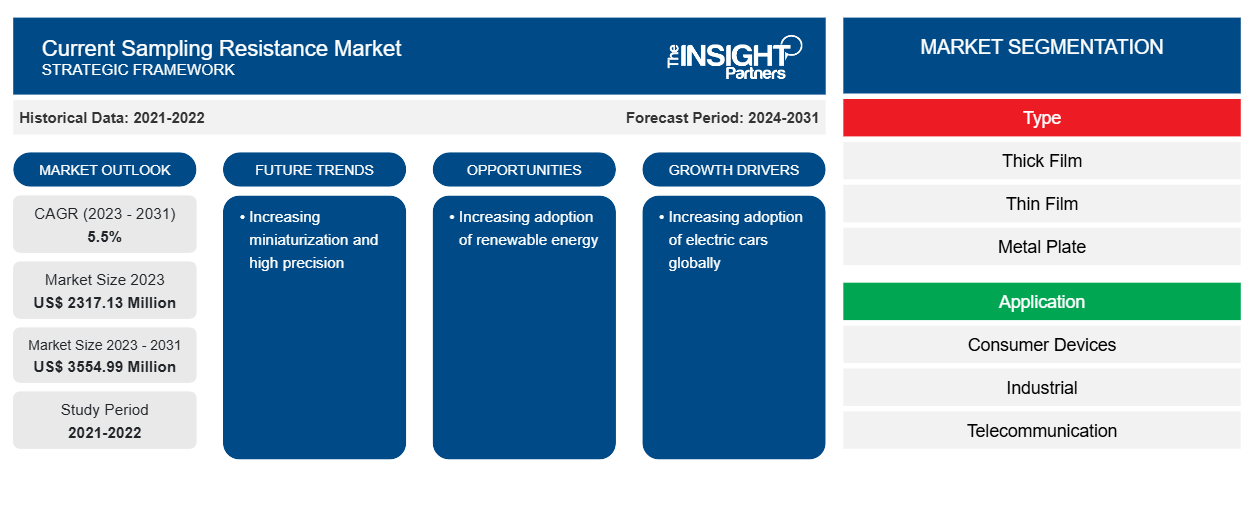

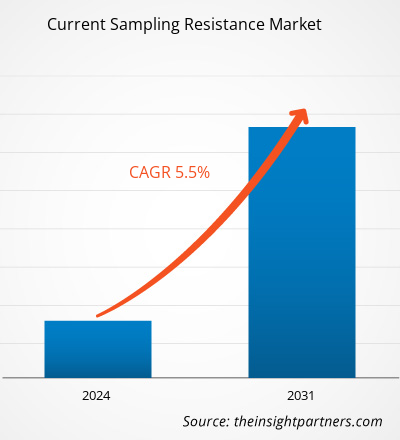

Se proyecta que el tamaño actual del mercado de resistencia al muestreo alcance los 3554,99 millones de dólares estadounidenses para 2031, frente a los 2317,13 millones de dólares estadounidenses en 2023. Se espera que el mercado registre una CAGR del 5,5 % durante 2023-2031. Es probable que la creciente miniaturización y la alta precisión sigan siendo una tendencia clave en el mercado.CAGR of 5.5% during 2023–2031. Increasing miniaturization and high precision are likely to remain a key trend in the market.

Análisis actual del mercado de resistencia al muestreo

Se espera que el uso de resistencias de montaje de alta densidad en varias aplicaciones aumente la velocidad a medida que la práctica de un mayor rendimiento en un área más pequeña se ha vuelto cada vez más esencial. Las resistencias de tamaños de 01005 pulgadas (0,0160,08 pulgadas) se están utilizando en teléfonos inteligentes y dispositivos portátiles. El montaje sin filetes, que proporciona un montaje de paso fino , y el montaje en almohadilla, en el que se crean orificios en la almohadilla del componente para eliminar patrones en la capa superficial, han mejorado la densidad de montaje en varias aplicaciones. Por lo tanto, las empresas están creando resistencias montadas de alta densidad para satisfacer la necesidad.Filletless mounting, which provides fine-pitch

Descripción general del mercado actual de resistencia al muestreo

La resistencia de muestreo de corriente de un material es la obstrucción que causa el flujo de corriente o carga a través del material. Cuanto mayor sea la resistencia, menor será la cantidad de corriente que pasa a través de él. Es la propiedad de un material que nos informa sobre el flujo de la corriente a través del material. Las sustancias que conducen fácilmente la corriente eléctrica se denominan conductores y tienen una resistencia eléctrica muy baja; por el contrario, las sustancias que no conducen fácilmente la corriente eléctrica se denominan aislantes y tienen una resistencia muy alta.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

Mercado actual de resistencia al muestreo: perspectivas estratégicas

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Factores impulsores y oportunidades del mercado de resistencia al muestreo actual

Creciente adopción de coches eléctricos a nivel mundial

Con la creciente adopción de coches eléctricos, el mercado está creciendo a medida que varios actores lanzan coches eléctricos. Por ejemplo, la resistencia eléctrica es la obstrucción que ofrece el material en el flujo de la corriente o carga a través del material. Además, el ensamblaje de vehículos eléctricos de EE. UU. asciende a ~2,3 millones de vehículos eléctricos, en comparación con los 18 millones fuera de EE. UU. Según el mismo informe, los vehículos eléctricos representarán ~10% de la producción mundial de vehículos eléctricos ligeros en 2025. Por lo tanto, la creciente adopción de coches eléctricos a nivel mundial está impulsando el mercado actual de resistencia de muestreo.

Aumento de la adopción de energías renovables

Se prevé que el aumento de las inversiones en redes inteligentes y energías renovables genere varias oportunidades para el mercado de los cuadros eléctricos. En el funcionamiento de redes inteligentes, se prefiere el funcionamiento automatizado de los cuadros eléctricos al funcionamiento convencional. Una subestación automatizada, en la que todas las operaciones están automatizadas, es más eficiente y requiere menos mano de obra. Además, los gobiernos de varias economías están invirtiendo en la tecnología de redes inteligentes. Por ejemplo, en 2022, Japón anunció un programa de financiación de 155.000 millones de dólares para estimular la inversión en redes inteligentes. Ese mismo año, en la India, el gobierno estableció un plan de 38.000 millones de dólares para ayudar a las empresas de distribución de energía y mejorar la infraestructura de distribución. Por tanto, la creciente adopción de energías renovables está creando más oportunidades para el mercado.switchgear market. In smart grid operation, automated switchgear operation is preferred over conventional operation. An automated substation, wherein all operations are automated, is more efficient and requires less manpower. Further, governments of various economies are investing in the smart grid technology. For instance, in 2022, Japan announced a financing program of US$155 billion to spur investment in smart grids. That same year, in India, the government established a US$38-billion scheme to help power distribution companies and improve distribution infrastructure. Thus, the increasing adoption of

Análisis de segmentación del informe de mercado de resistencia al muestreo actual

Los segmentos clave que contribuyeron a la derivación del análisis actual del mercado de resistencia al muestreo son el tipo y la aplicación.

- Según el tipo, el mercado actual de resistencias de muestreo se divide en película gruesa, película delgada y placa de metal. El segmento personalizado tuvo una mayor participación de mercado en 2023.

- Por tipo de instalación, el mercado se segmenta en montaje en superficie, montaje colgante y montaje empotrado/en pared lateral. El segmento de montaje en superficie tuvo una mayor participación de mercado en 2023.

- Por tipo, el mercado está segmentado en iluminación LED, iluminación incandescente, iluminación fluorescente y otros.

- Por aplicación, el mercado está segmentado en dispositivos de consumo, industriales, de telecomunicaciones, automotrices y otras aplicaciones.

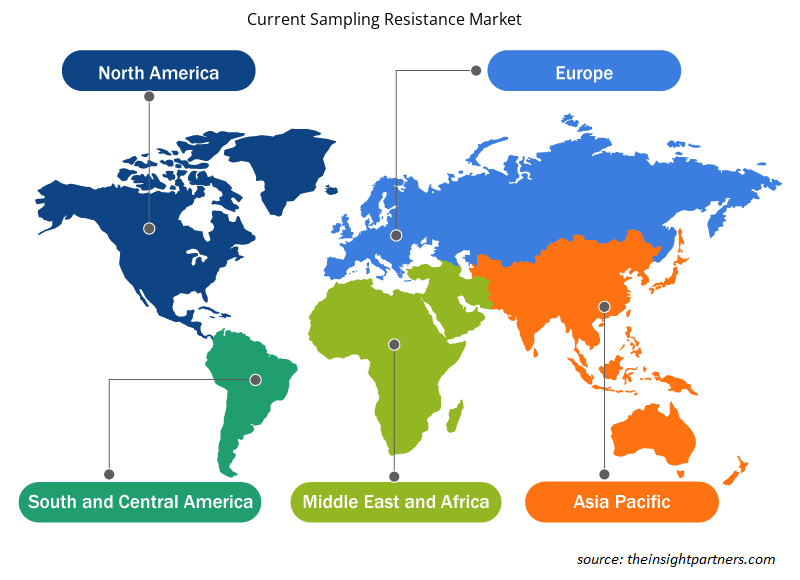

Análisis de la cuota de mercado de resistencia al muestreo actual por geografía

El alcance geográfico del informe actual del mercado de resistencia al muestreo se divide principalmente en cinco regiones: América del Norte, Asia Pacífico, Europa, Medio Oriente y África, y América del Sur y Central.

APAC domina el mercado actual de resistencias de muestreo. El mercado actual de resistencias de muestreo en esta región está creciendo debido a varios factores, como el aumento de las iniciativas gubernamentales para mejorar el estado de los automóviles eléctricos y la presencia de actores bien establecidos. Varios fabricantes ofrecen resistencias de chip de placa metálica de baja resistencia con inductancia parásita extremadamente baja y detección de corriente de alta precisión. Además, la reducción de resistencias se está acercando a su límite y es probable que la modularización se expanda a todo tipo de equipos en el futuro. dominates the current sampling resistance market. The current sampling resistance market in this region is growing due to various factors, such as increasing government initiatives to improve the condition of electric cars and the presence of well-established players. Metal plate chip low resistance resistors with extremely low parasitic inductance and high accuracy current sensing are available from various manufacturers. Furthermore, resistor reduction is nearing its limit, and modularization is likely to expand across all kinds of equipment in the future.

Perspectivas regionales del mercado de resistencia al muestreo actual

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de resistencia al muestreo actual durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de resistencia al muestreo actual en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga los datos específicos regionales para el mercado actual de resistencia al muestreo

Alcance del informe de mercado de resistencia al muestreo actual

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2023 | US$ 2317,13 millones |

| Tamaño del mercado en 2031 | US$ 3554,99 millones |

| CAGR global (2023 - 2031) | 5,5% |

| Datos históricos | 2021-2022 |

| Período de pronóstico | 2024-2031 |

| Segmentos cubiertos |

Por tipo

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de resistencia al muestreo actual: comprensión de su impacto en la dinámica empresarial

El mercado actual de resistencia al muestreo está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de resistencia al muestreo actual son:

- Compañía Cyntec, Ltd.

- Electrónica KOA Speer, Inc.

- Corporación Panasonic

- Compañía Rohm, Ltd.

- Samsung Electro-Mecánica Co., Ltd.

- Compañía Susumu, Ltd.

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de resistencia al muestreo actual

Noticias actuales del mercado de resistencia al muestreo y desarrollos recientes

El mercado actual de resistencia al muestreo se evalúa mediante la recopilación de datos cualitativos y cuantitativos posteriores a la investigación primaria y secundaria, que incluye publicaciones corporativas importantes, datos de asociaciones y bases de datos. A continuación, se enumeran algunos de los desarrollos en el mercado actual de resistencia al muestreo:

- TT Electronics, un fabricante global de componentes electrónicos para aplicaciones de rendimiento crítico, presentó sus resistencias de chip de lámina metálica (MFC). La serie MFC utiliza tecnología de lámina metálica sobre cerámica, que aprovecha las propiedades de propagación del calor de un sustrato cerámico con la tolerancia a las sobretensiones de un elemento de resistencia de aleación de metal a granel. (Fuente: TT Electronics, comunicado de prensa, noviembre de 2020)

- ROHM anunció la disponibilidad de resistencias shunt de la serie GMR50, que proporcionan una potencia nominal líder en la industria de 4 W (a una temperatura de electrodo TK = 90 °C) en un encapsulado compacto de 5,0 mm y 2,5 mm (tipo 2010). Son adecuadas para la detección de corriente en motores y circuitos de suministro de energía empleados en sistemas automotrices y equipos industriales. (Fuente: ROHM, comunicado de prensa, febrero de 2020)

Informe actual sobre el mercado de resistencia al muestreo: cobertura y resultados

El informe “Tamaño actual del mercado de resistencia al muestreo y pronóstico (2021-2031)” proporciona un análisis detallado del mercado que cubre las siguientes áreas:

- Tamaño actual del mercado de resistencia al muestreo y pronóstico a nivel global, regional y nacional para todos los segmentos clave del mercado cubiertos bajo el alcance

- Tendencias actuales del mercado de resistencia al muestreo, así como dinámicas del mercado, como impulsores, restricciones y oportunidades clave

- Análisis detallado de las cinco fuerzas de Porter y PEST y FODA

- Análisis actual del mercado de resistencia al muestreo que cubre las tendencias clave del mercado, el marco global y regional, los principales actores, las regulaciones y los desarrollos recientes del mercado.

- Análisis del panorama de la industria y de la competencia que abarca la concentración del mercado, el análisis de mapas de calor, los actores destacados y los desarrollos recientes del mercado actual de resistencia al muestreo

- Perfiles detallados de empresas

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de resistencia al muestreo actual

Obtenga una muestra gratuita para - Mercado de resistencia al muestreo actual