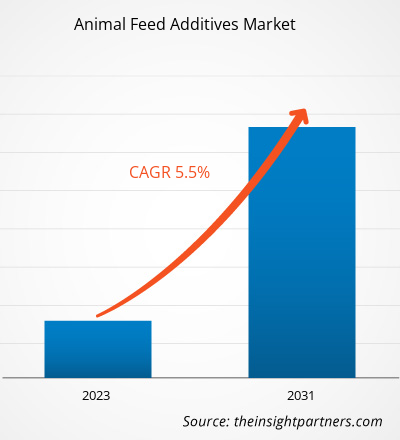

Se prevé que el tamaño del mercado de aditivos para piensos alcance los 58.421,18 millones de dólares estadounidenses para 2031, frente a los 40.697,92 millones de dólares estadounidenses de 2024; es probable que registre una tasa de crecimiento anual compuesta (TCAC) del 5,28 % durante el período de pronóstico. Es probable que la creciente demanda de productos pecuarios se mantenga como una tendencia clave en el mercado de aditivos para piensos.

Análisis del mercado de aditivos para piensos animales

La adición de aditivos alimentarios es especialmente importante en dietas especialmente formuladas, donde la ingesta rápida es altamente deseable. Algunos aditivos, como las vitaminas, los aminoácidos y sus metabolitos, son reguladores esenciales de las actividades metabólicas en los animales para la resistencia a los estresores ambientales, la reproducción, la metamorfosis larvaria, el comportamiento, la inmunidad , el crecimiento, el mantenimiento, la utilización de nutrientes y la ingesta de alimento. Los diversos beneficios de los aditivos han dado lugar a su creciente uso para abordar afecciones de salud específicas. Por lo tanto, el creciente uso de aditivos en la alimentación animal está impulsando la demanda del mercado de aditivos para piensos.

Descripción general del mercado de aditivos para piensos animales

Los aditivos alimentarios son sustancias o microorganismos que se añaden intencionalmente al alimento para mejorar su calidad nutricional. Estos aditivos pueden afectar la presentación, la higiene y la digestibilidad del alimento, o afectar la salud intestinal. La demanda de aditivos para piensos está aumentando rápidamente, a medida que aumenta el consumo de carne y productos relacionados a nivel mundial. El mercado se caracteriza por la presencia de un gran número de participantes, lo que resulta en un mercado altamente fragmentado. Los principales actores del mercado se centran en expandir sus negocios en los mercados nacionales e internacionales para una mayor penetración.

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

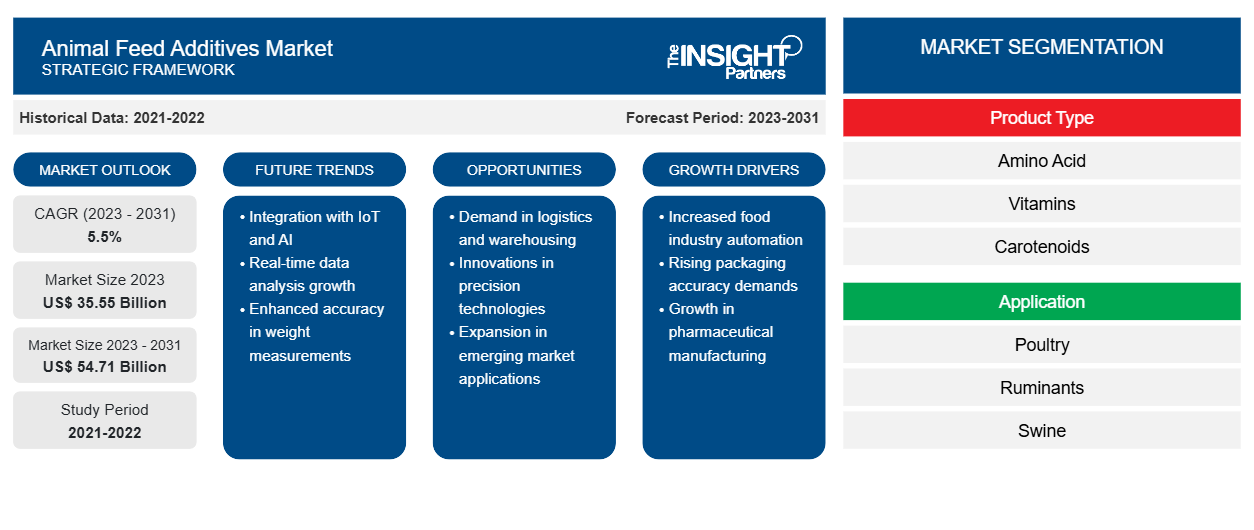

Mercado de aditivos para piensos: Perspectivas estratégicas

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Impulsores y oportunidades del mercado de aditivos para piensos animales

Aumentar la producción ganadera para favorecer el mercado

La producción ganadera industrial ha experimentado una transformación significativa gracias a los avances en antibióticos y vacunas animales. La creciente demanda de productos cárnicos impulsa la producción ganadera industrial. Los productos ganaderos representan el 16% de la energía y el 34% de las proteínas en la dieta humana. Asimismo, la producción ganadera representa alrededor del 19% del valor de la producción alimentaria y el 30% del valor global de la agricultura. La demanda de productos ganaderos se ve impulsada por los cambios en los estilos de vida y las preferencias alimentarias, la creciente urbanización, el aumento de los ingresos y el rápido crecimiento de la población mundial. Por lo tanto, la alta demanda de productos ganaderos impulsa el mercado. Este aumento repentino de la demanda de productos ganaderos repercute en la demanda de piensos y aditivos para piensos. Los aditivos ofrecen un mejor rendimiento intestinal, lo que reduce la necesidad de antibióticos perjudiciales. Los fitógenos, los acidificantes y la acuicultura son algunos ejemplos de aditivos para la salud intestinal. La demanda de estos aditivos está creciendo, especialmente tras la prohibición de los antibióticos como aditivo. Por lo tanto, la alta demanda de productos ganaderos impulsa el mercado de aditivos para piensos.

Industria avícola en auge: una oportunidad en el mercado de aditivos para piensos animales

Los aditivos alimentarios comúnmente utilizados en las dietas avícolas son antimicrobianos, antioxidantes, emulsionantes, aglutinantes, agentes de control de pH y enzimas. Estos aditivos se utilizan principalmente para mejorar la eficiencia del crecimiento y la capacidad de puesta de las aves. También ayudan a prevenir enfermedades y a optimizar el aprovechamiento del alimento. Además, se espera que el aumento en la demanda y el consumo de productos ganaderos, como lácteos, carne y huevos, impulse el mercado de aditivos alimentarios para el crecimiento y desarrollo de las aves de corral.

Análisis de segmentación del informe de mercado de aditivos para piensos animales

Los segmentos clave que contribuyeron a la derivación del análisis del mercado de aditivos para alimentos animales son el tipo de producto y la aplicación.

- Según el tipo de producto, el mercado se divide en aminoácidos, vitaminas, carotenoides, enzimas, prebióticos y probióticos, minerales, acidificantes, lípidos y otros. El segmento de aminoácidos tuvo una mayor participación de mercado en 2023.

- En términos de aplicación, el mercado se clasifica en avicultura, rumiantes, porcicultura, acuicultura y otros. El segmento de rumiantes dominó el mercado en 2023.

Análisis de la cuota de mercado de aditivos para piensos animales por geografía

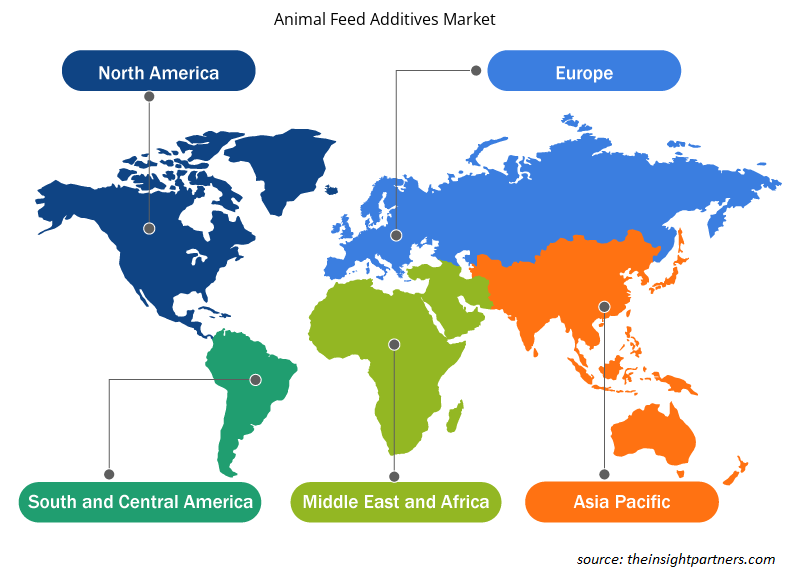

El alcance geográfico del informe del mercado de aditivos para alimentos para animales se divide principalmente en cinco regiones: América del Norte, Asia Pacífico, Europa, Medio Oriente y África, y América del Sur / América del Sur y Central.

El mercado de aditivos para piensos en Asia Pacífico está creciendo significativamente, ya que es el mayor productor de piensos a nivel mundial. La región alberga la mayor población humana de las cinco regiones y concentra alrededor del 60% de la población mundial. Por lo tanto, su tamaño está impulsando la demanda de carne y productos lácteos, lo que lidera la región en el sector ganadero y, en consecuencia, favorece el crecimiento del mercado de aditivos para piensos. Además, la rápida urbanización, impulsada por un sólido crecimiento económico en Asia Pacífico, está impulsando la demanda de productos cárnicos en toda la región. El aumento del ingreso per cápita y la mejora del nivel de vida de los consumidores de la región les permiten acceder a alimentos más saludables y nutritivos.

Perspectivas regionales del mercado de aditivos para piensos animales

Los analistas de Insight Partners han explicado detalladamente las tendencias regionales y los factores que influyen en el mercado de aditivos para piensos animales durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de aditivos para piensos animales en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga los datos regionales específicos para el mercado de aditivos para piensos animales

Alcance del informe de mercado de aditivos para piensos animales

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2024 | US$ 40.697,92 millones |

| Tamaño del mercado en 2031 | US$ 58.421,18 millones |

| CAGR global (2025-2031) | 5,28% |

| Datos históricos | 2021-2023 |

| Período de pronóstico | 2025-2031 |

| Segmentos cubiertos |

Por tipo de producto

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de aditivos para piensos animales: comprensión de su impacto en la dinámica empresarial

El mercado de aditivos para piensos está creciendo rápidamente, impulsado por la creciente demanda del usuario final debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y un mayor conocimiento de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían su oferta, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de empresas o compañías que operan en un mercado o sector en particular. Indica cuántos competidores (actores del mercado) hay en un mercado determinado en relación con su tamaño o valor total.

Las principales empresas que operan en el mercado de aditivos para piensos animales son:

- ADM

- Cargill Incorporated

- Alltech

- Tierra O'Lakes Inc.

- EVONI

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de aditivos para piensos animales

Noticias y desarrollos recientes del mercado de aditivos para piensos animales

El mercado de aditivos para piensos se evalúa mediante la recopilación de datos cualitativos y cuantitativos tras la investigación primaria y secundaria, que incluye importantes publicaciones corporativas, datos de asociaciones y bases de datos. A continuación, se presenta una lista de las novedades en el mercado en cuanto a innovación, expansión empresarial y estrategias:

- En diciembre de 2022, el grupo Adisseo acordó adquirir Nor-Feed y sus filiales para desarrollar y registrar aditivos botánicos para su uso en la alimentación animal (Fuente: Grupo Adisseo, Nota de prensa)

- En octubre de 2022, la colaboración entre Evonik y BASF otorgó a Evonik ciertos derechos de licencia no exclusivos para Opteinics™, una solución digital para mejorar la comprensión y reducir el impacto ambiental de las industrias de proteínas y piensos animales. (Fuente: Evonik, Boletín informativo)

- En noviembre de 2021, Archer-Daniels-Midland Company anunció la apertura de su nuevo laboratorio de nutrición animal en Rolle, Suiza. El nuevo laboratorio impulsará el desarrollo de aditivos alimentarios con base científica para satisfacer las necesidades de los clientes de alimentos para mascotas, acuicultura y especies ganaderas a nivel mundial. (Fuente: ADM, Boletín informativo)

Informe de mercado sobre aditivos para piensos animales: cobertura y resultados

El informe "Tamaño y pronóstico del mercado de aditivos para piensos animales (2021-2031)" ofrece un análisis detallado del mercado que abarca las siguientes áreas:

- Tamaño del mercado y pronóstico a nivel global, regional y nacional para todos los segmentos clave del mercado cubiertos bajo el alcance

- Dinámica del mercado, como impulsores, restricciones y oportunidades clave

- Principales tendencias futuras

- Análisis detallado PEST/de las cinco fuerzas de Porter y FODA

- Análisis del mercado global y regional que cubre las tendencias clave del mercado, los principales actores, las regulaciones y los desarrollos recientes del mercado.

- Análisis del panorama de la industria y la competencia que abarca la concentración del mercado, el análisis de mapas de calor, los actores destacados y los desarrollos recientes.

- Perfiles detallados de empresas

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Informes relacionados

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de aditivos para piensos animales

Obtenga una muestra gratuita para - Mercado de aditivos para piensos animales