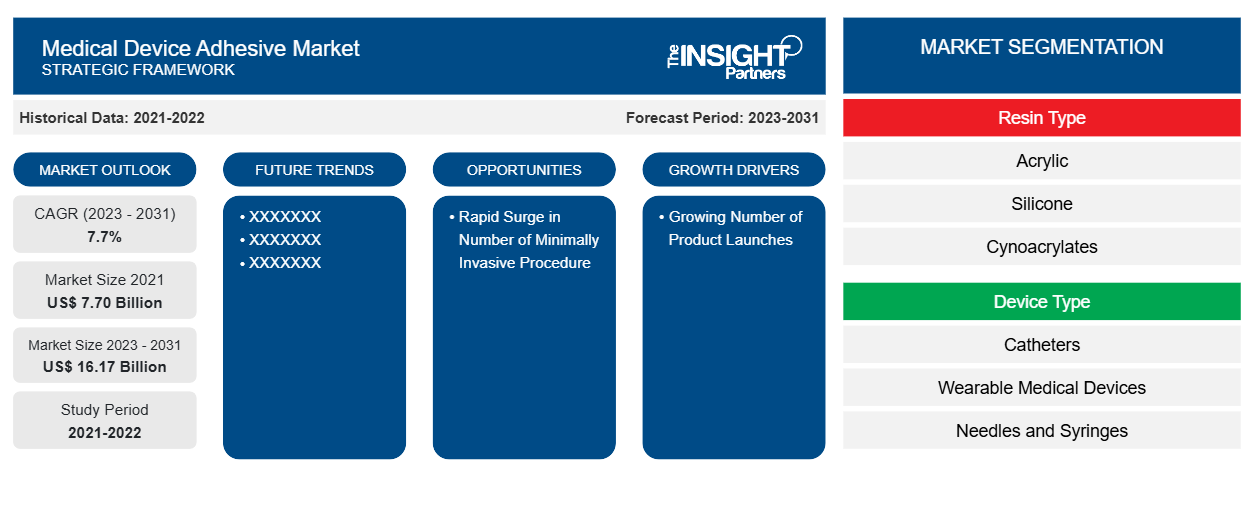

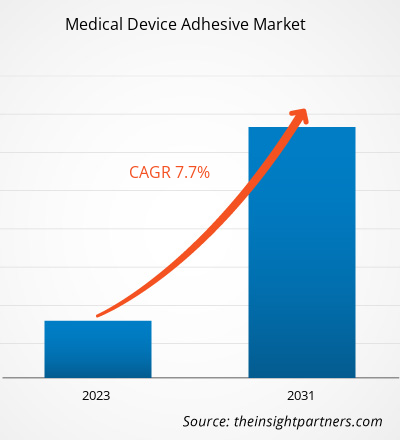

El tamaño del mercado de adhesivos para dispositivos médicos se estimó en 7.700 millones de dólares estadounidenses en 2021 y XX millones de dólares estadounidenses en 2023 y se espera que alcance los 16.170 millones de dólares estadounidenses para 2031. Se estima que registrará una CAGR del 7,7 % hasta 2031. Es probable que el aumento del uso de adhesivos para dispositivos médicos, los avances técnicos en adhesivos para dispositivos médicos y la creciente adopción de soluciones ecológicas y biocompatibles sigan siendo tendencias clave del mercado de adhesivos para dispositivos médicos.

Análisis del mercado de adhesivos para dispositivos médicos

El adhesivo para dispositivos médicos es un adhesivo especializado que se utiliza para unir dispositivos o componentes médicos, como apósitos y vendajes para heridas, catéteres, alambres guía, dispositivos médicos implantables, materiales dentales y muchos otros. El adhesivo debe cumplir con requisitos específicos antes de su selección, como biocompatibilidad, capacidad de estabilización, alta fuerza de unión y resistencia al agua. El adhesivo acrílico es uno de los adhesivos más comunes que desempeñan un papel crucial en la industria de los dispositivos médicos debido a sus propiedades para garantizar la seguridad y la eficacia.

Descripción general del mercado de adhesivos para dispositivos médicos

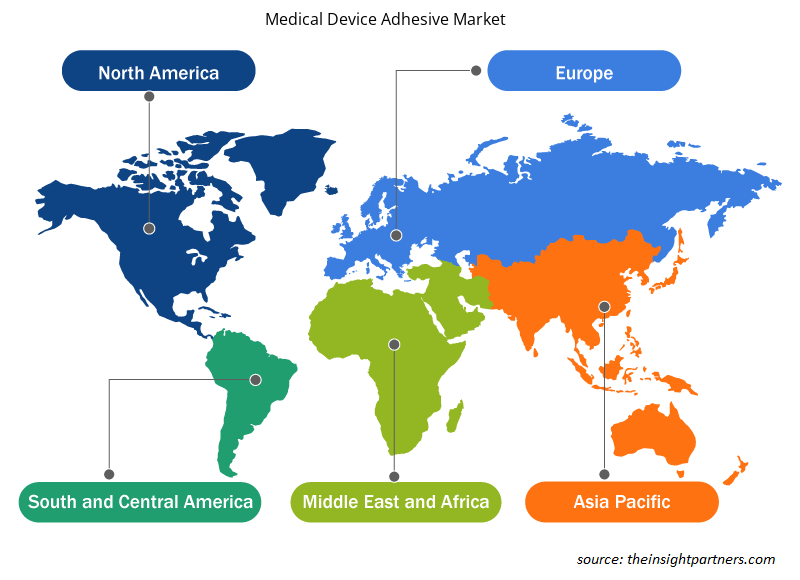

Los factores impulsores incluyen el uso creciente de adhesivos para dispositivos médicos y los avances tecnológicos en adhesivos para dispositivos médicos. Sin embargo, es probable que las complicaciones asociadas con estas soluciones obstaculicen el crecimiento del mercado hasta cierto punto. El mercado mundial de adhesivos para dispositivos médicos está segmentado por región en América del Norte, Europa, Asia-Pacífico, Oriente Medio y África, y América del Sur y Central. En América del Norte, Estados Unidos tiene una participación significativa del mercado de adhesivos para dispositivos médicos. Las innovaciones en la línea de productos impulsan principalmente el crecimiento del mercado del país. Los países de la región se centran en el desarrollo de productos basados en tecnología avanzada que ayudan a mejorar la calidad de vida de los pacientes. Además, se espera que el creciente número de empresas emergentes estimule aún más el crecimiento del mercado de adhesivos y selladores médicos en América del Norte. Se espera que la región de Asia Pacífico represente el crecimiento más rápido en el mercado de adhesivos para dispositivos médicos. Es probable que el creciente número de accidentes, procedimientos de trasplante y el creciente número de empresas que se centran en los países de Asia Pacífico para su expansión geográfica y otras estrategias impulsen el crecimiento del mercado.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

Mercado de adhesivos para dispositivos médicos: perspectivas estratégicas

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Impulsores y oportunidades del mercado de adhesivos para dispositivos médicos

Creciente número de lanzamientos de productos en desarrollo para favorecer el mercado

Los estudios de investigación y desarrollo en curso en todo el mundo están ganando impulso en la creación de soluciones médicas de alta gama para combinar una amplia escala de dispositivos médicos en el uso práctico. Las empresas están invirtiendo en el desarrollo de instrumentos innovadores para asegurar un buen retorno de la inversión (ROI). Además, la aprobación del producto por parte de las autoridades reguladoras confirma la confiabilidad y credibilidad de los selladores y adhesivos para dispositivos médicos de nueva generación. Recientemente, varias empresas del mercado han lanzado adhesivos para dispositivos médicos de alta gama y de primera calidad. Por ejemplo, en noviembre de 2021, Dymax lanzó una nueva línea de adhesivos curables por luz para dispositivos médicos portátiles . Los nuevos adhesivos de la serie 2000-MW no contienen TPO y están fabricados sin IBOA (un conocido irritante de la piel).ROI). Additionally, product approval by regulatory authorities confirms the reliability and credibility of the new-age medical device sealants and adhesives. Recently, various market companies have launched high-end and top-quality medical device adhesives. For instance, In November 2021, Dymax released a new line of light-curable adhesives for TPO and made without IBOA (a known skin irritant).

Aumento rápido del número de procedimientos mínimamente invasivos: una oportunidadEl mercado de adhesivos para dispositivos médicos

Los procedimientos mínimamente invasivos son los métodos preferidos que se están adoptando en lugar de los métodos de cirugía abierta tradicionales, como las cirugías endoscópicas, los procedimientos de diagnóstico endoscópico y las cirugías asistidas por robot. El proceso quirúrgico endoscópico se sigue ampliamente para operaciones relacionadas con el corazón, los pulmones, el estómago y los riñones. Las heridas posteriores al procedimiento se sellan con suturas quirúrgicas, grapadoras quirúrgicas, selladores o cintas adhesivas pertinentes. Sin embargo, debido a los avances tecnológicos en los métodos de cierre de heridas, el adhesivo para dispositivos médicos se encuentra entre los productos preferidos.

Por ejemplo, la hernia inguinal es una de las afecciones más comunes que se observan en hombres y mujeres, y los procedimientos quirúrgicos son el único tratamiento posible. Los principales tipos de procedimientos quirúrgicos son la cirugía abierta y la laparoscopia. Según los datos del Proyecto de Costos y Utilización de la Atención Médica y la Administración de Alimentos y Medicamentos de EE. UU., en la actualidad, se realizaron 611 000 reparaciones de hernias ventrales y 1 millón de hernias inguinales en EE. UU. en 2023. Las operaciones de sellado de heridas/cortes para estos procedimientos generalmente involucran selladores médicos, lo que ofrece una oportunidad significativa para los actores del mercado durante el período proyectado.

Análisis de segmentación del informe de mercado de adhesivos para dispositivos médicos

Los segmentos clave que contribuyeron a la derivación del análisis del mercado de adhesivos para dispositivos médicos son el tipo de resina y el tipo de dispositivo.

- Según el tipo de resina, el mercado de adhesivos para dispositivos médicos se divide en acrílico, silicona, cianoacrilatos, poliuretano, fotopolimerizable y epoxi. El segmento acrílico tuvo la mayor participación del mercado en 2023; además, se prevé que el mismo segmento registre el porcentaje de CAGR más alto del mercado durante el período de pronóstico.

- Por tipo de dispositivo, el mercado está segmentado en catéteres, dispositivos médicos portátiles, agujas y jeringas, marcapasos, conjuntos de tubos y mascarillas. El segmento de catéteres tuvo la mayor participación del mercado en 2023, mientras que se espera que los dispositivos portátiles registren la CAGR más alta del mercado durante 2023-2031.

Análisis de la cuota de mercado de adhesivos para dispositivos médicos por geografía

El alcance geográfico del informe de mercado de adhesivos para dispositivos médicos se divide principalmente en cinco regiones: América del Norte, Asia Pacífico, Europa, Oriente Medio y África, y América del Sur/América del Sur y Central. América del Norte domina el mercado de adhesivos para dispositivos médicos, seguida de Europa. El crecimiento de este mercado está impulsado principalmente por los actores del mercado que tienen la mayor participación de mercado en la industria de fabricación de adhesivos y selladores médicos, como Dymax Corporation, 3M Company, Johnson & Johnson y Baxter International Inc. Por ejemplo, Dymax Corporation lanza Dymax MD® 1040-M, un adhesivo resistente al autoclave para instrumentos médicos y ensamblajes. El adhesivo se lanza como parte de su línea de adhesivos MD®. Asia Pacífico es el mercado de adhesivos para dispositivos médicos de más rápido crecimiento a nivel mundial. China, India y Japón son tres de los principales contribuyentes al crecimiento del mercado, impulsados por el aumento del gasto sanitario per cápita en todos los países.

Perspectivas regionales del mercado de adhesivos para dispositivos médicos

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de adhesivos para dispositivos médicos durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de adhesivos para dispositivos médicos en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga datos regionales específicos para el mercado de adhesivos para dispositivos médicos

Alcance del informe de mercado de adhesivos para dispositivos médicos

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2021 | 7.700 millones de dólares estadounidenses |

| Tamaño del mercado en 2031 | US$ 16,17 mil millones |

| CAGR global (2023 - 2031) | 7,7% |

| Datos históricos | 2021-2022 |

| Período de pronóstico | 2023-2031 |

| Segmentos cubiertos |

Por tipo de resina

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de adhesivos para dispositivos médicos: comprensión de su impacto en la dinámica empresarial

El mercado de adhesivos para dispositivos médicos está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de adhesivos para dispositivos médicos son:

- Compañía: GlaxoSmithKline plc.

- AstraZeneca

- Pfizer Inc

- BD

- Sanofi

- Compañía farmacéutica Merck & Co., Inc.

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de adhesivos para dispositivos médicos

Noticias y desarrollos recientes del mercado de adhesivos para dispositivos médicos

El mercado de adhesivos para dispositivos médicos se evalúa mediante la recopilación de datos cualitativos y cuantitativos posteriores a la investigación primaria y secundaria, que incluye publicaciones corporativas importantes, datos de asociaciones y bases de datos. A continuación, se incluye una lista de los avances en el mercado de adhesivos para dispositivos médicos y las estrategias:

- En junio de 2023, Dymax, un fabricante líder de materiales y equipos de curado rápido, se complace en anunciar el lanzamiento de HLC-M-1000, el primer producto de su nueva serie de adhesivos híbridos curables por luz (HLC). (Fuente: Dymax, comunicado de prensa, 2023)

- En abril de 2023, Dymax lanzó el adhesivo 1045-M para dispositivos de administración de fármacos. Dymax diseñó el MD 1045-M para unir sustratos de vidrio, acero inoxidable, ABS y PC. Entre sus usos se incluyen el montaje de jeringas precargadas y dispositivos de un solo uso. También ayudan en el montaje de inyectores automáticos, tipo pluma y portátiles. La empresa formuló el MD 1045-M para resolver los desafíos asociados con la orientación de la aguja, el desbordamiento de material y los largos tiempos de curado. Fuente: (Prelude Fertility, comunicado de prensa, 2024)

Cobertura y resultados del informe sobre el mercado de adhesivos para dispositivos médicos

El informe “Tamaño y pronóstico del mercado de adhesivos para dispositivos médicos (2021-2031)” proporciona un análisis detallado del mercado que cubre las siguientes áreas:

- Tamaño del mercado y pronóstico a nivel global, regional y nacional para todos los segmentos clave del mercado cubiertos bajo el alcance.

- Dinámica del mercado, como impulsores, restricciones y oportunidades clave

- Principales tendencias futuras

- Análisis detallado de las cinco fuerzas de Porter y PEST y FODA

- Análisis del mercado global y regional que cubre las tendencias clave del mercado, los principales actores, las regulaciones y los desarrollos recientes del mercado.

- Análisis del panorama de la industria y la competencia que cubre la concentración del mercado, el análisis de mapas de calor, los actores destacados y los desarrollos recientes.

- Perfiles detallados de empresas

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Informes relacionados

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de adhesivos para dispositivos médicos

Obtenga una muestra gratuita para - Mercado de adhesivos para dispositivos médicos