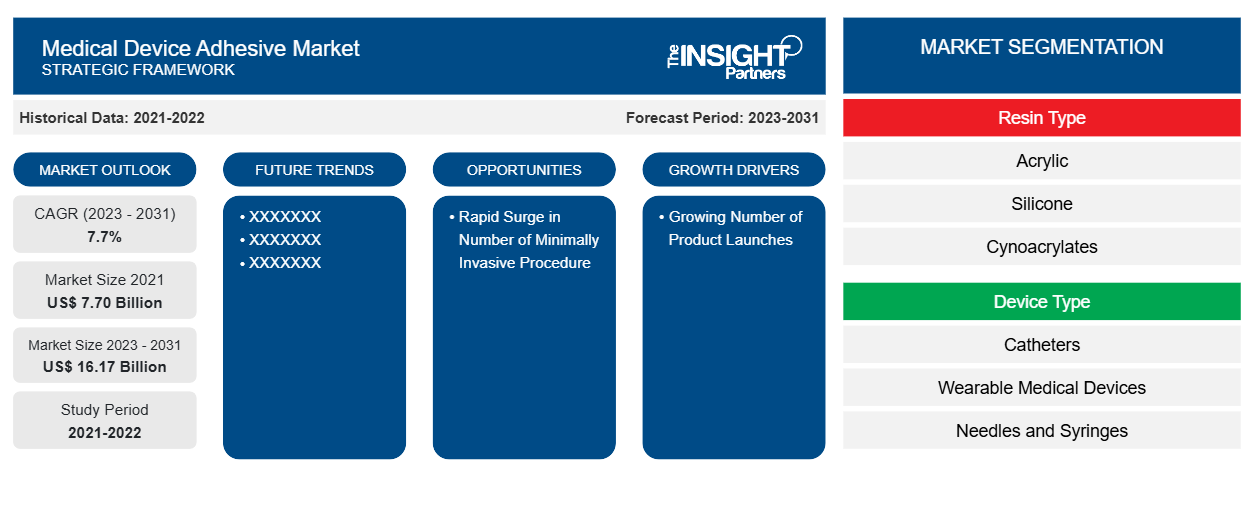

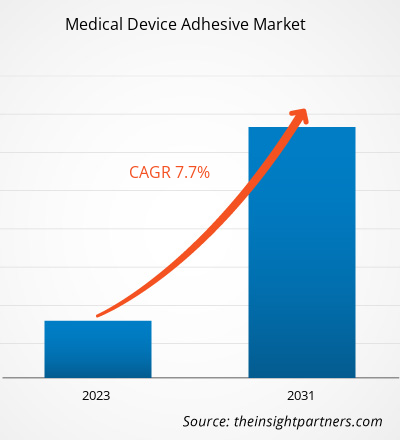

Si stima che la dimensione del mercato degli adesivi per dispositivi medici sia stata di 7,70 miliardi di dollari USA nel 2021 e di XX milioni di dollari USA nel 2023 e si prevede che raggiungerà i 16,17 miliardi di dollari USA entro il 2031. Si stima che registrerà un CAGR del 7,7% fino al 2031. L'aumento dell'uso di adesivi per dispositivi medici, il progresso tecnico negli adesivi per dispositivi medici e la crescente adozione di soluzioni ecologiche e biocompatibili rimarranno probabilmente le principali tendenze del mercato degli adesivi per dispositivi medici.

Analisi del mercato degli adesivi per dispositivi medici

L'adesivo per dispositivi medici è l'adesivo specializzato utilizzato per legare dispositivi o componenti medici, come medicazioni e bende, cateteri, fili guida, dispositivi medici impiantabili, materiali dentali e molti altri. L'adesivo deve soddisfare requisiti specifici prima della selezione, come biocompatibilità, stabilizzabilità, elevata forza di legame e resistenza all'acqua. L'adesivo acrilico è uno degli adesivi più comuni che svolgono un ruolo cruciale nel settore dei dispositivi medici grazie alle sue proprietà di garantire sicurezza ed efficacia.

Panoramica del mercato degli adesivi per dispositivi medici

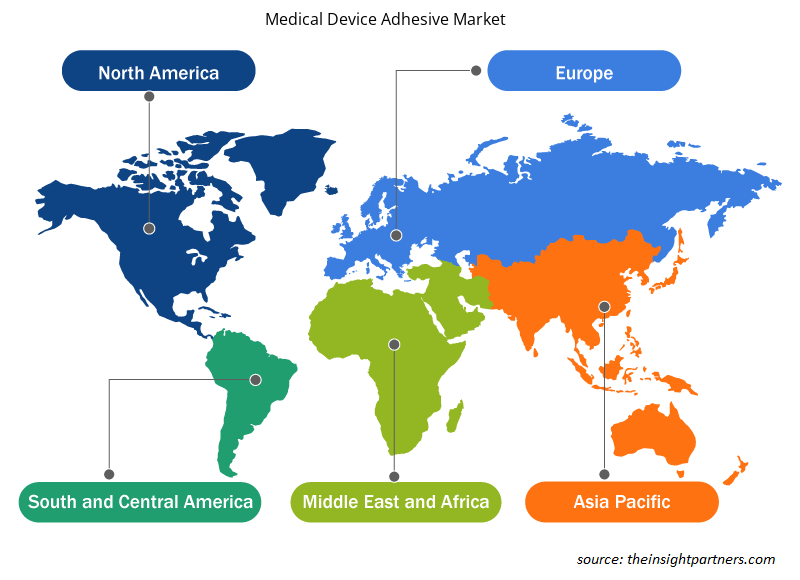

I fattori trainanti includono l'aumento dell'uso di adesivi per dispositivi medici e i progressi tecnologici negli adesivi per dispositivi medici. Tuttavia, è probabile che le complicazioni associate a queste soluzioni ostacolino in una certa misura la crescita del mercato. Il mercato globale degli adesivi per dispositivi medici è segmentato per regione in Nord America, Europa, Asia-Pacifico, Medio Oriente e Africa e Sud e Centro America. In Nord America, gli Stati Uniti detengono una quota significativa del mercato degli adesivi per dispositivi medici. Le innovazioni nella linea di prodotti guidano principalmente la crescita del mercato del paese. I paesi nella regione si concentrano sullo sviluppo di prodotti basati su tecnologie avanzate che aiutano a migliorare la qualità della vita dei pazienti. Inoltre, si prevede che il numero crescente di aziende startup stimolerà ulteriormente la crescita del mercato degli adesivi e dei sigillanti medici in Nord America. Si prevede che la regione Asia-Pacifico rappresenti la crescita più rapida nel mercato degli adesivi per dispositivi medici. Il numero crescente di incidenti, procedure di trapianto e il numero crescente di aziende che si concentrano sui paesi dell'Asia-Pacifico per la loro espansione geografica e altre strategie alimenteranno probabilmente la crescita del mercato.

Personalizza questo report in base alle tue esigenze

Riceverai la personalizzazione gratuita di qualsiasi report, comprese parti di questo report, o analisi a livello nazionale, pacchetto dati Excel, oltre a usufruire di grandi offerte e sconti per start-up e università

Mercato degli adesivi per dispositivi medici: approfondimenti strategici

-

Scopri le principali tendenze di mercato in questo rapporto.Questo campione GRATUITO includerà analisi di dati che spaziano dalle tendenze di mercato alle stime e alle previsioni.

Driver e opportunità del mercato degli adesivi per dispositivi medici

Numero crescente di lanci di prodotti Sviluppo per favorire il mercato

Gli studi di ricerca e sviluppo in corso in tutto il mondo stanno guadagnando slancio nella creazione di soluzioni mediche di fascia alta per combinare un'ampia gamma di dispositivi medici nell'uso pratico. Le aziende stanno investendo nello sviluppo di strumenti innovativi per garantire un buon ritorno sull'investimento (ROI). Inoltre, l'approvazione del prodotto da parte delle autorità di regolamentazione conferma l'affidabilità e la credibilità dei sigillanti e degli adesivi per dispositivi medici di nuova generazione. Di recente, varie aziende di mercato hanno lanciato adesivi per dispositivi medici di fascia alta e di alta qualità. Ad esempio, a novembre 2021, Dymax ha rilasciato una nuova linea di adesivi fotopolimerizzabili per dispositivi medici indossabili . I nuovi adesivi della serie 2000-MW sono privi di TPO e realizzati senza IBOA (un noto irritante per la pelle).

Rapido aumento del numero di procedure minimamente invasive: un'opportunitàil mercato degli adesivi per dispositivi medici

Le procedure minimamente invasive sono i metodi preferiti che vengono adottati rispetto ai tradizionali metodi di chirurgia aperta, come interventi endoscopici, procedure diagnostiche endoscopiche e interventi robotici assistiti. Il processo chirurgico endoscopico è ampiamente seguito per operazioni cardiache, polmonari, gastriche e renali. Le ferite post-procedura vengono sigillate con suture chirurgiche, suturatrici chirurgiche, sigillanti o nastri adesivi pertinenti. Tuttavia, a causa degli sviluppi tecnologici nei metodi di chiusura delle ferite, l'adesivo per dispositivi medici è tra i prodotti preferiti.

Ad esempio, un'ernia inguinale è tra le condizioni più comuni osservate tra uomini e donne, con procedure chirurgiche come unico trattamento possibile. I principali tipi di procedure operative sono la chirurgia aperta e la laparoscopia. Secondo i dati dell'Healthcare Cost and Utilization Project e della Food and Drug Administration statunitense, al momento, nel 2023 negli Stati Uniti sono state eseguite 611.000 riparazioni di ernia ventrale e 1 milione di ernia inguinale. Le operazioni di sigillatura di ferite/tagli per queste procedure di solito comportano sigillanti medici, offrendo così un'opportunità significativa per gli operatori del mercato durante il periodo previsto.

Analisi della segmentazione del rapporto di mercato degli adesivi per dispositivi medici

I segmenti chiave che hanno contribuito alla derivazione dell'analisi del mercato degli adesivi per dispositivi medici sono il tipo di resina e il tipo di dispositivo.

- In base al tipo di resina, il mercato degli adesivi per dispositivi medici è suddiviso in acrilico, silicone, cianoacrilati, poliuretano, fotopolimerizzazione ed epossidico. Il segmento acrilico ha detenuto la quota maggiore del mercato nel 2023; inoltre, si prevede che lo stesso segmento registrerà la più alta percentuale di CAGR nel mercato durante il periodo di previsione.

- In base al tipo di dispositivo, il mercato è segmentato in cateteri, dispositivi medici indossabili, aghi e siringhe, pacemaker, set di tubi e maschere. Il segmento dei cateteri ha detenuto la quota maggiore del mercato nel 2023; mentre si prevede che i dispositivi indossabili registreranno il CAGR più elevato nel mercato nel periodo 2023-2031.

Analisi della quota di mercato degli adesivi per dispositivi medici per area geografica

L'ambito geografico del rapporto sul mercato degli adesivi per dispositivi medici è principalmente suddiviso in cinque regioni: Nord America, Asia Pacifico, Europa, Medio Oriente e Africa e Sud America/Sud e Centro America. Il Nord America domina il mercato degli adesivi per dispositivi medici, seguito dall'Europa. La crescita di questo mercato è principalmente guidata dagli operatori di mercato che detengono la quota di mercato più grande nel settore della produzione di adesivi e sigillanti medici, come Dymax Corporation, 3M Company, Johnson & Johnson e Baxter International Inc. ad esempio, Dymax Corporation lancia Dymax MD® 1040-M, un adesivo resistente all'autoclave per strumenti medici e assemblaggio. L'adesivo viene lanciato come parte della sua linea di adesivi MD®. L'Asia Pacifico è il mercato degli adesivi per dispositivi medici in più rapida crescita a livello globale. Cina, India e Giappone sono i tre principali contributori alla crescita del mercato, guidata dall'aumento della spesa sanitaria pro capite nei paesi.

Approfondimenti regionali sul mercato degli adesivi per dispositivi medici

Le tendenze regionali e i fattori che influenzano il mercato degli adesivi per dispositivi medici durante il periodo di previsione sono stati ampiamente spiegati dagli analisti di Insight Partners. Questa sezione discute anche i segmenti e la geografia del mercato degli adesivi per dispositivi medici in Nord America, Europa, Asia Pacifico, Medio Oriente e Africa e Sud e Centro America.

- Ottieni i dati specifici regionali per il mercato degli adesivi per dispositivi medici

Ambito del rapporto di mercato sugli adesivi per dispositivi medici

| Attributo del report | Dettagli |

|---|---|

| Dimensioni del mercato nel 2021 | 7,70 miliardi di dollari USA |

| Dimensioni del mercato entro il 2031 | 16,17 miliardi di dollari USA |

| CAGR globale (2023-2031) | 7,7% |

| Dati storici | 2021-2022 |

| Periodo di previsione | 2023-2031 |

| Segmenti coperti |

Per tipo di resina

|

| Regioni e Paesi coperti |

America del Nord

|

| Leader di mercato e profili aziendali chiave |

|

Densità degli attori del mercato degli adesivi per dispositivi medici: comprendere il suo impatto sulle dinamiche aziendali

Il mercato degli adesivi per dispositivi medici sta crescendo rapidamente, spinto dalla crescente domanda degli utenti finali dovuta a fattori quali l'evoluzione delle preferenze dei consumatori, i progressi tecnologici e una maggiore consapevolezza dei benefici del prodotto. Con l'aumento della domanda, le aziende stanno ampliando le loro offerte, innovando per soddisfare le esigenze dei consumatori e capitalizzando sulle tendenze emergenti, il che alimenta ulteriormente la crescita del mercato.

La densità degli operatori di mercato si riferisce alla distribuzione di aziende o società che operano in un particolare mercato o settore. Indica quanti concorrenti (operatori di mercato) sono presenti in un dato spazio di mercato in relazione alle sue dimensioni o al valore di mercato totale.

Le principali aziende che operano nel mercato degli adesivi per dispositivi medici sono:

- Società anonima GlaxoSmithKline.

- AstraZeneca

- Pfizer Inc

- BD

- Sanofi

- Merck & Co., Inc.

Disclaimer : le aziende elencate sopra non sono classificate secondo un ordine particolare.

- Ottieni una panoramica dei principali attori del mercato degli adesivi per dispositivi medici

Notizie e sviluppi recenti sul mercato degli adesivi per dispositivi medici

Il mercato degli adesivi per dispositivi medici viene valutato raccogliendo dati qualitativi e quantitativi dopo la ricerca primaria e secondaria, che include importanti pubblicazioni aziendali, dati di associazioni e database. Di seguito è riportato un elenco degli sviluppi nel mercato degli adesivi per dispositivi medici e delle strategie:

- A giugno 2023, Dymax, produttore leader di materiali e attrezzature a polimerizzazione rapida, è lieta di annunciare il lancio di HLC-M-1000, il primo prodotto della sua nuova serie di adesivi ibridi fotopolimerizzabili (HLC). (Fonte: Dymax, comunicato stampa, 2023)

- Ad aprile 2023, Dymax ha lanciato l'adesivo 1045-M per dispositivi di somministrazione di farmaci. Dymax ha progettato MD 1045-M per legare substrati in vetro, SS, ABS e PC. Gli utilizzi per questi includono l'assemblaggio di siringhe preriempite e dispositivi monouso. Aiutano anche nell'assemblaggio di iniettori automatici, a penna e indossabili. L'azienda ha formulato MD 1045-M per risolvere le sfide associate all'orientamento dell'ago, al traboccamento del materiale e ai lunghi tempi di polimerizzazione. Fonte: (Prelude Fertility, comunicato stampa, 2024)

Copertura e risultati del rapporto sul mercato degli adesivi per dispositivi medici

Il rapporto "Dimensioni e previsioni del mercato degli adesivi per dispositivi medici (2021-2031)" fornisce un'analisi dettagliata del mercato che copre le seguenti aree:

- Dimensioni del mercato e previsioni a livello globale, regionale e nazionale per tutti i principali segmenti di mercato interessati dall'indagine.

- Dinamiche di mercato come fattori trainanti, vincoli e opportunità chiave

- Principali tendenze future

- Analisi dettagliata delle cinque forze PEST/Porter e SWOT

- Analisi del mercato globale e regionale che copre le principali tendenze del mercato, i principali attori, le normative e i recenti sviluppi del mercato.

- Analisi del panorama industriale e della concorrenza che comprende la concentrazione del mercato, l'analisi delle mappe di calore, i principali attori e gli sviluppi recenti.

- Profili aziendali dettagliati

- Analisi storica (2 anni), anno base, previsione (7 anni) con CAGR

- Analisi PEST e SWOT

- Valore/volume delle dimensioni del mercato - Globale, Regionale, Nazionale

- Industria e panorama competitivo

- Set di dati Excel

Report recenti

Rapporti correlati

Testimonianze

Motivo dell'acquisto

- Processo decisionale informato

- Comprensione delle dinamiche di mercato

- Analisi competitiva

- Analisi dei clienti

- Previsioni di mercato

- Mitigazione del rischio

- Pianificazione strategica

- Giustificazione degli investimenti

- Identificazione dei mercati emergenti

- Miglioramento delle strategie di marketing

- Aumento dell'efficienza operativa

- Allineamento alle tendenze normative

Ottieni un campione gratuito per - Mercato degli adesivi per dispositivi medici

Ottieni un campione gratuito per - Mercato degli adesivi per dispositivi medici