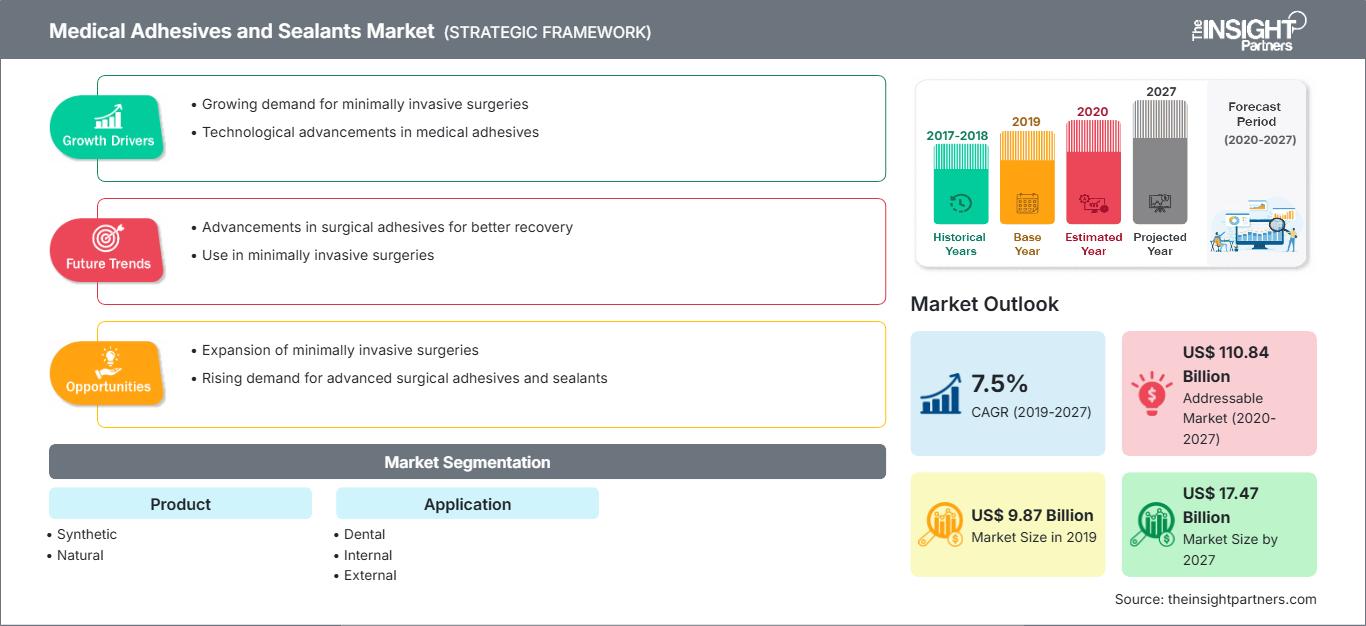

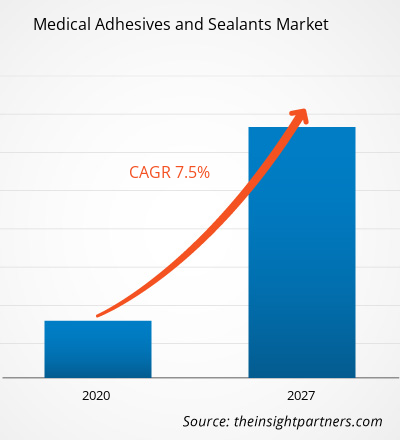

Se prevé que el mercado de adhesivos y selladores médicos alcance los 17.468,1 millones de dólares estadounidenses en 2027, frente a los 9.867,9 millones de dólares estadounidenses en 2019. Se estima que el mercado crecerá a una tasa de crecimiento anual compuesta (TCAC) del 7,5% entre 2020 y 2027.

Los sistemas de administración de fármacos son dispositivos médicos utilizados para inyectar medicamentos o sustancias químicas en el cuerpo. Algunos de los sistemas de administración de fármacos disponibles en el mercado incluyen los sistemas transmucosos, orales, pulmonares, inyectables, tópicos, nasales, implantables y oculares, entre otros. Estos sistemas se utilizan principalmente para la administración controlada o dirigida de diversos agentes terapéuticos con el fin de tratar diversas enfermedades o mejorar la salud del paciente. El mercado mundial de adhesivos y selladores médicos está impulsado por factores como el creciente número de procedimientos de implantación/trasplante y la mayor adopción de procedimientos mínimamente invasivos. Sin embargo, las complicaciones relacionadas con los adhesivos y selladores médicos dificultan el crecimiento del mercado. Además, se espera que las tendencias futuras, derivadas del creciente desarrollo de las tecnologías de adhesivos y selladores médicos, impulsen el mercado durante el período de pronóstico.

Perspectivas del mercado

Aumento del número de procedimientos de implante/trasplante médico

Los adhesivos y selladores médicos (ASM) se utilizan para prevenir la pérdida de sangre durante diversos procedimientos quirúrgicos, como cirugías cardiovasculares, implantes de órganos y procedimientos ortopédicos. Los ASM facilitan la cicatrización natural de las heridas, previenen fugas de aire y líquidos durante y después de las intervenciones quirúrgicas y otras aplicaciones. Estos adhesivos y selladores se utilizan como alternativa a las suturas y grapas quirúrgicas. Los profesionales médicos están adoptando cada vez más diferentes tipos de estos productos, lo que, a su vez, proyecta una mayor demanda de adhesivos y selladores médicos.

Obtendrá personalización gratuita de cualquier informe, incluyendo partes de este informe, análisis a nivel de país y paquetes de datos de Excel. Además, podrá aprovechar excelentes ofertas y descuentos para empresas emergentes y universidades.

Mercado de adhesivos y selladores médicos: Perspectivas estratégicas

-

Obtenga las principales tendencias clave del mercado que se describen en este informe.Esta muestra GRATUITA incluirá análisis de datos, que abarcarán desde tendencias de mercado hasta estimaciones y pronósticos.

Por ejemplo, el trasplante de órganos es uno de los procedimientos quirúrgicos que implican grandes incisiones en el cuerpo humano. Las heridas postoperatorias se cierran con suturas y grapas quirúrgicas; es necesario que cicatricen rápidamente para evitar complicaciones como infecciones, hemorragias y otras. Los adhesivos y selladores ayudan a prevenir dichas complicaciones. Según la Administración de Recursos y Servicios de Salud (HRSA), una división del gobierno estadounidense, en 2019 se realizaron aproximadamente 39 718 trasplantes de órganos. Esta cifra representó un nuevo récord por séptimo año consecutivo.

Además, los procedimientos de odontología restauradora incluyen implantes dentales, especialmente entre la población geriátrica a nivel mundial; sin embargo, cada vez más jóvenes optan por implantes dentales en lugar de puentes. Por lo tanto, se espera que estos factores impulsen el mercado en los próximos años.

Información sobre el producto

Según el tipo de producto, el mercado de adhesivos y selladores médicos se divide en sintéticos y naturales. El segmento sintético se subdivide en acrílico, silicona, cianoacrilato, polietilenglicol y otros. En 2019, el segmento sintético representó la mayor cuota de mercado. El crecimiento de este segmento se atribuye a la versatilidad y el alto rendimiento de los adhesivos sintéticos en comparación con los naturales. Además, estos adhesivos pueden modificarse según las necesidades y presentan mejores propiedades de adhesión que los adhesivos naturales. Se prevé que estos factores continúen impulsando el crecimiento del mercado en este segmento durante el período de pronóstico.

Información de la aplicación

Según su aplicación, el mercado de diagnósticos para animales de compañía se segmenta en dental, interno y externo. El segmento dental ostentó la mayor cuota de mercado en 2019, y se estima que el segmento interno registrará la mayor tasa de crecimiento anual compuesto (TCAC) durante el período de pronóstico.

Las empresas suelen adoptar estrategias de lanzamiento y aprobación de productos para expandir su presencia global y su cartera de productos y así satisfacer la creciente demanda de los consumidores. Los actores del mercado de adhesivos y selladores médicos adoptan la estrategia de colaboraciones para ampliar su base de clientes a nivel mundial, lo que también les permite mantener su marca a nivel global.

Perspectivas regionales del mercado de adhesivos y selladores médicos

Los analistas de The Insight Partners han explicado en detalle las tendencias regionales y los factores que influyen en el mercado de adhesivos y selladores médicos durante el período de previsión. Esta sección también analiza los segmentos y la geografía del mercado de adhesivos y selladores médicos en Norteamérica, Europa, Asia Pacífico, Oriente Medio y África, y Sudamérica y Centroamérica.

Alcance del informe de mercado de adhesivos y selladores médicos

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2019 | US$ 9.870 millones |

| Tamaño del mercado para 2027 | 17.470 millones de dólares estadounidenses |

| Tasa de crecimiento anual compuesto global (2019 - 2027) | 7,5% |

| Datos históricos | 2017-2018 |

| período de previsión | 2020-2027 |

| Segmentos cubiertos |

Por producto

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de los actores del mercado de adhesivos y selladores médicos: comprensión de su impacto en la dinámica empresarial

El mercado de adhesivos y selladores médicos está experimentando un rápido crecimiento, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían su oferta, innovan para satisfacer las necesidades de los consumidores y aprovechan las nuevas tendencias, lo que impulsa aún más el crecimiento del mercado.

- Obtenga una visión general de los principales actores del mercado de adhesivos y selladores médicos.

Mercado mundial de adhesivos y selladores médicos – Por producto

-

Sintético

- Acrílico

- Silicona

- cianoacrilato

- Polietilenglicol

- Otros

-

Natural

- Colágeno

- Fibrina

- Albúmina

- Otros

Mercado mundial de adhesivos y selladores médicos – Por aplicación

-

Dental

- Adhesión de prótesis dentales

- Selladores de fosas y fisuras

- Adhesivos restaurativos

- Cementos de fijación

- Adhesión ortodóncica

- Adhesivos para bandejas

- Adhesión de tejidos quirúrgicos dentales

-

Interno

- Hueso

- Cardiovascular

- Craneal

- Pulmonar

- Abdominal

- Otros

-

Externo

- Agentes de unión tisular

- Agentes adhesivos para prótesis

- Otros

Mercado de adhesivos y selladores médicos – Por geografía

-

América del norte

- A NOSOTROS

- Canadá

- México

-

Europa

- Francia

- Alemania

- Italia

- Reino Unido

- España

- El resto de Europa

-

Asia Pacífico (APAC)

- Porcelana

- India

- Corea del Sur

- Japón

- Australia

- Resto de Asia Pacífico

-

Oriente Medio y África (MEA)

- Sudáfrica

- Arabia Saudita

- Emiratos Árabes Unidos

- Resto de Oriente Medio y África

-

América del Sur y Central

- Brasil

- Argentina

- El resto de Sudamérica

Perfiles de empresas

- 3M

- Adhesys Medical GMBH

- GlaxoSmithKline Plc

- Closure Medical Corporation

- Henkel AG y CO. KGAA

- Mactac

- Corporación Dymax

- Adhesivos Ellsworth

- Productos médicos puritanos

- Dentsply Sirona

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Informes relacionados

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de adhesivos y selladores médicos

Obtenga una muestra gratuita para - Mercado de adhesivos y selladores médicos