Medical Device Adhesive Market Share and Forecast by 2031

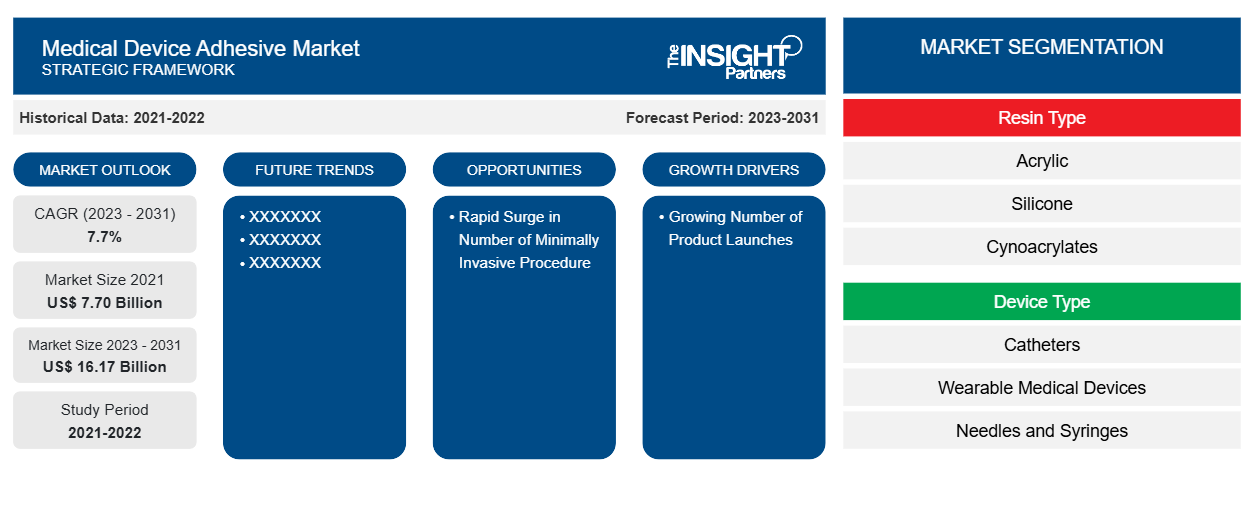

Medical Device Adhesive Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Resin Type (Acrylic, Silicone, Cyanoacrylates, Polyurethane, Light Curing, and Epoxy); Device Type (Catheters, Wearable Medical Devices, Needles and Syringes, Pacemakers, Tube Sets, and Masks), and Geography

Historic Data: 2021-2022 | Base Year: 2021 | Forecast Period: 2023-2031- Status : Data Released

- Report Code : TIPRE00003997

- Category : Life Sciences

- No. of Pages : 150

- Available Report Formats :

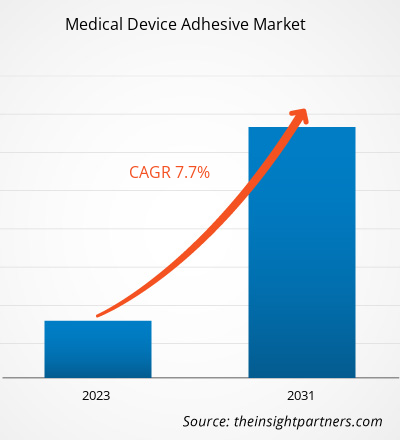

The medical device adhesive market size was estimated to be US$ 7.70 billion in 2021 and US$ XX million in 2023 and is expected to reach US$ 16.17 billion by 2031. It is estimated to record a CAGR of 7.7% till 2031. Increasing usage of medical device adhesive, technical advancement in medical device adhesive, and increasing adoption of eco-friendly and biocompatible solutions are likely to remain key medical device adhesive market trends.

Medical Device Adhesive Market Analysis

Medical device adhesive is the specialized adhesive used to bond medical devices or components, such as wound dressing and bandages, catheters, guide wire, implantable medical devices, dental materials, and many others. The adhesive must meet specific requirements before selection, such as biocompatibility, stabilizability, high bonding strength, and resistance to water. Acrylic adhesive is one of the most common adhesives that play a crucial role in the medical device industry due to its properties of ensuring safety and effectiveness.

Medical Device Adhesive Market Overview

Driving factors include increasing usage of medical device adhesive and technological advancements in medical device adhesive. However, complications associated with these solutions are likely to hamper the growth of the market to a certain extent. The global medical device adhesive market is segmented by region into North America, Europe, Asia-Pacific, Middle East & Africa, and South & Central America. In North America, the U.S. holds a significant share of the medical device adhesive market. Innovations in the product line primarily drive the growth of the country's market. Countries in the region focus on the development of advanced technology-based products that assist in improving the quality of patient lives. In addition, the increasing number of startup companies is further expected to stimulate the growth of the medical adhesive and sealants market in North America. The Asia Pacific region is expected to account for the fastest growth in the medical device adhesive market. The increasing number of accidents, transplant procedures, and the growing number of companies focusing on the countries in Asia Pacific for their geographical expansion and other strategies are likely to fuel the growth of the market.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONMedical Device Adhesive Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Medical Device Adhesive Market Drivers and Opportunities

Growing Number of Product Launches Development to Favor Market

Ongoing worldwide research and development studies are gaining momentum in creating high-end medical solutions for combining a wide scale of medical devices in practical usage. Companies are investing in developing innovative instruments to secure good return on investment (ROI). Additionally, product approval by regulatory authorities confirms the reliability and credibility of the new-age medical device sealants and adhesives. Recently, various market companies have launched high-end and top-quality medical device adhesives. For instance, In November 2021, Dymax released a new line of light-curable adhesives for wearable medical devices. The new 2000-MW series adhesives are free of TPO and made without IBOA (a known skin irritant).

Rapid Surge in Number of Minimally Invasive Procedures – An Opportunity in the Medical Device Adhesive Market

Minimally invasive procedures are the preferred methods that are being adopted over traditional open surgery methods, such as endoscopy surgeries, endoscopic diagnostic procedures, and robotic-assisted surgeries. The endoscopic surgical process is widely followed for heart, lung, stomach, and kidney-related operations. The post-procedure wounds are sealed with surgical sutures, surgical staplers, sealants, or relevant adhesive tapes. However, due to technological developments in wound closure methods, medical device adhesive is among the preferred products.

For instance, an inguinal hernia is among the most general conditions observed among men and women, with surgical procedures being the only possible treatment. The primary types of operational procedures are open surgery and laparoscopy. According to Healthcare Cost and Utilization Project data and the US Food and Drug Administration, At present, 611,000 ventral and 1 million inguinal hernia repairs was performed in the US in 2023. The wound/cut sealing operations for these procedures usually involve medical sealants, thereby offering a significant opportunity for market players during the projected period.

Medical Device Adhesive Market Report Segmentation Analysis

Key segments that contributed to the derivation of the medical device adhesive market analysis are resin type, and device type.

- Based on resin type, the medical device adhesive market is divided into Acrylic, Silicone, Cynoacrylates, Polyurethane, Light Curing, and Epoxy. The acrylic segment held the largest share of the market in 2023; also, the same segment is anticipated to register the highest CAGR % in the market during the forecast period.

- By device type, the market is segmented into catheters, wearable medical devices, needles and syringes, pacemaker, tube sets, and masks. The catheters segment held the largest share of the market in 2023; Whereas wearable devices is expected to register the highest CAGR in the market during 2023–2031.

Medical Device Adhesive Market Share Analysis by Geography

The geographic scope of the medical device adhesive market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America. North America dominates the medical device adhesive market, followed by Europe. The growth of this market is primarily driven by the market players that are holding the largest market share in the medical adhesives & sealants manufacturing industry, such as Dymax Corporation, 3M Company, Johnson & Johnson, and Baxter International Inc. for instance, Dymax Corporation launches Dymax MD® 1040-M, an autoclave-resistant adhesive for medical instruments and assembly. The adhesive is launched as a part of its MD® line of adhesives. Asia Pacific is the fastest-growing medical device adhesive market globally. China, India, and Japan are three major contributors to the market's growth, driven by increasing per capita healthcare expenditure across the countries.

Medical Device Adhesive Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 7.70 Billion |

| Market Size by 2031 | US$ 16.17 Billion |

| Global CAGR (2023 - 2031) | 7.7% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Resin Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Medical Device Adhesive Market Players Density: Understanding Its Impact on Business Dynamics

The Medical Device Adhesive Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Medical Device Adhesive Market News and Recent Developments

The medical device adhesive market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for medical device adhesives and strategies:

- In June 2023, Dymax, a leading manufacturer of rapid curing materials and equipment, is excited to announce the release of HLC-M-1000, the first product in its new Hybrid Light-Curable (HLC) series of adhesives. (Source: Dymax, Press Release, 2023)

- In April 2023, Dymax launched 1045-M adhesive for drug delivery devices. Dymax designed MD 1045-M to bond glass, SS, ABS, and PC substrates. Uses for these include assembling prefilled syringes and single-use devices. They also aid in assembling auto, pen, and wearable injectors. The company formulated MD 1045-M to solve the challenges associated with needle orientation, material overflow, and long cure times. Source: (Prelude Fertility, Press Release, 2024)

Medical Device Adhesive Market Report Coverage and Deliverables

The “Medical Device Adhesive Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments.

- Detailed company profiles

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For